Bitcoin Spot ETFs Extend Inflow Streak Amid Selective Ethereum Outflows and Altcoin Gains

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

On December 2, 2025, crypto spot ETF inflows highlighted strong institutional interest in Bitcoin and Solana, with net gains of $58.5 million and $45.8 million respectively, while Ethereum saw $9.9 million in targeted outflows and XRP drew $67.7 million in demand, signaling selective market rotations.

-

Bitcoin spot ETFs marked their fifth consecutive inflow day, led by BlackRock’s $120.14 million addition.

-

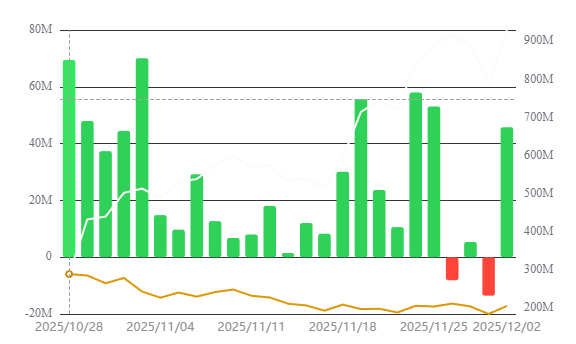

Solana spot ETFs continued upward momentum with $45.8 million net inflows, driven by Bitwise’s dominant performance.

-

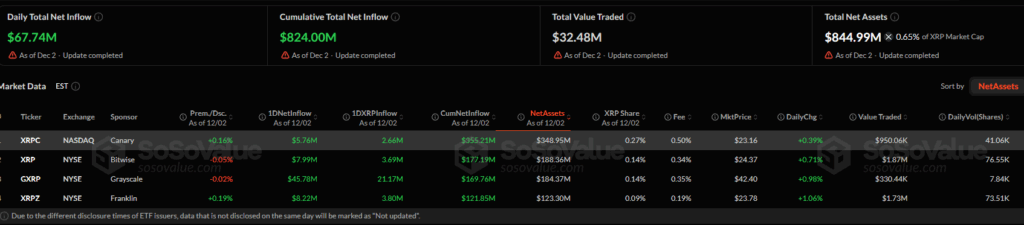

XRP spot ETFs accumulated $67.7 million, boosting cumulative assets as Grayscale spearheaded the gains, per Sosovalue data.

Crypto spot ETF inflows on December 2, 2025, show Bitcoin and Solana leading with robust gains, Ethereum facing outflows, and XRP surging—explore institutional trends shaping the market today.

What Are the Latest Crypto Spot ETF Inflows?

Crypto spot ETF inflows on December 2, 2025, demonstrated sustained institutional engagement, particularly for Bitcoin and Solana products, which posted net positives amid broader market stability. Ethereum experienced minor outflows due to rebalancing in key issuers, while XRP’s vehicles saw accelerated accumulation. These flows underscore evolving investor strategies in digital assets, with cumulative figures reflecting growing acceptance of ETF structures for exposure.

How Did Bitcoin Spot ETFs Perform on December 2?

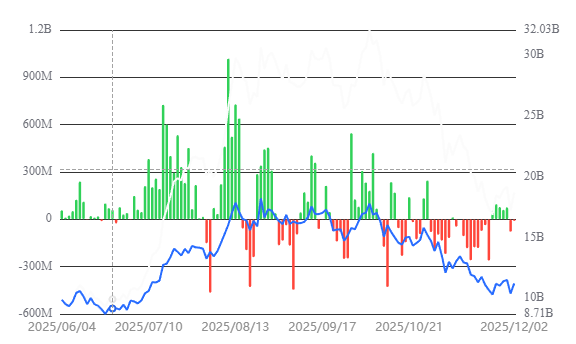

Bitcoin spot ETFs achieved a net inflow of $58.5 million, extending their positive streak to five days and elevating total assets to $57.77 billion, according to Sosovalue analytics. BlackRock’s IBIT dominated with $120.14 million added, pushing its holdings to $70.91 billion, while Fidelity’s FBTC contributed $21.85 million in steady support. Grayscale’s GBTC and ARK’s ARKB posted outflows of $25.02 billion and $90.94 million cumulatively, respectively, highlighting profit-taking patterns. Despite these adjustments, the overall trend affirmed resilient demand from major institutions, with experts like those from financial analytics firms noting this as a sign of maturing market infrastructure. Daily volatility did little to deter allocations, as inflows aligned with Bitcoin’s price recovery above key support levels.

On December 2nd (ET), Bitcoin spot ETFs recorded a total net inflow of $58.5 million, marking the 5th consecutive day of net inflows. Ethereum spot ETFs saw a total net outflow of $9.9 million, while Solana spot ETFs experienced a total net inflow of $45.8 million.… pic.twitter.com/9dKmbySeJY

— Wu Blockchain (@WuBlockchain) December 3, 2025

This performance, tracked via independent dashboards, illustrates how leading providers like BlackRock and Fidelity are capturing the bulk of new capital, fostering confidence in Bitcoin’s role as a core portfolio asset.

Frequently Asked Questions

What Caused Ethereum Spot ETF Outflows on December 2, 2025?

Ethereum spot ETFs recorded a net outflow of $9.91 million, primarily from BlackRock’s ETHA withdrawing $88.68 million or about 29,630 ETH, indicating targeted profit realization amid rising prices. Countering this, Fidelity’s FETH added $50.65 million and Grayscale contributed $28.11 million, balancing the session. Sosovalue data shows this as rotational activity favoring lower-cost options, not a sign of waning interest.

Why Are Solana Spot ETFs Seeing Consistent Inflows?

Solana spot ETFs attracted $45.77 million in net inflows on December 2, building cumulative totals to $650.81 million and reflecting strong ecosystem growth. Bitwise’s BSOL led with $29.45 million, reaching $574.42 million in assets, while Grayscale and 21Shares added support. This trend, per market trackers, stems from Solana’s high-speed network appealing to institutional developers and traders seeking scalable alternatives.

Key Takeaways

- Bitcoin’s Inflow Streak: Fifth day of positives at $58.5 million signals deepening institutional commitment, led by BlackRock’s expansion.

- XRP’s Accumulation Surge: $67.74 million inflows pushed totals to $824 million, with Grayscale driving broad issuer participation.

- Solana’s Steady Growth: $45.8 million gains highlight ETF viability for altcoins, advising investors to monitor network upgrades for future momentum.

Source: Sosovalue

Conclusion

The December 2, 2025, crypto spot ETF inflows for Bitcoin, Solana, and XRP, contrasted by Ethereum’s selective outflows, paint a picture of dynamic institutional strategies in the digital asset space. As cumulative assets climb—Bitcoin at $57.77 billion and Solana nearing $651 million—these trends, drawn from Sosovalue insights, affirm ETFs as a preferred gateway for regulated exposure. Investors should watch upcoming regulatory updates and price catalysts to capitalize on this evolving landscape.

Bitcoin and Solana Spot ETFs post strong inflows, while Ethereum records targeted outflows and XRP continues attracting institutional demand.

- Bitcoin Spot ETFs extend their fifth inflow streak as institutional demand strengthens, with BlackRock and Fidelity driving most of the positive daily flows.

- Ethereum Spot ETFs see selective withdrawals driven by a major outflow in BlackRock’s product, while lower-fee issuers record consistent new inflows.

- XRP and Solana ETFs register firm institutional accumulation, supported by strong daily inflows, rising net assets, and expanding multi-issuer participation.

Bitcoin Spot ETFs recorded another day of net inflows on December 2, reflecting steady institutional participation across major issuers. Ethereum and Solana ETF flows showed selective rotation, while XRP saw renewed accumulation momentum.

Source: Sosovalue

Source: Sosovalue