Bitcoin Stabilizes Above $92K Amid Cautious Crypto Reaction to Fed Rate Cut

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The cryptocurrency market reacted positively but cautiously to the Federal Reserve’s 25 basis point interest rate cut on December 10, 2025, with Bitcoin stabilizing above $92,000 and Ethereum climbing to $3,335, reflecting improved sentiment amid ongoing economic uncertainties.

-

Total crypto market capitalization rose toward $3.26 trillion post-announcement, indicating steady capital inflow into digital assets.

-

Altcoins mirrored the broader market, advancing to a $1.46 trillion cap without aggressive volatility.

-

Bitcoin’s RSI reached around 50, signaling building momentum, while Ethereum’s RSI hit 58, showing stronger bullish trends, according to TradingView data.

Crypto market reaction to Fed rate cut: Bitcoin holds steady above $92K, Ethereum surges; explore key insights and future implications for investors today.

What was the crypto market reaction to the Fed rate cut on December 10, 2025?

Crypto market reaction to the Fed rate cut was measured and constructive following the Federal Reserve’s decision to lower interest rates by 25 basis points. Major assets like Bitcoin and Ethereum exhibited orderly price movements, avoiding euphoria or sharp declines, as traders processed Chair Jerome Powell’s comments on labor market risks and data-dependent future policy. This response suggests a gradual shift toward optimism in a broader easing environment.

How did Bitcoin perform immediately after the FOMC announcement?

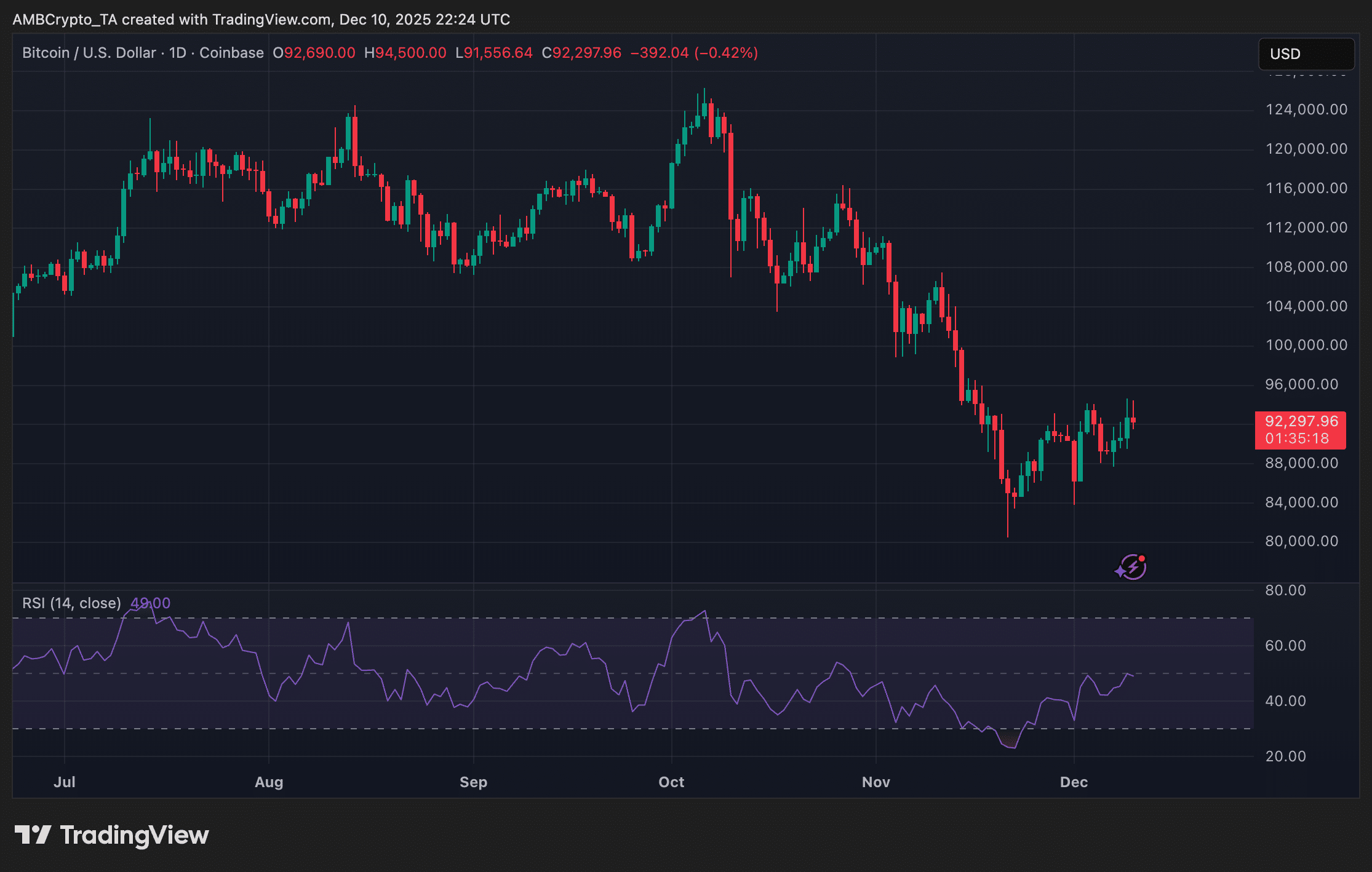

Bitcoin experienced a brief dip after the Federal Reserve’s statement but quickly stabilized, closing the session near $92,297. The asset’s Relative Strength Index (RSI) climbed to the 49-50 range, entering neutral-bullish territory and indicating slowly improving momentum without a strong uptrend yet. Supporting this stability were the Fed’s acknowledgment of employment downside risks—a traditionally favorable signal for Bitcoin—and expectations of potential further rate reductions if labor data weakens. However, Bitcoin failed to surpass short-term resistance levels, as investors awaited clearer signals on the policy path. Data from TradingView highlights this consolidation, with trading volumes remaining moderate. Experts note that such reactions align with historical patterns post-FOMC meetings, where initial caution precedes sustained moves based on economic indicators like unemployment rates, which stood at 4.2% in recent reports from the Bureau of Labor Statistics.

Source: TradingView

Analysts from financial institutions like JPMorgan have observed that Bitcoin often benefits from monetary easing cycles, as lower rates reduce the appeal of traditional yield-bearing assets and drive capital into alternatives. In this instance, the cut aligns with the Fed’s dual mandate to promote maximum employment and stable prices, with Powell emphasizing that decisions remain tied to incoming data rather than a preset course.

The broader context includes a U.S. economy showing resilience, with GDP growth projected at 2.5% for 2025 by the International Monetary Fund, yet inflationary pressures linger around 2.3%. Bitcoin’s performance underscores its role as a hedge against policy shifts, with on-chain metrics from Glassnode revealing increased holder conviction, as long-term holders accumulated over 200,000 BTC in the preceding month.

Frequently Asked Questions

What does the Fed’s rate cut mean for Bitcoin price in the short term?

The Fed’s 25 basis point cut signals potential easing, which could support Bitcoin prices by encouraging risk-on investments. In the short term, expect stabilization above $92,000 if labor data remains soft, but volatility may rise pending the next inflation report in January 2026, historically leading to 5-10% swings in BTC.

Why did Ethereum outperform Bitcoin after the Fed announcement?

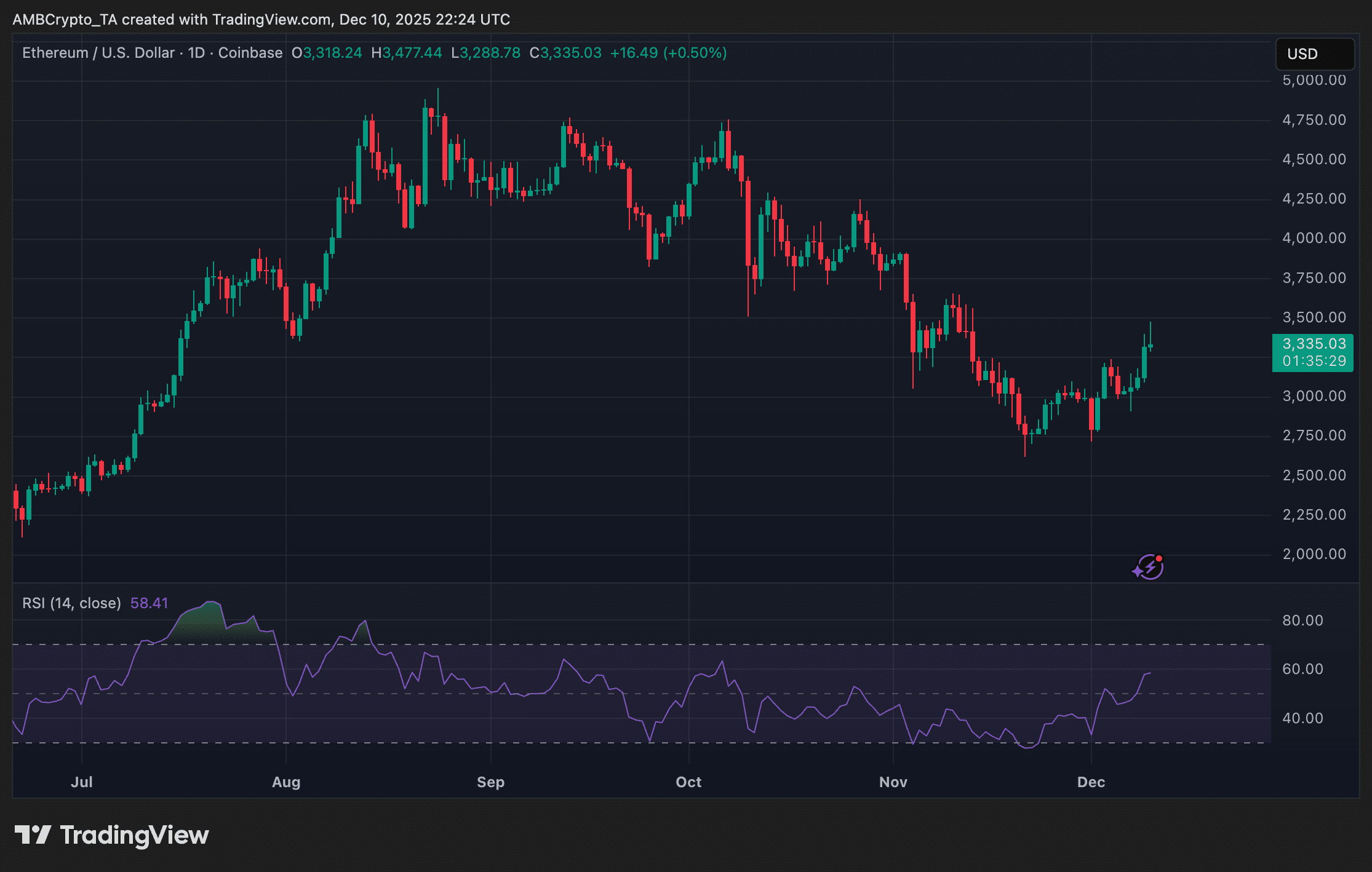

Ethereum’s stronger reaction stems from its higher sensitivity to liquidity improvements and ongoing network upgrades enhancing scalability. Closing near $3,335 with an RSI of 58, ETH benefits from whale accumulation and expectations of amplified gains in an easing cycle, making it a preferred play for traders seeking beta exposure to macro trends.

Key Takeaways

- Measured Market Response: The crypto sector welcomed the rate cut with gradual gains, avoiding overextension.

- Asset-Specific Dynamics: Bitcoin consolidated supportively, while Ethereum displayed cleaner bullish structure, per TradingView indicators.

- Future Outlook: Monitor upcoming economic data for signs of additional cuts to fuel a sustained crypto rally.

Source: TradingView

Conclusion

The crypto market reaction to the Fed rate cut on December 10, 2025, highlights a sector poised for growth amid monetary easing, with Bitcoin and Ethereum leading orderly advances. As Chair Jerome Powell stressed data dependence, future labor and inflation reports will shape the trajectory. Investors should stay informed on Federal Reserve updates, positioning for potential rallies as the 2026 easing cycle unfolds.

The total cryptocurrency market capitalization inched higher post-FOMC, approaching $3.26 trillion, as capital cautiously flowed into digital assets. This pattern echoes typical responses after such announcements, where initial rotations into risk assets occur without full commitment pending confirmation of sustained policy shifts. Altcoins followed suit, with their market cap reclaiming $1.46 trillion after early hesitation, buoyed by Powell’s balanced tone that acknowledged economic uncertainties while underscoring the cut’s role in supporting growth.

Delving deeper, the altcoin segment’s upward tick reflects broader sentiment improvement, though traders refrained from aggressive positioning. Factors like renewed interest in decentralized finance protocols and layer-2 solutions contributed to this resilience, with on-chain activity up 15% week-over-week according to reports from Dune Analytics. Ethereum’s edge over Bitcoin can be attributed to its ecosystem’s responsiveness to liquidity, where lower rates historically amplify adoption of yield-generating DeFi applications.

Looking at macroeconomic ties, the Fed’s move addresses softening employment indicators, with nonfarm payrolls adding only 150,000 jobs in November per Bureau of Labor Statistics data—below expectations. This environment favors assets like Bitcoin, which has correlated inversely with real yields in recent cycles, dropping 20% from peaks as rates eased in prior instances. Ethereum, meanwhile, benefits from technical recoveries, its chart showing higher lows since early December, supported by institutional inflows tracked by CryptoQuant.

Overall takeaways emphasize constructive caution: the market’s non-euphoric response indicates maturity, with traders balancing optimism against risks like persistent inflation or geopolitical tensions. As 2025 closes, the stage is set for crypto to capitalize on easing, provided the Fed maintains its trajectory. Stakeholders are advised to track the December jobs report for pivotal insights into the next policy pivot.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC