Bitcoin Supply Shift May Signal Potential Bottom Ahead of Fed Rate Decision

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin experienced a massive supply migration with over 8% of its total supply changing hands in the past week amid anticipation for the US Federal Reserve’s December rate decision and potential interest rate cuts. This historic onchain event signals a potential local bottom, similar to past market downturns.

-

Significant Supply Shift: More than 8% of Bitcoin’s supply moved in seven days, marking one of the largest migrations in history during the current market decline.

-

Market Uncertainty: Traders are bracing for the Federal Reserve’s December meeting, with shifting expectations toward a 25 basis point rate cut.

-

Historical Context: Past similar events in 2018 and 2020 preceded accumulation phases leading to new all-time highs, according to analyst Joe Burnett from Semler Scientific.

Bitcoin supply migration surges 8% ahead of Fed’s December rate decision—explore implications for crypto markets and potential rally. Stay informed on key onchain events shaping Bitcoin’s future.

What is the Bitcoin Supply Migration and Why Does It Matter?

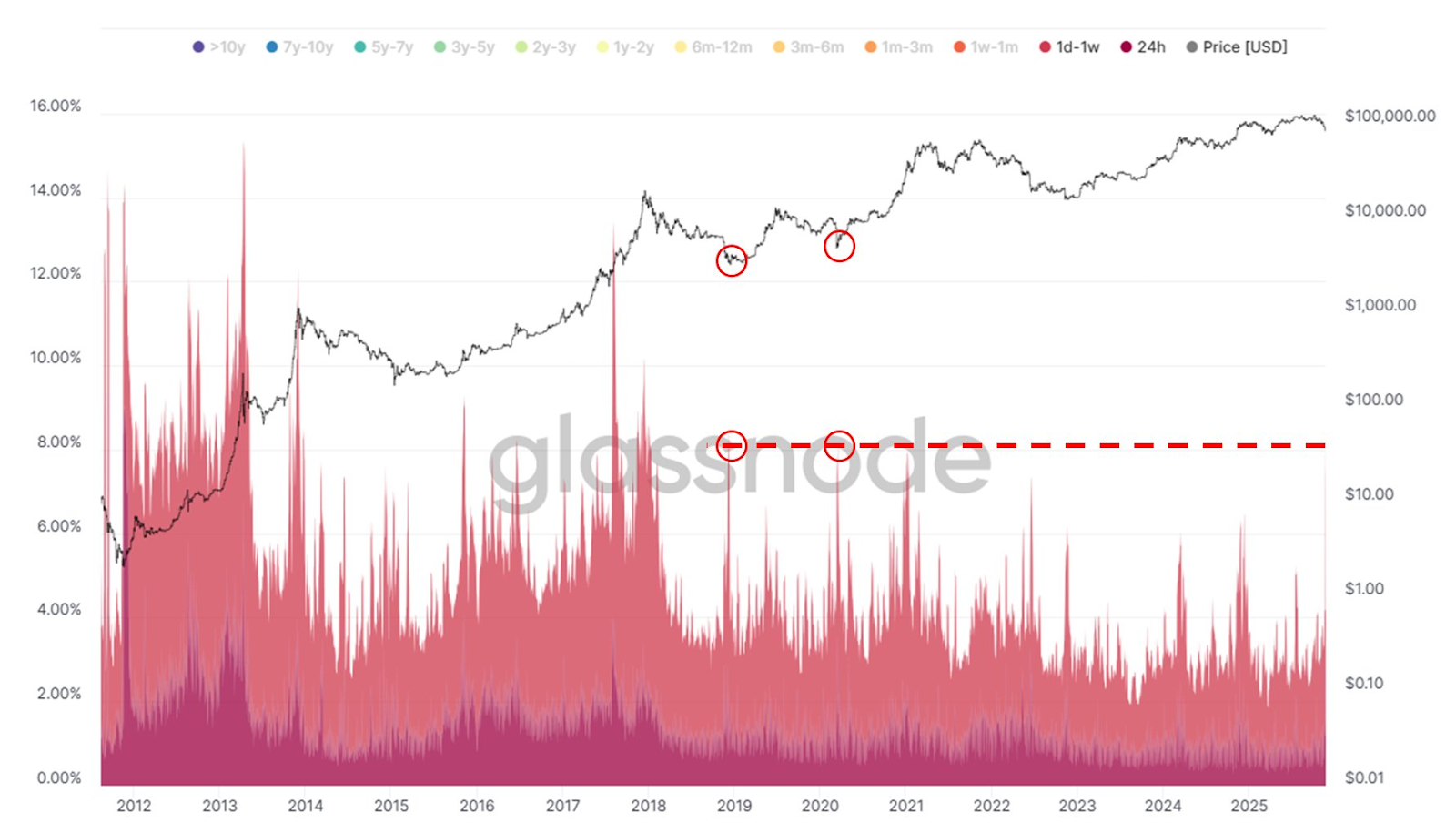

Bitcoin supply migration refers to the large-scale transfer of Bitcoin holdings between wallets and exchanges, with over 8% of the total supply—approximately 1.6 million BTC—changing hands in the past seven days. This event, described by Joe Burnett, analyst and director of Bitcoin Strategy at Semler Scientific, as one of the most significant onchain events in Bitcoin history, occurred during a market downturn tied to uncertainty over the US Federal Reserve’s December rate decision. While up to half of this movement may stem from a Coinbase Wallet Migration, the scale suggests broader trader activity as investors position for potential rate cuts.

How Are Federal Reserve Rate Expectations Influencing Crypto Markets?

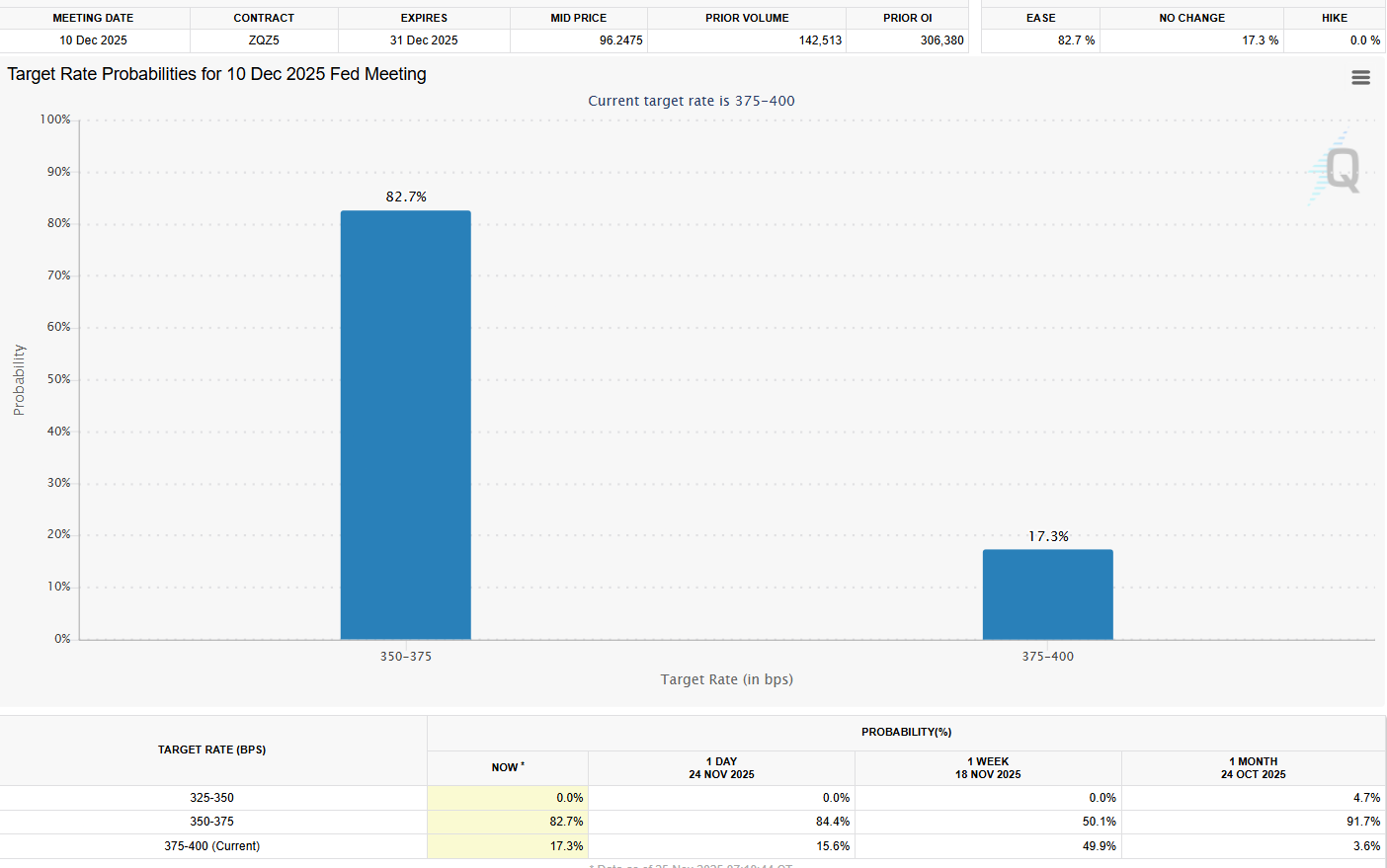

The broader crypto market remains on edge as expectations for the Federal Reserve’s interest rate decisions shift. Markets now price in an 82% chance of a 25 basis point cut at the December 10 meeting, up from 50% a week ago, according to data from the CME Group’s FedWatch tool. This adjustment fueled Bitcoin’s recent recovery from $81,000 to $87,000. Nic Puckrin, digital asset analyst and co-founder of The Coin Bureau, notes that mixed signals from the Fed have placed Bitcoin’s price and investor sentiment on a “knife’s edge.” He emphasizes that the December press conference could determine whether the market sees a Santa rally or further declines, with traders closely monitoring developments as the date approaches.

Bitcoin saw one of its largest supply migrations ever as traders braced for the US Federal Reserve’s December rate decision and shifting expectations toward a rate cut.

A historic shift in Bitcoin ownership unfolded during the latest market downturn, while the broader crypto market remained tied to uncertainty over a possible US Federal Reserve rate cut in December.

Over 8% of the total Bitcoin (BTC) supply changed hands in the past seven days, making the current market decline “one of the most significant onchain events” in Bitcoin history, according to Joe Burnett, analyst and director of Bitcoin Strategy at Semler Scientific.

During previous significant Bitcoin supply movements, Bitcoin traded at about $5,000 in March 2020 and around $3,500 in December 2018, said Burnett in a Tuesday X post.

Both occasions marked a local bottom ahead of an accumulation phase that ultimately led to new all-time highs.

Still, up to half of the current Bitcoin supply movement may be attributed to a Coinbase Wallet Migration announced on Saturday, added Burnett.

Source: Joe Burnett

Bitcoin rout continues as crypto treasuries face reckoning: Finance Redefined

Bitcoin, crypto markets on “knife’s edge” ahead of Fed interest rate decision in December

Meanwhile, Bitcoin’s price and investor sentiment remain on a “knife’s edge” due to mixed messages about December’s interest rate cut decisions, according to Nic Puckrin, digital asset analyst and co-founder of educational platform The Coin Bureau.

“What is more certain, though, is that the Fed holds the key to the market’s end-of-year finale, and its next rate decision will determine whether we get a Santa rally or a Santa dump,” he told Cointelegraph.

“What is more certain, though, is that the Fed holds the key to the market’s end-of-year finale, and its next rate decision will determine whether we get a Santa rally or a Santa dump,” he told Cointelegraph.

$1.9B exodus and flicker of hope hits crypto investment funds: CoinShares

Interest rate cut expectations for the Federal Reserve’s Dec. 10 meeting have changed drastically during the past week

Interest rate cut probabilities. Source: CMEgroup.com

Markets are pricing in an 82% chance of a 25 basis point interest rate cut, up from 50% a week ago, according to the CME Group’s FedWatch tool.

The growing interest rate cut expectations were the main fuel leading to Bitcoin’s recovery from $81,000 to $87,000, according to Puckrin.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

Frequently Asked Questions

What Caused the Recent 8% Bitcoin Supply Migration?

The migration of over 8% of Bitcoin’s supply in seven days stems from traders repositioning amid market uncertainty and the Coinbase Wallet Migration. Analyst Joe Burnett highlights this as a major onchain event, potentially signaling a bottom similar to 2018 and 2020 downturns that preceded rallies.

How Might the Fed’s December Rate Decision Impact Bitcoin Prices?

The Federal Reserve’s December 10 meeting could sway Bitcoin significantly, with an 82% probability of a 25 basis point cut boosting recovery expectations. As Nic Puckrin explains, this decision may trigger either a year-end rally or continued pressure, keeping markets highly volatile until the announcement.

Key Takeaways

- Historic Onchain Activity: The 8% supply shift in Bitcoin represents one of the largest migrations, driven partly by wallet updates and broader market positioning.

- Rate Cut Optimism: Rising expectations for a Fed cut to 82% have supported Bitcoin’s rebound from $81,000, underscoring monetary policy’s influence on crypto.

- Monitor Fed Signals: Investors should watch the December press conference closely, as it could define the market’s trajectory into 2026.

Conclusion

The recent Bitcoin supply migration of over 8% highlights heightened activity as the crypto market navigates uncertainty around the US Federal Reserve’s December rate decision. With expectations for a 25 basis point cut now at 82%, per the CME Group’s FedWatch tool, Bitcoin’s path forward hinges on these outcomes, much like past events that led to recoveries. As experts like Joe Burnett and Nic Puckrin observe, staying attuned to Federal Reserve signals remains crucial for informed decision-making in the evolving crypto landscape—position yourself for potential opportunities ahead.