Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin staged a powerful recovery from $89,200 to reach $93,888 following geopolitical tensions between Venezuela and the United States. The explosions in Caracas on January 3rd and subsequent arrest announcements increased volatility across crypto markets while reinforcing BTC’s safe-haven narrative amid global uncertainty.

- Bitcoin recorded over 5% gains amid the geopolitical crisis

- Critical support at $89,468.4 held firm, enabling upward momentum

- $93,323.07 emerges as strong resistance zone in technical analysis

Bitcoin surged to $93,888 following Venezuela-US tensions. Analyzing critical support and resistance levels.

What Are the Venezuela-US Tensions and How Did They Impact Bitcoin?

Bitcoin price initiated a significant upward trend following dramatic events in Caracas, Venezuela’s capital, on January 3, 2025. According to TradfiNews reports, multiple explosions were heard at 06:22 UTC, and approximately 1 hour and 20 minutes later, Venezuelan authorities blamed the United States for the attack. President Trump’s announcement at 09:22 UTC confirming large-scale operations against Venezuela, followed by news of N. Maduro and his wife’s arrest, sent shockwaves through global markets.

Why Do Geopolitical Crises Drive Bitcoin Prices Higher?

Historical data reveals that during periods of geopolitical uncertainty, investors tend to seek assets independent of traditional financial systems. Bitcoin, with its decentralized structure and cross-border transfer capabilities, positions itself as “digital gold” during such times. A similar dynamic was observed during the Venezuela-US tensions; investors showed increased appetite for BTC positions amid the uncertainty.

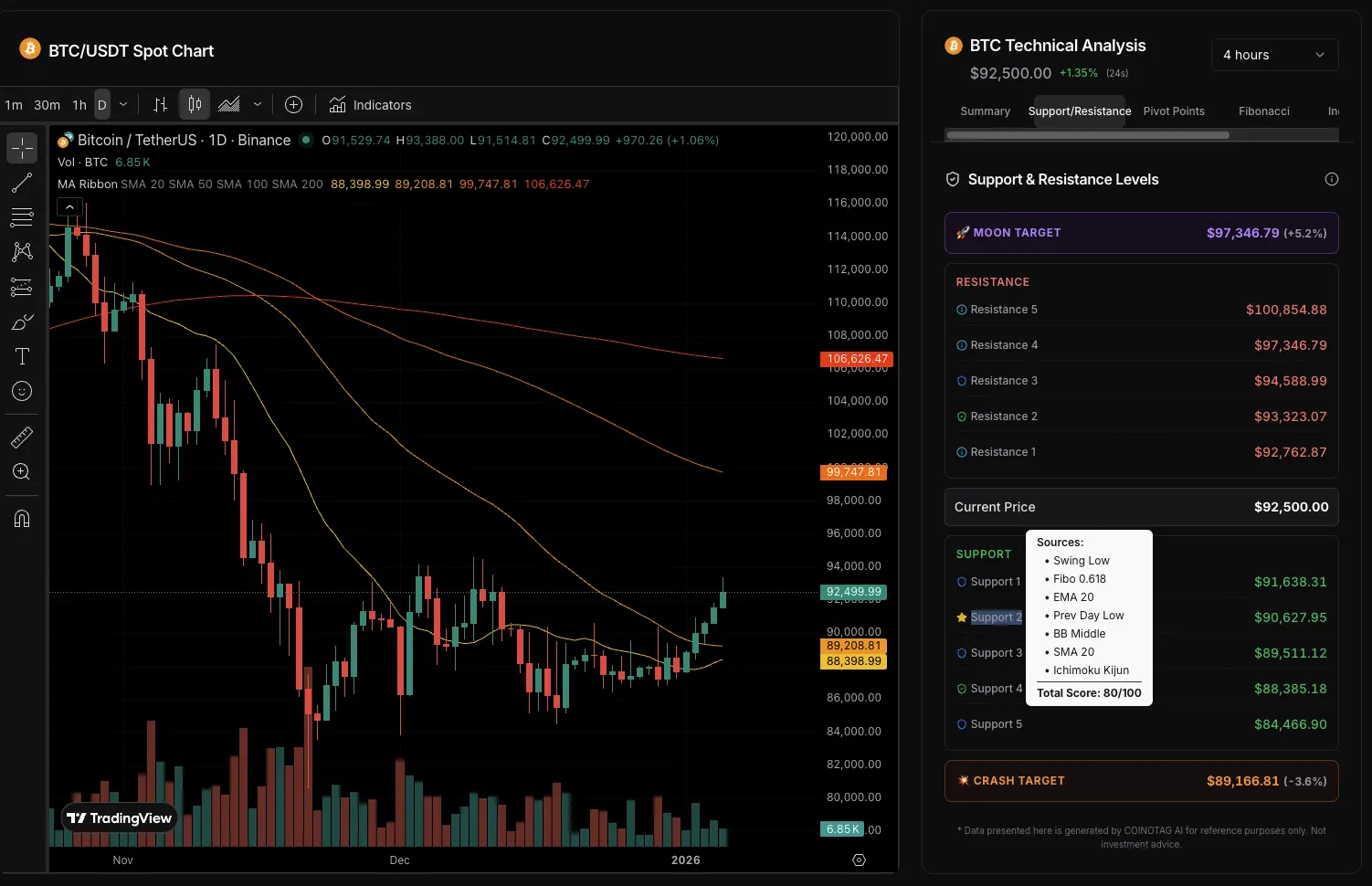

Bitcoin Technical Analysis: Critical Support and Resistance Levels

According to COINOTAG DATA’s 4-hour chart analysis, Bitcoin’s price action is supported by significant technical indicators. On the day of tensions, Bitcoin briefly retreated to $89,200 in Futures markets but managed to hold above the critical support level of $89,468.4.

Bitcoin 4h Strongest Support Level: $90,627.95

The Support 2 level at $90,627.95 stands out as the zone with the most confirmations in technical analysis. The technical indicators forming this level’s strength include:

- Swing Low: The lowest point where price reversed

- Fibonacci 0.618: Golden ratio retracement level

- EMA 20: 20-period exponential moving average

- Prev Day Low: Previous day’s lowest level

- Bollinger Band Middle: Middle band support

- SMA 20: 20-period simple moving average

- Ichimoku Kijun: Base line of the Ichimoku cloud indicator

The confluence of so many technical indicators at the same level demonstrates that the $90,627.95 zone forms an extremely strong support area. Maintaining this level during potential pullbacks is critical for the continuation of the uptrend.

Critical Resistance Zone: $93,323.07

The Resistance 2 level identified at $93,323.07 is evaluated as the most important barrier Bitcoin needs to overcome in the short term. Technical indicators converging at this level include:

- ATR Upper: Average True Range upper band

- R2: Pivot point second resistance level

- Donchian Upper: Donchian channel upper boundary

- Fibonacci 0.886: Deep retracement level

Bitcoin touching $93,888 indicates this resistance zone has been tested. A sustained breakout requires daily closes above this level.

Chronological Analysis of Price Movement

During the hours when Venezuelan events unfolded, Bitcoin was consolidating between $90,000 and $89,200. Following Trump’s announcements, a rapid recovery began in the market:

- Phase one: Recovery from $89,200 above the $89,468.4 critical support

- Phase two: Breaking the $90,300 near resistance

- Phase three: Reaching $91,518 within 4-5 hours

- Phase four: Brief pullback to $90,750

- Phase five: Strong surge to $93,888 level

Important Notes for Investors

The impact of geopolitical events on cryptocurrency markets is typically short-term. However, large-scale international crises like the Venezuela-US tensions can be evaluated as catalysts strengthening Bitcoin’s safe-haven status. Investors are advised to review their risk management strategies during such periods and closely monitor technical levels.

Frequently Asked Questions

Why did the Venezuela-US tensions cause Bitcoin price to rise?

During periods of geopolitical uncertainty, investors tend to shift toward assets independent of traditional financial systems. Bitcoin, with these characteristics, is perceived as a “digital safe haven” during crisis periods, and increased demand triggers upward price movements.

Why is the $90,627 support level so important for Bitcoin?

This level represents the intersection of seven different technical indicators including Fibonacci 0.618, EMA 20, Ichimoku Kijun, and Bollinger Band middle band. The presence of so many confirmations together signals that this level forms a strong buying zone.

When could Bitcoin reach $100,000?

According to technical analysis, Bitcoin first needs to sustainably break above the $93,323 resistance. If daily closes occur above this level, movement toward the psychological $100,000 target could accelerate. However, macroeconomic conditions and global developments will also be determining factors in this process.

Key Takeaways

- Geopolitical events impact crypto markets: Venezuela-US tensions triggered Bitcoin’s rise from $89,200 to $93,888

- Technical levels are critically important: $90,627.95 stands as strong support while $93,323.07 is the resistance to overcome

- Risk management is essential: In volatile market conditions, investors must carefully manage stop-loss levels and position sizes

Conclusion

Bitcoin demonstrated strong performance amid the uncertainty created by Venezuela-US tensions, reaching $93,888. Technical indicators reveal that the $90,627.95 level forms a robust support zone, while the $93,323.07 resistance represents the critical threshold to overcome in the short term. Investors are advised to follow developments closely and check current support-resistance levels on the COINOTAG CryptoCurrencies page. The impact of global geopolitical dynamics on crypto markets will continue to be a determining factor in the coming period.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC

Bitcoin Consolidates in Triangle, Signaling Potential 15% Move Amid Exchange Liquidity Flows

January 1, 2026 at 12:13 AM UTC