Bitcoin Volatility May Threaten Crypto Treasury Stability Amid Aave’s 2026 Plans

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Crypto market volatility in 2025 has intensified, with Bitcoin dropping over 5% to $84,398 before recovering to $87,769, threatening digital asset treasury firms’ net asset values and fundraising. This instability impacts corporate crypto strategies amid regulatory wins like Aave’s SEC probe closure.

-

Bitcoin’s weekly decline highlights ongoing crypto market volatility, dipping to $84,398 amid holiday slowdowns.

-

Digital asset treasury companies face challenges from multiple-to-net-asset-value swings, as explained by Solmate CEO Marco Santori.

-

Aave secures a regulatory victory with the SEC ending its four-year investigation, paving the way for a 2026 master plan targeting $1 billion in real-world assets, per platform data.

Crypto market volatility surges in 2025, impacting treasuries and DeFi. Discover Aave’s bold plans post-SEC win and Hyperliquid’s governance moves. Stay informed on Ethereum innovations and SEC tokenized stock rules—read now for key insights.

What is driving crypto market volatility in 2025?

Crypto market volatility in 2025 stems from reduced investor activity ahead of holidays, causing Bitcoin to fall over 5% to a low of $84,398 before rebounding above $87,769. This turbulence directly affects digital asset treasury companies, whose net asset values fluctuate wildly, complicating fundraising efforts. Experts like Solmate CEO Marco Santori emphasize the need for stable capital management to sustain these firms amid token price swings.

BTC/USD, 3-month chart. Source: Cointelegraph/TradingView

How does crypto market volatility impact digital asset treasury companies?

Crypto market volatility poses significant risks to digital asset treasury (DAT) firms, as their balance sheets are heavily tied to fluctuating token values. Solmate CEO Marco Santori notes that these companies must navigate the multiple-to-net-asset-value (mNAV) dynamic, where market caps exceed asset values during bull runs, enabling accretive fundraising. However, when token interest fades, mNAV drops, stalling growth and leaving firms idle.

Santori, speaking on Chain Reaction X, explained: “Every dollar of stock they sell, they take that and go out and buy the underlying coin with, and that increases their net asset value. So long as they can maintain the premium, they can just keep doing that.” Yet, pure-play DATs without revenue streams remain vulnerable to this “roller coaster,” underscoring the importance of diversified strategies. Data from TradingView illustrates Bitcoin’s recent 5% dip, mirroring broader market pressures on DAT sustainability.

In 2025, the rise of DATs represents a key narrative, but longevity depends on avoiding volatility traps. Santori’s Solmate avoids this by prioritizing exposure to Solana’s growth without mNAV dependency, protecting investors from extreme swings.

Aave’s 2026 Master Plan After SEC Investigation Ends

The U.S. Securities and Exchange Commission (SEC) has concluded its four-year probe into Aave, a major win for decentralized finance. Aave founder Stani Kulechov responded by unveiling a 2026 master plan focused on scaling the protocol to handle $1 billion in real-world asset deposits through Aave v4, Horizon, and the Aave App.

Kulechov stated on X: “As it stands, our strategy going into next year has three main pillars: Aave v4, Horizon, and Aave App.” This comes after 2025’s successes, with Kulechov viewing the platform as still in its early stages.

Source: Stani Kulechov

Aave v4 introduces enhancements to borrowing, lending, user interfaces, and liquidation processes via a Hub and Spoke model. The hub serves as a unified crosschain liquidity pool, while spokes enable customizable markets. Kulechov highlighted: “This will allow Aave to handle trillions of dollars in assets, making it the go-to choice for any institution, fintech, or company.”

Horizon, Aave’s RWA market, aims to integrate top financial institutions, boosting DeFi’s real-world ties. The plan includes new markets, assets, and integrations, with progressive total value locked (TVL) scaling through DAO partnerships.

Hyperliquid Governance Vote on $1 Billion Assistance Fund

The Hyper Foundation has initiated a validator vote to classify HYPE tokens in the Assistance Fund—worth about $1 billion—as permanently burned, removing them from circulating supply. This fund, embedded in the layer-1 network, converts trading fees into HYPE at a system address without retrieval options, requiring a hard fork otherwise.

Hyper Foundation stated: “By voting ‘Yes,’ validators agree to treat the Assistance Fund HYPE as burned.” Native Markets, issuer of USDH stablecoin, noted that 50% of its reserve yields feed into the fund, which would be recognized as burned if approved.

Source: Hyper Foundation

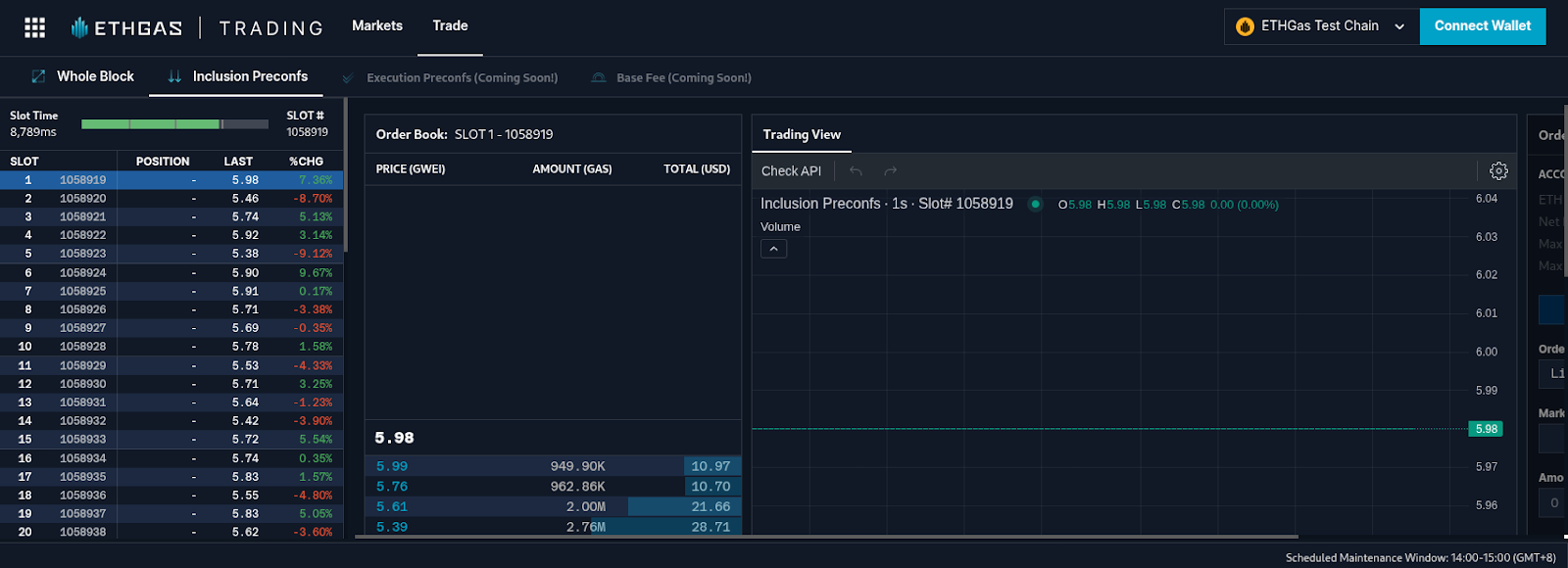

ETHGas Secures $12 Million Funding Amid Gas Futures Discussion

ETHGas, an Ethereum blockspace trading platform, raised $12 million in seed funding led by Polychain Capital. This follows Ethereum co-founder Vitalik Buterin’s recent advocacy for onchain gas futures to hedge fees and signal costs.

ETHGas promotes a reimagined blockspace allocation, launching a market with $800 million in commitments from validators and builders. Buterin argued such markets could provide clearer fee expectations, aligning with ETHGas’s innovations.

ETHGas’ Ethereum blockspace trading platform. Source: ETHGas

SEC Guidance on Custodying Tokenized Stocks and Bonds

The SEC’s Trading and Markets Division clarified that broker-dealers can custody tokenized stocks and bonds under existing rules, provided they meet operational, security, and governance standards. This applies solely to crypto asset securities, integrating them into traditional protections rather than creating new categories.

The guidance, though not a formal rule, emphasizes blockchain settlement within established frameworks. It signals regulators’ intent to apply familiar safeguards to tokenized assets, ensuring customer protection without novel treatments.

Source: US SEC

Frequently Asked Questions

What caused Bitcoin’s recent price drop in the crypto market volatility of 2025?

Bitcoin fell over 5% due to waning investor activity before holidays, reaching a low of $84,398 before climbing back above $87,769. This reflects broader crypto market volatility tied to seasonal slowdowns and token value fluctuations, impacting treasury stability per TradingView data.

How will Aave’s 2026 master plan address real-world assets in DeFi?

Aave’s plan targets $1 billion in RWA deposits via Aave v4’s Hub and Spoke model for scalable liquidity, Horizon for institutional onboarding, and the Aave App for enhanced access. Founder Stani Kulechov envisions trillions in assets, fostering new DeFi integrations spoken naturally for voice queries.

Key Takeaways

- Crypto market volatility challenges DATs: Firms must manage mNAV swings to sustain fundraising, as Solmate CEO Marco Santori advises diversified strategies over pure token exposure.

- Aave’s regulatory progress: Ending the SEC probe enables ambitious 2026 scaling, with v4 poised to handle institutional liquidity through innovative models.

- Regulatory clarity for tokenized assets: SEC guidance integrates blockchain securities into existing rules, promoting secure custody while maintaining traditional protections—monitor for compliance impacts.

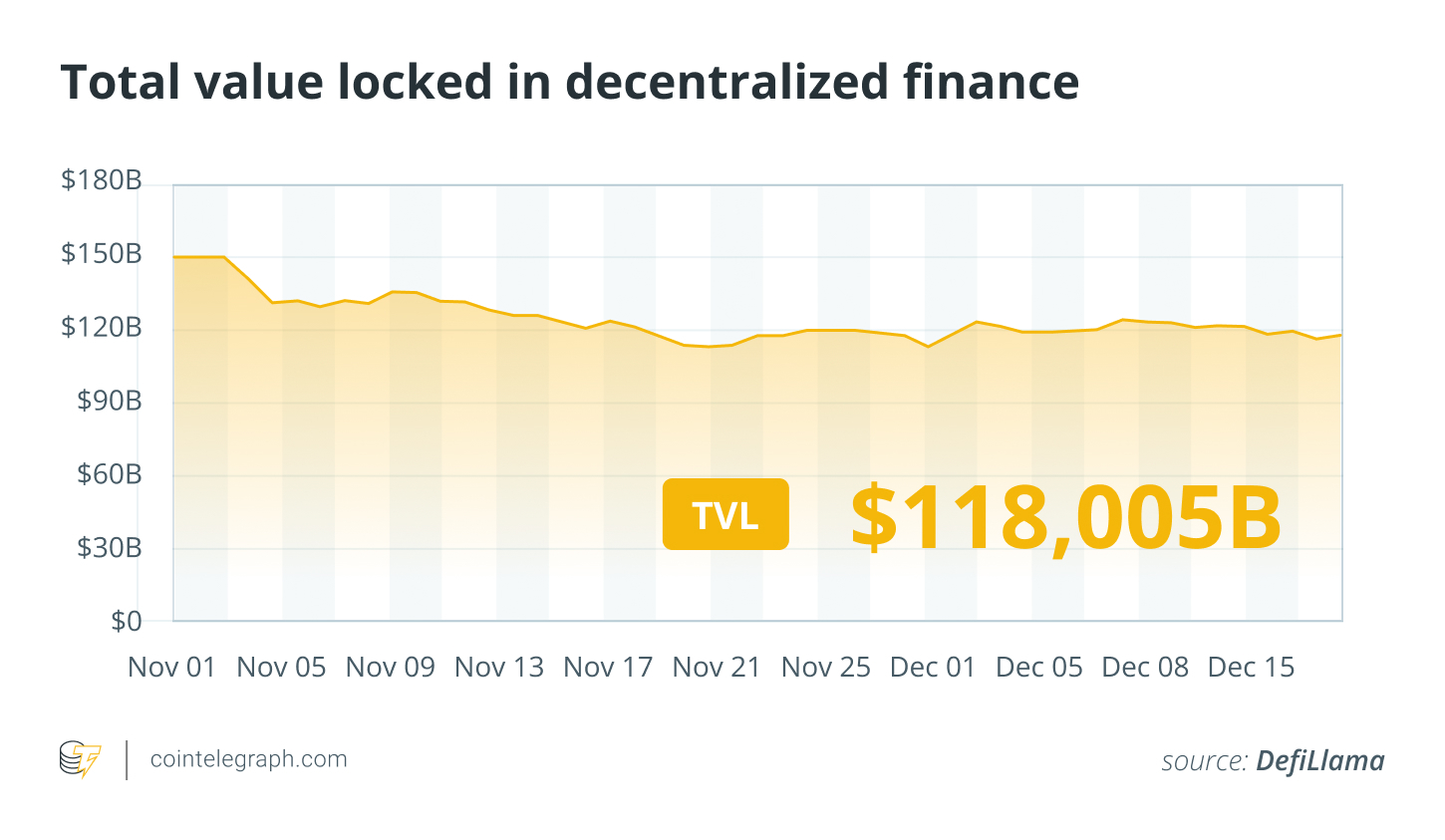

DeFi Market Overview

In the DeFi sector, most of the top 100 cryptocurrencies by market cap closed the week lower. Pump.fun’s PUMP token dropped 32%, the steepest decline, followed by Aster’s ASTER at over 27% down. Total value locked remains dynamic, per DefiLlama data.

Total value locked in DeFi. Source: DefiLlama

Conclusion

Crypto market volatility in 2025 continues to test digital asset treasury companies and DeFi protocols, from mNAV pressures highlighted by experts like Marco Santori to Aave’s forward momentum post-SEC clearance. With innovations in Ethereum blockspace via ETHGas and Hyperliquid’s governance decisions, the sector shows resilience. Tokenized securities gain SEC clarity, blending blockchain with traditional finance. As these developments unfold, stakeholders should prioritize risk management and regulatory adherence for sustained growth in the evolving landscape.