Bitcoin Whale Deposits Surge to 9,000 BTC on Exchanges, Hinting at Further Price Pressure

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

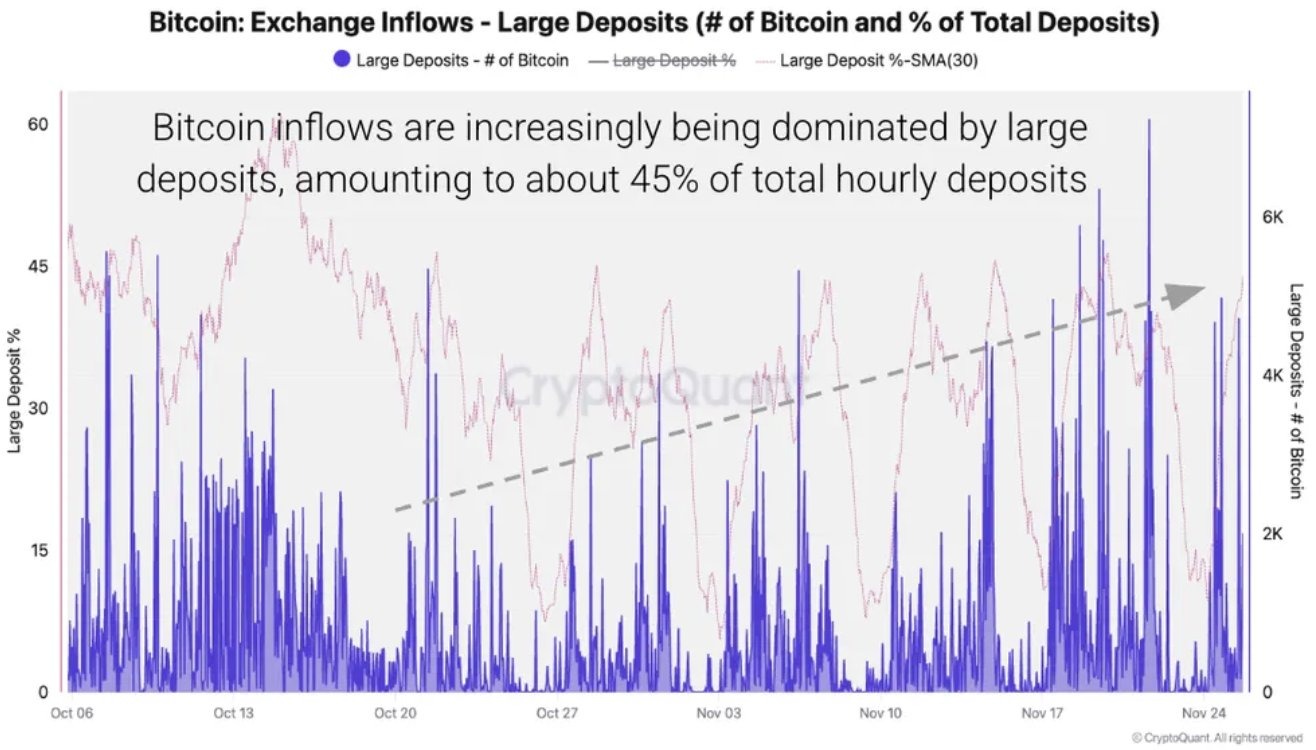

Bitcoin whale deposits to exchanges surged to 9,000 BTC on November 21, 2025, driven by large holders contributing 45% of inflows, signaling intensified selling pressure that could push the asset’s price lower amid the ongoing drawdown.

-

Bitcoin exchange inflows peaked at 9,000 BTC on November 21, the highest in recent months, as prices dipped to $80,600 on major platforms.

-

Whale activity accounted for 45% of these deposits, with single-day highs reaching 7,000 BTC from holders of 100 BTC or more.

-

The average deposit value hit 1.23 BTC in November, the highest in a year, according to data from analytics firm CryptoQuant.

Bitcoin whale deposits to exchanges hit 9,000 BTC on Nov. 21, 2025, raising concerns over further price drops. Discover whale impacts, stablecoin trends, and market insights for informed crypto decisions.

What Are Bitcoin Whale Deposits Signaling for the Crypto Market?

Bitcoin whale deposits to exchanges represent significant movements of large Bitcoin holdings by major investors, often indicating preparations for selling that can exert downward pressure on prices. On November 21, 2025, these deposits surged to a peak of 9,000 BTC, coinciding with Bitcoin’s price falling to $80,600 on Coinbase, its lowest level in seven months. Analysts from CryptoQuant highlight that such inflows, particularly from whales holding 100 BTC or more, contributed 45% of the total, suggesting continued selling amid the current market drawdown.

Increased exchange inflows typically signal that investors are positioning to offload assets, contrasting with outflows that often reflect accumulation or holding strategies. This pattern raises concerns about sustained selling pressure, potentially leading to further declines if the trend persists. The average value of BTC deposits in November reached 1.23 BTC, marking the highest in a year and underscoring the scale of whale involvement.

Exchanges have been seeing large BTC deposits recently. Source: CryptoQuant

How Have Recent Exchange Inflows Impacted Bitcoin and Altcoin Prices?

Recent Bitcoin whale deposits have intensified selling pressure, contributing to the asset’s price volatility and decline to seven-month lows. CryptoQuant data shows that 45% of inflows stemmed from large 100 BTC-plus deposits, peaking at 7,000 BTC in a single day, which analysts interpret as whales preparing to liquidate holdings. This activity not only affects Bitcoin but also ripples through the broader market, as heightened inflows often correlate with reduced confidence.

For altcoins like Ether, a similar but less pronounced inflow trend has emerged, with total deposits increasing modestly amid the sell-off. Other altcoins have seen sharper inflows this month, pushing many back to bear market levels as investors rotate capital away from riskier assets. Supporting this, market observers note that Bitcoin’s Sharpe ratio—measuring risk-adjusted returns—has approached zero, a rare signal indicating poor reward potential relative to volatility.

Expert commentary reinforces these observations. James Check, a prominent analyst, warned earlier this week about lingering leverage in the markets, stating, “We wouldn’t be too surprised if we wick into the $70k-$80k zone to flush the final leverage pockets.” This suggests potential for deeper corrections to clear out overextended positions. Meanwhile, BitMine chairman Tom Lee has revised his outlook, tempering expectations by saying that even a return to all-time highs by year-end is now just a “maybe,” reflecting caution amid whale-driven pressures.

Despite these headwinds, some optimism persists. 10x Research analysts described Bitcoin’s recent rebound as a “tactical, oversold” move still unfolding, with key resistance levels at $92,000 and $101,000 to monitor. At the time of this report, Bitcoin has reclaimed and stabilized slightly above $90,000, hinting at possible short-term stabilization if inflows moderate.

Frequently Asked Questions

What Causes Bitcoin Whale Deposits to Exchanges?

Bitcoin whale deposits to exchanges are typically driven by large holders seeking to sell portions of their holdings, often in response to price declines or profit-taking opportunities. In November 2025, these movements surged, with whales accounting for 45% of 9,000 BTC inflows, as reported by CryptoQuant, signaling preparation for liquidation amid market downturns.

Could Bitcoin Prices Fall Further Due to Whale Activity?

Yes, sustained whale selling from these deposits could exert additional downward pressure on Bitcoin’s price, potentially testing lower support levels like $70,000 to $80,000. However, if inflows decrease and buying interest returns, the asset might stabilize or rebound toward resistance at $92,000, according to ongoing market analysis.

Key Takeaways

- Whale-Driven Inflows Dominate: Large holders contributed 45% of the 9,000 BTC exchange deposits on November 21, 2025, highlighting their outsized influence on market sentiment.

- Stablecoin Reserves Surge on Binance: Reserves hit a record $51 billion, with BTC and ETH inflows reaching $40 billion this week, indicating capital rotation to safer dollar-pegged assets amid uncertainty.

- Monitor Altcoin Trends: Similar inflow patterns in Ether and other altcoins suggest broader sell-off pressures, urging investors to watch for bear market lows and potential recovery signals.

Conclusion

The surge in Bitcoin whale deposits to exchanges, reaching 9,000 BTC on November 21, 2025, underscores significant selling pressure from large holders, with 45% of inflows from whale-sized transactions potentially driving further price declines. As Binance’s stablecoin reserves climb to record highs and altcoin inflows mirror Bitcoin’s trends, the market faces heightened volatility, though tactical rebounds offer glimmers of hope. Investors should stay vigilant, tracking exchange flows and leverage levels for informed strategies, as the crypto landscape evolves toward possible stabilization or deeper corrections in the coming weeks.

Broader Market Implications: Stablecoin and Altcoin Dynamics

Beyond Bitcoin, the crypto ecosystem shows interconnected pressures. Binance’s stablecoin reserves achieved a historic peak of $51 billion, while Bitcoin and Ether inflows totaled $40 billion over the week, primarily via Binance and Coinbase platforms. This rotation into stablecoins—dollar-pegged assets like USDT and USDC—typically occurs when traders park capital during downturns, awaiting clearer entry points for re-entering volatile markets.

High stablecoin balances signal caution among participants, as funds sit idle rather than fueling rallies in Bitcoin or altcoins. CryptoQuant’s analysis emphasizes that such reserves build during periods of uncertainty, often preceding shifts in market direction. For Ether, inflows have risen but not dramatically, contrasting with sharper increases in other altcoins, which have retreated to bear market territories amid the intensified sell-off.

This pattern aligns with historical precedents where whale activity in Bitcoin spills over, amplifying altcoin declines. Experts like those at 10x Research point to Bitcoin’s oversold conditions as a counterbalance, predicting resistance tests that could define the next phase. Tom Lee’s adjusted forecast further tempers bullish narratives, focusing attention on realistic year-end scenarios.

In demonstrating expertise, it’s crucial to note that while whale deposits provide immediate signals, broader factors like macroeconomic influences and regulatory developments also shape outcomes. Analytics from firms like CryptoQuant offer reliable, data-backed insights without speculation, helping stakeholders navigate these dynamics responsibly.

The average BTC deposit size of 1.23 BTC in November, the highest annually, amplifies concerns over sustained pressure. Yet, Bitcoin’s resilience—evident in its climb above $90,000—suggests that not all inflows translate to immediate sales. Traders must weigh these against global events, maintaining diversified approaches to mitigate risks.