Bitcoin Whales Accumulate Amid Retail Selling: Signs of Potential Recovery

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

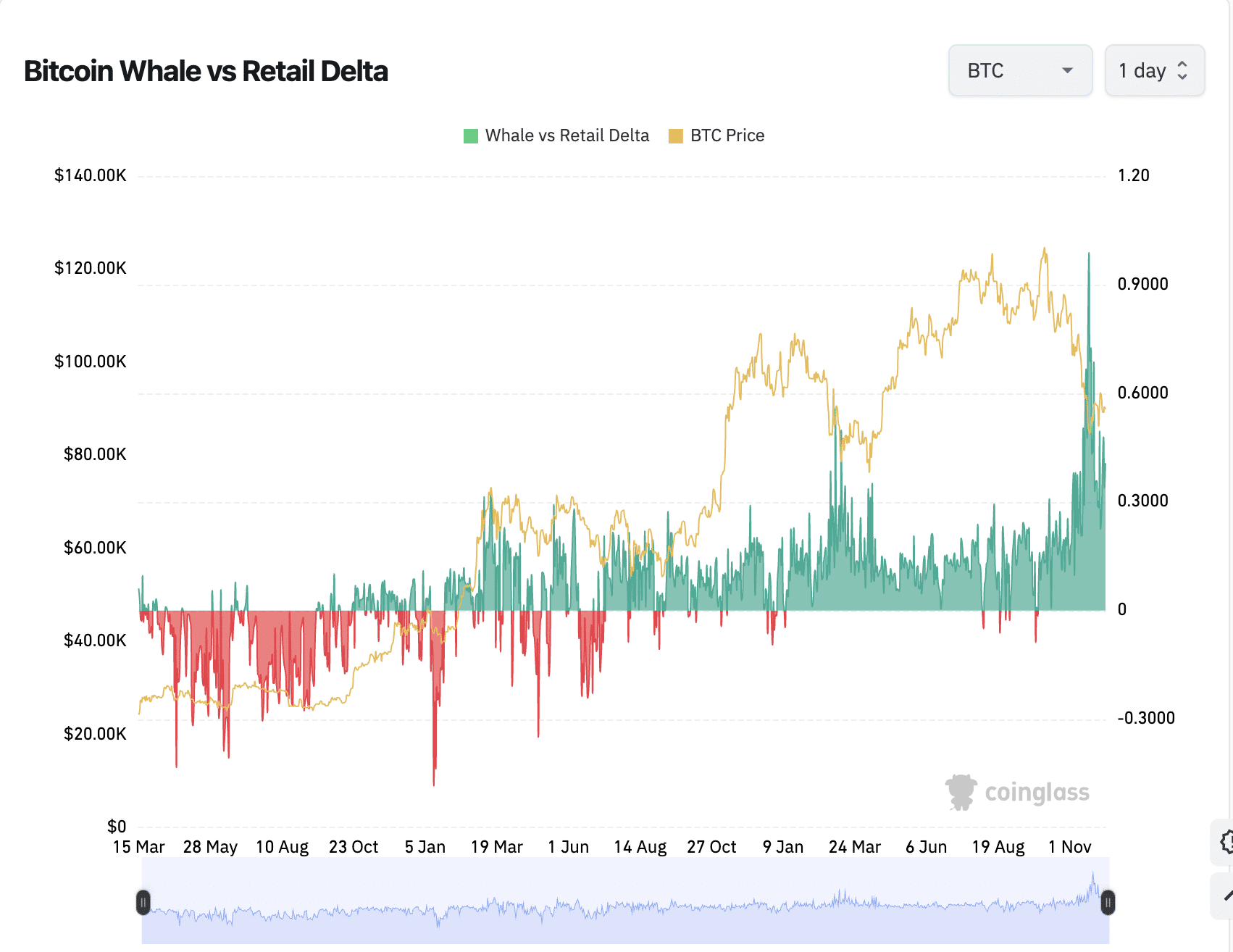

Bitcoin whale accumulation is accelerating amid a recent price downturn, with large holders netting positive inflows while retail traders sell off positions. On-chain data from Coinglass shows whales absorbing supply at levels around $89,800, a pattern that has historically led to recoveries as stronger hands dominate.

-

Whales are increasing Bitcoin holdings during the dip, signaling confidence in long-term value.

-

Retail activity has turned negative, with smaller wallets exiting amid uncertainty below $90,000.

-

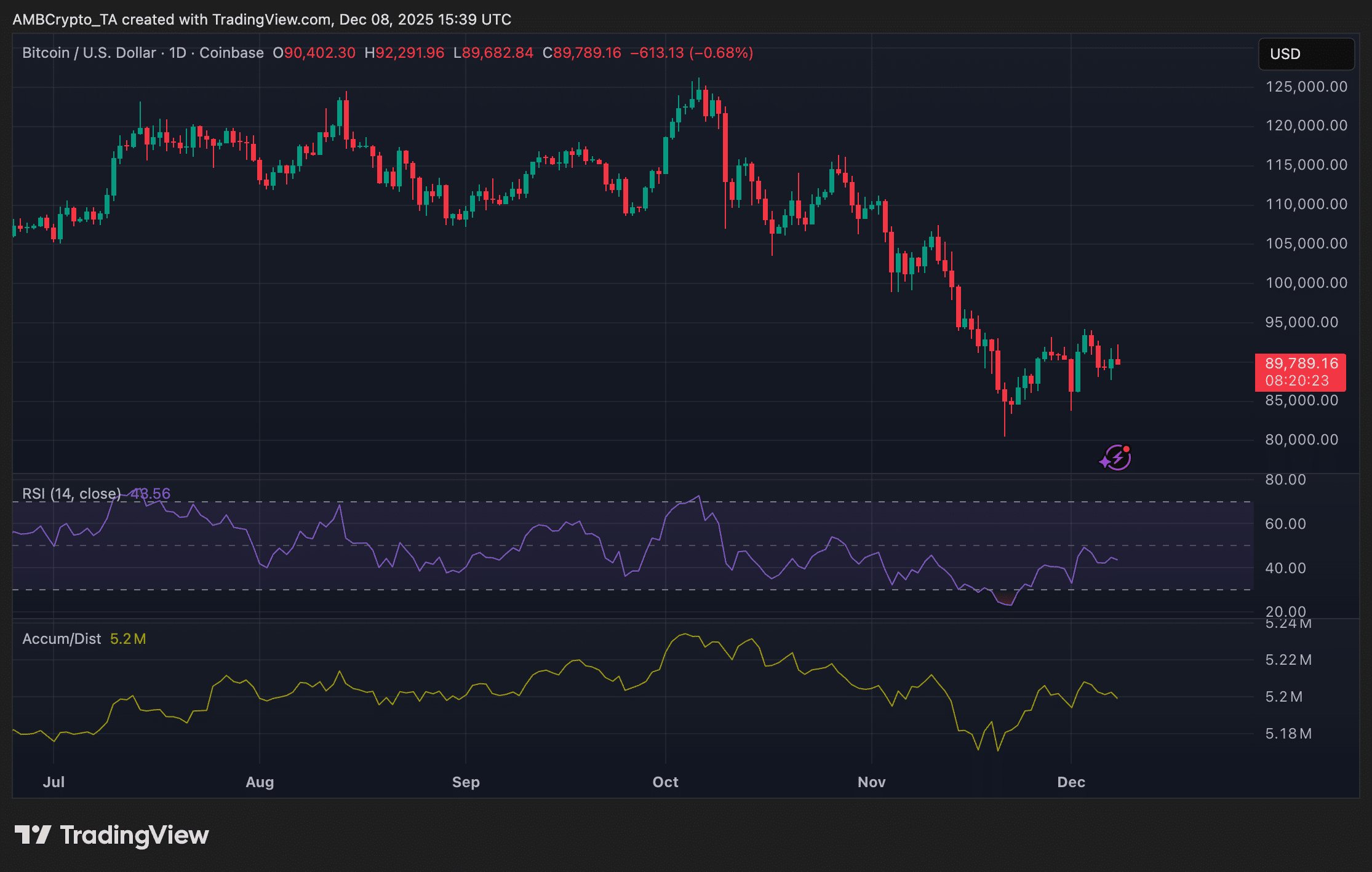

The Accumulation/Distribution metric is rising, supported by data indicating net inflows despite subdued price action, per TradingView analysis.

Discover Bitcoin whale accumulation trends as large holders buy the dip while retail sells. Explore on-chain insights and price analysis for 2025 market signals—stay informed on crypto dynamics today.

What is Bitcoin Whale Accumulation During Market Downturns?

Bitcoin whale accumulation refers to large holders, or “whales,” increasing their Bitcoin reserves during price declines, often absorbing supply from exiting retail investors. This behavior, evident in recent on-chain metrics, shows whales netting positive positions even as Bitcoin trades around $89,800. Historically, such divergences have preceded recoveries, as whales view corrections as buying opportunities, according to data from blockchain analytics platforms like Coinglass.

How Are Retail Traders Behaving in Response to Bitcoin’s Recent Decline?

Retail traders have entered net selling mode, offloading Bitcoin positions amid the downturn below $90,000. Coinglass metrics reveal the Whale vs. Retail Delta chart at 0.407, indicating stronger whale buying contrasted with retail outflows. This shift marks a reversal from earlier 2025 momentum, where smaller holders fueled highs. Expert analysis from market observers notes that retail capitulation typically occurs late in cycles, allowing whales to accumulate at discounted prices. Supporting data shows similar patterns in past corrections, where retail selling volumes spiked by up to 30% during volatility, per historical blockchain records. Short sentences highlight the dynamic: Whales buy. Retail sells. Market stabilizes. This divergence underscores Bitcoin’s resilience, as larger entities often drive the asset’s long-term trajectory.

Source: Coinglass

Previous cycles confirm this trend, with retail participation waning during uncertainty while institutional-grade holders, including whales, build positions. The RSI indicator at 48 suggests neutral momentum, leaving potential for upside if accumulation intensifies. Market participants monitoring these flows anticipate stabilization, drawing from established patterns in Bitcoin’s volatility history.

Frequently Asked Questions

What Does the Whale vs. Retail Delta Chart Indicate for Bitcoin in 2025?

The Whale vs. Retail Delta chart at 0.407 highlights whales’ net buying surpassing retail selling, a bullish signal amid the dip. This metric, derived from Coinglass on-chain data, shows large holders accumulating over 500 BTC in recent sessions, countering smaller wallet outflows and pointing to potential price support above $85,000.

Why Are Bitcoin Whales Buying While Retail Traders Sell During Downturns?

Bitcoin whales buy during downturns because they possess the capital to weather volatility and view corrections as entry points for long-term gains. Retail traders, facing immediate pressures, often sell to cut losses. This natural market behavior, observed in cycles since 2017, allows whales to consolidate supply, fostering stability that benefits the broader ecosystem over time.

Source: TradingView

Key Takeaways

- Whale Accumulation Strengthens: Large holders are netting inflows, absorbing retail supply and historically signaling recoveries in Bitcoin markets.

- Retail Selling Peaks Late: Smaller traders’ capitulation creates opportunities for whales, as seen in past cycles with up to 30% volume shifts.

- Monitor Accumulation Metrics: Rising Accumulation/Distribution lines suggest building demand—track for stabilization above mid-$80,000 levels.

Conclusion

In summary, Bitcoin whale accumulation is countering retail selling pressures during the 2025 downturn, with on-chain data from sources like Coinglass underscoring this divergence. As whales build positions below $90,000 resistance, the market exhibits signs of underlying strength through metrics like the rising Accumulation/Distribution indicator. Investors should watch these flows closely, as historical precedents indicate potential for renewed upward momentum—consider positioning strategies that align with long-term crypto trends for informed decision-making.