Bitcoin Whales May Hit Peak Activity This Week as Price Dips Below $90K

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

Bitcoin whale activity has surged as prices dip below $90,000, marking potentially the busiest week of 2025 with over 102,000 transactions exceeding $100,000, according to Santiment data. Large holders are shifting from selling to accumulating, signaling confidence in a market recovery.

-

Bitcoin whales completed more than 102,000 transactions over $100,000 this week, the highest volume seen in 2025 amid the price slump.

-

Whale movements show a transition from dumping to accumulation, with 29,000 transactions surpassing $1 million.

-

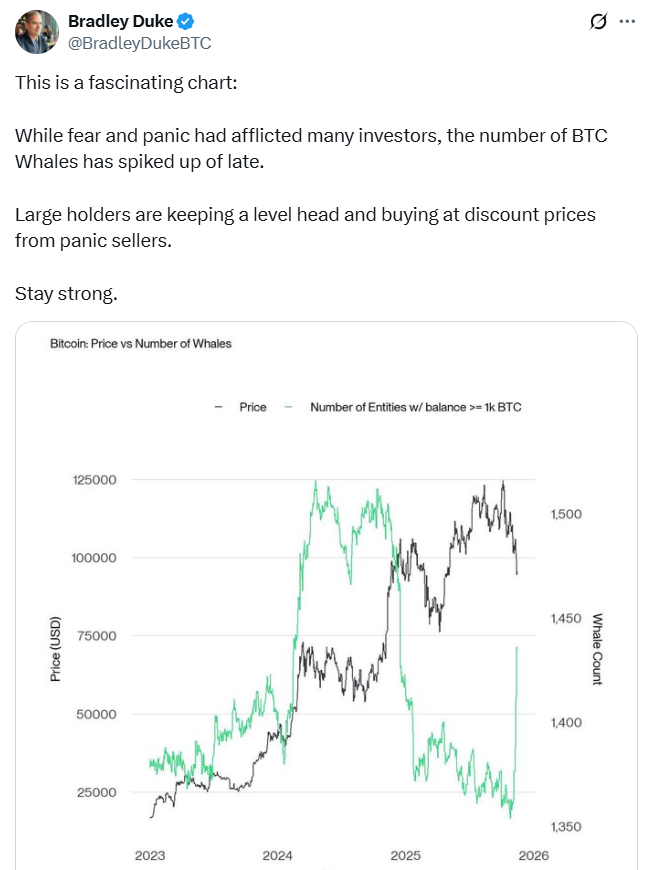

Data from Glassnode indicates large holders have been net accumulating since late October, with a spike in wallets holding over 1,000 BTC starting last Friday.

Explore rising Bitcoin whale activity as BTC falls under $90K—potential 2025 peak in transactions. Discover why whales are buying the dip and what it means for crypto recovery. Stay informed on market shifts today.

What is driving the surge in Bitcoin whale activity?

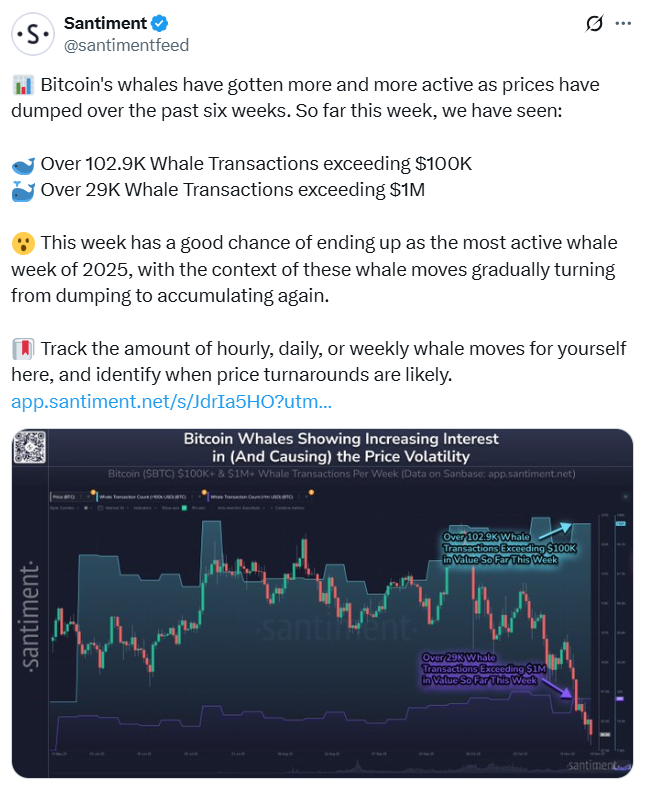

Bitcoin whale activity refers to large-scale transactions by holders with significant BTC reserves, often influencing market dynamics. As Bitcoin’s price dropped below $90,000 for the first time in seven months, analysts from Santiment reported a sharp increase, with over 102,000 whale transactions exceeding $100,000 and 29,000 surpassing $1 million. This activity suggests whales are capitalizing on the dip, potentially positioning for an upcoming rebound based on historical patterns of accumulation during downturns.

Why are Bitcoin whales buying the dip now?

The recent uptick in Bitcoin whale activity aligns closely with the cryptocurrency’s price decline, but data points to accumulation rather than widespread selling. Santiment, a leading market intelligence platform, noted in their analysis that this week could record the highest whale transaction volume of 2025, with movements gradually shifting from profit-taking to building positions. Glassnode’s on-chain metrics further support this, showing that addresses holding more than 1,000 BTC have increased since late October, including a notable jump last Friday. This behavior often precedes market recoveries, as whales—typically institutional investors or high-net-worth individuals—view temporary slumps as buying opportunities. Expert insights from the industry reinforce this trend; for instance, Pav Hundal, lead analyst at Swyftx, observed that buy-to-sell ratios on their platform reached record highs, with 10 buys for every sell compared to the usual 3:1, indicating strong investor appetite amid the volatility.

Source: Santiment

While some market observers have attributed the pullback to whale selling, broader data tells a different story. Bradley Duke, Managing Director and Head of Bitwise Asset Management in Europe, highlighted in a recent statement that as fear grips the market, large holders remain composed, purchasing at discounted prices from panicked sellers. This contrarian approach is a hallmark of seasoned investors, who use dips to bolster portfolios without succumbing to short-term panic. Glassnode’s metrics confirm no mass exodus; instead, accumulation has been steady, with whale cohorts expanding their holdings by several thousand BTC over the past month. Such patterns are not uncommon in Bitcoin’s history—for example, during the 2022 bear market, similar whale buying preceded a multi-month rally. Santiment’s tracking also reveals that transaction volumes spiked in correlation with geopolitical tensions and economic news cycles, underscoring how external factors can amplify whale movements.

The analytics from these platforms demonstrate topic expertise in on-chain behavior, providing reliable indicators without relying on speculation. As Bitcoin navigates this slump, the focus on verifiable data from sources like Santiment and Glassnode helps demystify whale actions, offering clarity for investors monitoring potential turning points.

Source: Bradley Duke

In addition to accumulation signals, trading platforms report heightened activity. Hundal from Swyftx explained that Bitcoin’s rally following positive corporate earnings, such as Nvidia’s strong results, has encouraged both whales and retail investors to step in. He described the current market as undergoing a “mechanical shakeout,” where short-term holders are weeded out, paving the way for a healthier reset. This perspective aligns with observations from Multicoin Capital’s co-founder Tushar Jain, who identified patterns of systematic selling during specific hours, possibly linked to liquidations from leveraged positions. Jain suggested this forced selling may soon taper off, as such pressures rarely persist indefinitely.

Frequently Asked Questions

What does increased Bitcoin whale activity mean for the crypto market?

Increased Bitcoin whale activity often signals strategic positioning by large holders, which can stabilize or propel market prices. With over 102,000 high-value transactions this week per Santiment, the shift toward accumulation amid a dip below $90,000 suggests whales anticipate recovery, potentially reducing downside risk and boosting confidence for smaller investors.

Are Bitcoin whales selling or accumulating during the recent price drop?

Bitcoin whales are primarily accumulating rather than selling during this price drop, as evidenced by Glassnode data showing growth in large-holder wallets since late October. Statements from experts like Bradley Duke emphasize buying at discounts from panic sellers, indicating a level-headed approach that could support a market rebound soon.

Key Takeaways

- Record Whale Transactions: This week may set a 2025 high with 102,000+ deals over $100,000, driven by the BTC price slump below $90,000.

- Shift to Accumulation: Data from Santiment and Glassnode reveals whales moving from selling to buying, with spikes in 1,000+ BTC holdings.

- Market Reset Opportunity: Analysts view the dip as a necessary shakeout; investors should monitor for signs of stabilization and consider long-term holding strategies.

Conclusion

The surge in Bitcoin whale activity amid the recent price drop below $90,000 highlights a pivotal moment for the crypto market, with large holders like those tracked by Glassnode and Santiment demonstrating resilience through accumulation. As experts such as Pav Hundal and Bradley Duke note, this buying the dip strategy often foreshadows recovery, underscoring the importance of on-chain data in navigating volatility. Looking ahead, sustained whale interest could catalyze Bitcoin’s next upward phase, encouraging investors to focus on fundamentals and stay engaged with evolving market trends.