Bitcoin’s 33% Drop May Signal Extended Volatility Amid Record ETF Volumes

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s 33% drop signals structural weakness amid record ETF volumes of $11.5 billion, as dip buyers vanish and on-chain activity hits lows, pointing to prolonged volatility rather than quick recovery.

-

Exchange outflows persist without accumulation support, suggesting capitulation as prices fall sharply.

-

Volatility compresses despite downside, indicating thin liquidity and sidelined traders.

-

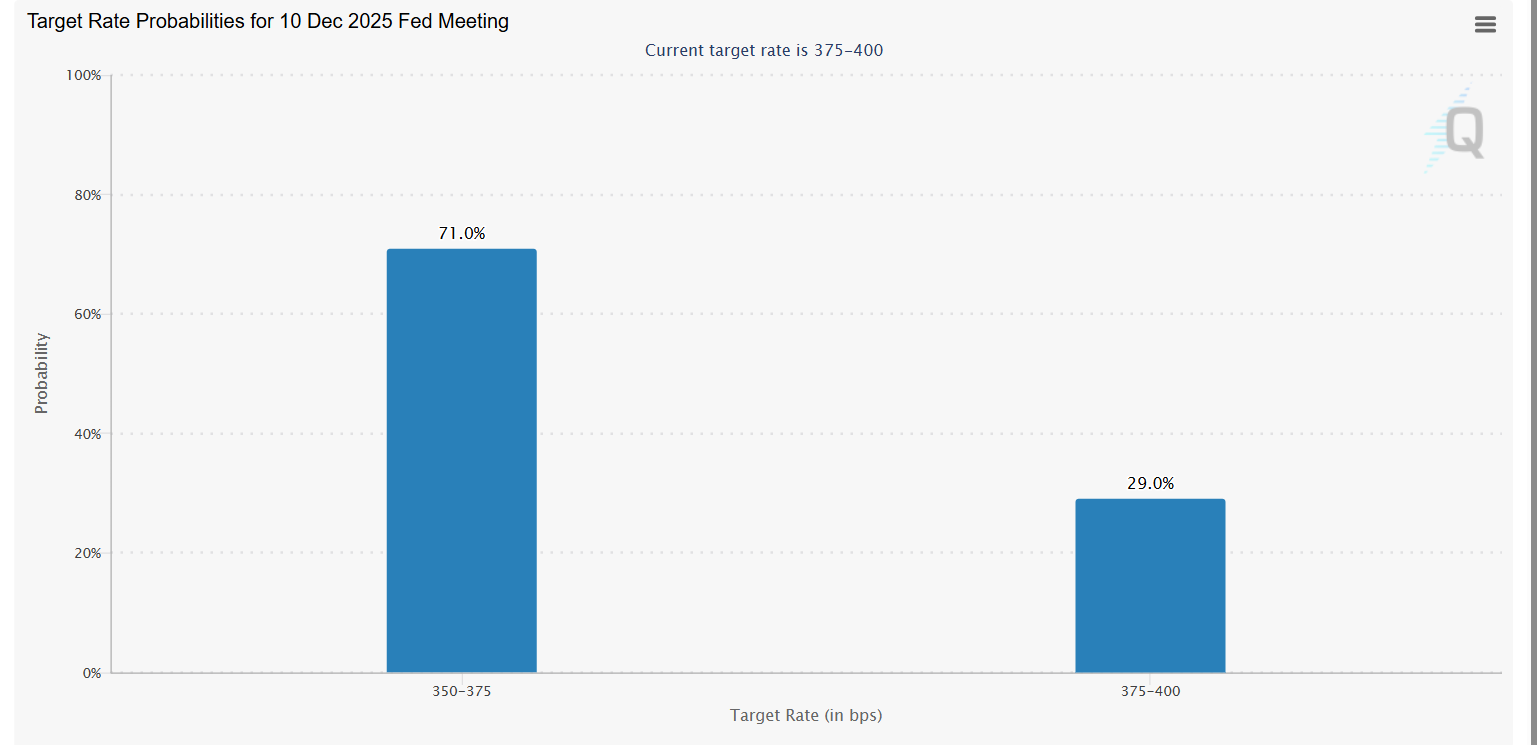

On-chain metrics like daily active addresses reach multi-month lows, with 71% odds of a Fed rate cut failing to boost risk appetite.

Bitcoin’s 33% plunge from ATH amid record ETF trading volumes raises volatility concerns—explore why dip buyers are absent and what macro signals mean for recovery. Stay informed on BTC trends.

What is causing Bitcoin’s 33% drop and record ETF volumes?

Bitcoin’s recent 33% drop from its all-time high stems from absent dip-buying support and declining on-chain activity, amplifying structural weaknesses in the market. U.S. Bitcoin ETFs recorded their highest-ever trading volume at $11.5 billion in a single day, driven by investors reshuffling positions amid heightened stress rather than new inflows. This dynamic highlights a shift from spot market stability to institutional liquidity channels, setting the stage for erratic price movements heading into December.

How are exchange outflows contributing to Bitcoin’s volatility?

Exchange outflows have continued unabated through late November, with netflows showing more red than green bars, according to data from CryptoQuant. Typically, such outflows signal long-term accumulation during price dips, but when paired with rapid declines, they often indicate capitulation among holders. In this case, as Bitcoin’s price slides, coins moving off exchanges to cold storage reflect a risk-off stance, where traders prioritize safety over speculation. Supporting data reveals uninterrupted outflows for weeks, exacerbating the lack of buying pressure and allowing sell orders to dominate. Experts at CryptoQuant note that this pattern, combined with falling prices, points to weakened market resilience, potentially prolonging the correction phase.

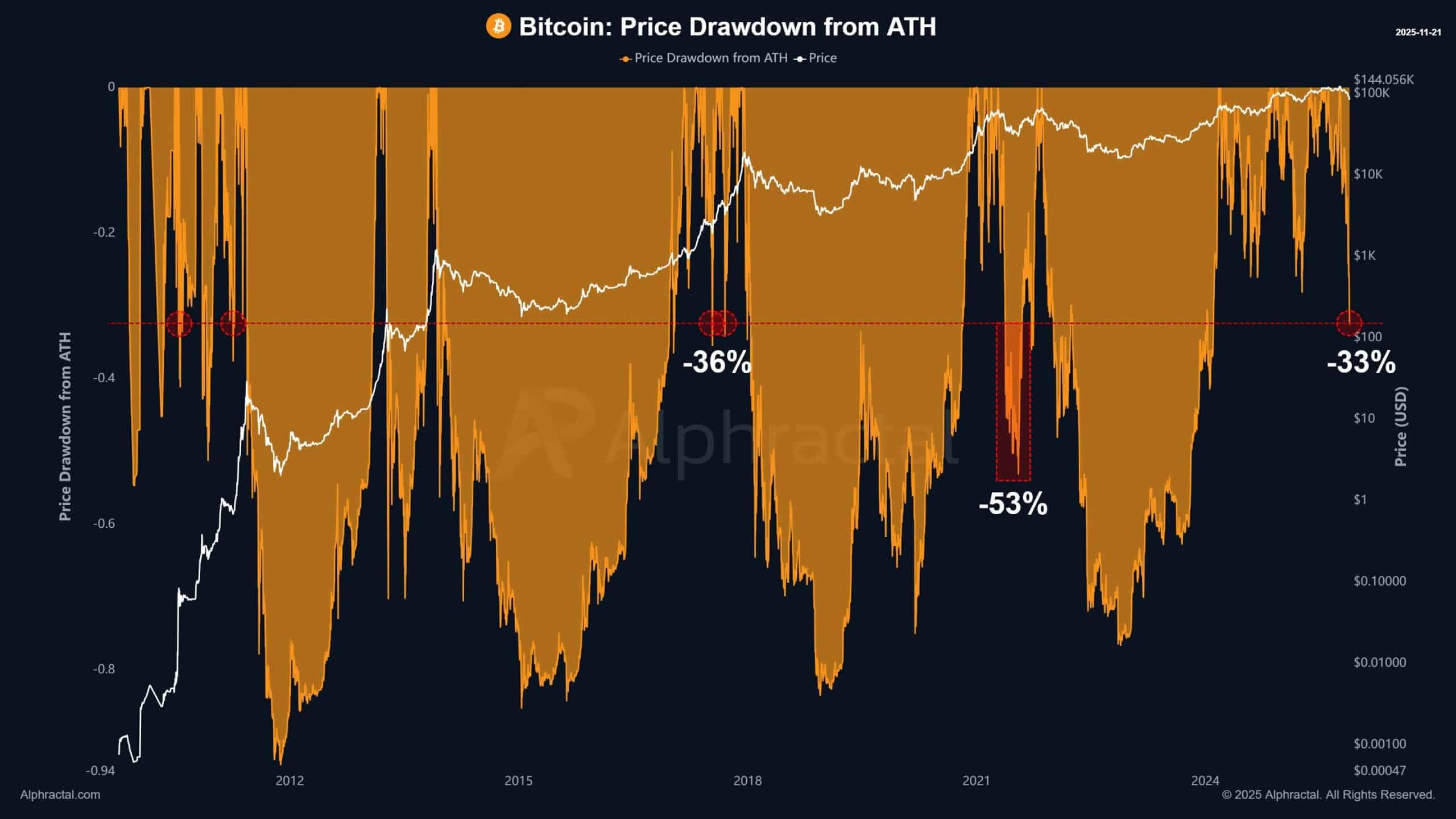

Bitcoin is entering December on fragile footing following a sharp 33% decline from its recent all-time high, a level that historically precedes extended downside rather than swift rebounds. The sole exception occurred in June-July 2021, when a 53% plunge still led to a new peak, but current conditions suggest a more protracted struggle.

Source: Alphractal

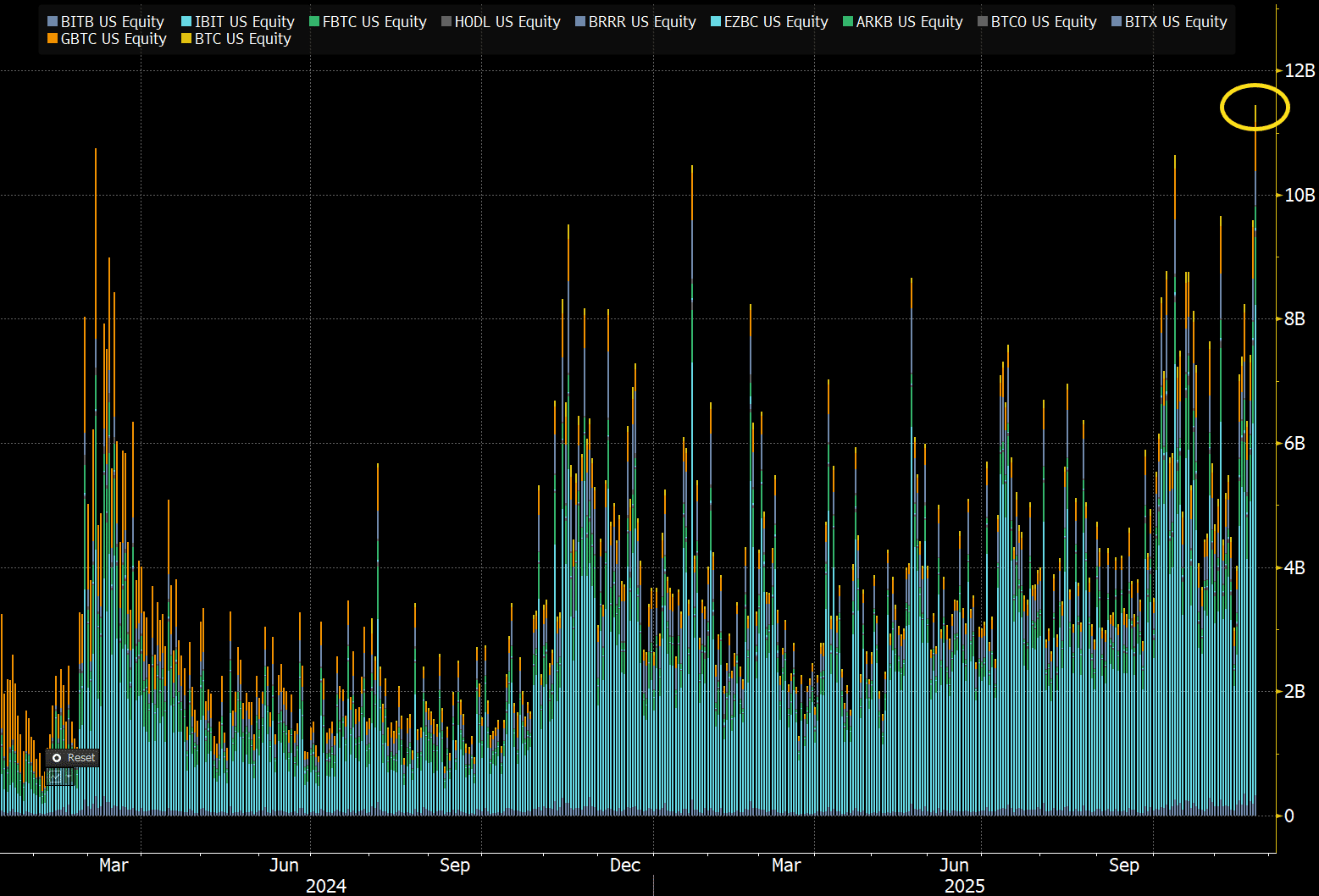

Alphractal’s analysis underscores a clear sign of structural fragility, fostering aimless volatility. Despite spot markets suffering, U.S. Bitcoin ETFs surged with $11.5 billion in volume, BlackRock’s IBIT alone accounting for $8 billion. This surge acts as a liquidity outlet during turmoil, where capital rotates and hedges adjust without bolstering spot prices.

Source: X

Such volumes are anticipated in distressed environments, transforming ETFs into mechanisms for exposure management.

Why is on-chain activity signaling caution for Bitcoin holders?

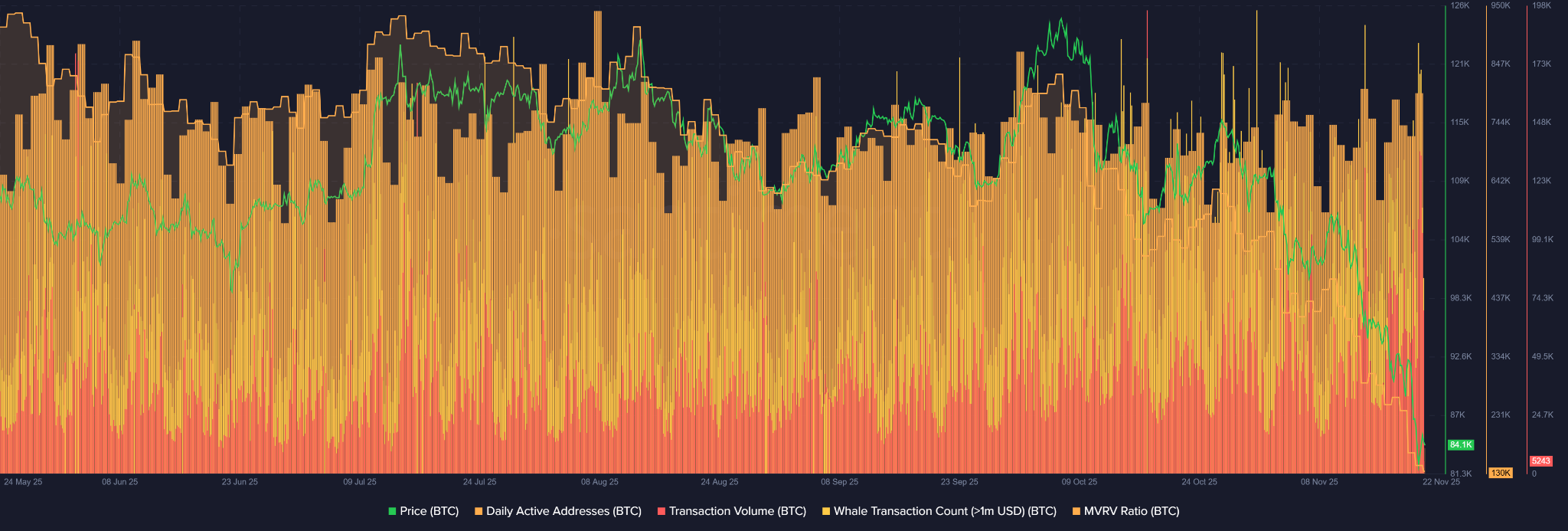

On-chain metrics paint a concerning picture, with Santiment data revealing daily active addresses, transaction volumes, and whale transfers at multi-month lows despite ongoing price erosion. In typical corrections, these indicators rise as retail investors buy dips and large holders accumulate, but current levels suggest widespread hesitation. This absence of participation thins liquidity, making each sell order more impactful and rebound efforts short-lived.

Source: Santiment

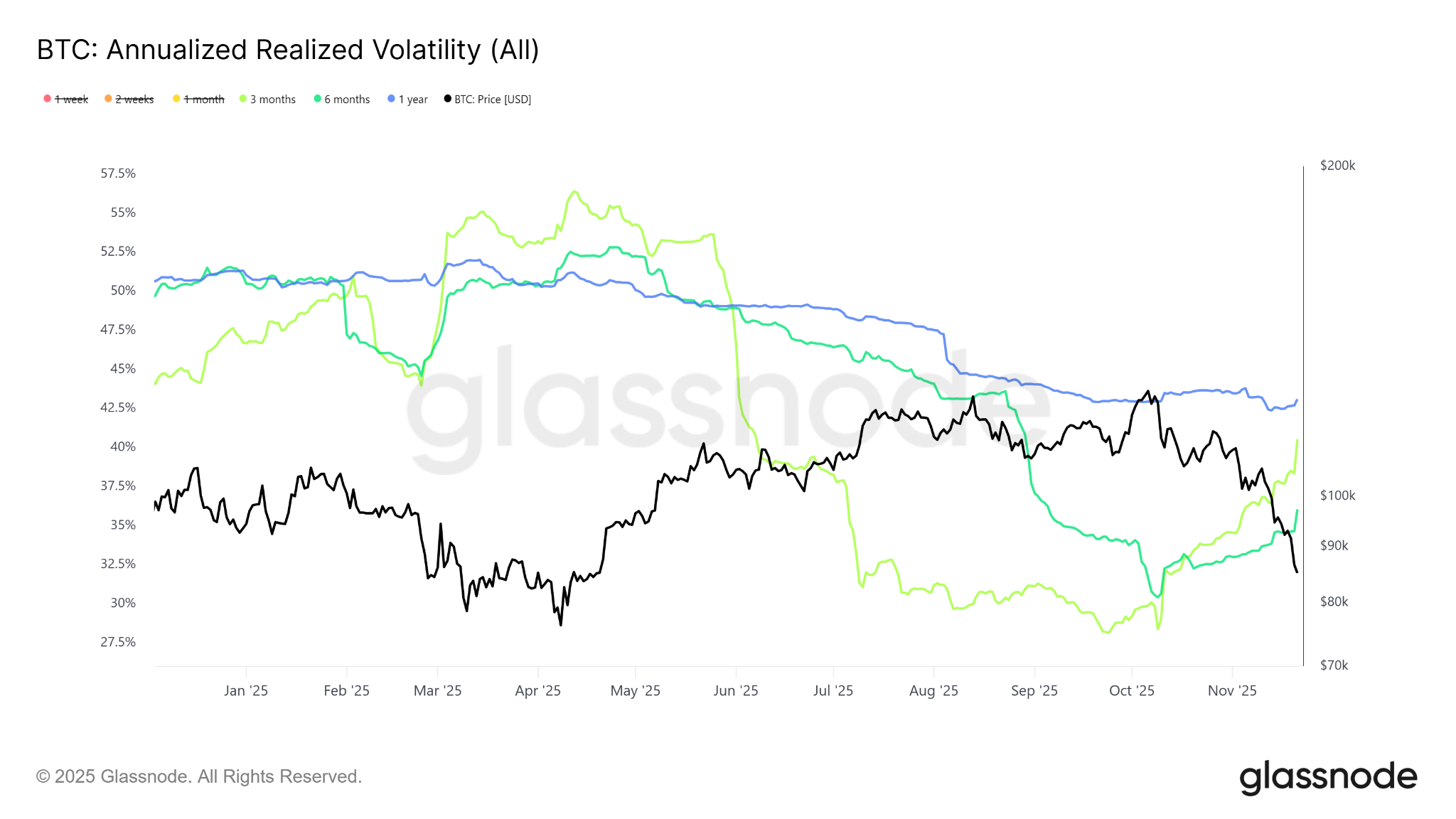

Whales appear reactive rather than proactive, contributing to a market where direction hinges on the next significant move. Glassnode’s realized volatility metrics across 1-6 month periods have compressed steadily, even as prices decline—a counterintuitive sign of drying liquidity and sidelined traders.

Source: Glassnode

While compressed volatility often precedes stability, in this context at local lows, it risks unleashing sharp, unpredictable swings—either toward recovery or deeper troughs.

Source: Cryptoquant

How do macroeconomic factors influence Bitcoin’s current downturn?

Macroeconomic signals offer limited solace, with CME FedWatch data indicating a 71% probability of a December rate cut to the 350-375 basis points range, yet Bitcoin remains disconnected from this potential risk-on catalyst.

Source: CME FedWatch

Traders seek policy clarity amid mixed signals. The U.S. Department of Labor’s September report showed 119,000 new nonfarm payrolls—exceeding expectations of 52,000—but the unemployment rate climbed to 4.4%, a four-year high. A Bitunix analyst observed, “At the macro level… this ‘split-signal’ dynamic intensifies disagreement among policymakers… leading to renewed demand for safety in a high-rate environment — an uncertainty that is quickly spilling over into risk assets.” This discord dampens enthusiasm for assets like Bitcoin, where hesitation prevails until alignment emerges across policy, liquidity, and participation.

Frequently Asked Questions

What does Bitcoin’s 33% drop from ATH mean for long-term holders?

Bitcoin’s 33% decline from its all-time high typically signals extended corrections historically, except in rare cases like 2021. For long-term holders, persistent outflows and low activity suggest capitulation risks, but compressed volatility could precede a rebound if macro conditions improve. Monitoring ETF flows and on-chain metrics remains essential for assessing recovery potential.

Why are Bitcoin ETFs seeing high volumes during the price drop?

During Bitcoin’s price drop, ETFs experience elevated volumes as they serve as liquidity channels for institutional investors reshuffling exposures and unwinding hedges. This $11.5 billion record reflects stress management rather than bullish buying, allowing capital rotation without direct spot market support, which aligns with voice search queries on market dynamics.

Key Takeaways

- Structural Weakness Evident: Bitcoin’s 33% drop lacks dip-buyer support, with on-chain activity at lows signaling prolonged volatility.

- ETF Volumes as Outlet: Record $11.5 billion trading reflects repositioning amid stress, not accumulation.

- Macro Uncertainty Persists: Fed rate cut odds offer hope, but mixed labor data fuels risk aversion—watch for policy clarity to guide next moves.

Conclusion

Bitcoin’s 33% drop and surging ETF volumes underscore a market grappling with structural challenges, low on-chain engagement, and macroeconomic mixed signals. As volatility compresses at key lows, the path forward hinges on renewed participation and policy resolution. Investors should prioritize risk management while eyeing potential catalysts for stabilization in the Bitcoin ecosystem.