Bitcoin’s $85B Unrealized Losses Signal Potential Crossroads Amid Whale Sell-Off

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

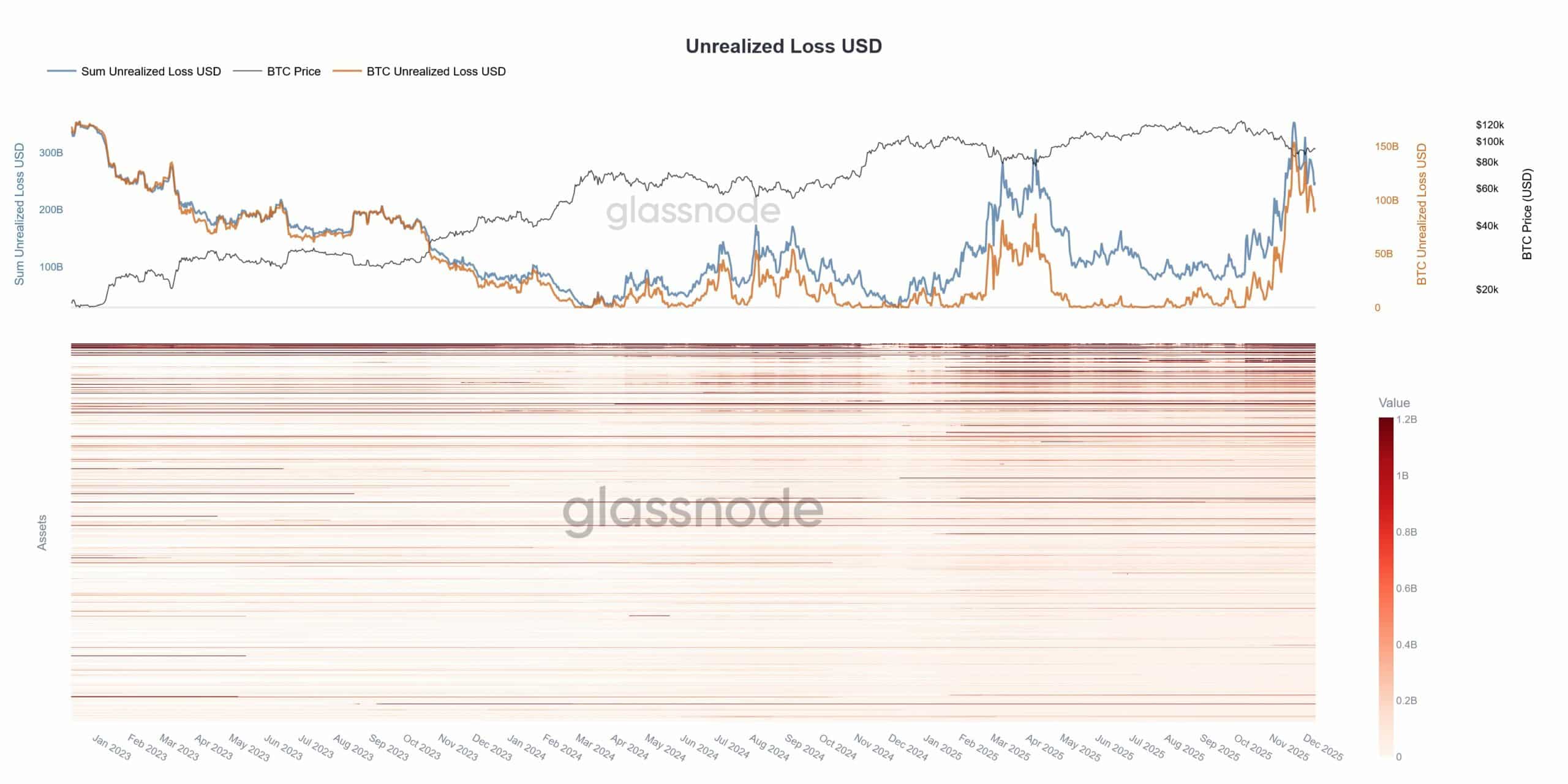

Bitcoin’s unrealized losses have reached $85 billion amid a stagnant market hovering between $89,000 and $94,000, signaling heightened selling pressure. Across the crypto sector, total unrealized losses stand at $350 billion, driven by prolonged prices below peaks, raising concerns for potential sell-offs.

-

Bitcoin leads with $85 billion in unrealized losses, affecting short- and long-term holders.

-

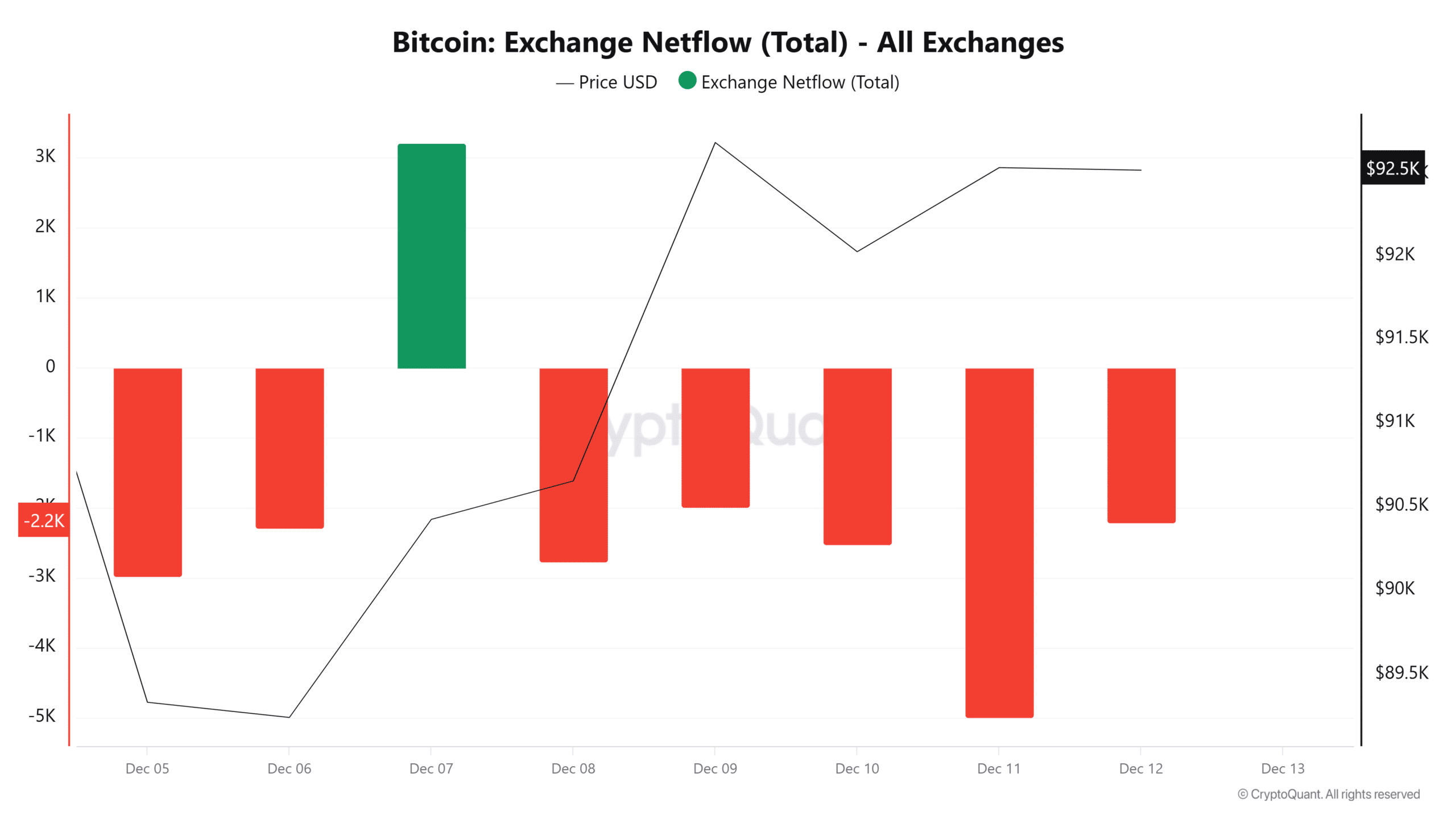

Crypto market netflows indicate accumulation despite whale sales.

-

Technical indicators show short-term bullish shift but longer-term bearish trend, with potential targets at $94,000 or support at $90,000.

Discover Bitcoin unrealized losses surging to $85B in a consolidating market. Explore whale activities and technical outlook for BTC’s next move. Stay informed on crypto trends today.

What Are Bitcoin’s Unrealized Losses and Why Do They Matter Now?

Bitcoin’s unrealized losses represent the paper losses on BTC holdings not yet sold, calculated as the difference between current market price and acquisition cost. As of recent data, these losses for Bitcoin have climbed to $85 billion, reflecting a market pause below historical highs for over a week. This buildup, part of a broader $350 billion in crypto ecosystem unrealized losses, heightens risks of panic selling if sentiment worsens, potentially destabilizing prices further.

How Have Whale Activities Contributed to Market Pressure?

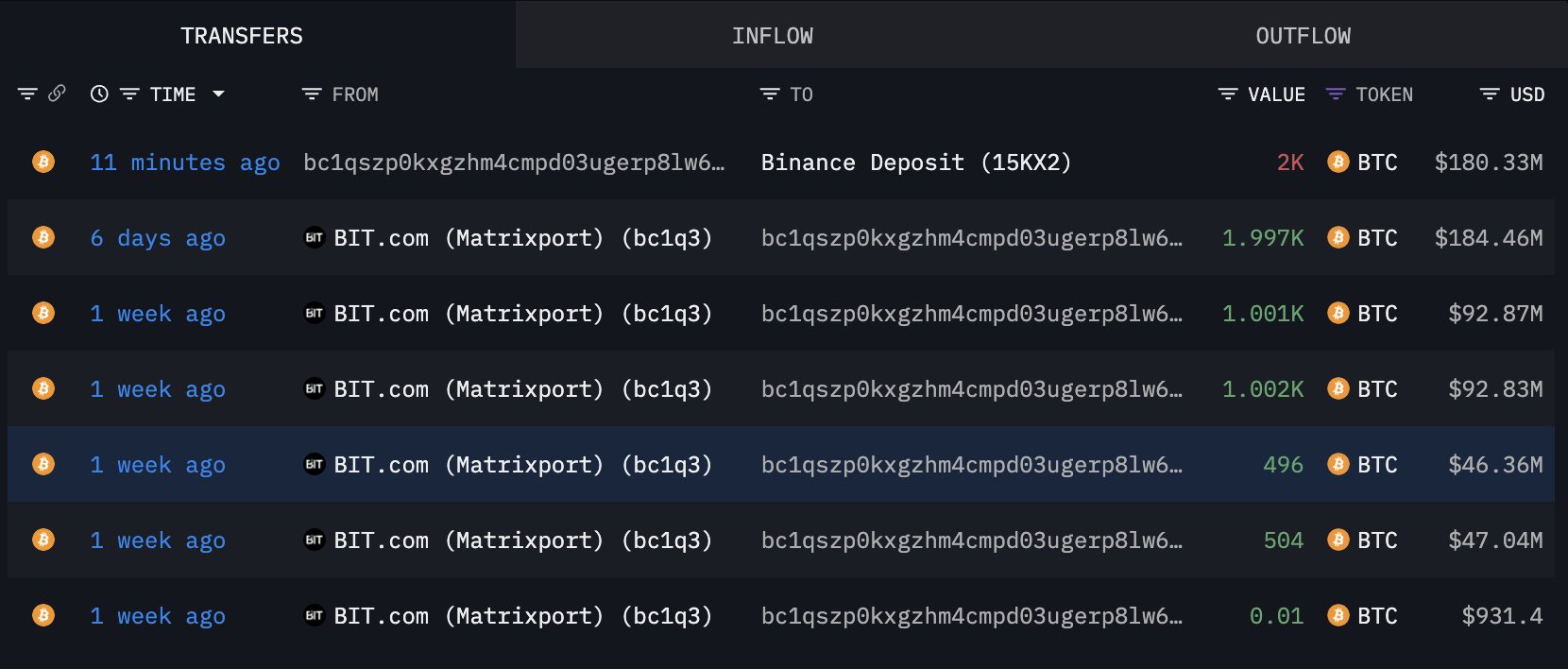

Recent on-chain data reveals increased exchange inflows as large holders adjust positions amid rising losses. For instance, the Fund Flow Ratio for Bitcoin rose from 0.06 to 0.106, indicating more BTC deposits on platforms like Binance, which often precede sales. A prominent whale example involves a deposit of 2,000 BTC valued at $180.33 million, resulting in approximately $5 million in realized losses after acquiring 5,000 BTC earlier at higher prices from Matrixport. Data from Arkham Intelligence confirms the address retains 3,000 BTC worth $277.61 million, underscoring selective profit-taking or loss minimization strategies. Glassnode reports highlight that such actions from whales, who control significant volumes, can amplify market volatility, especially when unrealized losses across assets like BTC push holders toward liquidation to avoid deeper deficits.

Source: Glassnode

Experts from on-chain analytics firms like Lookonchain note that these movements often signal waning confidence among high-net-worth investors. When combined with broader market data showing BTC trading between $89,000 and $94,000 for nearly seven days, it paints a picture of indecision. Short-term holders, in particular, face the brunt, with many positions underwater due to the extended consolidation phase. This scenario increases the likelihood of cascading sales if external factors, such as regulatory news or macroeconomic shifts, trigger fear. Historical patterns from Glassnode studies indicate that peaks in unrealized losses have preceded corrections of 20-30% in past cycles, though recoveries follow when accumulation resumes.

Despite the pressures, not all indicators point downward. Exchange netflows have shown negative balances for five straight days, with only one positive day in the last week, suggesting net outflows and holder accumulation. At the time of reporting, netflow stood at -2.2k BTC, a bullish sign amid the noise.

Source: CryptoQuant

Source: Arkham

Frequently Asked Questions

What Causes Bitcoin Unrealized Losses to Spike During Market Consolidation?

Unrealized losses in Bitcoin spike when prices stall below acquisition costs for extended periods, as seen in the current range of $89,000 to $94,000. Data from Glassnode shows short-term holders bearing most of the $85 billion burden, exacerbated by whale sales and reduced inflows, potentially leading to further pressure if support breaks.

Is Bitcoin’s Technical Outlook Turning Bullish After Recent Whale Losses?

Bitcoin’s short-term outlook shows a bullish tilt as it crosses above the EMA20 at around $91,769, supported by negative exchange netflows indicating accumulation. However, longer-term EMAs and a Directional Movement Index at 17 suggest persistent bearish forces, with CryptoQuant data pointing to a possible rebound to $94,000 if momentum holds, or a drop to $90,000 otherwise.

Source: CryptoQuant

Source: TradingView

Analysts from TradingView emphasize monitoring the EMA50 at $96,476 as a key resistance. If breached downward, historical data suggests retests of lower supports could follow, but current accumulation trends offer hope for stabilization.

Key Takeaways

- Bitcoin Unrealized Losses at $85 Billion: This figure, from Glassnode, highlights widespread holder pain in a market stuck below peaks, increasing sell-off risks.

- Whale Realizes $5 Million Loss: A major holder sold 2,000 BTC on Binance after acquiring at higher prices, per Lookonchain and Arkham data, reflecting caution amid consolidation.

- Technical Crossroads for BTC: Short-term gains above EMA20 suggest potential upside to $94,000, but bearish longer EMAs warn of drops to $90,000 if support fails.

Conclusion

In summary, Bitcoin’s unrealized losses of $85 billion underscore a tense crypto market phase, compounded by whale decisions and mixed technical signals. As demand hints at recovery through negative netflows, investors should watch key levels closely. With the broader ecosystem facing $350 billion in similar pressures, staying vigilant could position traders for the next directional shift—consider monitoring on-chain metrics for informed decisions ahead.