Bitcoin’s Building Momentum Faces Cautious ETF and Options Sentiment

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s price is currently oscillating between $89,000 and $93,000, driven by on-chain dynamics where investors alternate between profitability and profit-taking. This range-bound movement signals building momentum amid cautious sentiment from ETF holders and options traders hedging against downside risks.

-

Bitcoin’s MVRV ratio has risen to 1.67, indicating improved investor profitability as the asset moves away from its $81,900 mean value.

-

US spot Bitcoin ETFs shifted from net buying $134.2 million to selling $707.3 million, reflecting bearish distribution.

-

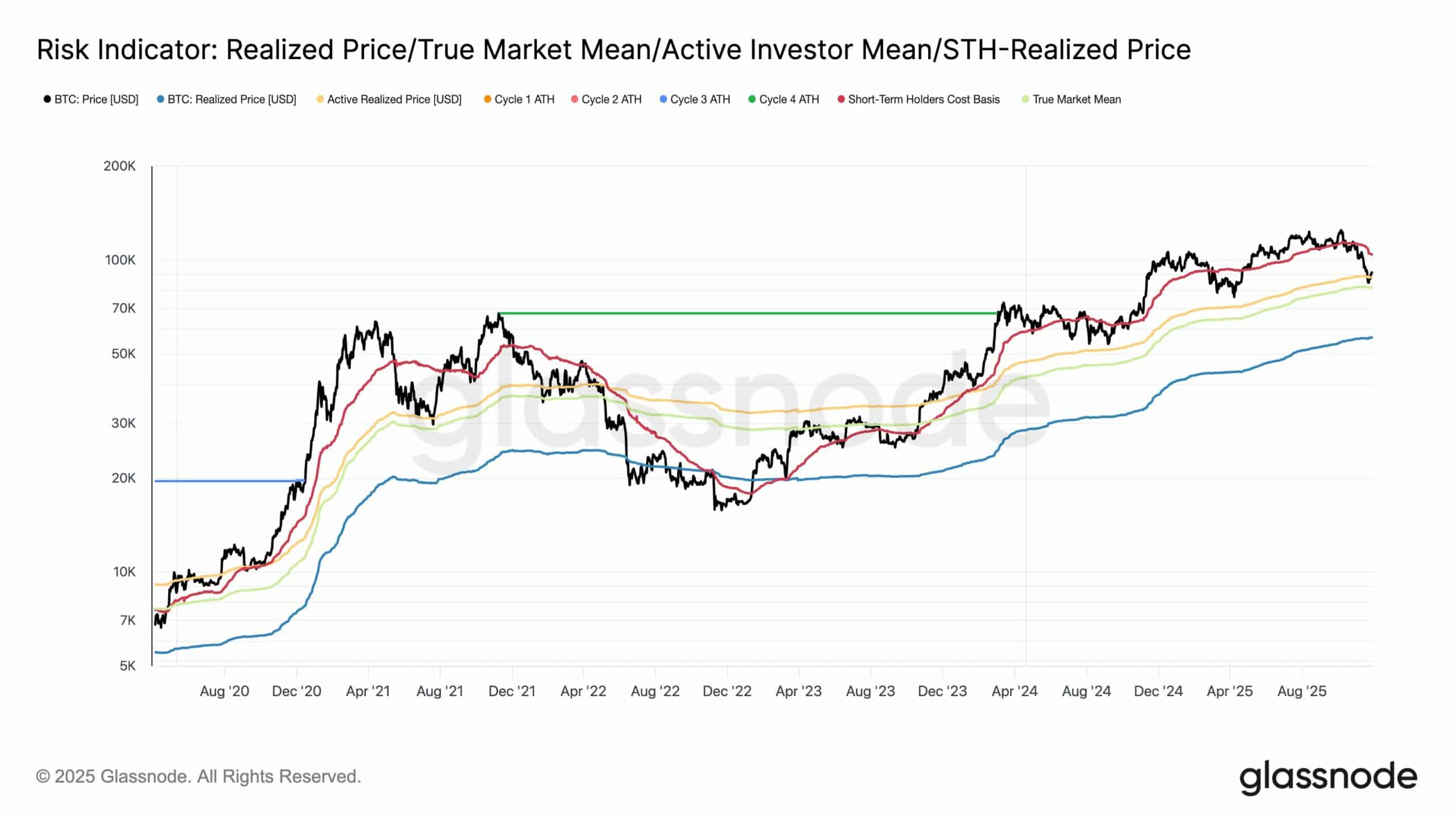

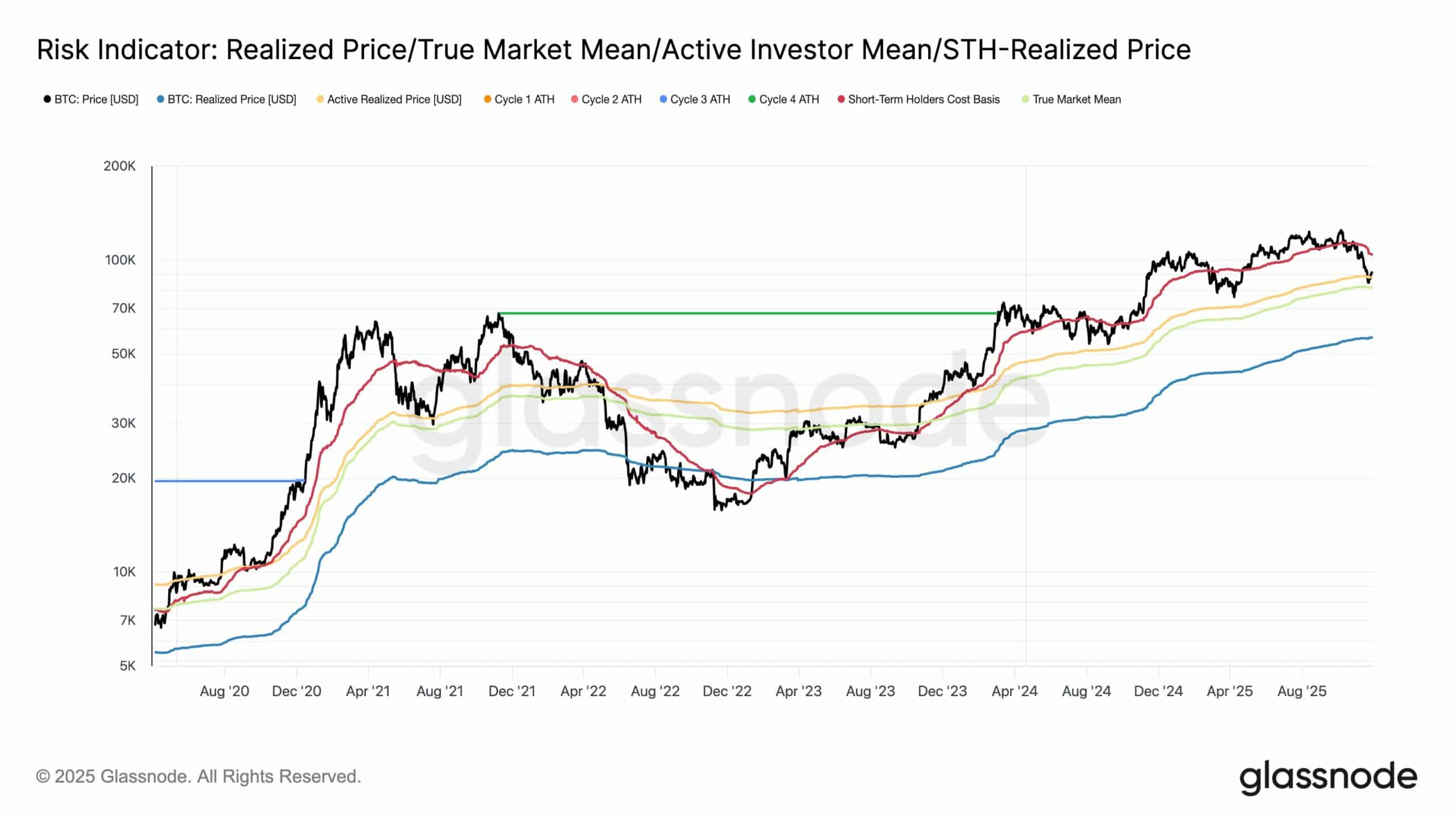

Supply in profit increased to 67.3 percent, with short-term holders at a net loss below their $109,000 average buy price, per Glassnode data.

Discover Bitcoin’s price momentum in 2025 as it hovers between $89,000 and $93,000 amid on-chain shifts and cautious ETF behavior. Explore key indicators and expert insights for informed trading decisions. Stay updated on BTC trends today.

What is Driving Bitcoin’s Current Price Momentum?

Bitcoin’s current price momentum stems from a delicate balance of on-chain profitability cycles and market participant behaviors, keeping the cryptocurrency trading within a $89,000 to $93,000 band. Investors are experiencing alternating phases of gains and distributions, particularly among US spot ETFs, which have flipped from accumulation to selling. This dynamic, highlighted by Glassnode’s analysis, suggests underlying strength despite persistent caution.

How Are ETF Investors Influencing Bitcoin’s Market Sentiment?

US spot Bitcoin exchange-traded funds (ETFs) have played a pivotal role in the recent price consolidation, transitioning from bullish accumulation to bearish profit-taking. Glassnode’s research indicates that as Bitcoin’s price edged away from its True Market Mean Value of $81,900, the Market Value to Realized Value (MVRV) ratio climbed to 1.67, boosting overall investor profitability. Trading volume surged to $22.6 billion during this period, underscoring heightened activity.

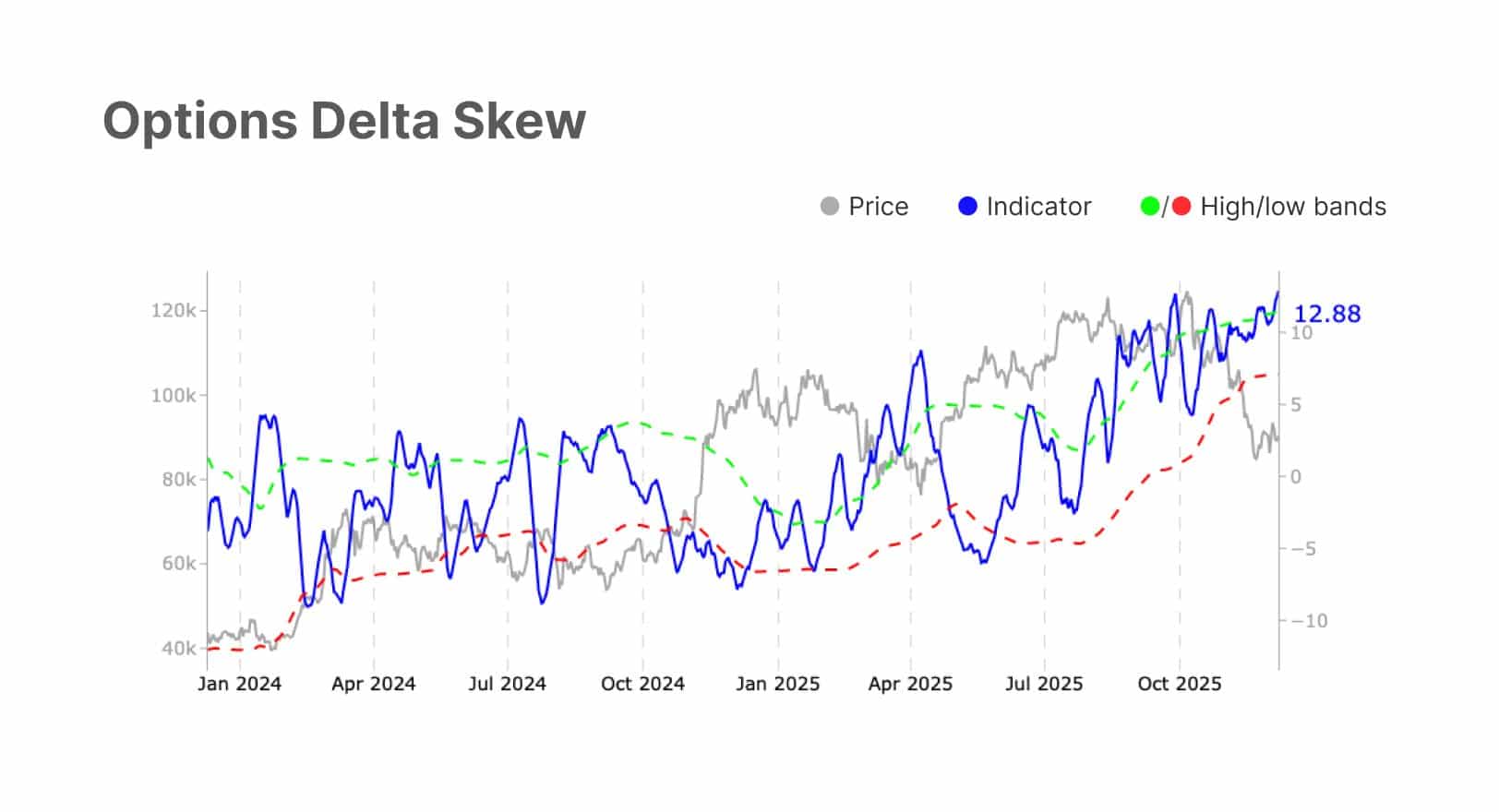

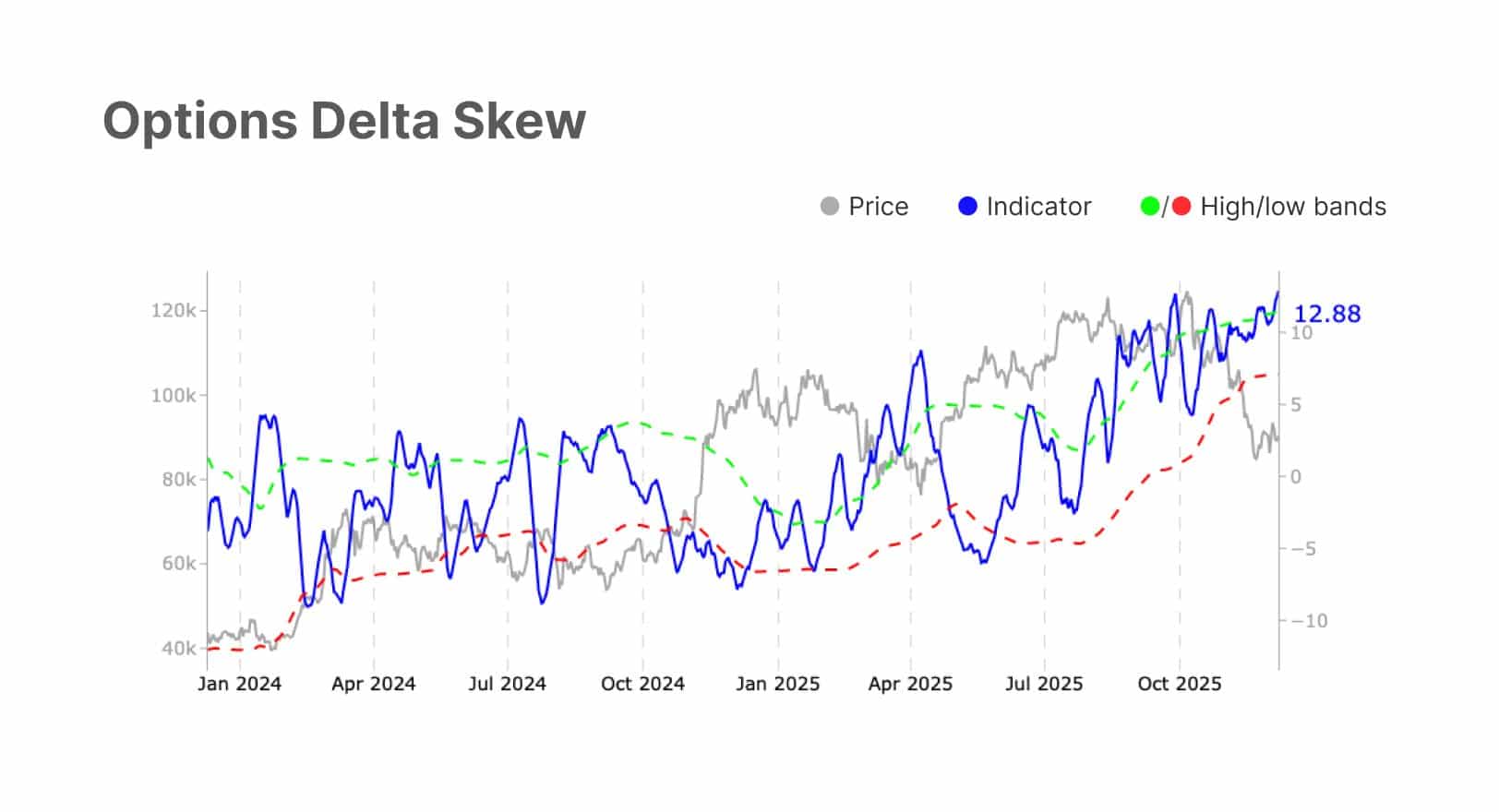

However, this profitability surge prompted ETF investors to distribute holdings aggressively. Data shows a stark reversal: from net purchases of $134.2 million to net sales of $707.3 million in Bitcoin. This shift reflects a bearish stance among institutional players, who are locking in gains amid fears of volatility. In the options market, skepticism persists, with the 25-delta skew rising to 12.88 percent. Traders are paying premiums for downside protection through short positions, indicating they view the bullish push as fragile.

Source: Glassnode

Glassnode emphasized that while these trends point to early recovery signals, the market’s cautious positioning underscores ongoing rebuilding of confidence post-volatility. This bearish undercurrent from ETFs could cap upside potential unless broader sentiment improves.

Frequently Asked Questions

What Role Do Short-Term Holders Play in Bitcoin’s Price Recovery?

Short-term holders (STH) are key drivers in Bitcoin’s current price dynamics, with their Spent Output Profit Ratio (SOPR) rising to 18.5 percent and Hot Capital Share at 39.9 percent, per Glassnode metrics. Operating at a net loss below their $109,000 average entry, STHs are incentivized to hold as momentum builds toward $100,000, potentially accelerating recovery if profit-taking remains minimal.

Why Is Bitcoin’s Momentum Building Despite Bearish ETF Flows?

Bitcoin’s momentum is building through rising supply in profit at 67.3 percent and subtle on-chain accumulation, even as ETF outflows introduce pressure. Macro factors like equity market strength add uncertainty, but experts note that sustained profitability could outweigh short-term distributions, fostering a gradual shift to bullish confidence.

Key Takeaways

- Profitability Surge: Bitcoin’s MVRV at 1.67 and 67.3 percent supply in profit highlight improving investor positions, though tempered by ETF selling.

- Cautious Hedging: Options market skew of 12.88 percent shows traders prioritizing downside protection amid volatile sentiment.

- STH Influence: With STH-SOPR at 18.5 percent and net losses persisting, accumulation by these holders could propel Bitcoin past $94,000 if macro conditions stabilize.

Source: Glassnode

Conclusion

Bitcoin’s price momentum in 2025 remains a story of cautious optimism, with on-chain indicators like rising MVRV and supply in profit pointing to foundational strength despite ETF bearishness and hedging in options markets. Short-term holders’ behavior will be crucial in breaking the $89,000-$93,000 range. As macro uncertainties ease, investors should monitor profitability metrics closely for signals of a decisive upward shift—consider tracking these trends to position effectively in the evolving crypto landscape.