Bitcoin’s Corporate Backing May Weaken Amid ETF Outflows and Liquidity Reversal

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin corporate support is weakening due to significant ETF outflows totaling $1.22 billion in late November 2025, collapsing premiums on digital asset treasuries, and a shrinking stablecoin supply, all reducing market liquidity and pressuring corporate balance sheets tied to the asset.

-

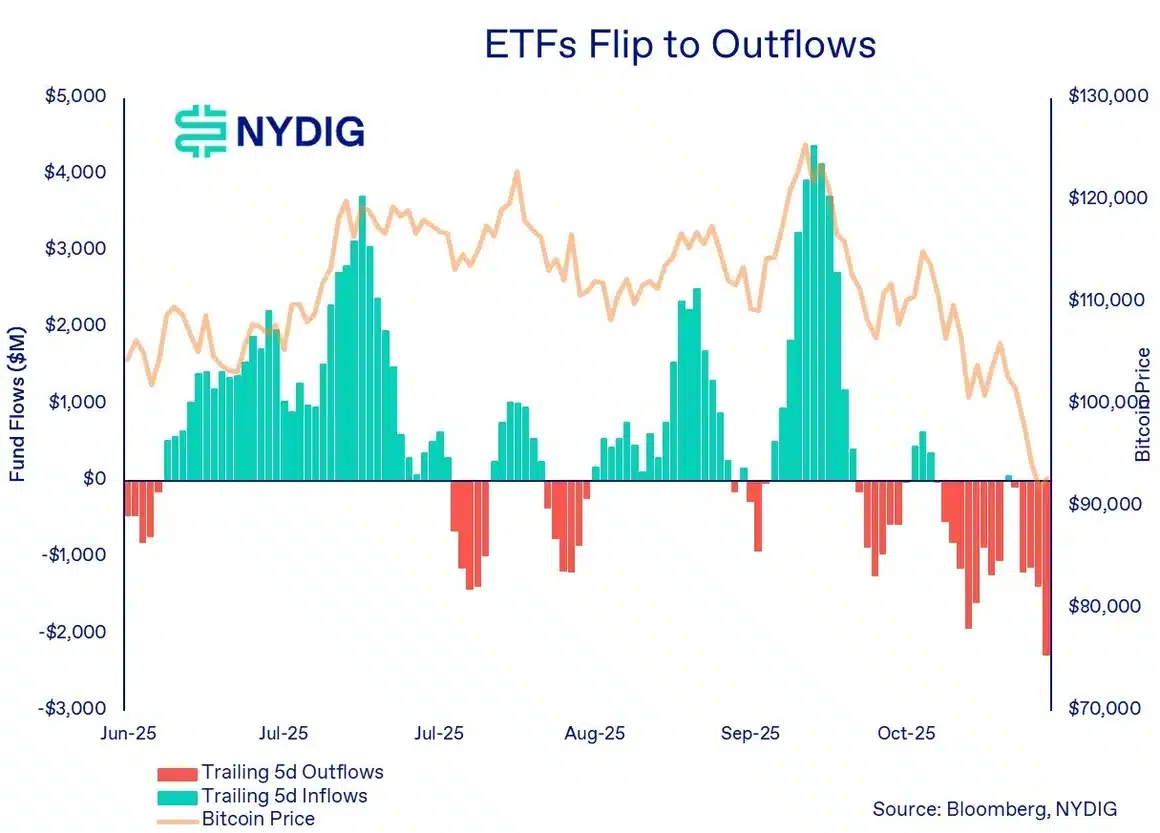

ETF outflows have reversed inflows, with four consecutive weeks of net selling pressure impacting Bitcoin prices.

-

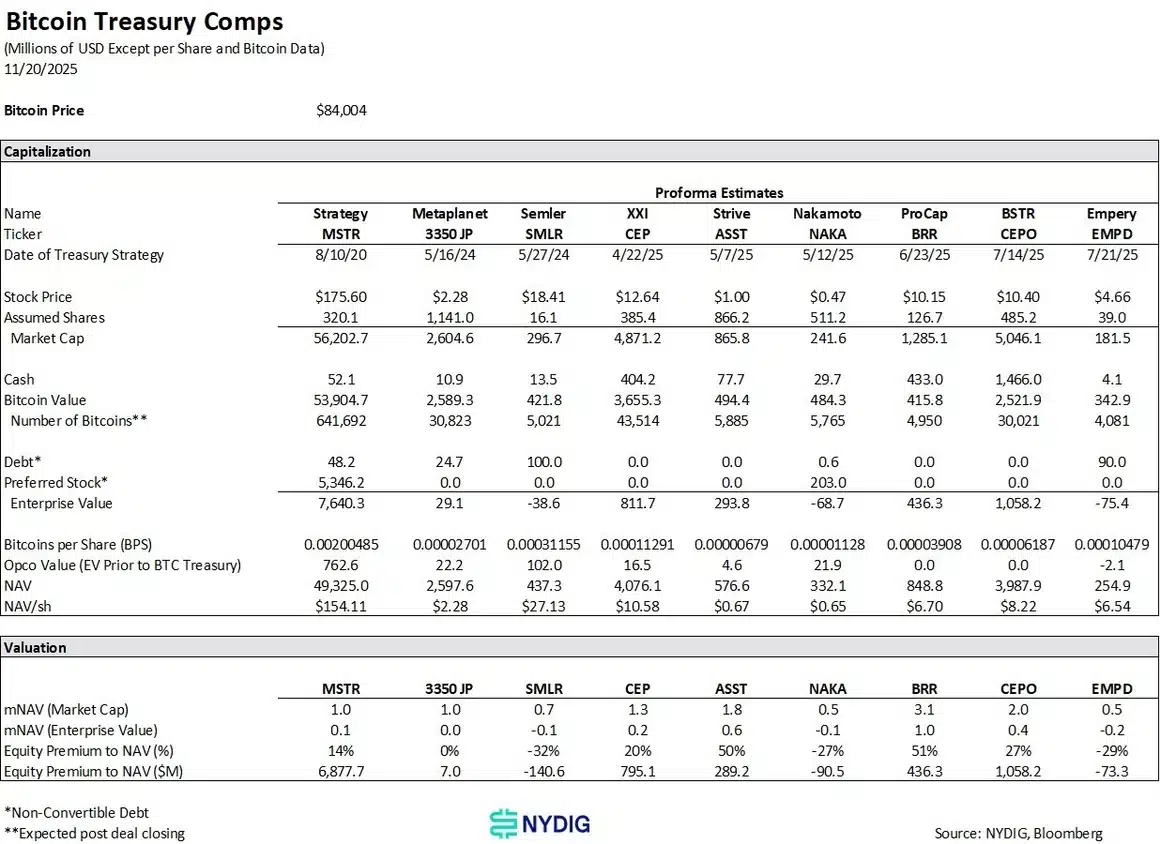

Digital asset treasury premiums have fallen sharply, diminishing incentives for corporate Bitcoin accumulation.

-

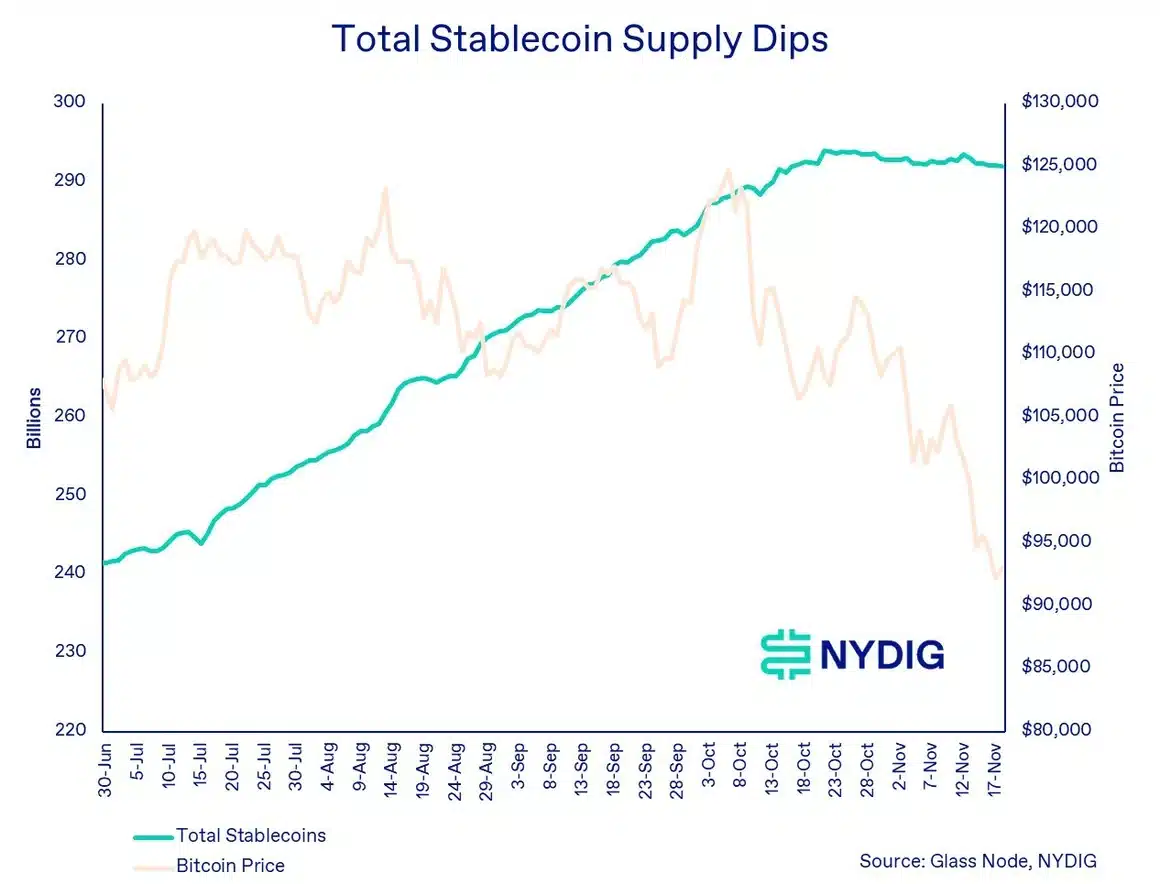

Stablecoin supply contracted for the first time in months, signaling reduced overall crypto market liquidity with balances dropping notably.

Discover why Bitcoin corporate support is weakening in 2025 amid ETF outflows and liquidity reversals. Explore impacts on treasuries and strategies for investors navigating this shift.

Why is Bitcoin corporate support weakening?

Bitcoin corporate support is weakening primarily because key demand drivers like spot ETFs, digital asset treasuries, and stablecoin supplies have reversed course. After months of robust inflows, ETFs recorded $1.22 billion in outflows from November 17 to 21, 2025, while treasury premiums collapsed and stablecoin balances shrank, eroding liquidity that once bolstered corporate adoption. This shift exposes vulnerabilities in balance-sheet strategies reliant on sustained Bitcoin price appreciation.

How are ETF outflows affecting Bitcoin’s institutional demand?

Spot Bitcoin ETFs, which drove billions in inflows throughout much of 2025, experienced four straight weeks of outflows by late November, culminating in $1.22 billion withdrawn between November 17 and 21. According to NYDIG’s latest analysis, this reversal has transformed steady buying pressure into significant selling, directly contributing to price declines. The data highlights a broader liquidity drain, as institutional investors pull back amid macroeconomic uncertainties, with ETF holdings now under strain from redemptions that outpace new subscriptions.

Source: NYDIG

NYDIG reports emphasize that these outflows coincide with a broader market contraction, where Bitcoin’s dominance has risen not from fresh inflows but from sharper declines in altcoins. Corporate treasuries, once buoyed by ETF momentum, now face heightened scrutiny as liquidity evaporates. Experts note that without renewed institutional entry, this trend could persist, testing the resilience of Bitcoin’s corporate adoption model.

Source: X

Premiums on digital asset treasuries (DATs) have also plummeted, removing key incentives for corporations to hold or expand Bitcoin positions. Reports indicate that crypto treasuries have incurred losses exceeding $45 billion as major assets dropped 30-50% in value during recent corrections. While some venture capital firms maintain that DATs are not net sellers, isolated cases like SharpLink’s modest divestments underscore the mounting pressures on these strategies.

Source: NYDIG

The contraction in stablecoin supply marks another reversal, with balances declining for the first time in several months and pulling liquidity from the broader ecosystem. NYDIG data shows this shrinkage aligning with reduced trading volumes and heightened volatility, as stablecoins like USDT and USDC see diminished issuance amid risk aversion. This dynamic amplifies the liquidity challenges for Bitcoin, as fewer fiat on-ramps constrain corporate participation.

Source: NYDIG

Frequently Asked Questions

What risks do Bitcoin corporate treasuries face in the next 90 days?

Bitcoin corporate treasuries risk forced selling and index exclusions if holdings exceed 50% of assets, as MSCI reviews on January 15, 2025, could bar high-exposure firms from major benchmarks. JPMorgan projects up to $8.8 billion in outflows, pressuring balance sheets and potentially triggering algorithmic liquidations unrelated to underlying asset strength.

Is Bitcoin’s network security impacted by weakening corporate support?

Bitcoin’s decentralized network operates independently of corporate involvement, maintaining robust security through global mining and consensus mechanisms. While corporate selling adds short-term pressure, the protocol’s fundamentals remain intact, supported by long-term holders and sovereign entities like El Salvador, ensuring continuity beyond institutional cycles.

Key Takeaways

- Reversed liquidity engines: ETF outflows, DAT premium collapses, and stablecoin contractions have collectively drained demand from Bitcoin markets.

- Corporate vulnerabilities exposed: Balance-sheet models face stress from potential index exclusions and refinancing deadlines in early 2025.

- Sovereign resilience: Entities like El Salvador continue accumulating, highlighting Bitcoin’s durability despite corporate fragility—investors should focus on long-term protocol strength.

Conclusion

Bitcoin corporate support is weakening amid ETF outflows and liquidity reversals, straining digital asset treasuries and exposing risks in institutional strategies. Yet, the asset’s core network endures, bolstered by sovereign adopters viewing it through decade-long lenses rather than quarterly pressures. As markets navigate this phase, stakeholders must prioritize diversified approaches to sustain engagement with Bitcoin’s evolving ecosystem.

The 90 day countdown

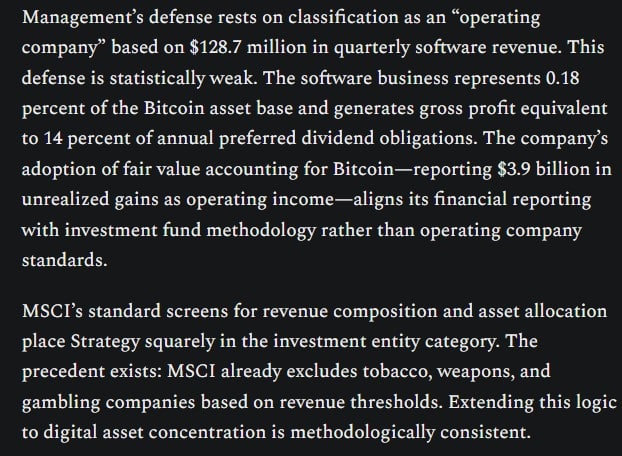

Analyst Shanaka Anselm Perera highlights escalating pressures culminating on January 15, 2025, when MSCI evaluates exclusions for companies holding over 50% in digital assets from key indices—Strategy, at 77% Bitcoin allocation, stands at particular risk. The October 10 crash illustrated how MSCI concerns and bearish notes from institutions like JPMorgan can spark rapid sell-offs, with Strategy’s CEO later affirming its operational status, though policy uncertainty lingers.

Source: Substack

JPMorgan forecasts $2.8 billion in index-related forced sales, potentially escalating to $8.8 billion total outflows—equivalent to 15-20% of Strategy’s market capitalization. These automated liquidations disregard corporate narratives, converging with ETF and stablecoin trends to test the limits of Bitcoin-tied financing models.

Bitcoin will survive. The model will not.

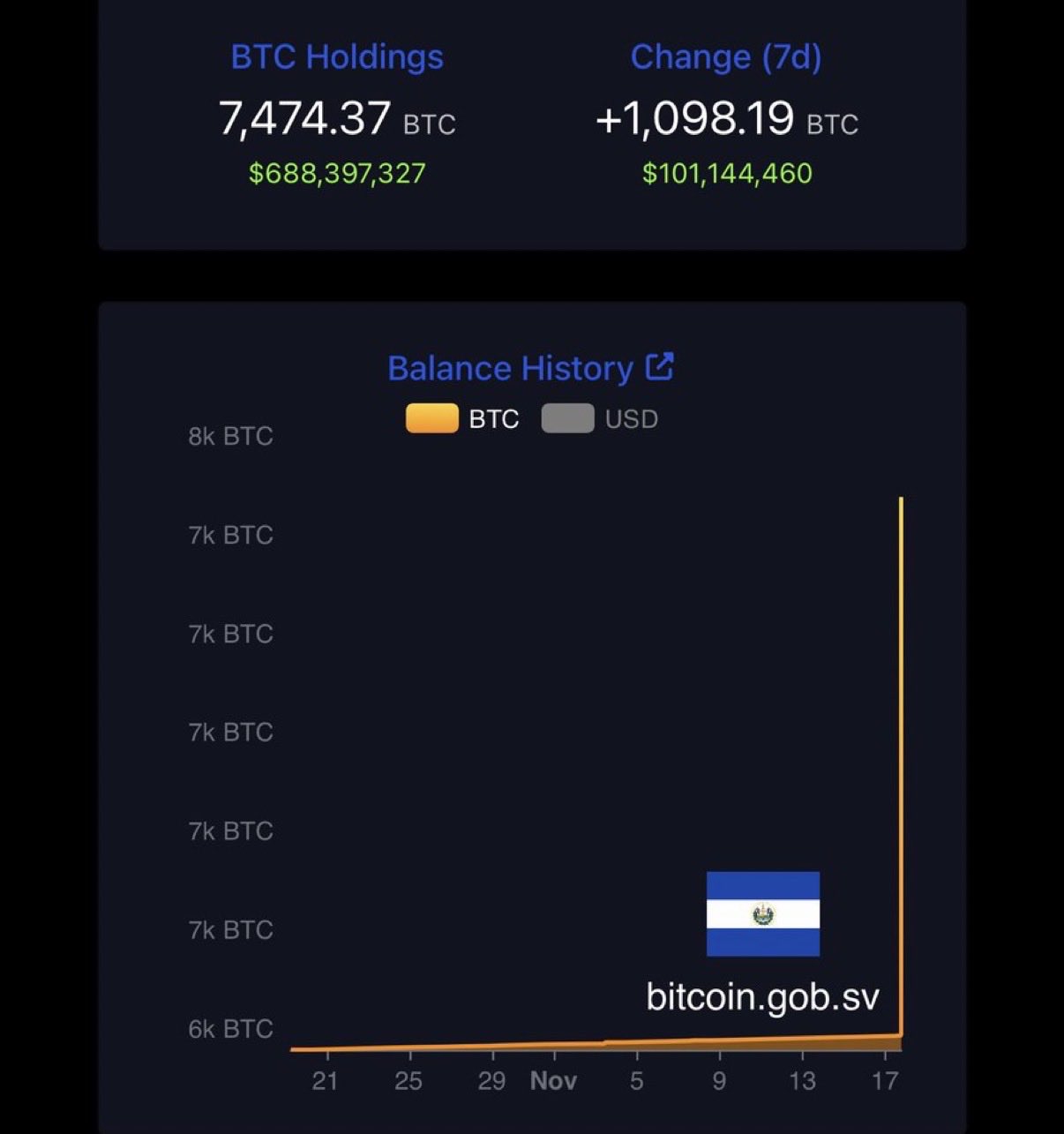

Amid rising corporate risks, sovereign interest remains steadfast. El Salvador’s $100 million Bitcoin purchase during the recent downturn exemplifies long-horizon commitments contrasting with corporations’ 90-day cycles.

Source: X

Thus, Bitcoin faces no existential threat, but corporate treasury paradigms may falter under liquidity constraints. Dedicated holders persist, yet market dynamics now prioritize cash flows over conviction, positioning the coming 90 days as a litmus test for institutional endurance alongside Bitcoin’s proven resilience.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026