Bitcoin’s Four-Year Cycle Shows Signs of Evolving Into a Supercycle

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s four-year cycle is evolving beyond traditional patterns, with the 2024 halving leading to stabilization rather than sharp rallies or crashes. Institutional demand and ETF inflows are driving a potential supercycle, keeping prices resilient amid macroeconomic shifts.

-

Bitcoin’s post-2024 halving performance shows a modest 7% yearly decline, diverging from historical 60%+ gains.

-

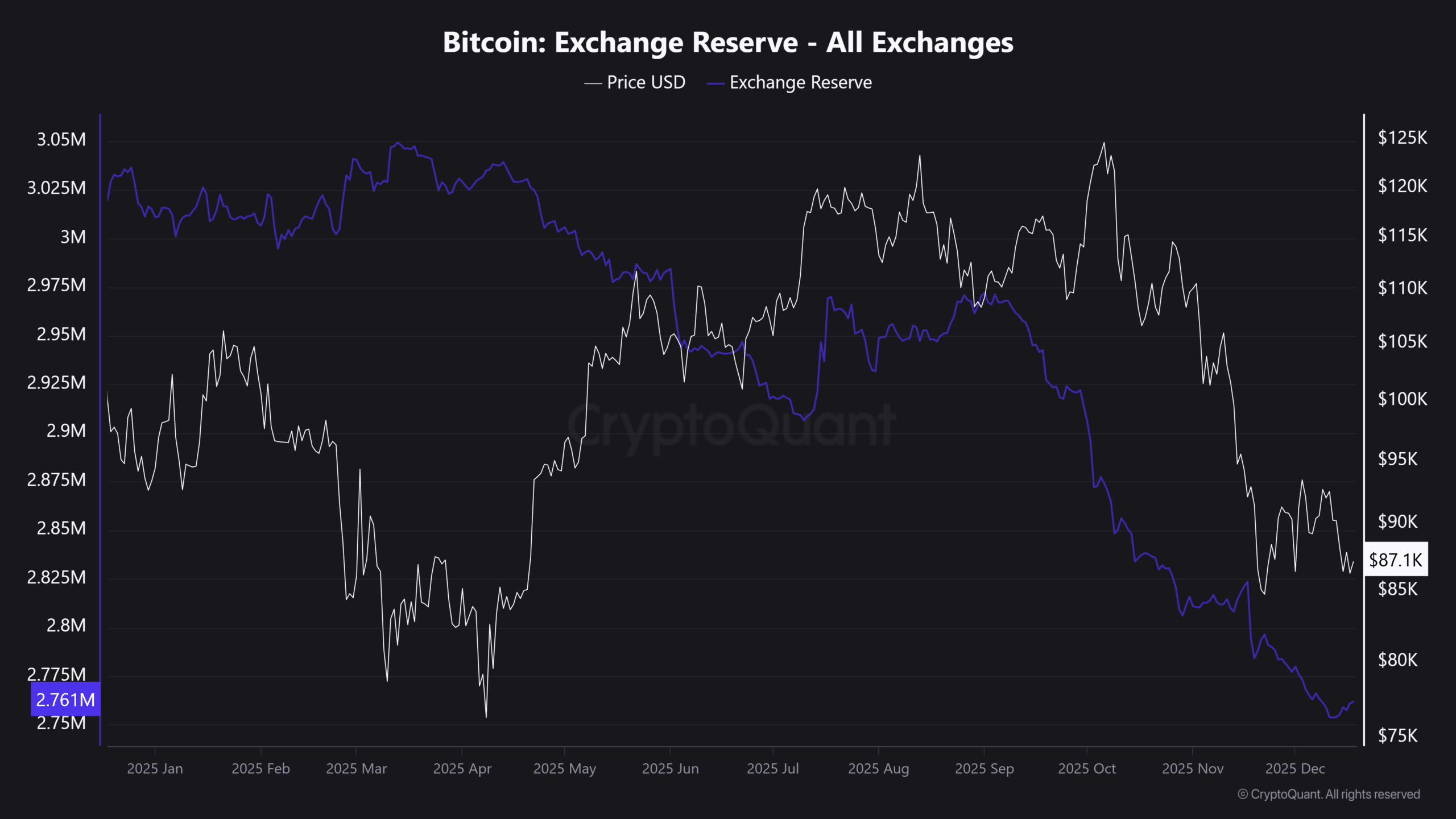

Exchange reserves have dropped significantly, with 140,000 BTC accumulated in Q4 2024, signaling reduced selling pressure.

-

Institutional adoption via ETFs has added billions in support, fostering a more mature market structure per CryptoQuant data.

Discover how Bitcoin’s four-year cycle is transforming into a supercycle amid ETF launches and falling reserves. Stay informed on BTC’s stable future and investment opportunities today.

What is happening to Bitcoin’s four-year cycle?

Bitcoin’s four-year cycle, historically tied to halving events that reduce mining rewards and increase scarcity, is showing signs of deviation in 2025. The April 2024 halving cut rewards to 3.125 BTC per block, yet 18 months in, the market has not followed the typical post-halving rally and subsequent bear phase. Instead, factors like institutional inflows are promoting stability, potentially ushering in a prolonged bull phase known as a supercycle.

Why is this cycle behaving differently from past ones?

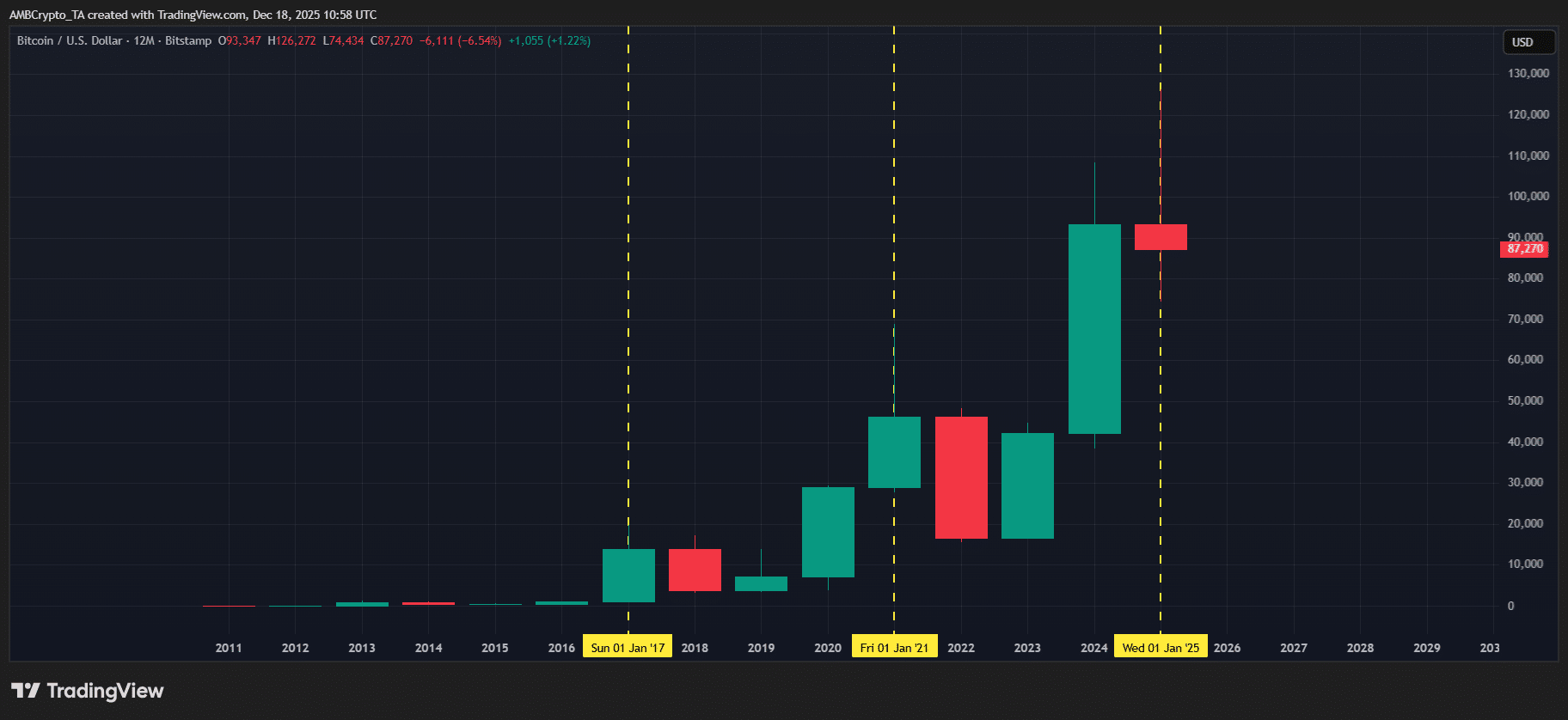

The traditional Bitcoin four-year cycle has been marked by explosive growth in the year following halvings, followed by corrections. For example, after the 2020 halving, Bitcoin surged 60% in 2021 before a 64% drop in 2022. Data from TradingView indicates that in the current cycle, Bitcoin is on track for a roughly 7% decline by the end of 2024, contrasting sharply with prior patterns.

This shift stems from maturing market dynamics. Exchange reserves have fallen, with CryptoQuant reporting 140,000 BTC withdrawn in Q4 2024 alone, reflecting accumulation by long-term holders. The introduction of spot Bitcoin ETFs in 2024 has brought in over $20 billion in institutional capital, according to financial analysts, providing a steady demand floor that dampens volatility.

Macroeconomic influences, including interest rate adjustments by central banks, further support this stability. Experts like those from Glassnode note that on-chain metrics show reduced leverage in derivatives markets, preventing the hype-fueled booms and busts of earlier cycles. In 2018, a 73% crash followed a 125% rally; today, such extremes appear less likely due to broader adoption.

Source: TradingView (BTC/USDT)

Historical data underscores this evolution. The 2016 halving sparked a 125% gain into 2017, only for a 73% correction in 2018 driven by retail speculation. Current trends, bolstered by regulatory clarity and corporate treasury allocations, suggest a more sustainable trajectory. “Bitcoin is transitioning from a speculative asset to a store of value,” states a report from Chainalysis, highlighting reduced volatility in holder behavior.

Frequently Asked Questions

Is Bitcoin’s four-year cycle still relevant in 2025?

Bitcoin’s four-year cycle remains influential due to halving mechanics, but its reliability is waning as institutional participation grows. The 2024 halving has not produced the expected rally, with prices stabilizing around $90,000 amid ETF demand, per on-chain analytics from firms like Glassnode.

What factors are driving a potential Bitcoin supercycle?

A Bitcoin supercycle refers to an extended bull market without deep corrections, fueled by ETFs, declining exchange reserves, and global adoption. This natural progression supports steady growth, making Bitcoin more appealing for long-term investors seeking reliable digital gold exposure.

Source: CryptoQuant

The supercycle narrative gains traction from metrics like the MVRV ratio, which indicates undervaluation compared to past peaks. “With halvings now anticipated by markets, the supply shock is front-loaded, extending the uptrend,” notes an analysis from Santiment, emphasizing how ETF approvals have institutionalized Bitcoin’s growth path.

Key Takeaways

- Deviation from Tradition: Bitcoin’s four-year cycle post-2024 halving shows only a mild decline, breaking from historical 60%+ rallies due to maturing fundamentals.

- Institutional Backbone: ETF inflows exceeding $20 billion and 140,000 BTC in Q4 accumulations are stabilizing prices, per CryptoQuant and TradingView data.

- Supercycle Potential: Reduced volatility and on-chain holder accumulation suggest a prolonged bull market; investors should monitor macroeconomic policies for entry points.

Conclusion

Bitcoin’s four-year cycle is undergoing a profound shift, influenced by the 2024 halving’s muted impact and the rise of institutional tools like ETFs. As exchange reserves dwindle and adoption accelerates, the asset appears poised for a supercycle of sustained growth. Forward-looking investors may find opportunities in this stabilized environment, positioning portfolios for long-term resilience in the evolving crypto landscape.