Bitcoin’s Key Price Levels Suggest Possibilities for Correction or Surge Beyond $100,000

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

The recent fluctuations in Bitcoin’s price are raising concerns among investors, particularly regarding the RHODL Ratio and its implications for market trends.

-

An inability to maintain the crucial $92,500 support level may trigger a more significant sell-off among short-term holders, adding to the market’s volatility.

-

According to COINOTAG insights, “Should demand dwindle, Bitcoin’s trajectory may lean toward further declines rather than breakout momentum.”

Bitcoin’s RHODL Ratio decline indicates rising speculation among short-term holders, posing risks to price stability as Bitcoin struggles with key support levels.

Market Dynamics: Short-Term Holders Influence Bitcoin’s Stability

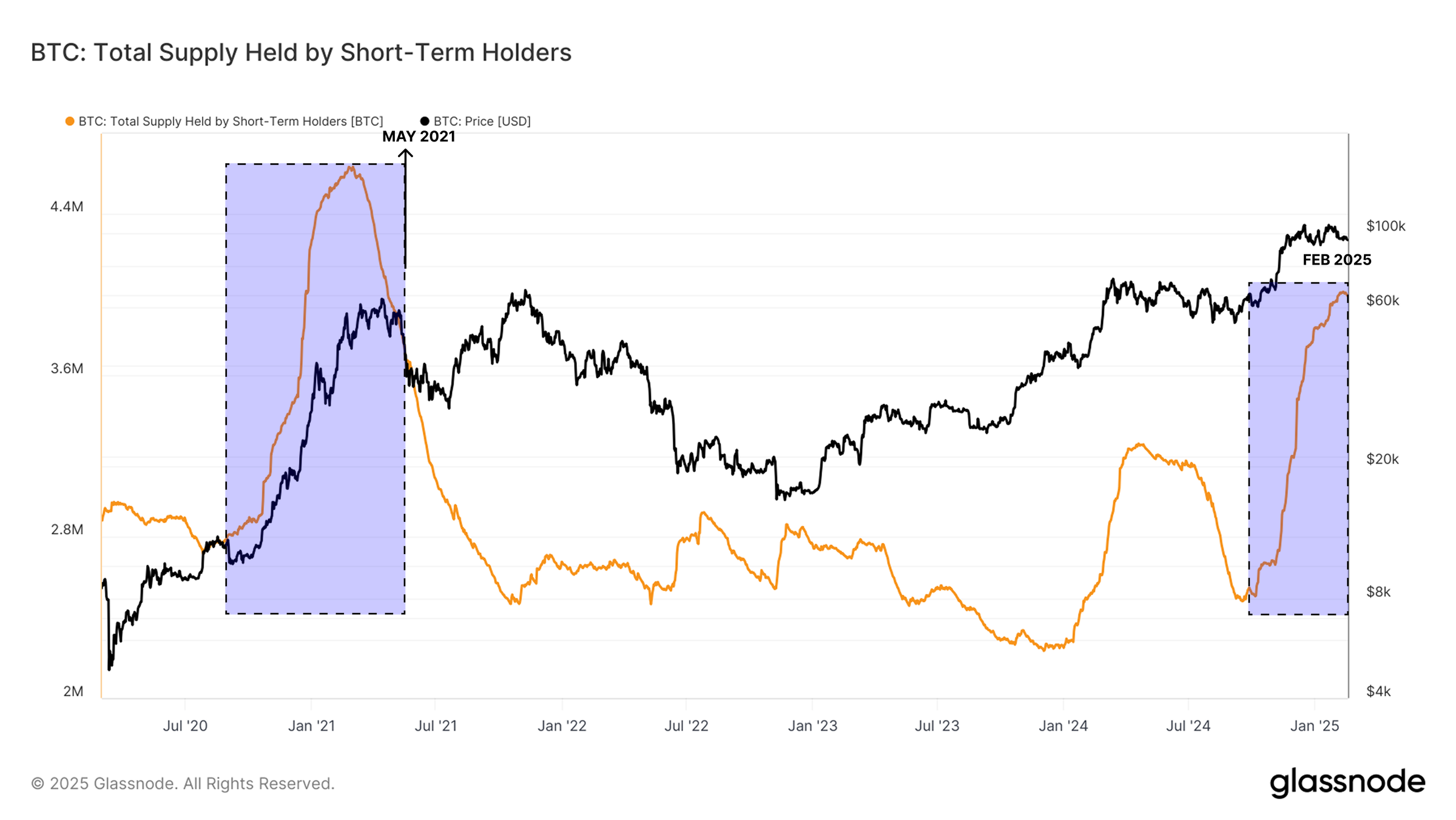

The role of short-term holders (STHs) has become increasingly significant as Bitcoin faces resistance at the critical $100,000 threshold. The current supply dynamics reflect historical patterns similar to those observed in May 2021, highlighting the potential for volatility.

As the supply from STHs grows, there is heightened sensitivity to negative price movements. If support at $92,500 fails, the resulting selling pressure could be substantial, leading to an increased likelihood of a broader market correction.

Accumulation Patterns Signal Future Price Movements

Observing accumulation patterns can offer insights into Bitcoin’s future performance. During past market cycles, periods of high supply influx indicated a shift in investor sentiment. Adverse movements below support levels often led to panic selling, particularly among new investors who acquired their assets at peak prices.

The current trends suggest that continued accumulation of Bitcoin could help stabilize its price, allowing it to push beyond current resistance levels. Nevertheless, a lack of buying pressure may spell trouble, risking a decline towards previously mentioned support levels.

Bitcoin Short-Term Holder Supply. Source: Glassnode

Understanding the Current Price Consolidation Range

Bitcoin’s current price action shows a consolidation within the range of $98,212 to $95,761, indicating a precarious situation for the cryptocurrency. Repeated attempts to maintain these support levels underline the growing risk of a breakout to the downside.

If Bitcoin fails to uphold its lower support, it could witness a swift drop towards $93,625, with further declines possible if bearish momentum continues to build. These levels are critical not just for immediate price action but also in shaping longer-term investor sentiment.

Bitcoin Price Analysis. Source: TradingView

Long-Term Outlook and Future Market Direction

While short-term fluctuations pose challenges, the overall outlook for Bitcoin remains contingent on long-term accumulation strategies. Investors who maintain a bullish perspective could play a pivotal role in disrupting current bearish patterns.

Reclaiming critical price levels such as $100,000 could ignite bullish momentum, signaling a potential run toward all-time highs. Market participants are keeping a close watch as these dynamics unfold, particularly given the fluctuating supply and demand landscape.

Conclusion

The current state of Bitcoin pricing amidst the decline in the RHODL Ratio serves as a reminder of the inherent volatility within cryptocurrency markets. Investors must remain vigilant in observing key support levels, as failure to sustain these could lead to significant price corrections. Ultimately, the balance between short-term speculation and long-term growth strategies will dictate Bitcoin’s trajectory in the coming weeks.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/8/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/7/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/6/2026

DeFi Protocols and Yield Farming Strategies

2/5/2026