Bitcoin’s Potential Q1 2026 Rally as US Inflation Cools

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The Bitcoin Q1 2026 outlook points to a potential rally, with historical trends showing an average 50% ROI in the first quarter. Despite a weak Q4 2025, cooling U.S. inflation at 2.6% core CPI could spark renewed interest, positioning Bitcoin for gains toward new highs as predicted by analysts like Tom Lee.

-

Bitcoin’s Q4 2025 decline of 23% erased much of prior gains, shifting market sentiment to caution without strong dip buying.

-

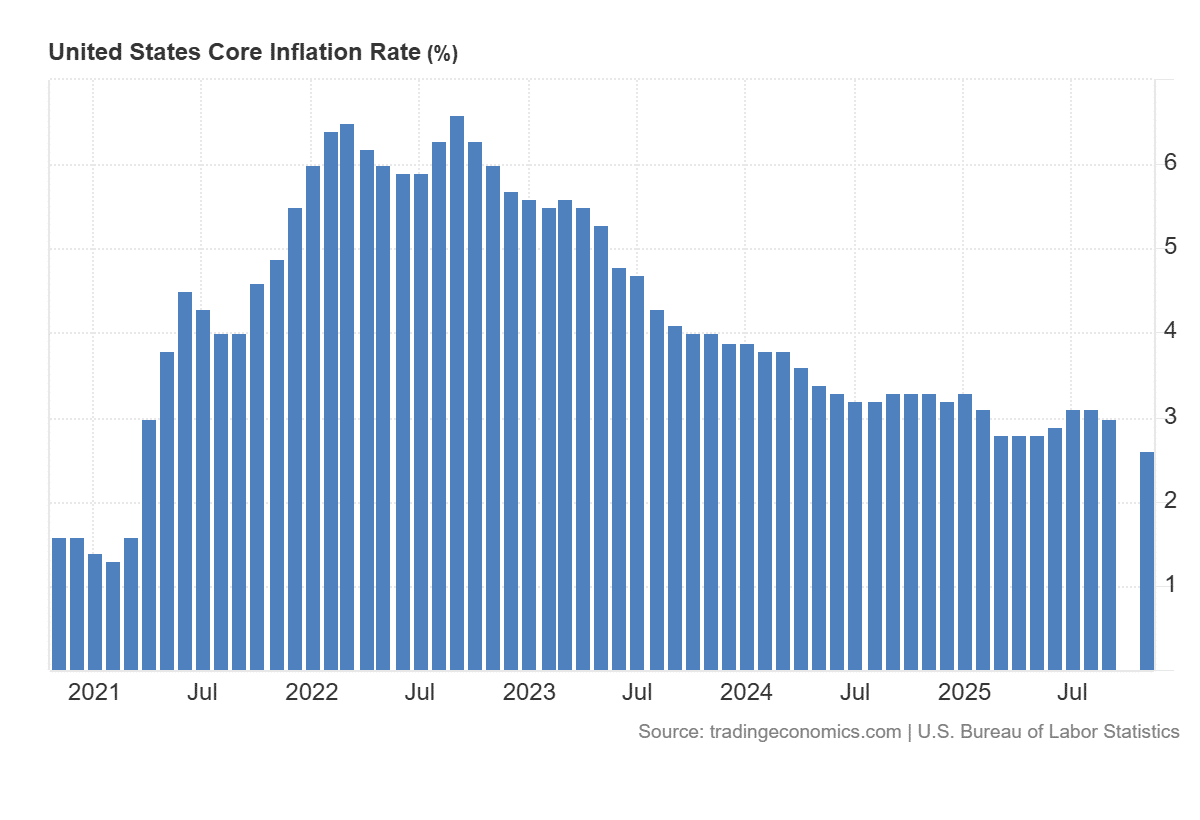

November’s CPI report revealed core inflation at a multi-year low of 2.6%, below expectations and nearing the Fed’s 2% target.

-

Historical Q1 performance averages 50% returns for Bitcoin, supported by macroeconomic improvements and institutional inflows.

Discover the Bitcoin Q1 2026 outlook amid cooling inflation and historical trends. Explore predictions, key data, and market insights for potential rallies—stay informed on crypto’s next moves today.

What is the Bitcoin Q1 2026 Outlook?

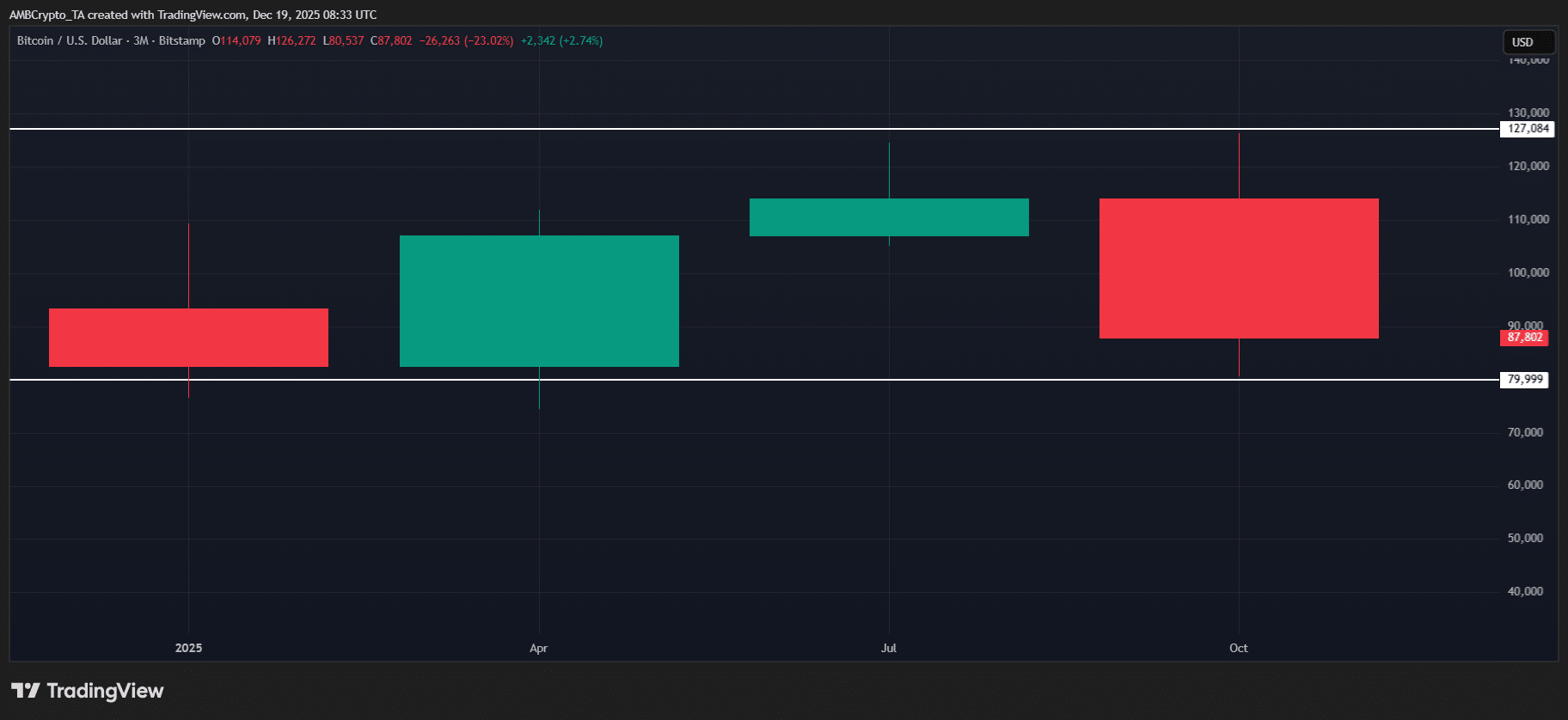

Bitcoin Q1 2026 outlook suggests a strong recovery potential following a turbulent Q4 2025, where the asset dropped 23% and erased over 60% of earlier quarterly gains. Analysts like Tom Lee maintain optimism, forecasting new all-time highs by early 2026, driven by historical Q1 trends averaging 50% returns and favorable macroeconomic shifts. This period has consistently ranked as Bitcoin’s second-most bullish quarter, setting the stage for renewed investor confidence.

How Has Recent U.S. Inflation Data Influenced Bitcoin’s Trajectory?

The latest U.S. inflation figures have provided a positive catalyst for Bitcoin, with core CPI falling to 2.6%—the lowest since April 2021—and headline CPI at 2.7%, missing economist expectations of 3.1%. This data, reported by the Bureau of Labor Statistics, brings inflation closer to the Federal Reserve’s 2% target, easing pressures from prior rate hikes and government shutdown uncertainties. Bitcoin responded with a 2.93% intraday surge, indicating market relief and potential for sustained upward momentum.

Experts note that such cooling inflation typically correlates with risk-on assets like cryptocurrencies, as lower rates could encourage capital flows into high-growth sectors. For instance, institutional players such as Ark Invest have increased exposure to crypto-related equities, signaling broader confidence. Historical patterns show Bitcoin thriving in low-inflation environments post-Fed adjustments, with Q1 often amplifying these effects through seasonal buying.

Trading volume has stabilized, and open interest remains controlled, avoiding the greed-fueled excesses of earlier 2025 quarters. As fear indices recede, Bitcoin’s price action—hovering 30% below its October peak—may attract value investors, further bolstering the Q1 setup.

Source: TradingView (BTC/USDT)

Looking ahead, the absence of major fiscal disruptions post-shutdown allows focus on these fundamentals. Bitcoin’s resilience amid Q4’s 23% decline—coupled with this inflation reprieve—positions it well for historical Q1 strength, where returns have averaged 50% since inception.

Frequently Asked Questions

What Caused Bitcoin’s Weak Performance in Q4 2025?

Bitcoin’s Q4 2025 weakness stemmed from unmet seasonal expectations, resulting in a 23% decline that wiped out 60% of Q2 and Q3 gains. Factors included cracked support levels, flushed leveraged positions, and spiking fear indices, with limited dip buying despite prices 30% off October highs. Broader market caution overshadowed potential tailwinds.

Will Cooling Inflation Lead to Bitcoin Gains in Early 2026?

Yes, cooling inflation like the recent 2.6% core CPI drop is likely to support Bitcoin gains in early 2026 by aligning with the Fed’s 2% target and reducing rate hike fears. This environment historically favors risk assets, potentially igniting Q1’s average 50% ROI as institutional interest returns and sentiment improves.

Key Takeaways

- Historical Q1 Strength: Bitcoin has averaged 50% returns in the first quarter, making it a prime period for recovery after Q4’s 23% drop.

- Inflation’s Positive Impact: U.S. core CPI at 2.6%—a multi-year low—has already lifted Bitcoin 2.93% intraday, signaling reduced macroeconomic headwinds.

- Analyst Optimism: Forecasts from experts like Tom Lee predict new all-time highs by January 2026, urging investors to monitor institutional flows closely.

Conclusion

The Bitcoin Q1 2026 outlook remains promising despite Q4 2025’s challenges, with cooling U.S. inflation and historical trends pointing to substantial upside. As core CPI nears the Fed’s target, renewed institutional participation could drive the asset toward analyst-predicted highs. Investors should prepare for this seasonal bullish window by staying attuned to economic indicators and market sentiment shifts.

Source: TradingEconomics