Bitcoin’s Quantum Risk: Consensus Dilemma May Unleash Legacy Coins

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s quantum risk primarily stems from a consensus dilemma rather than a technological barrier, as the network faces challenges in securing legacy coins against future quantum attacks without community agreement on freezing inactive addresses.

-

Consensus Challenge: Bitcoin’s community may struggle to agree on measures like freezing unmoved coins, potentially leading to market floods from compromised old addresses.

-

Quantum-resistant upgrades are feasible for new addresses using NIST-approved cryptography, but legacy Bitcoin remains vulnerable.

-

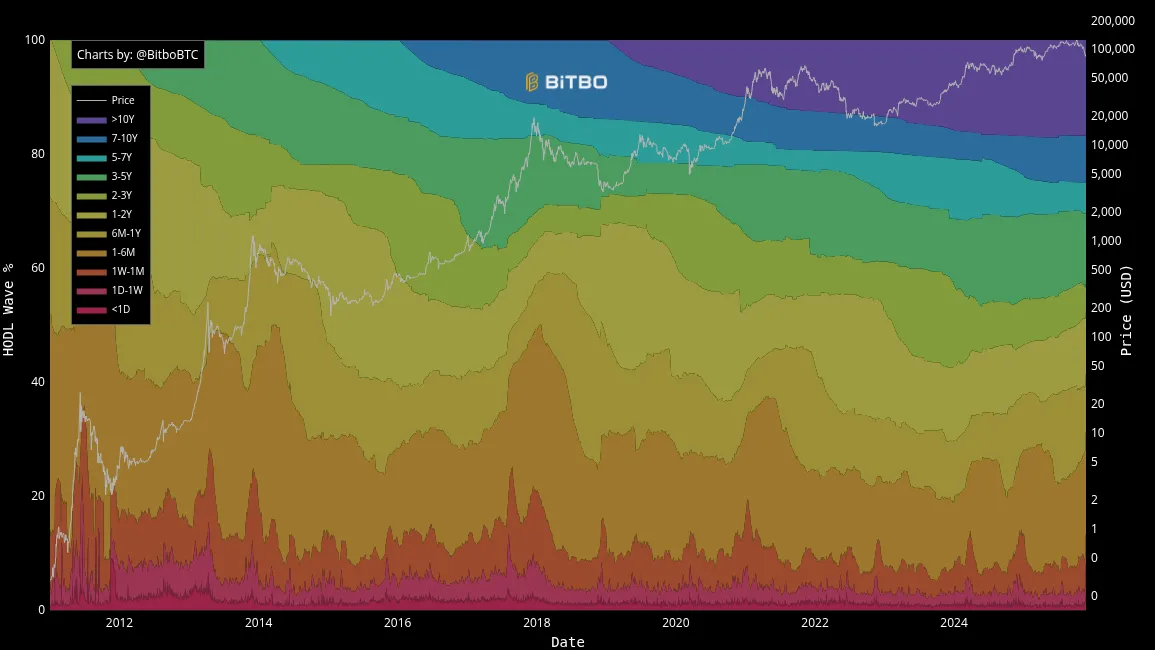

Over 32% of Bitcoin hasn’t moved in five years, raising questions about lost assets and their impact if quantum threats materialize, per BitBo data.

Explore Bitcoin’s quantum risk: Consensus issues threaten legacy coins as quantum computing advances. Learn expert insights on upgrades and implications for BTC holders. Stay informed on crypto security today.

What is Bitcoin’s Quantum Risk?

Bitcoin’s quantum risk refers to the potential vulnerability of the cryptocurrency’s cryptographic foundations to attacks from powerful quantum computers, which could crack current encryption methods like ECDSA and Schnorr signatures. This risk is not immediate but could emerge in decades, primarily posing a consensus challenge for the Bitcoin network rather than a purely technical one, as securing legacy coins requires community-wide decisions. Experts argue that without agreement on protective measures, significant portions of dormant Bitcoin could be exposed, leading to potential market disruptions.

How Can Bitcoin Achieve Quantum Resistance?

Bitcoin’s path to quantum resistance involves adopting post-quantum cryptography standards already endorsed by the US National Institute of Standards and Technology (NIST), which finalized multiple schemes in 2024. For instance, the Bitcoin Improvement Proposal 360 outlines integrating these into the protocol, enabling new addresses to use quantum-safe signatures while maintaining network compatibility. However, transitioning legacy addresses remains complex; a full upgrade might require soft forks, but experts like James Check, founder of onchain analysis service Checkonchain, emphasize that consensus on handling inactive coins is the real hurdle.

Supporting data from BitBo indicates that 32.4% of all Bitcoin supply has remained unmoved for over five years, with 16.8% dormant for more than a decade. This highlights the scale of at-risk assets, as quantum computers could theoretically forge signatures to access funds in these addresses. Ceteris Paribus, head of research at Delphi Digital, notes that while quantum-resistant tech is viable, it doesn’t address the fate of old coins, stating, “Quantum resistant Bitcoin will be feasible but it doesn’t solve what you do with the old coins.”

Bitcoin hodl waves chart. Source: BitBo

Early cypherpunk Adam Back, referenced in the original Bitcoin whitepaper, discussed this in an interview, suggesting the community must decide between deprecating vulnerable addresses or risking theft. Check advocates allowing old coins to re-enter the market naturally, avoiding divisive consensus fights that could fragment development efforts.

Frequently Asked Questions

What Happens to Lost Bitcoin in the Event of a Quantum Attack?

In a quantum attack scenario, lost or dormant Bitcoin in non-quantum-resistant addresses could be compromised if attackers forge signatures, potentially flooding the market with reactivated coins. However, experts like James Check argue the Bitcoin network is unlikely to freeze these assets due to consensus challenges, preserving decentralization but exposing up to 32% of supply based on recent dormancy data from BitBo.

Is Quantum Computing a Near-Term Threat to Bitcoin?

Quantum computing poses no immediate threat to Bitcoin, with projections indicating viable attacks are at least two to four decades away, as noted by Adam Back. Current encryption holds strong against classical computers, and ongoing research into post-quantum standards ensures proactive defenses, allowing the ecosystem time to adapt without panic.

Key Takeaways

- Consensus Over Tech: Bitcoin’s quantum risk hinges more on community agreement than technical feasibility, complicating protections for legacy coins.

- Dormant Supply Exposure: Data shows over 32% of Bitcoin unmoved for five years, underscoring the potential economic impact of unaddressed vulnerabilities.

- Proactive Upgrades Needed: Adopting NIST-endorsed cryptography via proposals like BIP 360 can secure new transactions, urging holders to migrate funds promptly.

Conclusion

Bitcoin’s quantum risk underscores the delicate balance between technological innovation and community consensus in safeguarding the network’s integrity. As experts like James Check and Adam Back highlight, while quantum-resistant solutions for Bitcoin quantum risk are within reach, addressing legacy coins demands unified action to prevent disruptions. Looking ahead, proactive adoption of post-quantum cryptography will fortify Bitcoin against emerging threats, ensuring its longevity as a secure digital asset—holders should monitor protocol developments closely for migration opportunities.

James Check, founder and lead analyst at Checkonchain, elaborated on this in a recent analysis, stating that the threat is “more of a consensus problem than a technology issue.” He pointed out that development politics could limit reactive measures, especially for the 16.8% of Bitcoin dormant over 10 years.

Responding to insights from Ceteris Paribus of Delphi Digital, Check noted the uniqueness of Bitcoin’s dilemma: tech fixes exist, but legacy handling is secondary yet critical. This perspective aligns with broader discussions on cryptocurrency security evolution.

The technological groundwork for quantum resistance is solid. NIST’s endorsement of post-quantum schemes last year paves the way for implementation, making secure addresses feasible. Yet, Bitcoin’s reliance on ECDSA for legacy and Schnorr for Taproot leaves gaps that a new signature standard must fill.

Adam Back’s comments suggest even Satoshi Nakamoto’s holdings could come into play if quantum advances force movement, though he tempers urgency by estimating a 20-40 year horizon. This timeline allows for measured responses without hasty overhauls.

Unlike Bitcoin, some blockchains have explored backwards-compatible fixes. Researchers in July proposed a zero-knowledge proof system for networks like Sui and Solana, leveraging deterministic key derivation to verify ownership without exposing vulnerabilities. While not applicable to Bitcoin or Ethereum due to differing algorithms, it demonstrates innovative approaches in the space.

These developments reinforce the need for Bitcoin’s ecosystem to prioritize quantum readiness through ongoing research and community dialogue. By focusing on consensus-building and incremental upgrades, Bitcoin can mitigate quantum-resistant Bitcoin challenges effectively.

In summary, the discourse around Bitcoin’s quantum risk reveals a maturing protocol prepared for future-proofing. Stakeholders should engage with updates from sources like Checkonchain and Delphi Digital to stay ahead, ensuring the network’s resilience in an evolving technological landscape.

Comments

Other Articles

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

Solana Shows Potential Bullish Breakout with Growing Institutional ETP Assets

December 17, 2025 at 08:36 AM UTC

Bitwise’s Bitcoin-Topped Crypto Index Fund Shifts to NYSE Arca Amid Institutional Inflows

December 9, 2025 at 06:27 PM UTC