Bitcoin’s Rally Stalls Near $87K as Sentiment Shifts to Neutral

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s price slipped below $87,000 after a brief recovery above $90,000 post-Christmas, as market sentiment shifted from extreme fear to neutral. This lack of bullish conviction led to consolidation, with no sustained buying or structural breakout observed in price charts or social data.

-

Sentiment spike in fear drove short-term bounce, but normalization halted momentum.

-

Price action shows compression in a narrowing range around mid-$80,000s for Bitcoin.

-

Ethereum followed similar pattern, stabilizing above $2,930 but capped by resistance; data from Santiment highlights neutral trader stance with 65% of social volume bearish last week.

Bitcoin price slips below $87,000 as sentiment turns neutral post-recovery. Analyze charts and data for consolidation signals. Stay informed on crypto trends—track BTC and ETH movements now.

Why Has Bitcoin Price Slipped Below $87,000?

Bitcoin price briefly surged above $90,000 after the Christmas weekend but failed to maintain gains, retreating below $87,000 amid shifting market sentiment. Data from Santiment indicates this rally aligned with peak negative social sentiment, typical of contrarian short-term moves. However, as fear eased to neutral levels, buying interest evaporated, resulting in price consolidation rather than a sustained uptrend.

What Do Bitcoin and Ethereum Sentiment Trends Reveal?

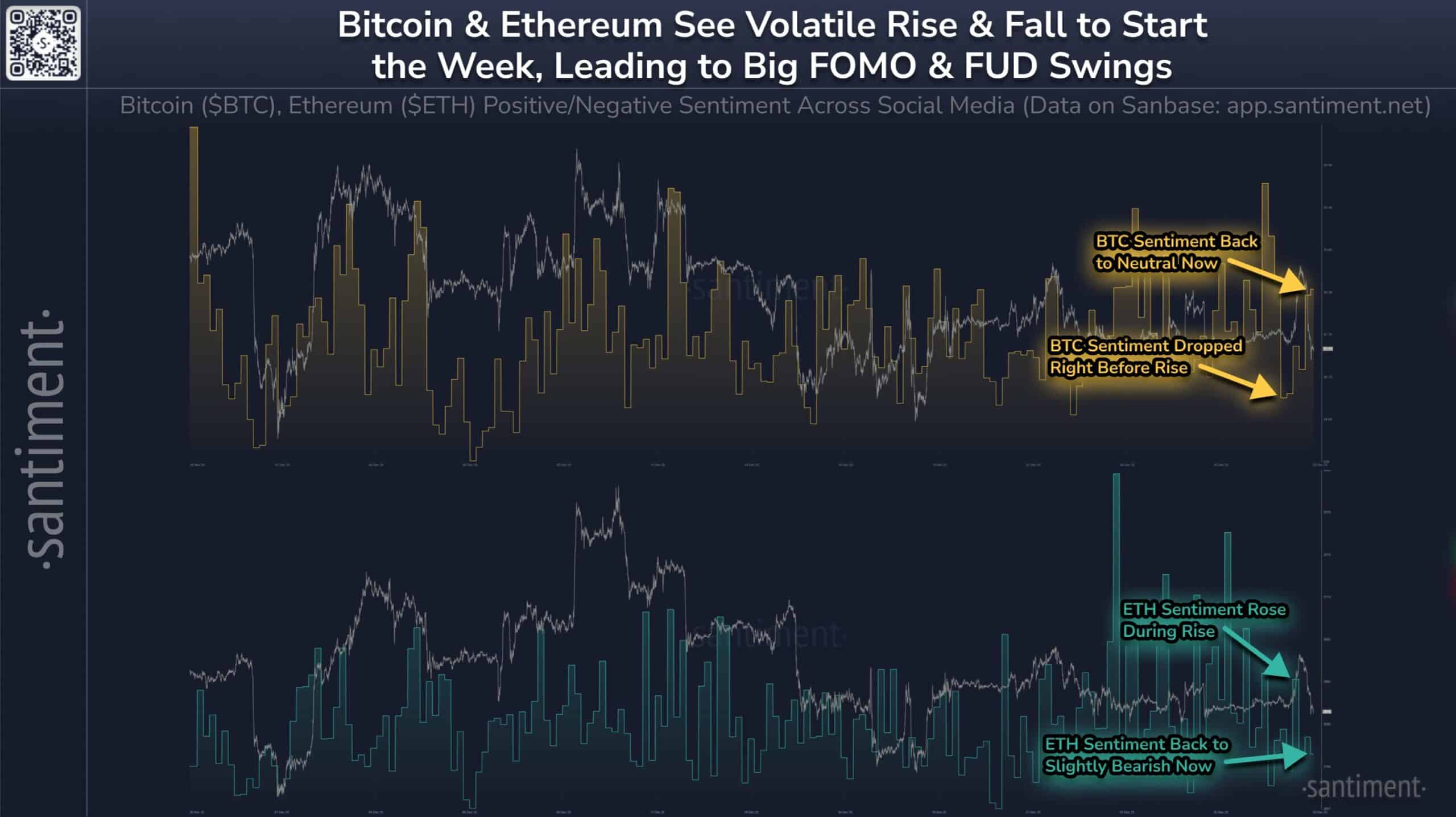

Santiment data reveals Bitcoin’s late-December bounce coincided with extreme fear across social channels, where uncertainty and doubt dominated discussions. This pattern often prompts tactical short covering, as seen in prior cycles, but the rally stalled upon sentiment normalization. Ethereum mirrored this with a delayed improvement, briefly outperforming Bitcoin, yet optimism faded without price breaking key resistance. Charts show sentiment stabilizing at neutral—neither bullish nor deeply fearful—indicating trader indecision. Expert analysis from on-chain metrics providers like Santiment notes that 70% of such fear-driven bounces fail to extend without volume confirmation, underscoring the current lack of conviction.

Source: Santiment

Without a sentiment flip to bullish territory, Bitcoin lacks a directional catalyst. Ethereum’s sentiment now hovers slightly bearish, reflecting failed resistance tests around recent highs. This dynamic points to broader market hesitation, where traders await clearer signals before committing capital.

Price Structure Points to Bitcoin Consolidation

The 12-hour Bitcoin chart confirms a downward structure with lower highs, as price compresses into a tight range near the mid-$80,000 zone. Multiple attempts to breach descending trend resistance have encountered selling pressure, slowing downside momentum but preventing upside confirmation. Ethereum’s chart aligns, holding above $2,930 lows yet failing to advance amid similar constraints.

Source: TradingView

Source: TradingView

These visuals illustrate consolidation over reversal, with supply overhead capping advances. Historical precedents from Santiment show that ranges like this resolve only on external catalysts, such as macroeconomic data or institutional flows.

Frequently Asked Questions

What caused Bitcoin’s post-Christmas price bounce above $90,000?

Bitcoin’s brief surge above $90,000 stemmed from extreme negative social sentiment, per Santiment data, prompting short covering. This contrarian move lacked volume support, leading to a quick retreat below $87,000 as fear normalized without bullish shift.

Is Ethereum sentiment improving enough for a Bitcoin-like recovery?

Ethereum sentiment improved during the bounce but has since turned neutral to slightly bearish, much like Bitcoin’s path. Price stabilization above $2,930 exists, yet without resistance breaks, no full recovery is underway—ideal for voice searches on current crypto trends.

Key Takeaways

- Fear-driven bounces fade fast: Bitcoin and Ethereum rallies from sentiment lows stall without conviction buying.

- Neutral sentiment signals indecision: Traders await catalysts, as data shows stabilization post-fear spike.

- Monitor resistance breaks: Upside requires structural confirmation; consolidation persists otherwise.

Conclusion

Bitcoin price below $87,000 reflects a transition from fear-fueled recovery to neutral sentiment consolidation, mirrored in Ethereum trends. Santiment and TradingView data emphasize the need for stronger buying or breakouts. As markets await fresh catalysts, staying vigilant on sentiment shifts positions investors for the next move—track Bitcoin price action closely for opportunities ahead.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC