Bitcoin’s Settlement Volume Approaches Visa and Mastercard Amid Limited Merchant Adoption

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin settlement volume reached $6.9 trillion over the past 90 days, matching or surpassing Visa and Mastercard combined, positioning it as a key alternative for cross-border value transfers without traditional banking infrastructure.

-

Bitcoin’s on-chain activity highlights its role in global settlements, driven by trading and remittances.

-

Stablecoins facilitate $225 billion in daily transfers, offering low fees and constant availability.

-

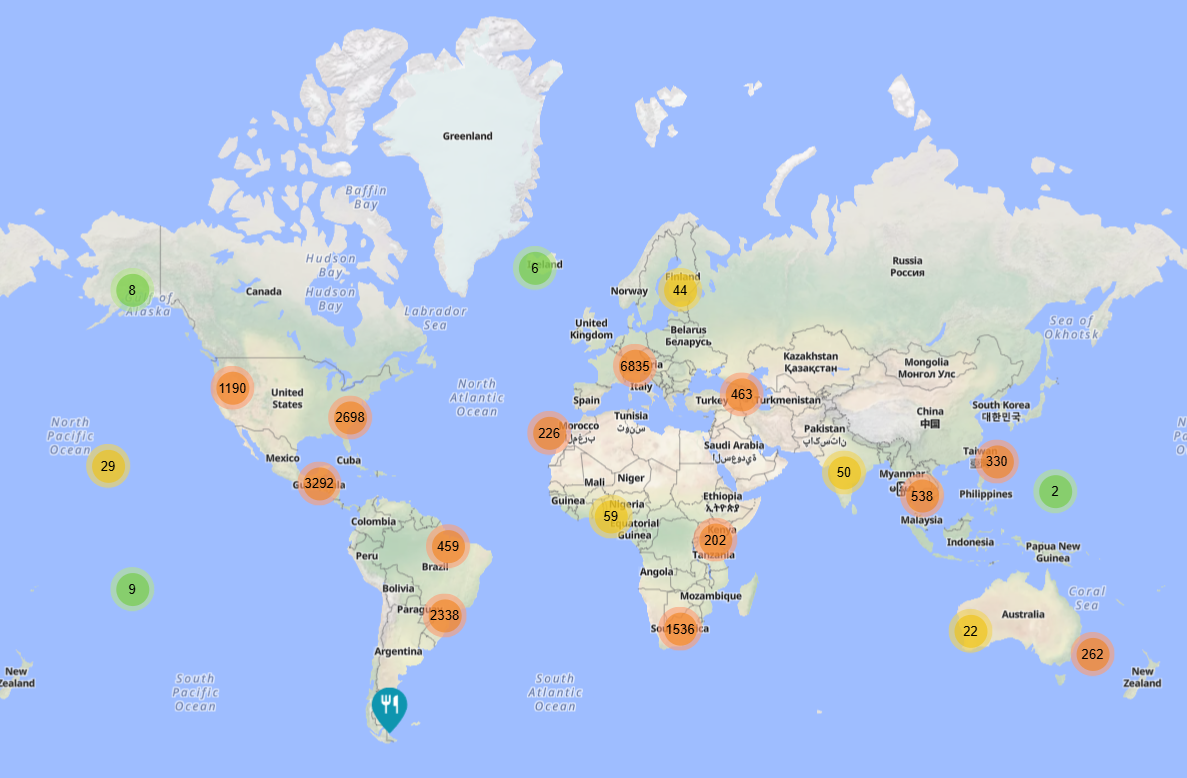

Despite high volumes, organic merchant adoption lags, with only around 20,000 businesses worldwide accepting Bitcoin directly.

Discover how Bitcoin’s $6.9 trillion settlement volume rivals Visa and Mastercard in 2025. Explore stablecoin growth and adoption challenges in this in-depth analysis. Stay informed on crypto’s evolving payment landscape.

What is Bitcoin’s Settlement Volume and How Does It Compare to Traditional Networks?

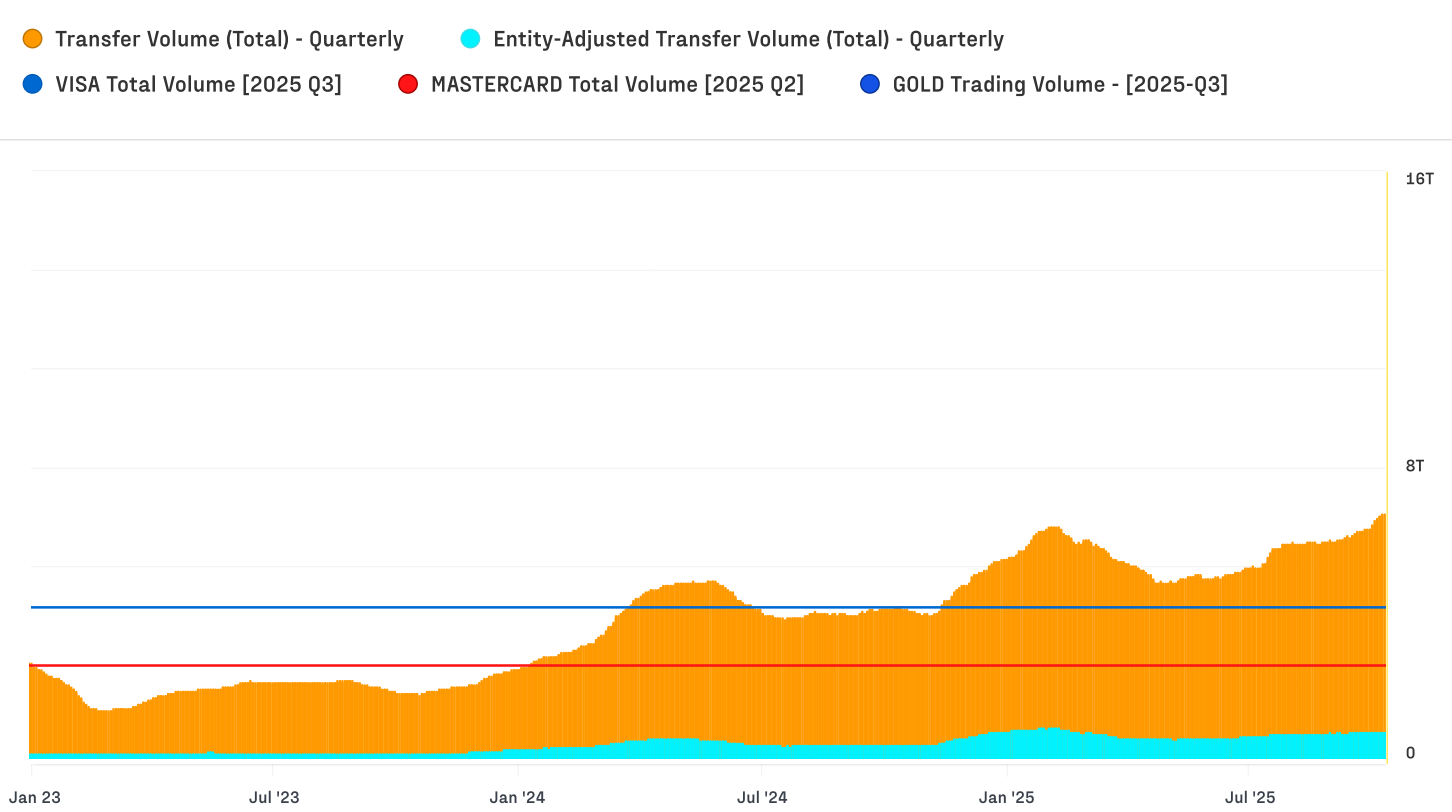

Bitcoin settlement volume refers to the total value of transactions processed on the Bitcoin network over a specific period, serving as a measure of its utility in transferring value globally. In the past 90 days, Bitcoin settled $6.9 trillion in payments, aligning closely with the combined volumes of major card networks like Visa and Mastercard. This growth underscores Bitcoin’s emergence as a viable alternative for international transfers, bypassing conventional banking and card systems.

How Do Stablecoins Contribute to Overall Crypto Settlement Activity?

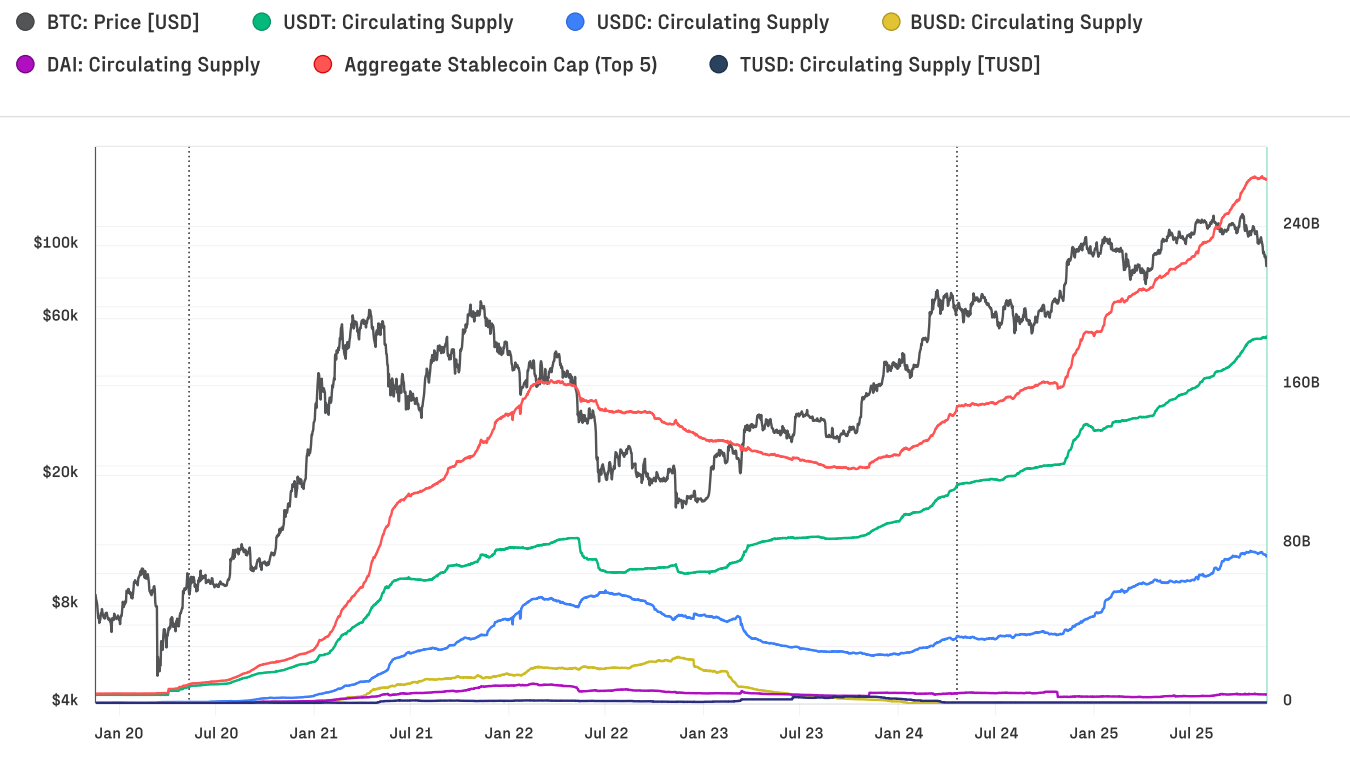

Stablecoins, pegged to assets like the US dollar, are playing an increasingly vital role in the crypto ecosystem by enabling efficient, low-cost value transfers. According to Glassnode’s fourth quarter 2025 digital asset research report, stablecoins moved an average of $225 billion daily over the past 30 days across the top five variants. This volume benefits from their price stability, minimal fees, and round-the-clock accessibility, making them attractive for both institutional and retail users.

However, not all activity is driven by genuine user demand. Glassnode and CEX.io research indicate that approximately 70% of the $15.6 trillion in stablecoin transfers during the third quarter of 2025 stemmed from automated trading bots. Organic transactions accounted for about 20%, with the rest involving internal smart contract movements or exchange operations. Experts at CEX.io emphasize that distinguishing bot-driven from human-initiated activity is essential for assessing stablecoins’ real-world impact and potential regulatory risks.

Bitcoin and US dollar–pegged stablecoins are emerging as a global alternative for moving value across borders without banks and card networks, as the Bitcoin network’s settlement volume begins to rival the world’s largest payment giants.

Bitcoin (BTC) settled $6.9 trillion worth of payments over the past 90 days, which is “on par with or above Visa and Mastercard,” according to blockchain data platform Glassnode’s digital asset research report for the fourth quarter of 2025, published on Wednesday.

Over the same period, Visa processed $4.25 trillion in payment volume and Mastercard $2.63 trillion, for a combined $6.88 trillion, according to the report.

“Activity is migrating off-chain as flows move to #ETFs and brokers, but Bitcoin and #stablecoins continue to dominate on-chain settlement,” Glassnode said on X.

Bitcoin, Visa, Mastercard, transfer volume comparison. Source: Glassnode

Bank of America backs 1%–4% crypto allocation, opens door to Bitcoin ETFs

Bitcoin’s Economic Settlement Still Small Next to Cards

Adjusting for internal transfers between related addresses, Bitcoin’s economic settlement volume drops to approximately $870 billion per quarter, equating to about $7.8 billion daily. Glassnode views this as evidence of Bitcoin’s expanding influence as a settlement layer that connects institutional and everyday financial flows worldwide.

By comparison, Visa handles an average of $39.7 billion in daily transactions, while Mastercard manages $26.2 billion, predominantly for consumer purchases and routine expenditures. Bitcoin’s volumes, on the other hand, are largely fueled by trading activities, cross-border remittances, and long-term value storage, reflecting its strengths in larger-scale transfers rather than everyday retail.

Merchants accepting Bitcoin payments. Source: BTCmap.org

Worldwide, only 20,599 merchants accept Bitcoin payments according to BTCmap, compared to Visa’s 175 million global merchant locations.

Bitcoin traders hit peak unrealized pain as ETFs start to turn positive

Stablecoins, aggregate supply. Source: Glassnode

Stablecoins are now moving an average of $225 billion in value per day, according to the 30-day moving average of aggregate transfer volume for the top five stablecoins calculated by Glassnode.

Yet, about 70% of the $15.6 trillion stablecoin transfers during the third quarter of 2025 were linked to automated trading bots, not organic activity.

Organic non-bot activity only accounted for about 20% of the total, while the remaining 9% was attributed to internal smart contract transfers and internal exchange transactions, according to a research report from crypto exchange CEX.io.

The exchange’s researchers said it was “crucial” to distinguish between organic and bot activity for policymakers to evaluate the systemic risk and real-world adoption of stablecoin payments.

Frequently Asked Questions

What Factors Drive Bitcoin’s High Settlement Volume in 2025?

Bitcoin’s settlement volume of $6.9 trillion in the last 90 days is propelled by its use in trading, remittances, and as a store of value, as detailed in Glassnode’s Q4 2025 report. Institutional adoption via ETFs and brokers has shifted some activity off-chain, yet on-chain dominance persists, rivaling traditional networks.

Why Is Stablecoin Activity Mostly Attributed to Bots?

Stablecoins see $225 billion in daily transfers, but around 70% comes from automated bots executing high-frequency trades, per Glassnode and CEX.io analyses. This automation ensures efficiency in volatile markets, though organic use for payments and remittances represents a growing, albeit smaller, portion at about 20%.

Key Takeaways

- Bitcoin Rivals Payment Giants: With $6.9 trillion settled quarterly, Bitcoin matches Visa and Mastercard’s volumes, highlighting its potential in global finance.

- Stablecoin Efficiency: Daily transfers average $225 billion, supported by low costs and 24/7 access, though bot activity dominates current flows.

- Adoption Challenges: Limited to 20,599 merchants, Bitcoin’s retail use lags; focus remains on institutional and remittance applications for broader impact.

Conclusion

Bitcoin’s settlement volume and the rise of stablecoins signal a transformative shift in global payments, challenging established networks like Visa and Mastercard while addressing cross-border inefficiencies. As adoption grows beyond trading to everyday use, these digital assets could reshape financial infrastructure. Investors and businesses should monitor regulatory developments and technological advancements to capitalize on this evolving landscape.