Bithumb BTC Error Fixed: Market Stable

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

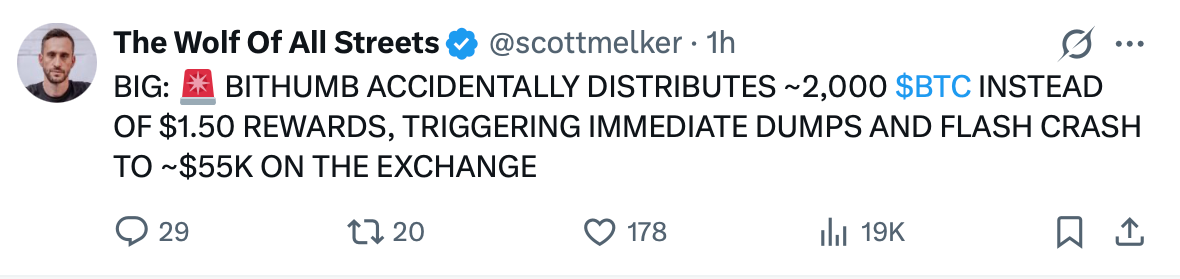

South Korean crypto exchange Bithumb detected that an abnormal amount of Bitcoin (BTC) was credited to some user accounts during a promotional event and quickly fixed the internal payment error. This error caused short-term sharp price fluctuations on the exchange as buyers sold the BTC. The company restricted the affected accounts through internal controls, stabilized market prices within minutes, and prevented cascading liquidations.

Source: Scott Melker

Bithumb BTC Promotion Error Details

The incident is not related to a hack or security breach; no losses in customer assets. Trading, deposits, and withdrawals are normal. Some users on X claimed ~2.000 BTC was credited but it was unverified. According to CoinGecko, Bithumb's trust score is 7/10, 24-hour volume 2.2 billion dollars. In January, it detected 200 million dollars in dormant assets from 2.6 million inactive accounts.

BTC Price Latest News and Technical Analysis

Bitcoin has risen %15 in the last 15 hours, surpassing 68.000$ from 60.000$ (currently 70.540$, +%10.39). RSI 32.39 (oversold), trend is down, EMA20: 81.078$. MicroStrategy CEO Phong stated there is no issue with prices below their 76.000$ average.

- Supports: S1 67.382$ (Strong, %71), S2 62.910$ (Strong, %62)

- Resistances: R1 79.710$ (Strong, %79), R2 71.041$ (Strong, %71)

Issues continue on centralized exchanges: Coinbase reduced restrictions, Binance distributed 728 million $ compensation.

Source: Binance.com

Critical Support and Resistance Levels for BTC

The Bithumb incident did not affect BTC futures; the overall market is recovering. Although Supertrend gives a bearish signal, strong supports offer buying opportunities.

Frequently Asked Questions About the Bithumb BTC Error

Did the Bithumb error permanently affect the BTC price? No, it was stabilized within minutes.

Are customer funds safe? Yes, no losses; operations normal.

What is BTC's current trend? Short-term recovery, RSI shows oversold.