BitMine Approaches 6 Million ETH Target as Price Defends Key Support

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

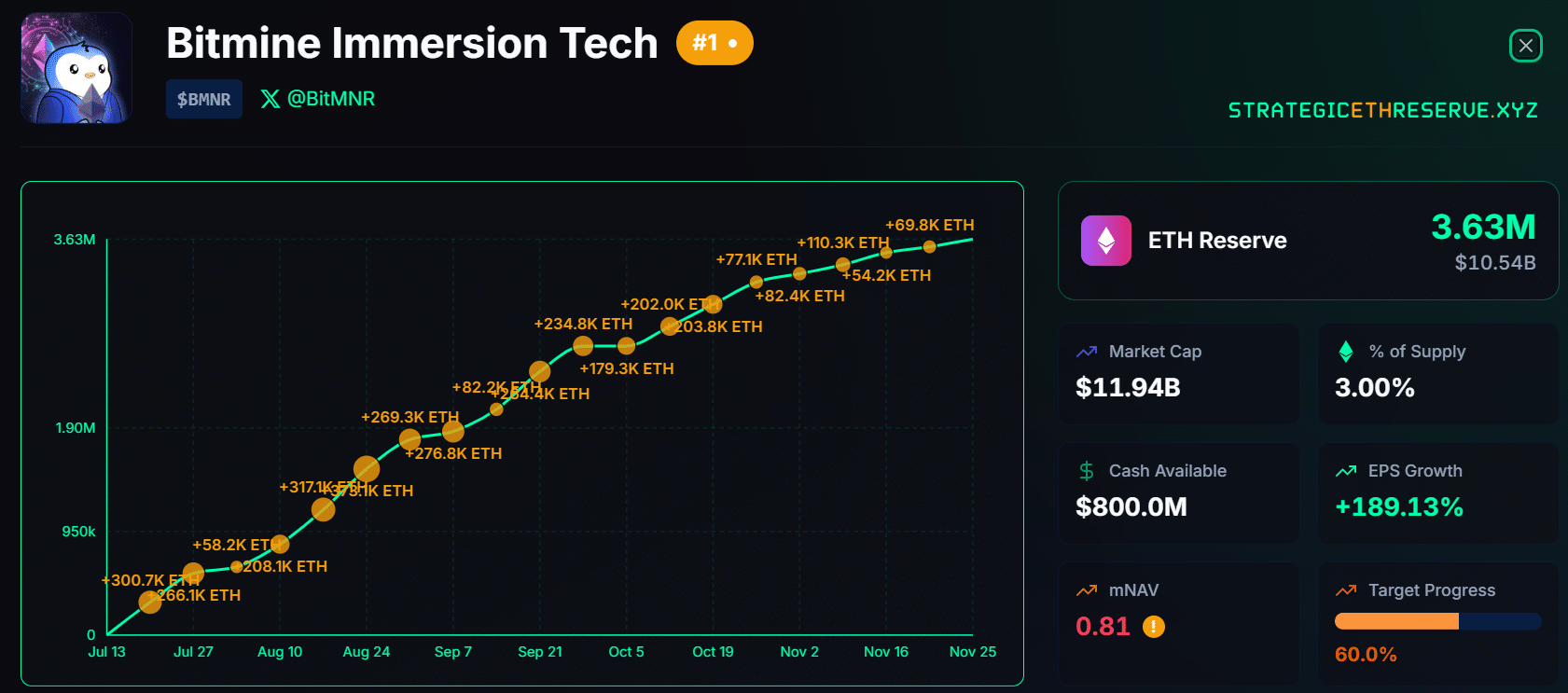

BitMine Immersion has reached 60% of its goal to hold 6 million ETH, accumulating 3.63 million ETH or 3% of the total supply. This aggressive strategy, dubbed the ‘Alchemy of 5%,’ positions the firm as a major Ethereum treasury holder amid market dips.

-

BitMine acquired 69,822 ETH last week, boosting its holdings significantly.

-

Current pace suggests reaching the target in about five months.

-

ETH price defended $2,800 support, rising 5%, with BitMine’s stock up 20%.

Discover how BitMine’s ETH holdings strategy is reshaping crypto treasuries. Explore the latest accumulation and market impacts in this in-depth analysis.

What is BitMine Immersion’s ETH holdings target?

BitMine Immersion’s ETH holdings target aims to secure 6 million ETH, equivalent to 5% of Ethereum’s total supply, through its “Alchemy of 5%” initiative. The firm, recognized as the world’s largest Ethereum treasury entity, recently added 69,822 ETH to reach 3.63 million ETH, marking 60% progress. This buildup capitalizes on market dips to strengthen its position in the digital asset space.

How has BitMine’s recent ETH acquisition influenced market dynamics?

BitMine’s latest purchase has injected fresh momentum into Ethereum markets. The acquisition during a Q4 price dip to around $2,600 allowed the firm to amass assets at favorable rates, signaling strong institutional confidence. According to data from Strategic ETH Reserve, BitMine has averaged 122,000 ETH weekly since October, holding 3% of the supply in less than a year. Tom Lee, chair of BitMine and CIO at Fundstrat, highlighted the opportunity, stating, “A few weeks ago, we noted the likely downside for ETH prices would be around $2,500 and current ETH prices are basically there. This implies asymmetric risk/reward as the downside is 5% to 7%, while the upside is the supercycle ahead for Ethereum.”

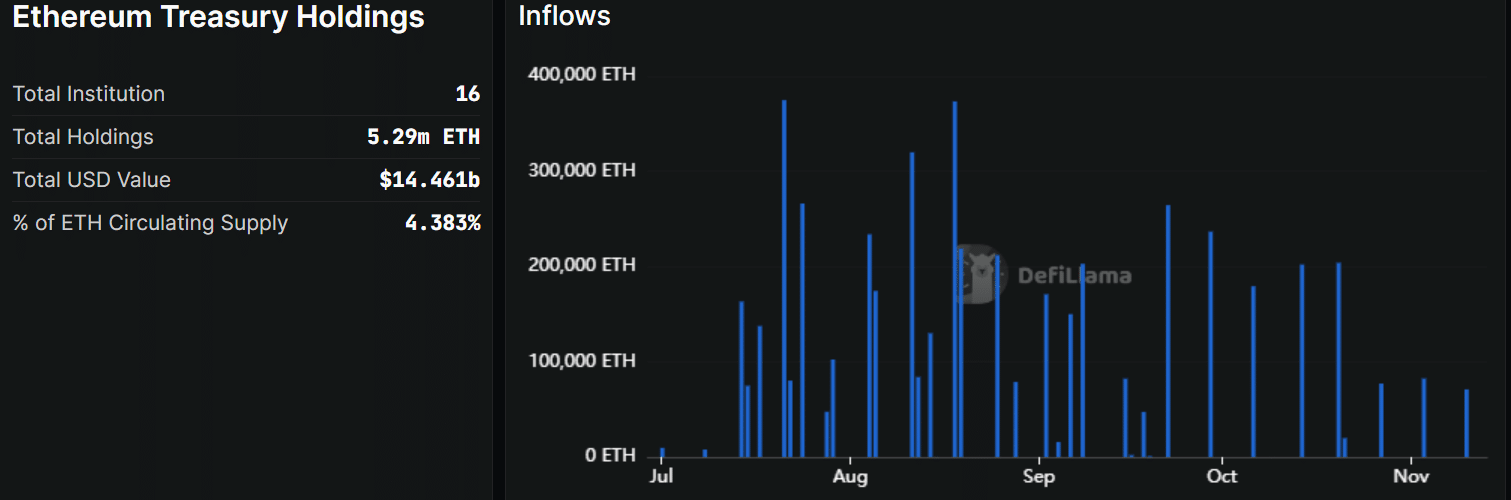

Market reactions were immediate: BitMine’s stock, ticker BMNR, climbed 20% to $31.1 following the announcement. Ethereum itself rebounded 5%, holding above the critical $2,800 support level. This move underscores BitMine’s role in driving treasury inflows, which had slowed to 70,000 ETH per week in October and November per DeFiLlama metrics. By contrast, BitMine’s aggressive bidding has single-handedly elevated overall demand.

BitMine’s aggressive ETH bid

Source: Strategic ETH Reserve

At its current acquisition rate, BitMine could achieve its 6 million ETH goal in approximately 20 weeks, or five months. This timeline assumes consistent weekly purchases of around 122,000 ETH, a pace that has already transformed the firm’s balance sheet.

While broader treasury demand has plateaued, BitMine’s strategy demonstrates resilience. Experts note that such concentrated holdings can stabilize prices during volatility, as seen in recent dips. The firm’s approach aligns with a growing trend among institutions to diversify into Ethereum as a foundational blockchain asset.

Source: DeFiLlama

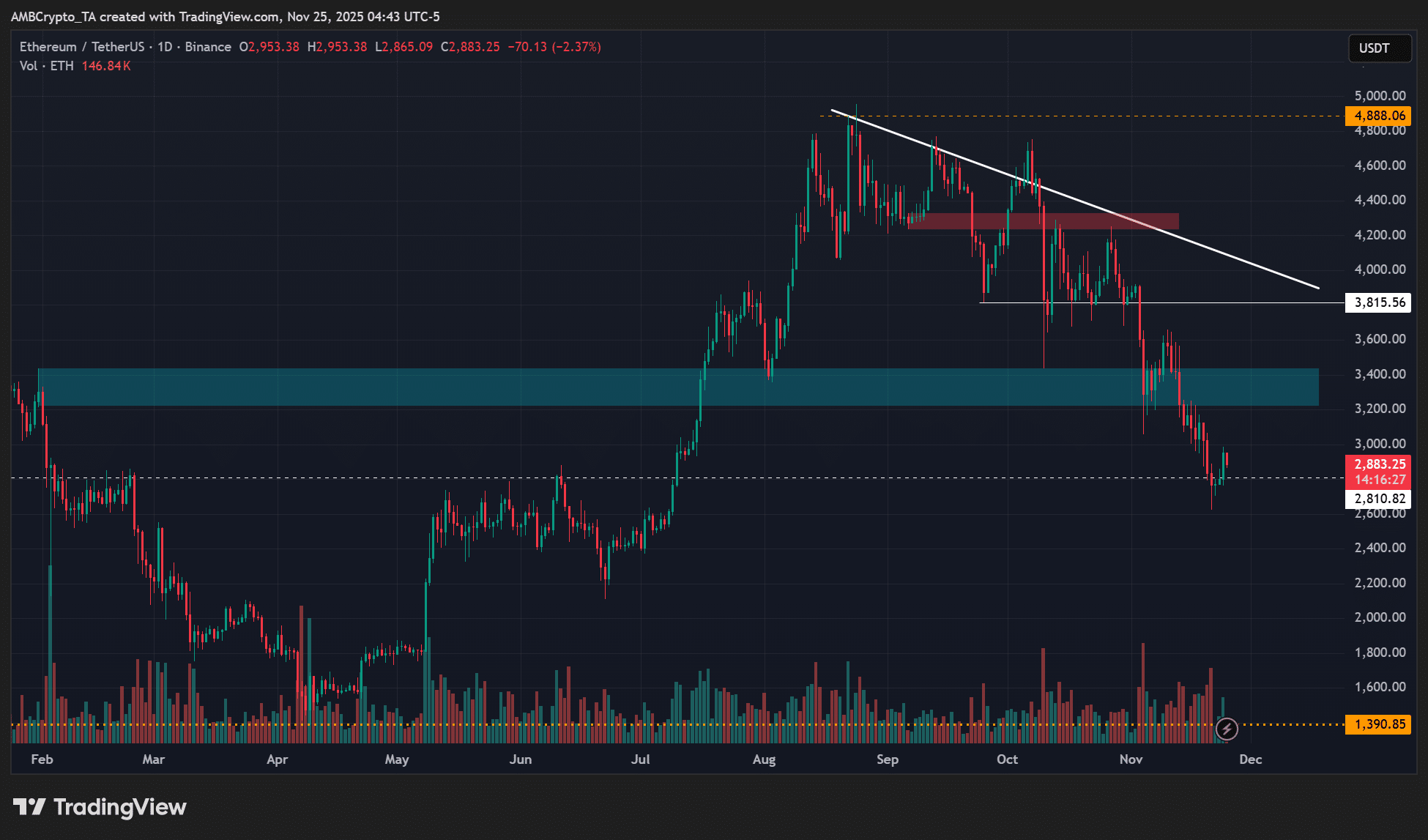

ETH price action

Ethereum’s price chart shows resilience, with a 5% bounce on November 24 that solidified the $2,800 support. Trading at $2,880 at the time of reporting, ETH’s path to $3,000 and beyond hinges on Bitcoin breaking $90,000, given their correlated movements.

Source: ETH/USDT, TradingView

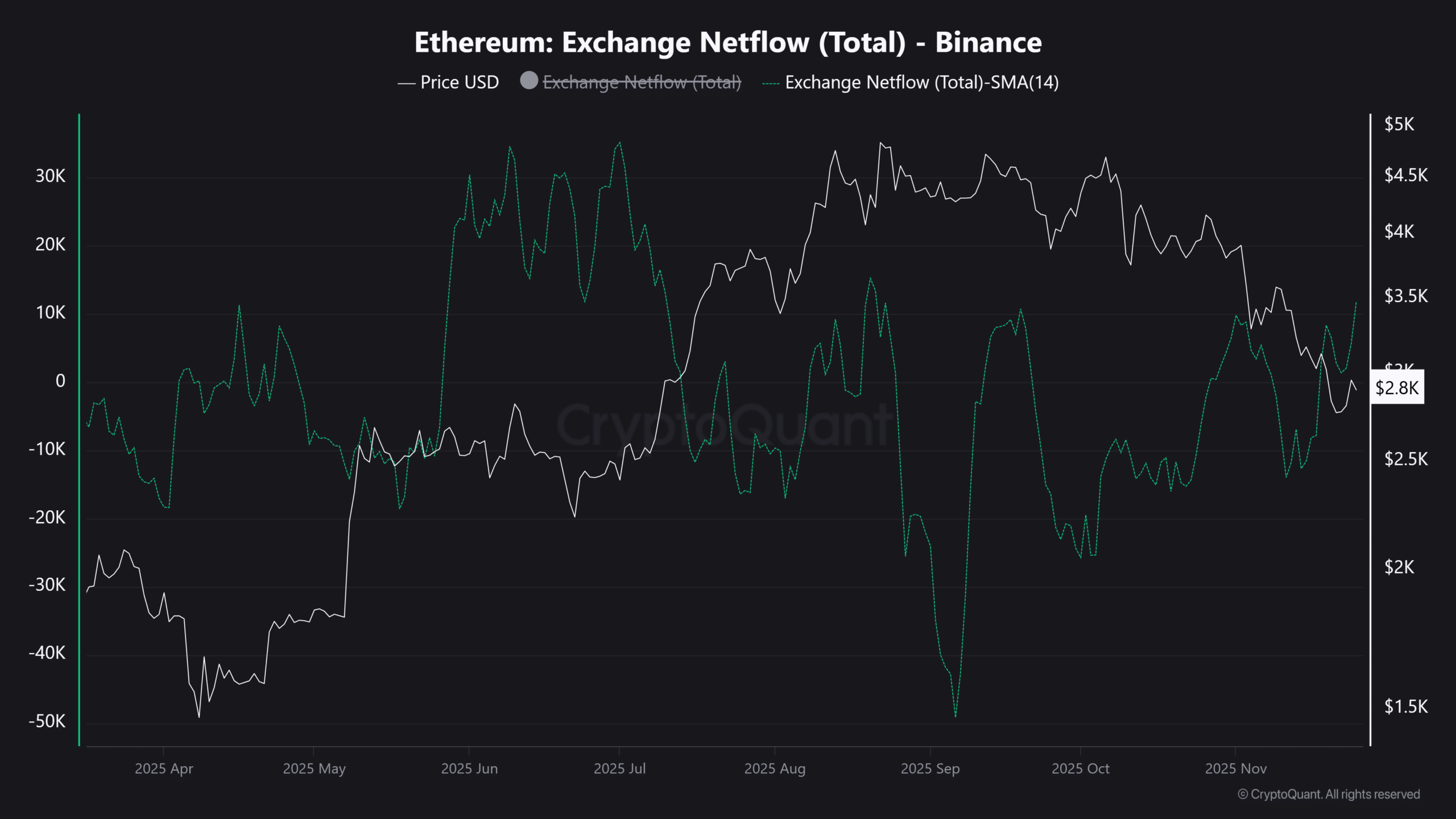

Despite this uptick, exchange inflows on platforms like Binance have increased, suggesting some holders are selling to lock in gains or mitigate losses post-drawdown. CryptoQuant data reveals a spike in netflows, pointing to potential selling pressure.

Source: CryptoQuant

Counterbalancing this, institutional interest is rebounding. Ethereum ETFs have seen inflows for two straight days, which could ease downward pressure and support recovery if sentiment shifts positively. BitMine’s ongoing accumulation exemplifies how strategic buying can counterbalance retail outflows, fostering long-term stability.

The broader context reveals Ethereum’s evolving role in finance. With upgrades enhancing scalability, holdings like BitMine’s underscore ETH’s utility beyond speculation. Analysts from Fundstrat emphasize that such treasury builds signal a maturing asset class, potentially driving adoption in DeFi and beyond.

Frequently Asked Questions

What is the current status of BitMine’s ETH holdings goal?

BitMine Immersion has achieved 60% of its 6 million ETH target, holding 3.63 million ETH as of the latest report. This represents 3% of Ethereum’s total supply, with an additional 69,822 ETH added last week during a market dip.

How might BitMine’s strategy impact Ethereum’s price in the coming months?

BitMine’s consistent ETH purchases could provide price support by reducing available supply, especially during volatility. If the firm maintains its pace, combined with ETF inflows, Ethereum may see upward pressure toward $3,000, assuming favorable market conditions and Bitcoin’s performance.

Key Takeaways

- Progress Toward Target: BitMine is 60% through its 6 million ETH goal, with 3.63 million ETH secured, highlighting strategic accumulation.

- Market Reaction: The latest buy propelled BitMine’s stock up 20% and ETH 5%, defending key support levels amid broader inflows.

- Future Outlook: At current rates, full target achievement is projected in five months; monitor institutional flows for sustained recovery.

Conclusion

BitMine Immersion’s ETH holdings strategy marks a pivotal moment for institutional crypto adoption, with its 3.63 million ETH stash demonstrating commitment to Ethereum’s long-term potential. As the firm advances toward 5% of the supply, recent acquisitions have bolstered market confidence and price stability. Investors should watch for continued inflows and Bitcoin’s trajectory, which could accelerate ETH’s recovery and validate this treasury approach in the evolving digital asset landscape.