Bitmine Persists in ETH Buys Amid Sliding BMNR Shares and Staking Focus

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Bitmine ETH purchases continue amid price volatility, with a linked wallet recently adding 28,625 ETH from FalconX as prices hovered around $2,800. This move expands Bitmine’s treasury by 10% in the past month, positioning the firm as a key Ethereum holder focused on staking rewards despite unrealized losses.

-

Bitmine’s persistent ETH accumulation: The company added over $82 million in ETH recently, bringing holdings to 2.94% of total supply.

-

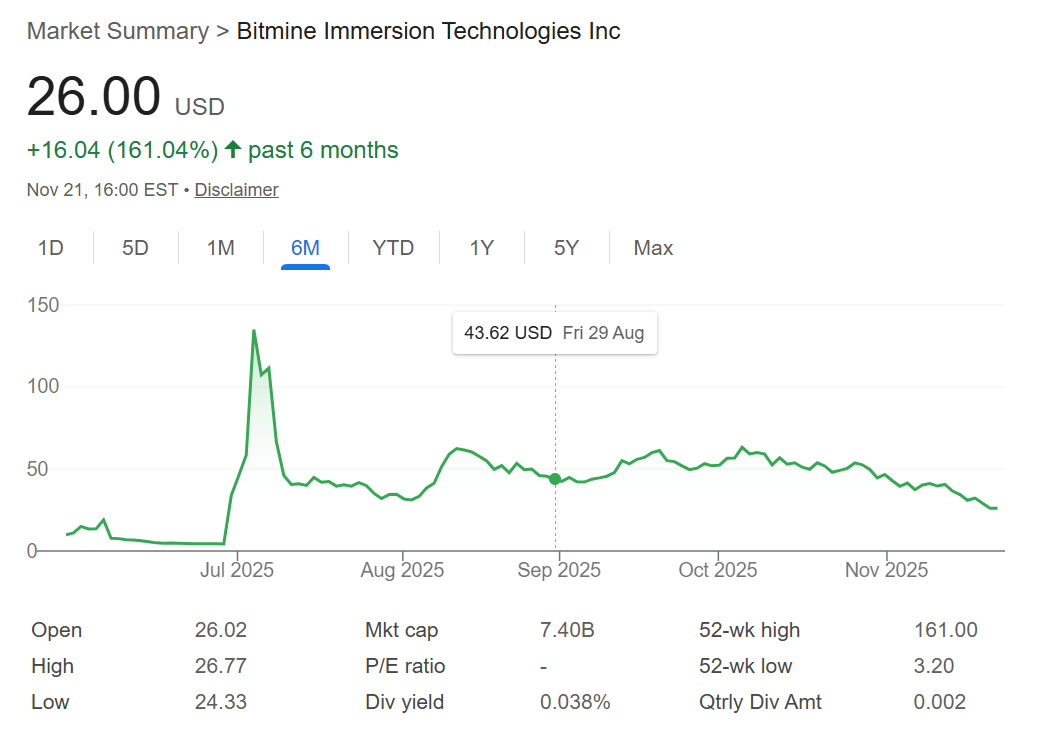

BMNR shares reflect market caution, trading near one-month lows at $26, down 80% from July peaks.

-

Staking strategy drives buys: Bitmine targets 5% ETH ownership via MAVAN validator network, projecting $400-500 million in annual rewards.

Discover Bitmine ETH purchases in 2025: Firm buys dip despite losses, eyes staking gains. Explore treasury growth, share impacts, and validator plans for institutional Ethereum exposure. Stay informed on crypto trends.

What Are Bitmine’s Recent ETH Purchases?

Bitmine ETH purchases demonstrate the firm’s unwavering commitment to Ethereum amid market downturns. In a recent transaction, a wallet associated with Bitmine received 28,625 ETH from a FalconX hot wallet, even as prices stabilized near the $2,800 level. This addition follows a prior purchase of 21,000 ETH, totaling over $82 million in new acquisitions within days and expanding the company’s treasury by 10% over the last month.

Bitmine, led by founder Tom Lee—a vocal Ethereum advocate—remains one of the few dedicated acquisition and trading (DAT) companies actively increasing its ETH exposure. The strategy involves sporadic, sizable orders, with the latest inflow directed to a newly created custom wallet. Despite Ethereum’s price breakdown below $4,000 and subsequently $3,000, Bitmine capitalized on the dip to bolster its position. However, the firm’s average acquisition cost exceeds $4,000 per ETH, resulting in current unrealized losses that underscore the high-risk nature of this accumulation approach.

Why Is Bitmine Betting on Ethereum Staking?

Bitmine’s ETH purchases are strategically tied to Ethereum’s staking ecosystem, where the company envisions long-term passive income generation. By staking its substantial holdings, Bitmine aims to earn block rewards and transaction fees, potentially generating $400 to $500 million annually once scaled. This revenue stream would primarily come in the form of additional ETH tokens, aligning with the firm’s treasury-focused model.

The introduction of MAVAN, or Made in America Validator Network, positions Bitmine as a reliable, U.S.-based validator for institutional clients seeking secure staking options. Although Ethereum’s proof-of-stake mechanism is permissionless, partnering with a known entity like Bitmine reduces operational risks for large-scale investors. Data from on-chain analytics, as reported by sources like Google Finance, highlight Bitmine’s growing influence, with current holdings representing 2.94% of Ethereum’s total supply and ambitions to reach 5%.

Tom Lee, Bitmine’s founder, has long championed Ethereum’s utility beyond mere price appreciation, emphasizing staking as a superior yield mechanism compared to traditional finance. This approach differs from competitors by enabling both staking participation and the potential issuance of liquid staking tokens, enhancing liquidity without sacrificing rewards. As Ethereum’s network matures post-Merge, Bitmine’s investments signal confidence in its role as the backbone of decentralized finance, even as short-term price pressures persist.

Supporting this bet, institutional ownership in Bitmine remains robust at over 31%, with 353 holders increasing positions in late September during a more optimistic phase for ETH. While some sellers, such as Sassicaia Capital Advisers, reduced exposure by 82% through 38,000 shares, broader trends show no widespread capitulation. This resilience amid volatility reinforces Bitmine’s narrative as a dedicated Ethereum stakeholder.

BMNR Shares Trade Near One-Month Low

Bitmine’s market value net asset (mNAV) ratio stands at 0.72, indicating BMNR shares do not trade at a premium to the underlying ETH treasury. Currently priced at $26, shares have declined sharply from a July peak above $135, reflecting an 80% drop. This slide coincides with Ethereum’s price correction, eroding investor confidence in the DAT model’s viability during bearish conditions.

BMNR shares continued to slide, down 80% from their peak in July. Bitmine has not stopped buying ETH in the meantime, aiming to lock in gains from staking. | Source: Google Finance.

BMNR shares continued to slide, down 80% from their peak in July. Bitmine has not stopped buying ETH in the meantime, aiming to lock in gains from staking. | Source: Google Finance.Despite the downturn, Bitmine’s recent ETH purchases affirm its liquidity and resolve. The company holds resources to execute these buys even in a distressed share environment, underscoring a long-term horizon over immediate market sentiment. Analysts tracking DAT firms note that low mNAV ratios, while not inherently bargain signals, often precede shifts in perception if underlying assets like ETH recover.

Frequently Asked Questions

What Impact Do Bitmine’s ETH Purchases Have on Its Treasury in 2025?

Bitmine’s ETH purchases have significantly expanded its treasury, increasing holdings by 10% in the past month to 2.94% of Ethereum’s supply. This growth, valued at over $82 million in recent additions, supports staking initiatives like MAVAN, despite average costs above $4,000 per ETH leading to unrealized losses. The strategy prioritizes yield generation over short-term price gains.

Is Bitmine’s Staking Strategy a Good Long-Term Play for Ethereum Investors?

Yes, Bitmine’s staking strategy leverages Ethereum’s proof-of-stake rewards, projecting $400-500 million in annual income for large validators. By building MAVAN as a secure U.S.-based network, it appeals to institutions preferring trusted partners over permissionless options. This positions Ethereum holders like Bitmine for sustainable returns as network fees and adoption grow, spoken naturally for voice queries on crypto yields.

Key Takeaways

- Persistent Accumulation: Bitmine’s wallet added 28,625 ETH recently, part of a 10% treasury expansion despite price dips below $3,000.

- Share Pressure: BMNR trades at $26, reflecting an 80% decline from peaks, with mNAV at 0.72 signaling tempered DAT confidence.

- Staking Focus: Through MAVAN, Bitmine aims for 5% ETH supply and $0.01 per share dividends in 2025 from validator rewards.

Conclusion

Bitmine’s ETH purchases in 2025 highlight a bold commitment to Ethereum accumulation and staking amid volatility, with recent inflows from FalconX bolstering its position toward 5% supply ownership. As BMNR shares navigate lows and institutional support holds steady, the MAVAN network emerges as a cornerstone for secure, yield-generating validation. Investors eyeing Ethereum staking strategies should monitor Bitmine’s progress, as its playbook could yield substantial returns in a maturing crypto landscape—consider diversifying into ETH-focused assets for long-term exposure.

Comments

Other Articles

Vitalik Buterin: The AI Revolution in DAO Management

February 23, 2026 at 02:58 PM UTC

BitMine Boosts Ethereum Stake to 461K ETH, Eyes Network Share Growth

January 1, 2026 at 08:06 PM UTC

Ethereum Inflow to Binance Surges to 24,500 ETH, Hinting at Short-Term Bearish Pressure

January 1, 2026 at 05:00 PM UTC