BitMine Plans ETH Staking Initiative Amid Over $1,000 Losses Per Token

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

BitMine, a leading crypto treasury company, plans to stake its Ether (ETH) holdings through the Made in America Validator Network (MAVAN) launching in Q1 2026, aiming to generate revenue despite over $3.7 billion in unrealized losses from ETH’s price drop below $3,000.

-

BitMine pilots MAVAN with three staking providers to secure Ethereum’s proof-of-stake network and earn ETH rewards.

-

The initiative addresses declining stock performance amid a broader crypto market downturn in 2025.

-

With ETH at approximately $2,700, BitMine faces over $1,000 loss per ETH held, per 10x Research data.

Discover how BitMine’s ETH staking strategy navigates market losses—explore MAVAN’s potential for revenue and shareholder value in 2025’s volatile crypto landscape. Stay informed on crypto treasury innovations.

How Does BitMine Plan to Stake Its ETH Holdings Amid Market Challenges?

BitMine ETH staking involves launching the Made in America Validator Network (MAVAN) to validate Ethereum’s proof-of-stake blockchain and earn rewards. The company, which holds significant Ether and Bitcoin, announced this pilot on Friday with three infrastructure providers, targeting a full rollout in the first quarter of 2026. This move seeks to generate revenue from staking while navigating substantial unrealized losses.

What Is the Impact of ETH Price Decline on Crypto Treasury Companies Like BitMine?

The Ethereum price collapse has severely affected BitMine and similar firms. According to a report from 10x Research, published Thursday, BitMine holds over $3.7 billion in unrealized losses based on an ETH price of $3,023. By Friday, ETH fell further to around $2,700, exacerbating the situation and leaving the company more than $1,000 underwater per ETH acquired during its peak in July and August.

This downturn follows ETH’s all-time high above $4,900 in August, wiping out a year’s gains for treasury companies. The report highlights that such losses make attracting new retail investors challenging, as existing shareholders grapple with billions in paper deficits. Competition intensifies from asset managers like BlackRock and ETF providers offering cost-effective digital asset exposure and staking yields.

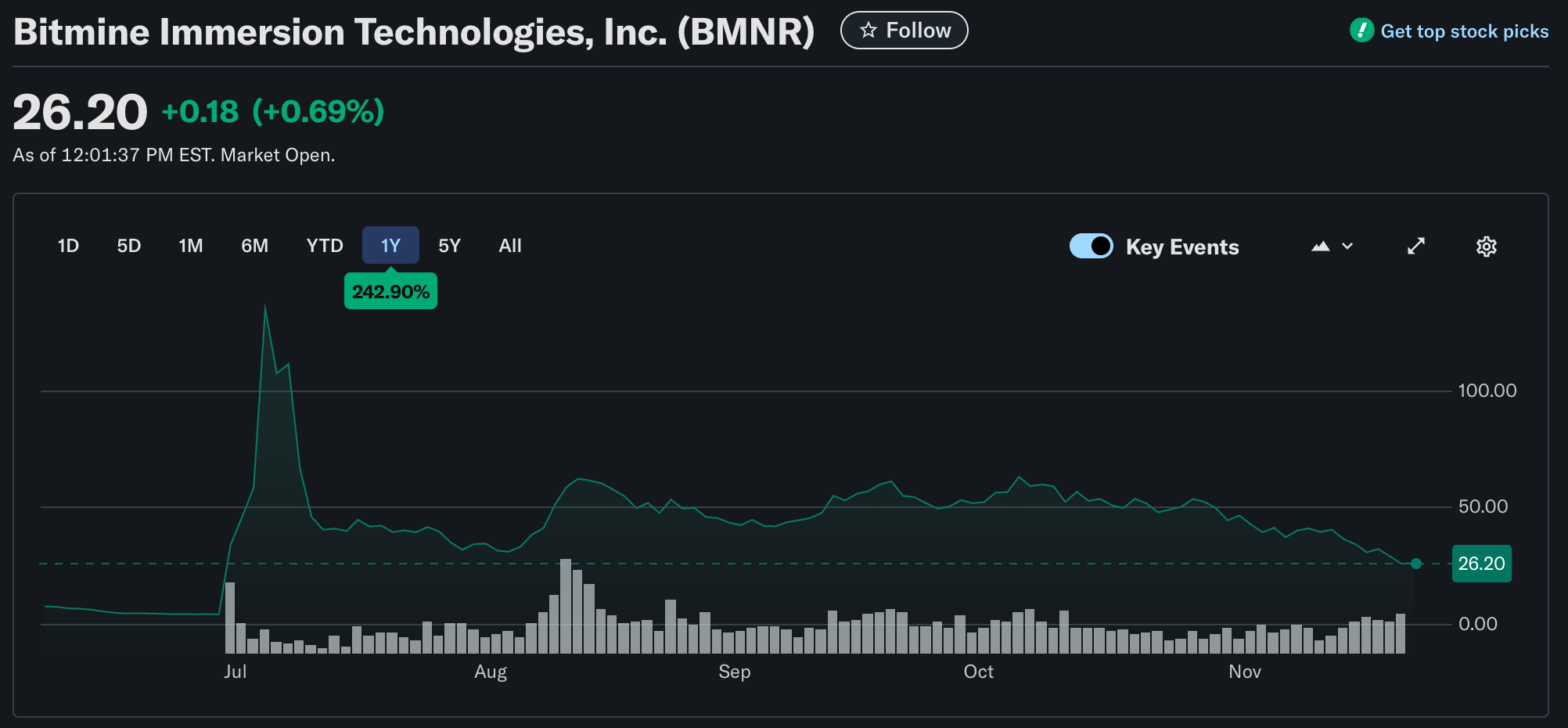

BitMine’s stock has crashed alongside other crypto treasury companies, which have seen a slow bleed in 2025. Source: Yahoo Finance

BitMine’s multiple on net asset value (mNAV) has plummeted, reflecting investor concerns over the model’s sustainability in a bearish market. Staking ETH through MAVAN represents a strategic pivot to offset these pressures by leveraging network security contributions for reward income.

“At scale, we believe our strategy will best serve the long-term best interests of our shareholders,” stated BitMine chairman Tom Lee. This endorsement underscores confidence in staking as a revenue stream, even as the broader crypto sector faces a collapse in valuations.

The price of ETH has collapsed following an all-time high of over $4,900 in August. Source: TradingView

Staking in proof-of-stake systems like Ethereum not only secures the network but also provides validators with rewards in ETH, potentially stabilizing finances for holders like BitMine. However, continued price volatility could amplify financial stress if ETH dips further below $3,000. Treasury companies must balance accumulation strategies with adaptive measures like MAVAN to maintain investor trust.

Expert analysis from 10x Research emphasizes the shifting landscape: “Treasury companies will face a hard reality: attracting new retail investors becomes nearly impossible when existing shareholders are sitting on billions in losses.” This insight reveals the urgency for innovation in crypto treasury management.

Frequently Asked Questions

What Is BitMine’s Made in America Validator Network (MAVAN)?

MAVAN is BitMine’s initiative to stake ETH on Ethereum’s proof-of-stake network, piloted with three providers for a 2026 launch. It focuses on U.S.-based validation to earn rewards, enhancing revenue while supporting blockchain security, as announced by the company.

Why Is BitMine Staking ETH Despite Unrealized Losses?

Staking ETH allows BitMine to generate ongoing rewards from network validation, providing a revenue source in a downturn. Chairman Tom Lee highlights this as a long-term strategy benefiting shareholders, countering losses from ETH’s price drop to $2,700 and positioning the firm for market recovery.

Key Takeaways

- Strategic Staking Launch: BitMine’s MAVAN pilots ETH staking to secure Ethereum and earn rewards, targeting Q1 2026 rollout.

- Market Impact: Over $3.7 billion in losses at $2,700 ETH price challenges treasury models, per 10x Research.

- Investor Outlook: Focus on long-term value through staking to attract capital amid competition from ETFs.

Conclusion

BitMine’s ETH staking via the Made in America Validator Network marks a proactive response to 2025’s crypto market challenges, including ETH price declines and mNAV erosion. By generating staking rewards, the company aims to bolster shareholder interests despite significant unrealized losses. As Ethereum’s ecosystem evolves, such strategies could redefine crypto treasury resilience—investors should monitor upcoming pilots for signs of stabilization and growth opportunities.