BlackRock CEO Larry Fink Reflects on Evolving Bitcoin Views and ETF Volatility

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Larry Fink’s crypto evolution at BlackRock marks a shift from viewing cryptocurrencies as tools for money laundering to leading the spot Bitcoin ETF market with billions in assets. This change highlights growing institutional adoption of digital assets in mainstream finance.

-

Larry Fink’s views on crypto transformed over eight years, from skepticism in 2017 to embracing Bitcoin ETFs today.

-

BlackRock’s iShares Bitcoin Trust (IBIT) has become one of the largest spot Bitcoin funds, peaking at around $70 billion in value.

-

Recent net outflows of over $2.3 billion for IBIT in November 2025 underscore Bitcoin’s volatility, with drops tied to global trade and geopolitical news.

Larry Fink’s crypto evolution: BlackRock CEO discusses shift from money laundering fears to Bitcoin ETF leadership at DealBook Summit. Explore insights on digital assets. Read now for key takeaways.

What is Larry Fink’s Big Shift on Crypto?

Larry Fink’s crypto evolution represents a profound change in perspective for the BlackRock CEO, evolving from dismissing cryptocurrencies as enablers of illicit finance in 2017 to spearheading the firm’s entry into the spot Bitcoin exchange-traded fund space. During a panel at The New York Times’ DealBook Summit, Fink openly acknowledged this transformation, attributing it to an ongoing thought process that adapts to new evidence. He highlighted BlackRock’s iShares Bitcoin Trust (IBIT) as a public testament to this shift, managing exposure to billions in Bitcoin assets.

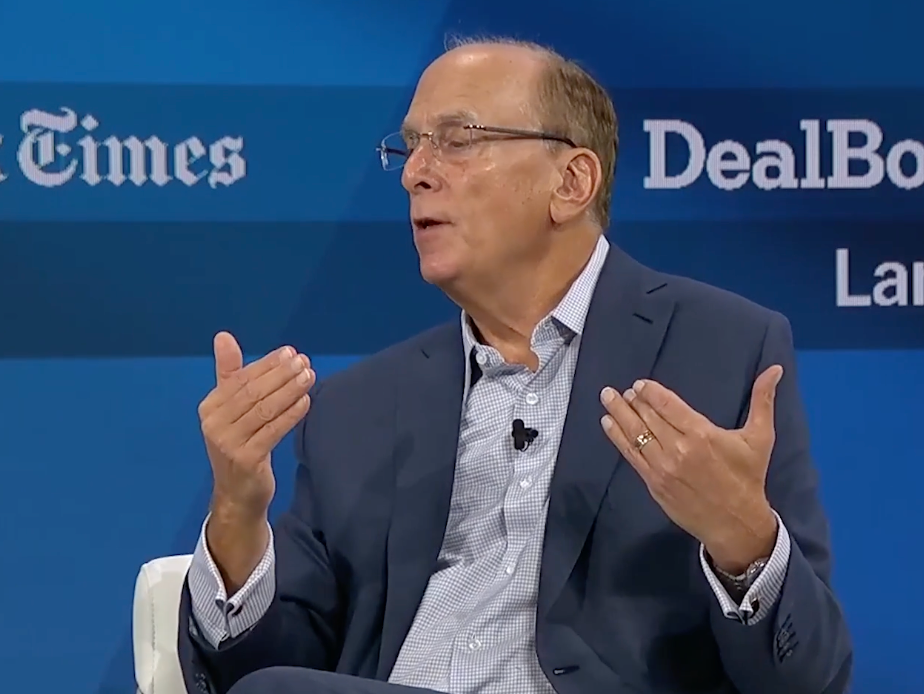

BlackRock CEO Larry Fink speaking at the DealBook Summit on Wednesday. Source: The New York Times

This evolution did not occur in isolation. Fink joined Coinbase CEO Brian Armstrong on stage, where he balanced optimism with caution, describing Bitcoin as “an asset of fear” that reacts sharply to macroeconomic developments like US-China trade agreements and potential resolutions to the Ukraine conflict. Such insights underscore the maturation of crypto within institutional portfolios, driven by regulatory clarity and market dynamics.

How Has BlackRock’s Bitcoin ETF Performed Amid Market Volatility?

BlackRock’s iShares Bitcoin Trust ETF, ticker IBIT, launched in January 2024 following approval from the US Securities and Exchange Commission, quickly ascended to prominence among spot Bitcoin products. By mid-2025, it achieved a peak valuation of approximately $70 billion, outpacing many competitors and demonstrating robust investor interest in regulated crypto exposure. However, performance has shown volatility, with net outflows exceeding $2.3 billion throughout November 2025, including significant withdrawals of $463 million on November 14 and $523 million on November 18.

Despite these setbacks, BlackRock’s business development director, Cristiano Castro, expressed confidence in ETFs as “liquid and powerful instruments” during recent analyses. This resilience aligns with broader industry trends, where spot Bitcoin ETFs from firms like Grayscale, Bitwise, Fidelity, ARK 21Shares, Invesco Galaxy, and VanEck collectively manage substantial assets. Data from market trackers indicates that while short-term outflows reflect Bitcoin’s price sensitivity—dropping amid positive global news—the long-term trajectory supports institutional integration. Experts note that such funds provide a bridge for traditional investors, reducing direct custody risks while offering liquidity comparable to equities.

Fink’s earlier 2017 remarks, where he linked cryptocurrencies to “demand for money laundering,” contrast sharply with today’s reality. Regulatory advancements, including SEC oversight, have addressed many initial concerns, fostering a more legitimate framework. As BlackRock navigates these waters, its ETF strategies exemplify how asset managers are adapting to crypto’s role in diversified portfolios, with projections from financial analysts suggesting continued growth as adoption barriers diminish.

Frequently Asked Questions

What prompted Larry Fink’s crypto evolution at BlackRock?

Larry Fink’s shift stemmed from eight years of observing crypto’s maturation, regulatory progress, and institutional demand. Initially skeptical, he now views digital assets as valid portfolio components, evidenced by BlackRock’s spot Bitcoin ETF launch in 2024, which has attracted billions in investments despite market fluctuations.

Why is Bitcoin considered a volatile asset by experts like Fink?

Bitcoin’s volatility arises from its sensitivity to global events, such as trade deals or geopolitical tensions, leading to rapid price swings. As Fink noted, it’s challenging to time trades effectively, making it unsuitable for short-term speculation but valuable for long-term holders seeking diversification in uncertain economic climates.

Key Takeaways

- Larry Fink’s transformation: Highlights how traditional finance leaders are increasingly embracing crypto, from past doubts to active participation via ETFs.

- IBIT’s market position: As the largest spot Bitcoin ETF, it peaked at $70 billion, though November 2025 saw $2.3 billion in outflows amid Bitcoin’s fear-driven reactions.

- Investor caution advised: Fink warns of timing challenges in volatile assets like Bitcoin, urging focus on long-term strategies over speculative trades.

Conclusion

Larry Fink’s crypto evolution underscores BlackRock’s pivotal role in bridging traditional finance and digital assets, with the iShares Bitcoin Trust ETF exemplifying this integration amid ongoing market volatility. As institutional adoption accelerates, supported by regulatory frameworks, investors stand to benefit from diversified exposure. Stay informed on these developments to navigate the evolving landscape of crypto investments effectively.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026