BlackRock Files for Staked Ether ETF with SEC Approval Pending

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

BlackRock has filed with the SEC to launch the iShares Staked Ethereum Trust ETF, offering investors indirect exposure to staked Ether. This move follows the 2024 approval of spot Ether ETFs and aims to provide yields from Ethereum’s proof-of-stake mechanism, potentially expanding institutional access to crypto staking.

-

BlackRock’s filing introduces a staked Ether ETF, marking a significant step in cryptocurrency investment products.

-

The iShares Staked Ethereum Trust would trade on Nasdaq under the ticker ETHB, focusing on staked ETH for yield generation.

-

Approval is not guaranteed, but this follows recent staking additions by firms like Grayscale and Bitwise, with BlackRock managing over $10 trillion in assets.

Discover BlackRock’s latest SEC filing for a staked Ether ETF, unlocking yields for investors. Learn how this could transform crypto exposure amid growing institutional interest. Stay informed on Ethereum staking trends today.

What is BlackRock’s Staked Ether ETF Filing?

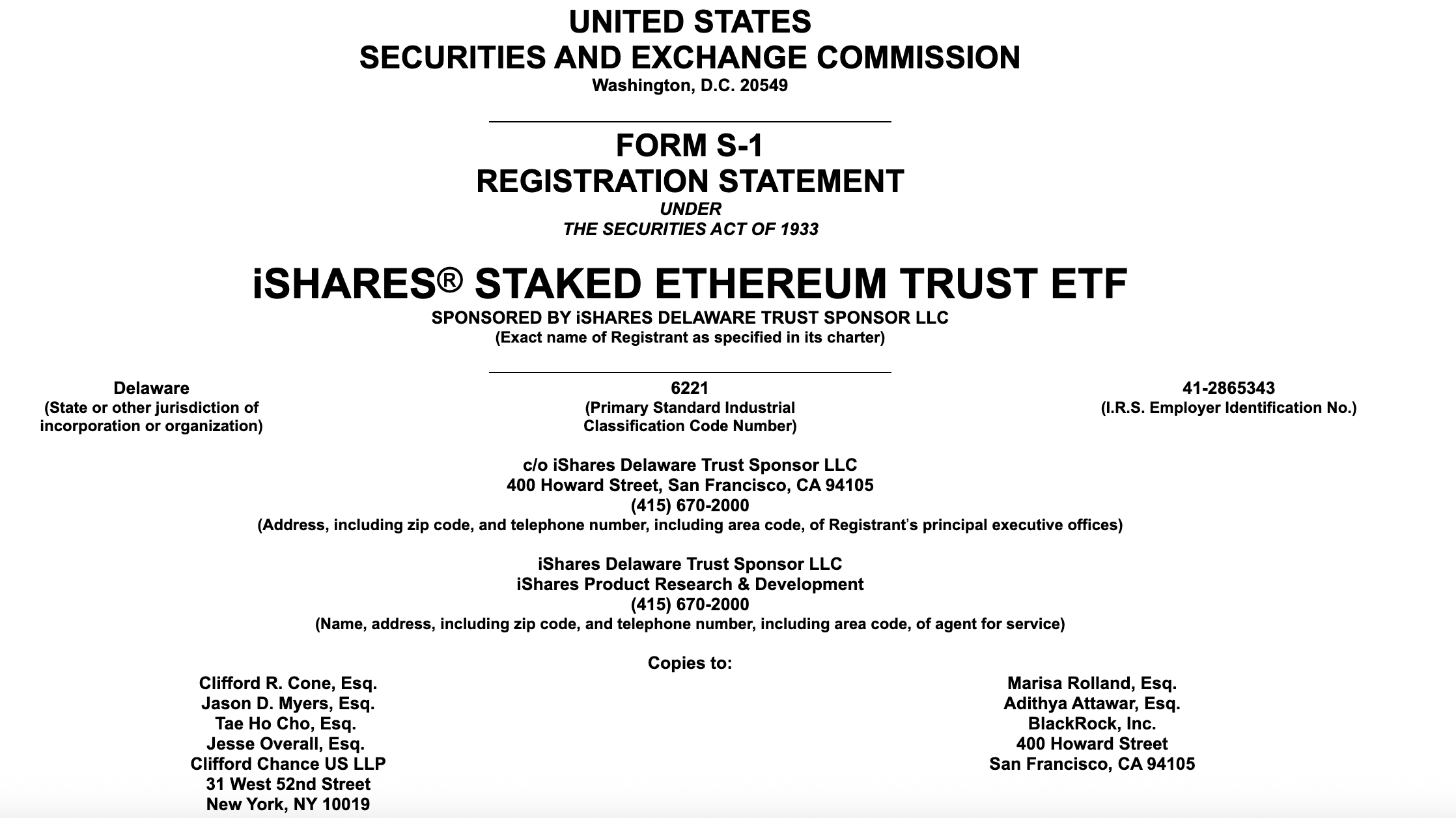

BlackRock’s staked Ether ETF filing represents the asset manager’s push to offer investors exposure to Ethereum’s staking rewards through a regulated exchange-traded fund. In a Form S-1 registration statement submitted to the U.S. Securities and Exchange Commission on Friday, BlackRock outlined plans for the iShares Staked Ethereum Trust, which would hold staked Ether to generate yields from the network’s proof-of-stake consensus. This product builds on BlackRock’s existing cryptocurrency offerings, including its spot Bitcoin ETF, and could provide indirect access to staking without requiring investors to manage nodes themselves.

BlackRock staked Ether ETF filing on Friday. Source: SEC

The proposed ETF, intended for listing on the Nasdaq exchange under the ticker ETHB, would be among the first major staked cryptocurrency funds from a traditional finance giant. Staking involves locking up Ether to validate transactions on the Ethereum blockchain, earning rewards in return—currently yielding around 3-5% annually, according to network data. BlackRock’s initiative comes after the SEC approved spot Ether ETFs in May 2024, which opened the door for broader crypto integration into mainstream portfolios but initially excluded staking features due to regulatory concerns.

Asset managers have been navigating a cautious regulatory landscape. While spot ETH ETFs hold direct Ether, staking introduces complexities around custody and yield distribution. BlackRock, which oversees approximately $10 trillion in assets globally, positions this ETF as a way to capture Ethereum’s growing utility in decentralized finance and layer-2 solutions. The filing emphasizes compliance with SEC guidelines, including robust security measures for digital assets.

How Does Staking Work in BlackRock’s Proposed Ether ETF?

Staking in the context of BlackRock’s staked Ether ETF would allow the fund to delegate Ether to validators on the Ethereum network, earning rewards that could be passed to shareholders after fees. This process supports Ethereum’s security and scalability, with over 30 million ETH currently staked, representing more than 25% of the total supply as reported by Ethereum’s on-chain analytics. Experts note that staking yields could enhance ETF attractiveness, potentially drawing billions in inflows similar to BlackRock’s Bitcoin ETF, which amassed over $20 billion since its 2024 launch.

The ETF structure addresses key investor pain points, such as technical barriers to direct staking. By pooling assets, BlackRock aims to minimize risks like slashing penalties for validator downtime, which can result in small losses. According to filings, the trust would partner with qualified custodians to ensure secure staking operations. Regulatory approval remains pivotal; the SEC has scrutinized staking for potential securities implications, but recent precedents—like Grayscale’s October 2024 addition of staking to its ETH trusts—suggest a thawing stance. Industry analysts, including those from financial research firms, predict that if approved, this could accelerate mainstream adoption of yield-bearing crypto products.

BlackRock’s experience with its iShares Bitcoin Trust ETF (ticker: IBIT), the largest spot Bitcoin fund with billions under management, underscores its expertise in crypto ETFs. The firm has emphasized transparent reporting and risk disclosures in past products, which could bolster its case here. Staking’s role in Ethereum’s ecosystem is expanding, with protocols like restaking gaining traction—unlocking ETH from traditional staking for additional DeFi yields. BlackRock’s entry signals confidence in Ethereum’s long-term viability amid network upgrades like Dencun, which reduced layer-2 costs by up to 90%.

Other players have tested staking waters. Grayscale Investments enabled staking in its spot ETH and mini ETH trusts in October 2024, allowing holders to earn rewards directly. Bitwise and others followed with Solana staking products, highlighting diverse blockchain approaches. Canary Capital’s July 2024 filing for a staked Injective product further illustrates market momentum, though approvals have been selective. The SEC’s focus remains on investor protection, ensuring funds mitigate volatility and operational risks inherent in proof-of-stake networks.

Frequently Asked Questions

What Does BlackRock’s Staked Ether ETF Mean for Crypto Investors?

BlackRock’s staked Ether ETF filing offers a regulated avenue for investors to gain exposure to Ethereum staking yields without direct involvement in blockchain operations. If approved, it could attract institutional capital, boosting ETH liquidity and prices while providing returns of 3-5% annually from network rewards, based on current Ethereum staking data.

Will the SEC Approve BlackRock’s Staked Ether ETF Soon?

The SEC’s approval timeline for BlackRock’s staked Ether ETF remains uncertain, as filings like the Form S-1 initiate a review process that often spans months. Drawing from the 2024 spot Ether ETF approvals and recent staking precedents, a decision could come by mid-2025, prioritizing compliance and market stability.

Key Takeaways

- Strategic Expansion: BlackRock’s filing extends its crypto portfolio beyond Bitcoin, targeting Ethereum’s staking ecosystem for yield-focused investments.

- Regulatory Hurdles: While the SEC approved spot ETH ETFs in 2024, staking introduces new scrutiny, but precedents from Grayscale and Bitwise suggest progress.

- Investor Benefits: Approval could democratize staking access, enabling passive income from ETH while leveraging BlackRock’s $10 trillion asset management scale.

Conclusion

BlackRock’s staked Ether ETF filing marks a pivotal development in bridging traditional finance and Ethereum’s proof-of-stake innovations, potentially reshaping how investors access crypto yields. With the SEC’s ongoing evaluation and the firm’s proven track record in Bitcoin ETFs, this could usher in an era of greater institutional participation. As the crypto market evolves, staying attuned to such filings will be essential for informed decision-making—consider monitoring regulatory updates to capitalize on emerging opportunities in staked Ether products.