BlackRock Pursues Staked Ethereum ETF to Boost Returns

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

BlackRock has registered a new staked Ethereum ETF in Delaware, expanding beyond its flagship ETHA product launched in July 2024. This move aims to offer investors yield through staking, with average annual returns around 3.95%, while navigating regulatory hurdles under the Securities Act of 1933.

-

BlackRock’s staked Ethereum ETF registration signals expansion in crypto offerings, following $13.1 billion inflows into ETHA.

-

The product will incorporate staking for enhanced returns, appealing to yield-seeking investors previously deterred by ETHA’s lack of income generation.

-

Average ETH staking yields 3.95% annually, per Blocknative data, potentially transforming the ETF into a total-return vehicle amid a more crypto-friendly SEC under the Trump administration.

Discover BlackRock’s staked Ethereum ETF pursuit: higher yields via staking on ETHA’s success. Explore regulatory steps and benefits for investors. Stay updated on crypto ETF innovations today.

What is BlackRock’s Staked Ethereum ETF?

BlackRock’s staked Ethereum ETF represents an evolution of the firm’s cryptocurrency offerings, building on the success of its iShares Ethereum Trust ETF (ETHA). Registered in Delaware, this new fund aims to incorporate Ethereum staking to generate additional yields, addressing previous limitations in the spot ETH product. Launched approximately 15 months after ETHA in July 2024, it seeks regulatory approval to provide investors with both price exposure and staking rewards, potentially attracting a broader investor base.

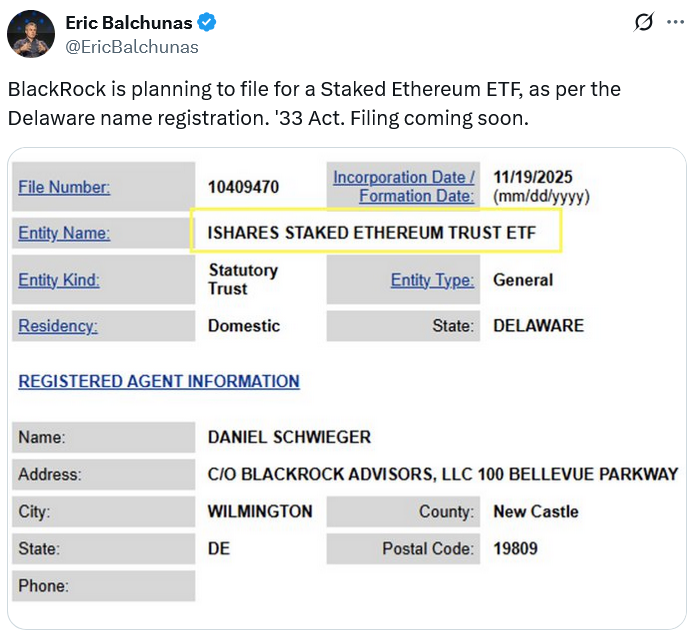

Source: Eric Balchunas

BlackRock’s decision follows significant growth in its existing Ethereum ETF, which has drawn $13.1 billion in inflows since inception. Initially, ETHA did not include staking due to operational complexities and regulatory concerns, as stated on BlackRock’s official resources. However, recent proposals to the U.S. Securities and Exchange Commission (SEC) suggest a shift, with BlackRock joining other issuers in advocating for staking integration.

The SEC, operating under the current administration, has adopted a more accommodating stance toward cryptocurrency exchange-traded products. This includes a new generic listing standard that streamlines approvals, eliminating the need for exhaustive case-by-case reviews. Bloomberg ETF analyst Eric Balchunas highlighted that the filing falls under the Securities Act of 1933, emphasizing robust transparency and investor safeguards before public trading begins.

Currently, around 70 cryptocurrency-related products await SEC approval, delayed partly by a U.S. government shutdown in October and November. BlackRock’s initiative arrives amid launches of similar staked ETH ETFs by firms like REX-Osprey and Grayscale in September and October, respectively.

How Does Staking Enhance Returns in a BlackRock Ethereum ETF?

Staking in an Ethereum ETF introduces a yield mechanism that complements the asset’s price appreciation, creating a more comprehensive investment vehicle. By locking Ethereum holdings to support network validation, the fund can earn rewards, with Blocknative data indicating an average annual staking return of approximately 3.95%. This addition could significantly boost overall performance, making the ETF attractive to income-oriented investors who previously overlooked Ethereum products lacking such features.

Experts note that staking transforms the ETF from a pure price-exposure play into a total-return product, potentially increasing its appeal in a competitive market. Regulatory approval remains key, as issuers must address complexities like custody and reward distribution. According to financial analysts, this development aligns with Ethereum’s proof-of-stake model, post its transition, and could draw institutional capital seeking diversified crypto yields.

The filing’s timing reflects broader industry momentum, with the SEC’s evolving policies facilitating innovation. BlackRock’s approach underscores a cautious yet strategic expansion, prioritizing compliance while eyeing enhanced investor value.

Frequently Asked Questions

What Steps Are Required for BlackRock’s Staked Ethereum ETF Approval?

BlackRock’s staked Ethereum ETF begins with Delaware registration, a preliminary step for new funds. Further actions include filing detailed documents with the SEC for review under the Securities Act of 1933, ensuring transparency and investor protections. Approval timelines vary, influenced by the SEC’s streamlined standards, potentially accelerating the process for this and similar products.

Why Is BlackRock Expanding Its Ethereum ETF with Staking Now?

BlackRock is pursuing staking for its Ethereum ETF to offer competitive yields amid growing demand for income-generating crypto investments. Following ETHA’s success with over $13 billion in inflows, this addresses past limitations without staking, appealing to yield-focused investors. The move aligns with a more favorable regulatory environment, enabling broader product innovation.

Key Takeaways

- Expansion Beyond ETHA: BlackRock’s new staked ETF builds on ETHA’s $13.1 billion inflows, introducing staking for added yields after 15 months.

- Yield Potential: Average 3.95% staking returns from Blocknative data could enhance total returns, broadening appeal to income seekers.

- Regulatory Progress: SEC’s generic standards and Trump-era openness may fast-track approvals, with 70 crypto products in queue.

Conclusion

BlackRock’s pursuit of a staked Ethereum ETF marks a pivotal step in evolving cryptocurrency investment options, leveraging the flagship ETHA’s momentum while incorporating staking for superior Ethereum ETF returns. With regulatory tailwinds and industry precedents from REX-Osprey and Grayscale, this development promises enhanced yields and investor protections. As the crypto landscape matures, such innovations position BlackRock to capture growing institutional interest—monitor upcoming SEC decisions for the latest on this promising fund.