BlackRock’s IBIT Fuels Record $3.79B November Outflows from US Spot Bitcoin ETFs

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

US spot Bitcoin ETFs experienced record outflows of $3.79 billion in November 2025, led by BlackRock’s IBIT with $2.47 billion, marking 63% of the total and surpassing February’s previous high of $3.56 billion.

-

BlackRock’s IBIT dominates outflows: The fund saw $2.47 billion in redemptions, driving 63% of November’s total withdrawals from US spot Bitcoin ETFs.

-

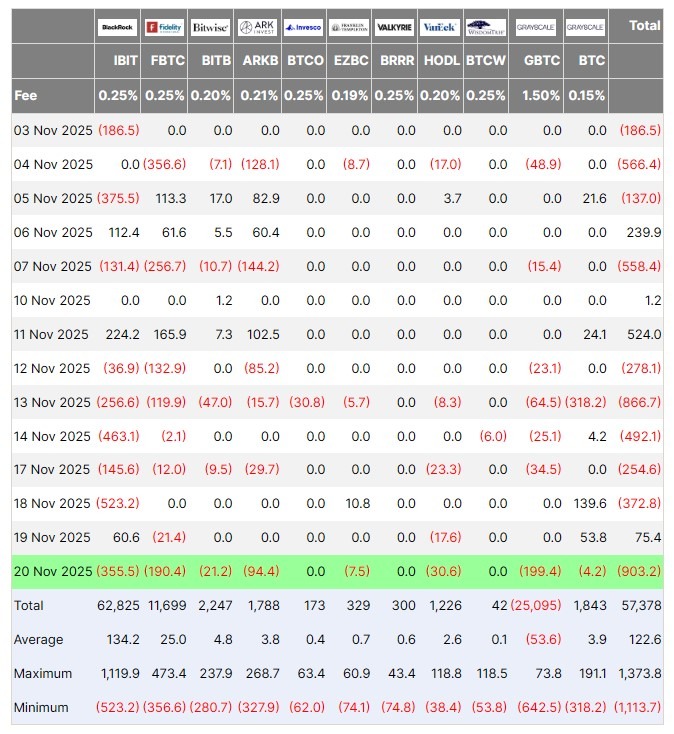

Thursday’s $903 million outflow was the largest single-day redemption in November, according to data from Farside Investors.

-

Bitcoin price fell to $83,461, its lowest in seven months, amid declining digital asset treasury inflows reported by DefiLlama, down 82% from September to October.

Discover how BlackRock’s IBIT led Bitcoin ETF outflows in November 2025, totaling $3.79B and impacting BTC price. Stay informed on crypto market trends and ETF performance—explore more insights today.

What are the causes of record Bitcoin ETF outflows in November 2025?

Bitcoin ETF outflows in November 2025 reached a historic $3.79 billion across US spot funds, primarily driven by redemptions from major players like BlackRock’s IBIT. This surge erased earlier weekly gains and positioned the month as the worst for outflows since the ETFs launched in January 2024. Factors include shifting investor sentiment and broader market pressures, with Thursday’s $903 million redemption marking one of the largest single-day drops, per Farside Investors data.

How did BlackRock’s IBIT contribute to these Bitcoin ETF outflows?

BlackRock’s iShares Bitcoin Trust (IBIT) emerged as the primary catalyst behind November’s Bitcoin ETF outflows, recording $2.47 billion in net redemptions that accounted for 63% of the $3.79 billion total from all US spot Bitcoin ETFs. This fund alone drove $1.02 billion in weekly outflows, described by Ki Young Ju, founder and CEO of CryptoQuant, as the largest weekly redemption ever for IBIT. Such heavy withdrawals reflect investor caution amid volatile crypto conditions, underscoring the fund’s significant market influence since its inception.

Bitcoin ETF flows, in USD million. Source: Farside Investors

Fidelity’s Wise Origin Bitcoin Fund (FBTC) ranked second, with $1.09 billion in monthly outflows, including $225.9 million this week. Combined, IBIT and FBTC represent 91% of November’s total redemptions, amplifying the liquidity drain that has exceeded February 2025’s previous record of $3.56 billion. These trends highlight the concentrated impact of top issuers on overall ETF performance, as noted in analyses from market tracking platforms.

US spot Bitcoin exchange-traded funds had shown a brief recovery earlier in the week, attracting $75.4 million in inflows on Wednesday after five consecutive outflow days. However, this momentum reversed sharply on Thursday with $903 million in redemptions—the highest daily figure for November and among the largest since the ETFs’ debut. Farside Investors data confirms this as a pivotal shift, pushing monthly totals toward an unprecedented low if trends persist through the end of the month.

Frequently Asked Questions

What is the total amount of Bitcoin ETF outflows in November 2025 so far?

November 2025 has seen $3.79 billion withdrawn from US spot Bitcoin ETFs to date, surpassing February’s $3.56 billion record. This figure, led by major funds like BlackRock’s IBIT, indicates the month could become the worst for outflows since the products launched in January 2024, based on Farside Investors tracking.

How have Bitcoin ETF outflows affected the current BTC price?

Bitcoin ETF outflows contributed to BTC dropping to $83,461 as of Friday, its lowest point in seven months, last observed in April 2025. According to CoinGecko data, this decline followed nearly $1 billion in Thursday redemptions, signaling potential for further market corrections as investor confidence wanes.

Key Takeaways

- Historic Outflow Scale: November’s $3.79 billion in Bitcoin ETF outflows marks the largest monthly total ever, exceeding prior records and driven by institutional redemptions.

- IBIT’s Dominant Role: BlackRock’s fund alone accounted for 63% of withdrawals, with CryptoQuant noting its record weekly outflow of $1.02 billion, highlighting concentration risks.

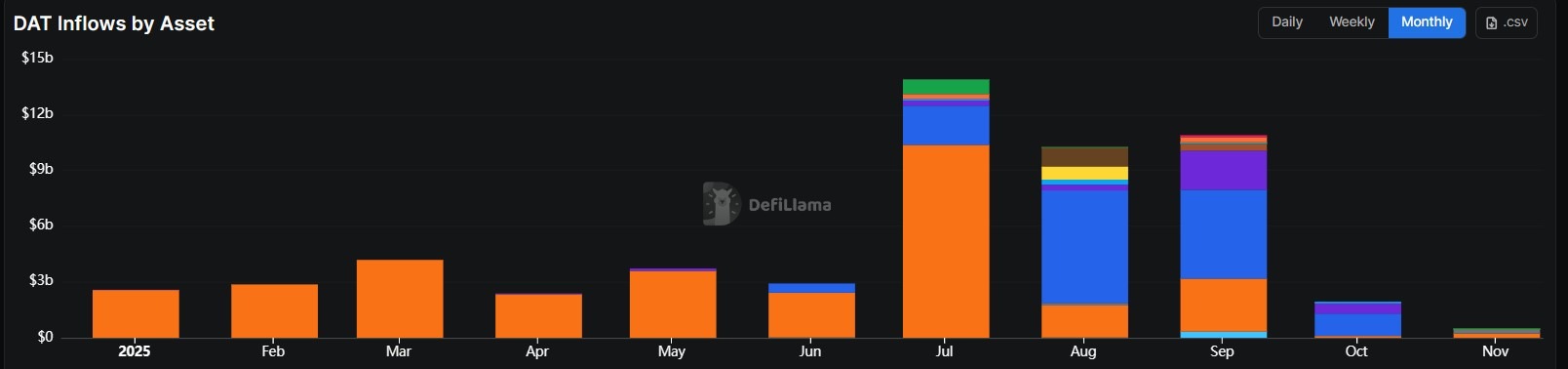

- Price and Inflow Impacts: BTC hit $83,461 amid these trends, while DefiLlama reports an 82% drop in digital asset treasury inflows to $1.93 billion in October, urging investors to monitor liquidity shifts closely.

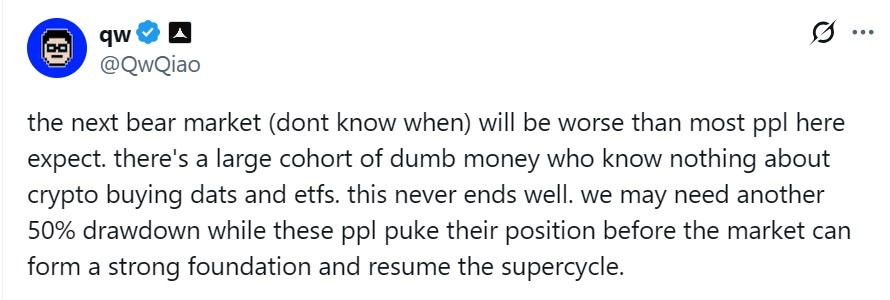

Source: QwQiao

The broader market context reveals deepening concerns among industry experts. Alliance DAO co-founder QwQiao warned of a potential harsher bear market, pointing to influxes of inexperienced investors via ETFs and digital asset treasuries (DATs). He suggested markets might face another 50% drawdown to build a sustainable base, a view echoed in his September analysis reposted amid recent events.

DAT inflows by asset. Source: DefiLlama

Chris Burniske, co-founder of Placeholder, a crypto venture firm, emphasized that the selling pressure from DATs is just beginning. Just as these instruments boosted Bitcoin’s rise, they could now accelerate downturns. DefiLlama data illustrates this shift: DAT inflows plummeted 82% to $1.93 billion in October from $10.89 billion in September, following $20 billion in crypto liquidations that month. Year-to-date, November inflows stand at a mere $505 million, positioning it as the weakest month of 2025 and underscoring reduced institutional appetite.

This confluence of ETF outflows and DAT slowdowns paints a picture of liquidity challenges in the crypto ecosystem. While spot Bitcoin ETFs revolutionized access for traditional investors since their 2024 launch, recent data from sources like Farside Investors and CryptoQuant reveals vulnerabilities to rapid sentiment swings. The $903 million Thursday outflow not only halted a nascent recovery but also intensified scrutiny on whether these products can stabilize amid macroeconomic uncertainties.

Conclusion

In summary, Bitcoin ETF outflows in November 2025 have set a grim record at $3.79 billion, with BlackRock’s IBIT leading at 63% of the total and contributing to BTC’s slide to $83,461. Secondary factors like declining DAT inflows, down 82% per DefiLlama, further pressure the market. As experts like Ki Young Ju and Chris Burniske caution, investors should prepare for prolonged volatility; staying updated on ETF flows and price movements will be key to navigating this evolving landscape.