Blockchain Analysis Suggests Single Entity Controlled 30% of PEPE Genesis Supply

PEPE/USDT

$418,450,648.50

$0.0000037 / $0.00000342

Change: $0.00000028 (8.19%)

+0.0056%

Longs pay

Contents

Blockchain analysis reveals that approximately 30% of the PEPE memecoin’s genesis supply was controlled by a single entity at launch in April 2023, leading to $2 million in sales the next day and contributing to early price pressure. This challenges the token’s “for the people” narrative, as per data from Bubblemaps.

-

Genesis Supply Concentration: Nearly one-third of PEPE tokens were bundled under one wallet cluster at launch.

-

Early Selling Impact: The entity sold $2 million worth of tokens shortly after, preventing PEPE from reaching a $12 billion market cap.

-

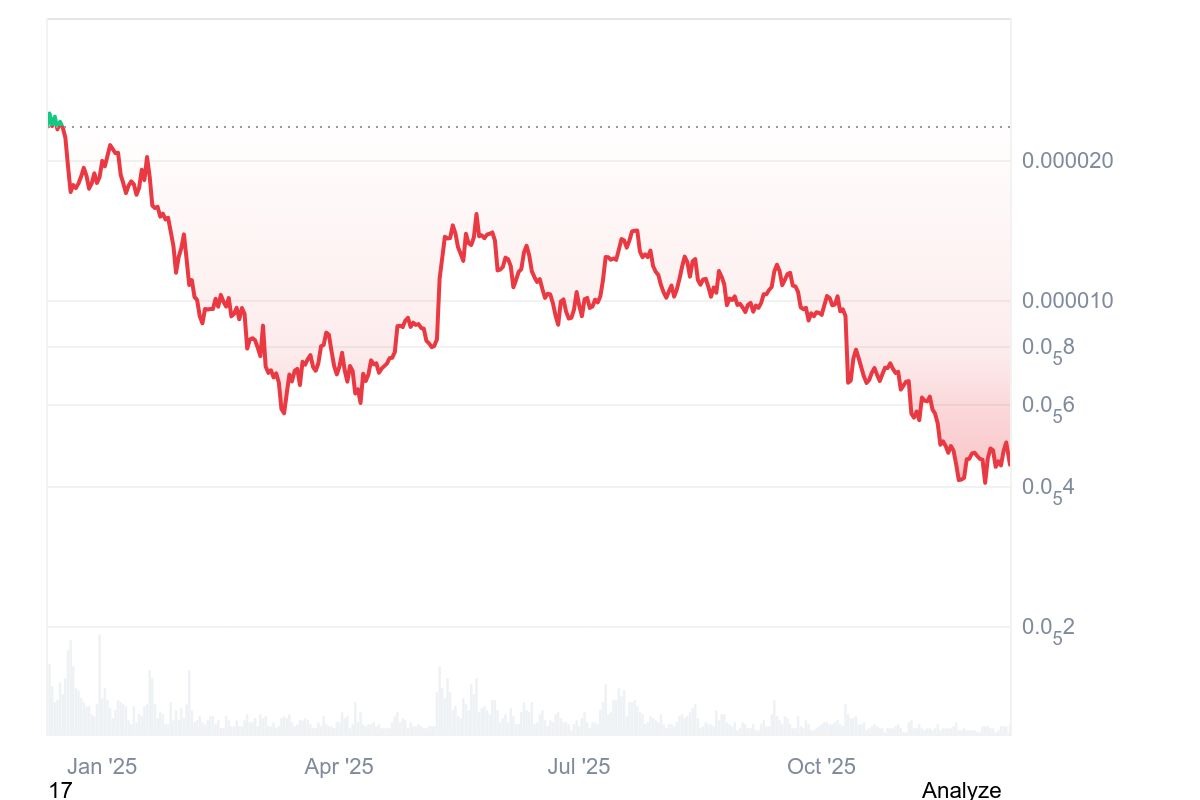

Price Performance: PEPE has declined 5.7% in the last 24 hours and over 81% year-over-year, according to CoinMarketCap data.

Discover the hidden concentration in PEPE’s launch supply that fueled early sell-offs. Learn how blockchain forensics exposes memecoin risks and protects investors from insider dumps—stay informed on crypto trends today.

What is the Concentration in PEPE’s Genesis Supply?

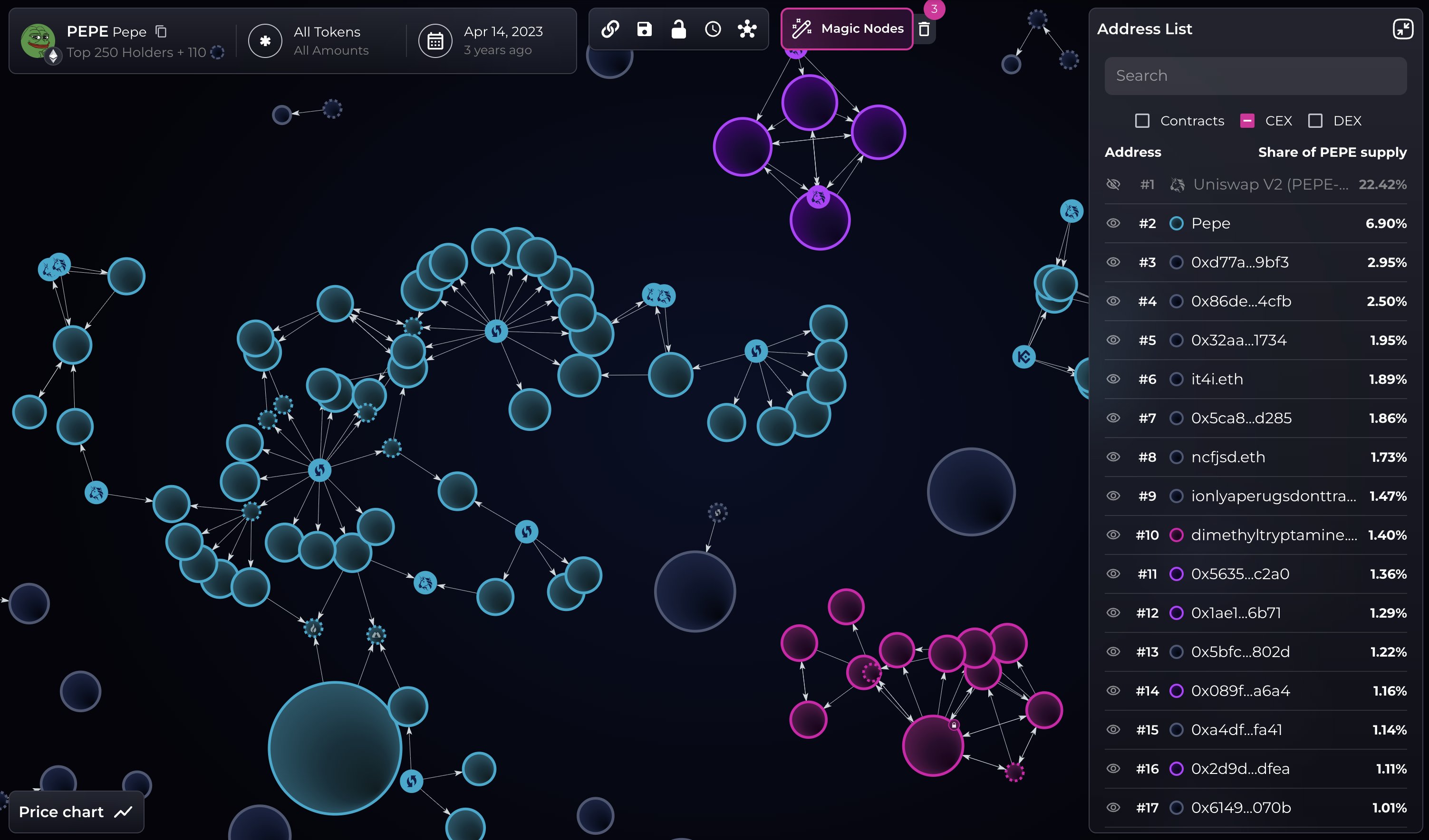

PEPE token supply concentration at launch involved about 30% of the initial allocation held by a single entity, as revealed by blockchain data visualization from Bubblemaps. This grouping occurred during the April 2023 stealth launch, contradicting claims of a fair distribution with no presale. The concentrated holdings enabled rapid sales that exerted downward pressure on the price right from the start.

How Did Early Selling Affect PEPE’s Market Performance?

Detailed blockchain forensics show the wallet cluster dumped $2 million in PEPE tokens just one day after launch, halting momentum toward a potential $12 billion valuation. This sell-off created significant pressure, aligning with PEPE’s branding as a “coin for the people” yet highlighting insider advantages. Bubblemaps’ analysis underscores how such concentrations can mislead investors, with the token’s price dropping 5.7% in the past 24 hours and over 81% from its yearly peak, per CoinMarketCap statistics. Experts note that without transparency, memecoins like PEPE risk eroding trust in decentralized projects.

Source: Bubblemaps

Silk Road-linked Bitcoin wallets recently moved $3 million to a new address, adding to broader concerns in the crypto space about legacy holdings and their market influence.

Investor sentiment around PEPE has been further strained by a December exploit on its official website, where users were briefly redirected to a phishing scam known as the inferno drainer. This incident, involving wallet drainers and social engineering tactics, amplified vulnerabilities in memecoin ecosystems. Despite these challenges, select traders have profited handsomely; for instance, one investor turned a $2,000 stake into $43 million in March by enduring a 74% drawdown from PEPE’s all-time high before cashing out $10 million in gains.

PEPE/USD, 1-year chart. Source: CoinMarketCap.com

Crypto markets are approaching key inflection points, with memecoins like PEPE illustrating both speculative highs and regulatory scrutiny.

Frequently Asked Questions

What Role Did Bubblemaps Play in Analyzing PEPE’s Launch?

Bubblemaps utilized its Time Travel feature, a forensic tool launched in May, to reconstruct the historical token distribution of PEPE. This revealed the 30% supply bundling under one entity, helping investors identify potential insider manipulations and avoid scams in the memecoin sector.

How Can Investors Spot Insider Activity in Memecoins Like PEPE?

To detect insider-heavy launches, examine wallet clusters holding large supply portions early on, using tools like blockchain analytics for distribution patterns. Look for coordinated sells post-launch, which signal rug pull risks, and prioritize projects with transparent, decentralized allocations for safer entry points.

Key Takeaways

- Supply Concentration Risks: A single entity controlling 30% of PEPE’s genesis supply led to immediate sell pressure, underscoring the need for launch transparency.

- Forensic Tools’ Value: Bubblemaps’ analytics exposed hidden accumulations, aiding in scam prevention across memecoins like MELANIA and fake Eric Trump tokens.

- Market Lessons: While some traders profited millions from PEPE, the token’s 81% yearly decline highlights volatility—diversify and research wallet activities before investing.

Conclusion

The revelation of PEPE token supply concentration through blockchain forensics paints a cautionary tale for memecoin enthusiasts, emphasizing how early insider sales can derail even hyped launches. As tools like Bubblemaps continue to demystify on-chain activities, investors gain better defenses against rug pulls and unfair distributions in the PEPE memecoin space. Looking ahead, greater adoption of transparency measures could foster a more equitable crypto landscape—consider leveraging analytics for informed decisions in your portfolio.

Forensics Tool Targets Insider-Heavy Launches

Bubblemaps’ Time Travel feature has emerged as a critical asset in the Web3 toolkit, allowing users to trace token histories and uncover patterns of early concentration that often precede dumps. In PEPE’s case, this tool highlighted the bundled 30% supply, which fueled the $2 million sell-off and stalled growth. By visualizing wallet interactions, it empowers retail investors to sidestep projects with red flags, such as those prone to liquidity removals or mass exits.

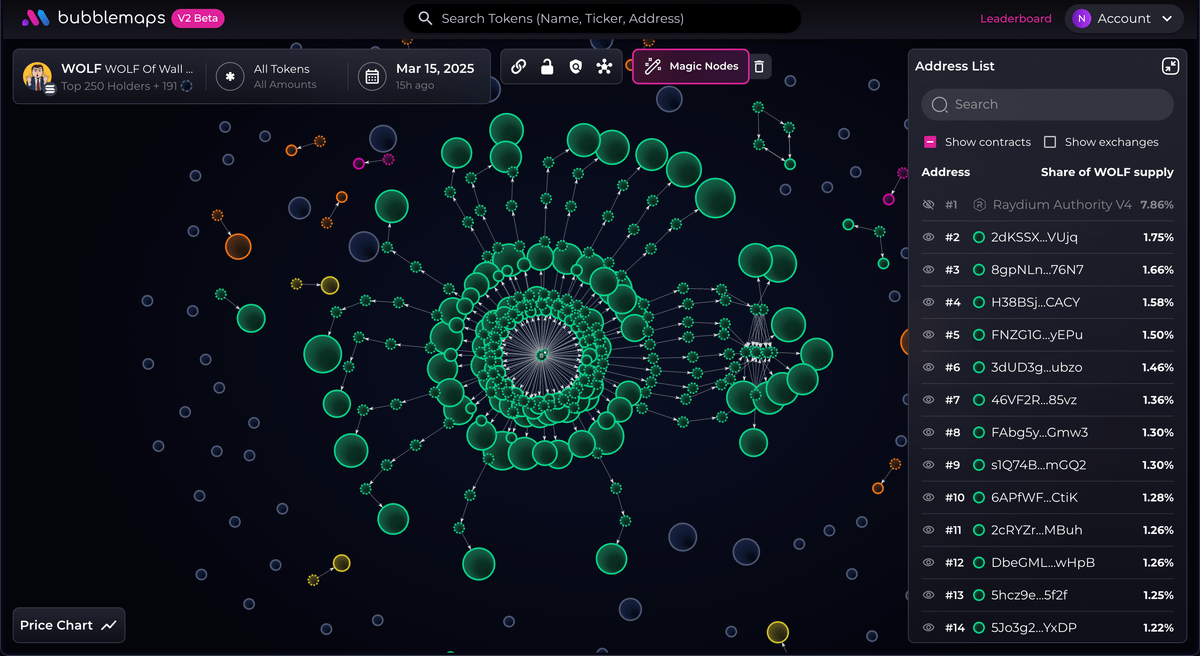

Detecting scams remains paramount in the memecoin arena, where rug pulls have inflicted substantial losses. For example, Bubblemaps previously flagged anomalies in the Melania token and several fraudulent Eric Trump-inspired coins, preventing further victimization. The platform’s role extends to high-profile incidents, like the WOLF token rug pull in March, where creators Hayden Davis—also linked to Official Melania Meme and Libra—crashed the value by 99% in hours, evaporating $42 million in market cap.

Source: Bubblemaps

These exposures demonstrate the forensic tool’s efficacy in promoting accountability. Memecoin degeneracy, while funding innovative pursuits like anti-aging research, also necessitates vigilance against exploitative practices. As the industry matures, integrating such analytics into due diligence routines will be essential for sustainable growth and investor protection. Overall, PEPE’s story serves as a benchmark for evaluating launch fairness, urging the community to prioritize verifiable on-chain evidence over promotional narratives.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026