BMNR Shareholders Supported ETH Purchases

ETH/USDT

$14,005,555,347.39

$2,039.05 / $1,941.66

Change: $97.39 (5.02%)

-0.0019%

Shorts pay

Contents

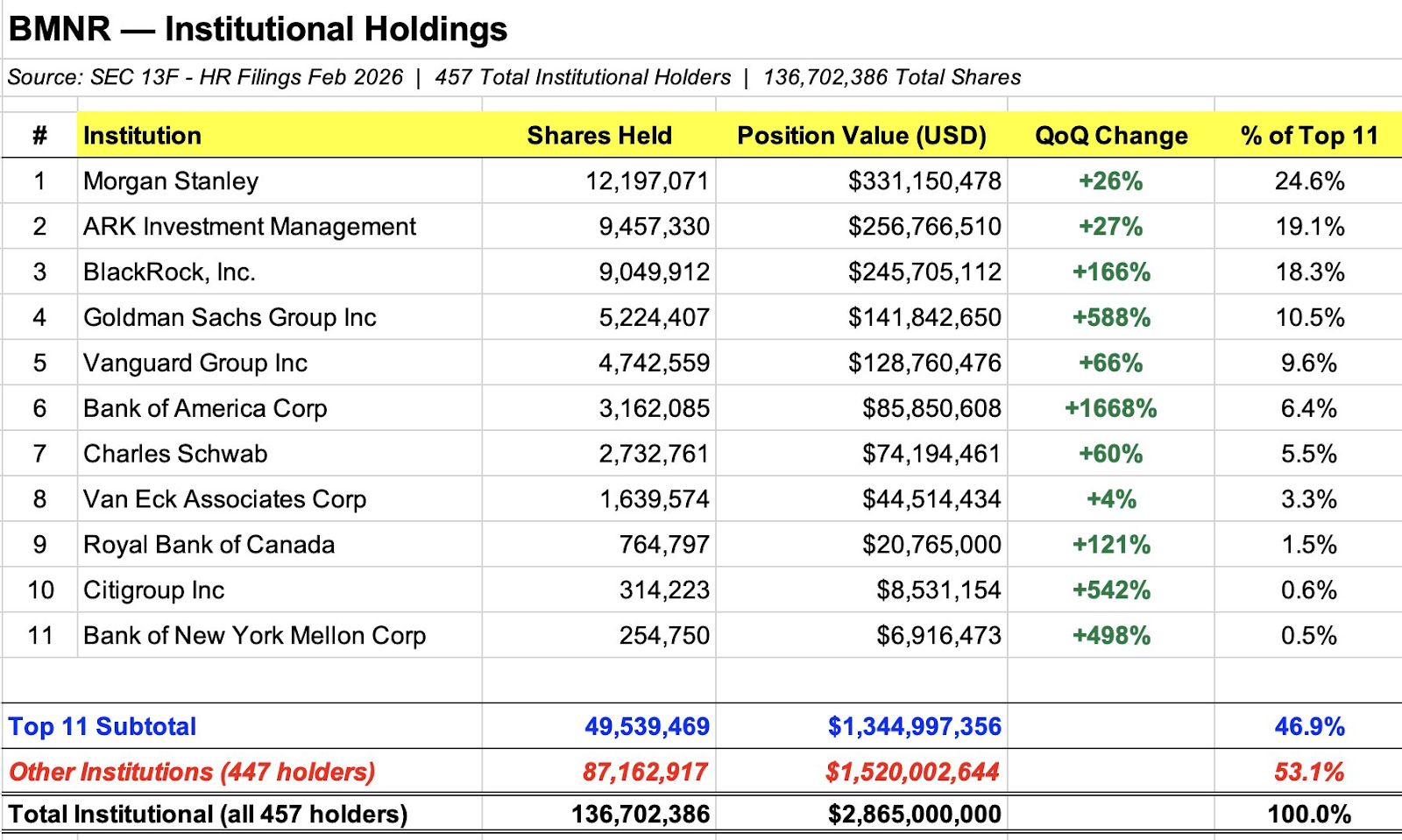

Bitmine Immersion Technologies (BMNR) stock's largest shareholders increased their investments despite the crypto market crash in the fourth quarter of 2025 and the 48% drop in share price. This accumulation financed the company's Ether (ETH) purchases, keeping the market net asset value (mNAV) ratio above 1.

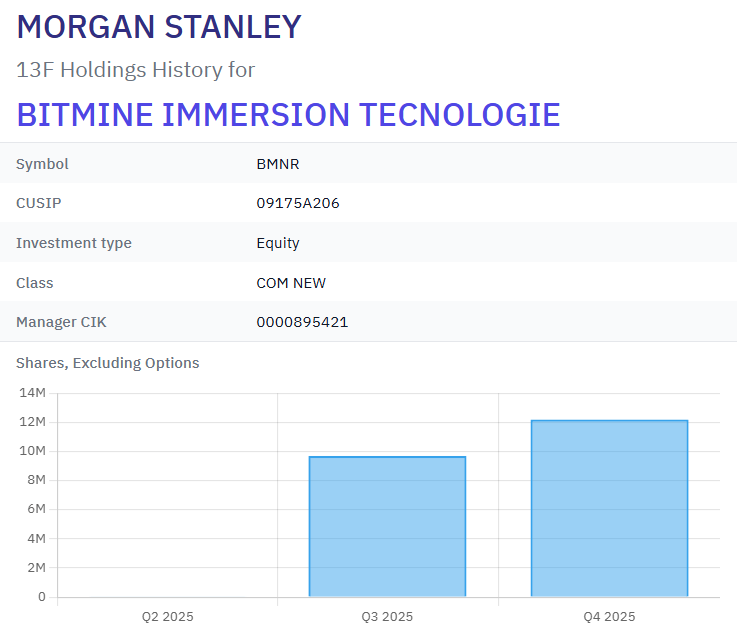

Morgan Stanley BMNR share holdings during 2025, 13F-HR filing. Source: 13f.info

BMNR Shareholders' Dramatic Position Increases

Morgan Stanley, as the largest shareholder, increased its position by 26% to 12.1 million shares ($331 million). ARK Investment Management increased by 27% to 9.4 million shares ($256 million). BlackRock +166%, Goldman Sachs +588%, Vanguard +66%, and Bank of America +1,668%. The top 11 institutional shareholders—including Charles Schwab, Van Eck, Royal Bank of Canada, Citigroup, and Bank of New York Mellon—all expanded their positions. These moves demonstrate institutional investors' belief in the long-term ETH vision.

| Institution | Increase % | Shares | Value ($M) |

|---|---|---|---|

| Morgan Stanley | %26 | 12.1M | 331 |

| ARK | %27 | 9.4M | 256 |

| BlackRock | %166 | - | - |

BMNR's Record ETH Accumulation and mNAV Strategy

The company purchased 45,759 ETH ($260 million) last week and holds 4.37 million ETH ($8.69 billion) as the largest institutional ETH holder. The share price fell 60% over the last six months to about $19.90. Thanks to mNAV >1, ETH purchases continue, supporting the institutional accumulation trend highlighted in the ETH detailed analysis.

Source: Collin

BMNR stock price, six-month chart. Source: Google Finance

ETH Technical Analysis: Supports and Resistances

ETH is currently at $1,952.33, down -1.81% in 24h. RSI 33.26 (oversold), downtrend continues. EMA 20: $2,157. Supertrend bearish.

- Supports: S1 $1,747.80 (⭐70/100, -10.46%), S2 $1,925.05 (⭐68/100, -1.38%)

- Resistances: R1 $1,956.76 (⭐80/100, +0.24%), R2 $2,063.38 (⭐67/100, +5.70%)

BMNR purchases signal bottom fishing in ETH futures.

BlackRock's Staked ETH ETF Application Sheds Light on BMNR

Latest breaking news: BlackRock applied for a new staked Ethereum ETF to receive 18% of staking fees (February 19, 2026). This aligns with BlackRock's 166% increase in BMNR; maximizing ETH staking returns. Peter Thiel's ETHZ tokenization separation shows diversification in the ETH ecosystem.

What Does BMNR's ETH Strategy Tell Investors?

Institutional giants are accumulating ETH through BMNR despite the 2025 crash. With RSI oversold signal, recovery is possible if S2 $1,925 support holds. mNAV superiority could position the company as a leader in the ETH rally. Watch: R1 $1,956 resistance.