BNB May Extend Decline as On-Chain Activity and Stablecoin Supply Plunge

BNB/USDT

$669,473,373.58

$615.60 / $588.64

Change: $26.96 (4.58%)

-0.0013%

Shorts pay

Contents

BNB lost its 35-day hold above $1,000 due to a sharp collapse in on-chain activity, with daily transactions dropping nearly 50% from 31.3 million to 15.1 million, network utilization falling from 51% to 19%, and DEX volume shrinking by $5.02 billion, signaling reduced demand.

-

BNB’s price decline below $1,000 stems from weakened on-chain metrics, including a 50% drop in daily transactions.

-

On-chain demand slowed gradually, with network utilization plunging to 19% from 51%.

-

DEX volume on BNB Chain fell from $6.31 billion to $1.29 billion, a $5.02 billion decrease, while stablecoin supply dropped by $98 million.

Discover why BNB price declined below $1,000 after 35 days, driven by on-chain activity collapse. Explore impacts on BNB Chain and future outlook for investors.

Why Did BNB Lose Its 35-Day Hold Above $1,000?

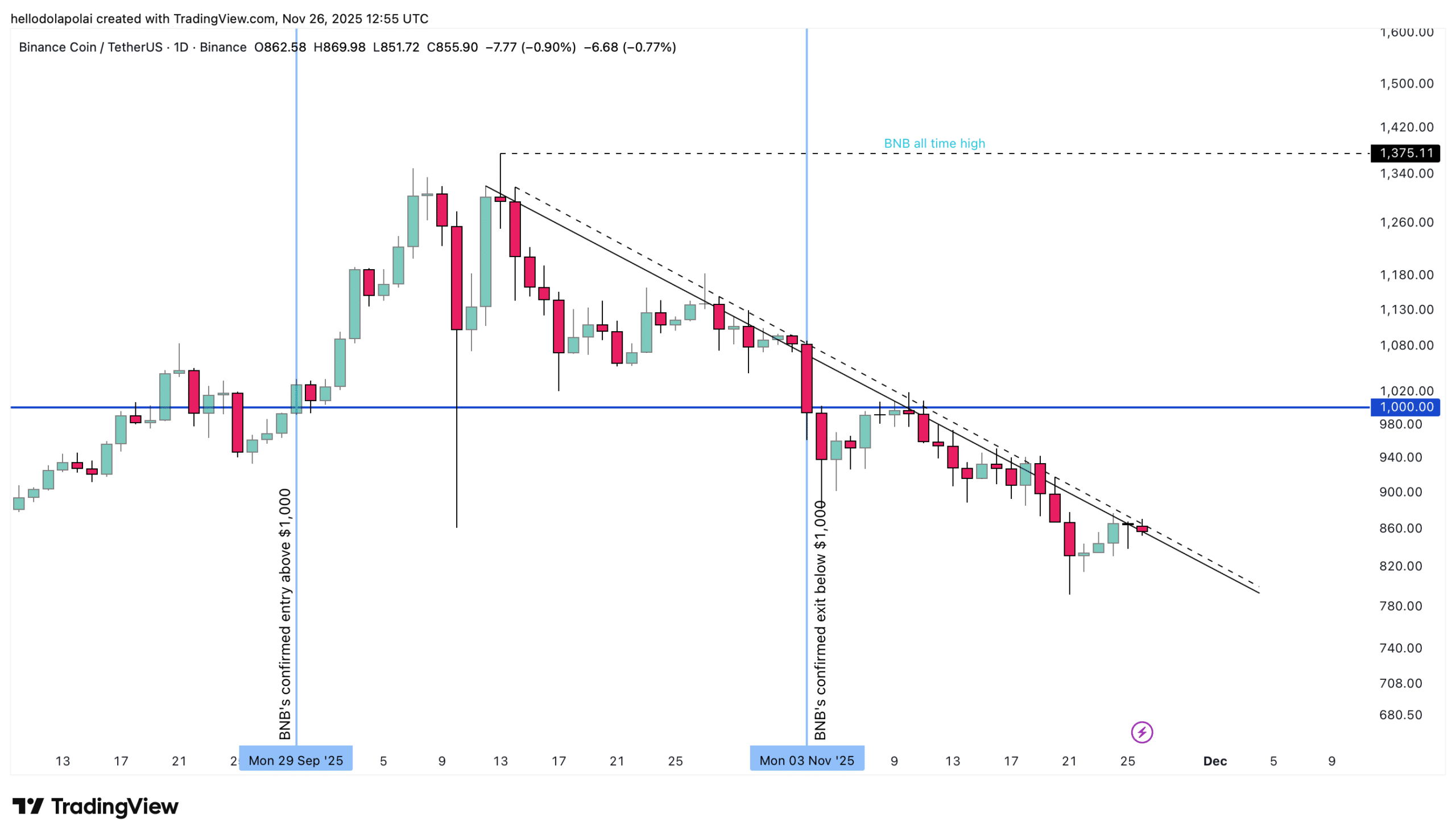

BNB price decline below $1,000 after maintaining that level for 35 days resulted from a significant slowdown in on-chain demand and activity on the BNB Smart Chain. The token, which hit an all-time high of around $1,375 earlier this year, crossed the $1,000 threshold on September 29 and held until November 3, but underlying weaknesses emerged. Data indicates a collapse in transactions and trading volume, leading to a 25% drop to approximately $857.

What Caused the On-Chain Activity Collapse on BNB Chain?

The BNB Chain experienced a marked reduction in usage, with daily active transactions peaking at 31.3 million on October 8 when BNB traded near $1,334. By November 4, as BNB fell below $1,000, transactions had decreased to 21.4 million, and at the latest report, they stood at 15.1 million—a nearly 50% decline. Network utilization also dropped sharply from 51% to 19%, highlighting diminished interest from users and developers. According to data from BSCScan, this trend points to exhaustion in the ecosystem’s backend activity, which has historically supported BNB’s value.

Source: BSCScan

This decline in activity has broader implications for BNB’s ecosystem, as the chain’s robustness relies on consistent transaction volumes and user engagement. Despite BNB Chain reaching all-time highs in activity earlier this year, the recent pullback reveals vulnerabilities that could prolong the downward pressure if not addressed.

How Has the Decline Impacted Trading Volume and Stablecoins on BNB Chain?

The most evident effect of the on-chain slowdown is the collapse in decentralized exchange volume on BNB Chain. On October 8, DEX volume hit $6.31 billion amid peak transactions, but by the latest figures, it has fallen to $1.29 billion—a stark reduction of $5.02 billion. This drop underscores capital rotation away from the BNB ecosystem toward other networks.

Source: DeFiLlama

Compounding this, stablecoin supply on the chain has decreased to $13.27 billion from a peak of roughly $13.368 billion on November 18—a loss of about $98 million. Unlike scenarios where stablecoins accumulate as sidelined capital, this outflow indicates investors are exiting rather than waiting for opportunities. BNB Chain maintains its position as the third-largest by market relevance, but sustained declines could erode this standing. Experts note that such metrics often precede prolonged corrections in token prices, emphasizing the need for revitalized activity to stabilize BNB.

Frequently Asked Questions

What Factors Led to BNB’s 25% Price Drop from Its Recent Highs?

BNB’s 25% decline to around $857 was driven by fading on-chain demand, with daily transactions falling nearly 50% and DEX volume dropping by $5.02 billion. Network utilization also plummeted from 51% to 19%, reflecting reduced user engagement on BNB Smart Chain, a key value driver for the token.

Is BNB Chain Still Competitive Amid the Current Decline?

Yes, BNB Chain ranks third in market relevance despite the slowdown, supported by its historical highs in activity this year. However, the drop in stablecoin supply by $98 million and transaction volumes signals capital shifting elsewhere, prompting users to monitor for signs of recovery in ecosystem demand.

Key Takeaways

- On-Chain Transactions Plunge: Daily activity fell from 31.3 million to 15.1 million, a 50% drop, weakening BNB’s foundational demand.

- DEX Volume Collapse: Trading volume shrank by $5.02 billion to $1.29 billion, indicating capital outflow from the ecosystem.

- Price Outlook: BNB faces resistance at a descending trendline; a breakout could signal recovery, but current momentum suggests potential further downside.

BNB at a Critical Juncture

Currently, BNB trades near a descending diagonal resistance that has capped upward moves in recent sessions. Failure to surpass this level may lead to additional declines, while a strong breakout could restore bullish momentum.

Source: TradingView

Conclusion

The BNB price decline underscores vulnerabilities in the BNB Chain’s on-chain activity and stablecoin dynamics, with transactions and volumes hitting multi-week lows. As capital rotates to competing networks, investors should watch for renewed engagement to support recovery. Monitoring key metrics from sources like BSCScan and DeFiLlama will be essential for gauging the ecosystem’s resilience moving forward.