BNM Stablecoin Sandbox: Ringgit Tokenization

ALT/USDT

$13,167,377.07

$0.008300 / $0.006810

Change: $0.001490 (21.88%)

-0.0107%

Shorts pay

Contents

Malaysia's Central Bank Launches Stablecoin Sandbox Pilots

Malaysia's Central Bank Bank Negara Malaysia (BNM) is piloting three regulatory sandbox programs through the Digital Asset Innovation Hub (DAIH). A regulatory sandbox is a framework that allows innovative financial solutions to be tested in a supervised environment. These programs aim to accelerate cross-border payments using ringgit stablecoins, develop tokenized real-world assets (RWAs), and test tokenized bank deposits. RWAs refer to assets like real estate or bonds being tokenized on the blockchain to provide liquidity and fractional ownership. The research will form the basis for wholesale CBDC development.

The benefits of asset tokenization. Source: BNM

Standard Chartered Bank, CIMB Group Holding, Maybank, and Capital A are participating in the trials. BNM will prioritize Shariah compliance. The results will shape policy direction.

Main Targets of Malaysia's Digital Asset Roadmap

- Supply chain management optimization

- Developing Shariah-compliant digital products

- Increasing credit access with blockchain

- Programmable finance solutions

- 24/7 cross-border payments

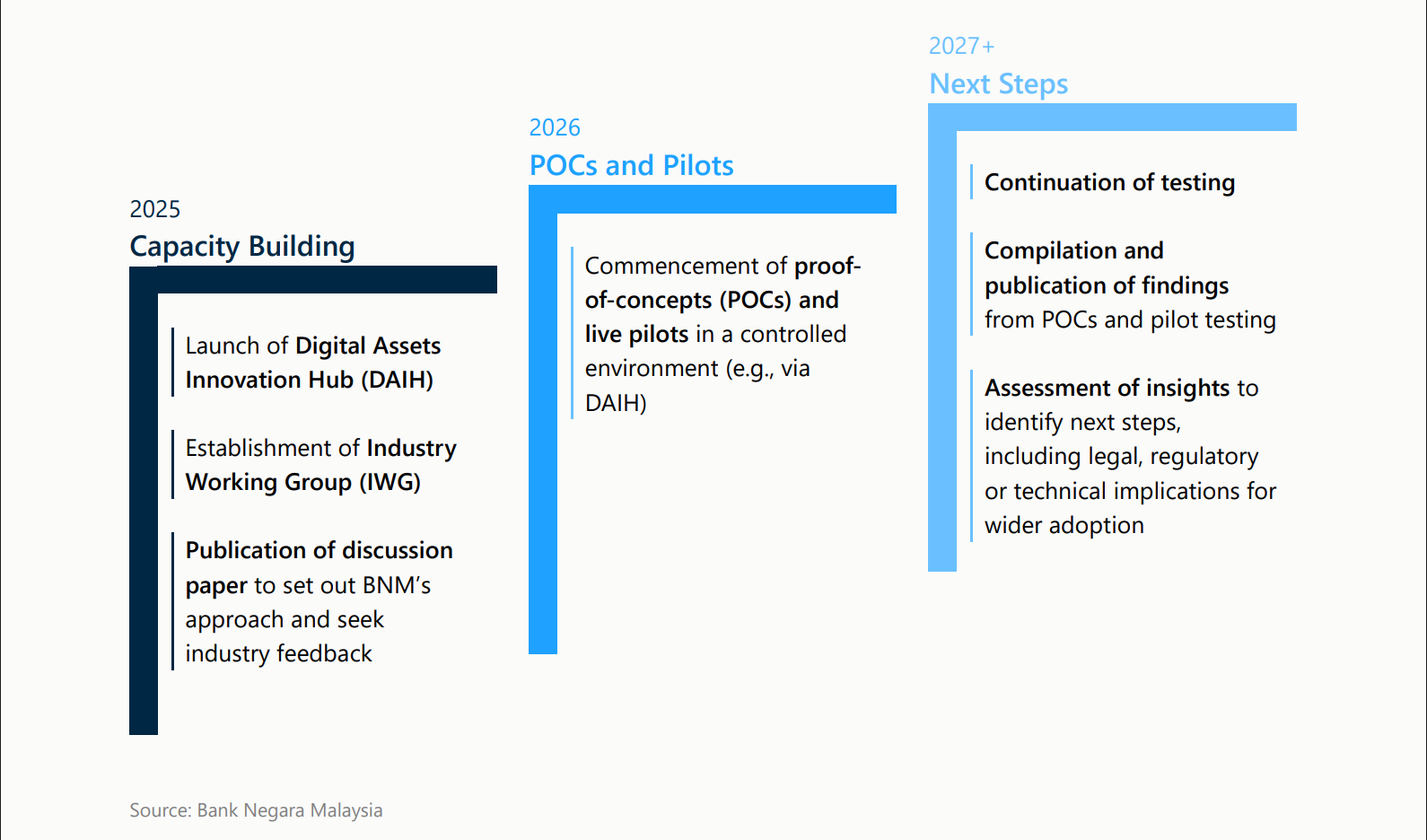

Malaysia’s central bank outlines a three-year roadmap for digital assets. Source: BNM

Malaysia's Crown Prince Ismail Ibrahim launched the RMJDT ringgit-pegged stablecoin with Bullish Aim in December; it's in the sandbox phase, not public. Standard Chartered and Capital A are planning wholesale settlement. Wholesale stablecoins/CBDCs are designed for inter-institutional use.

Critical Support and Resistance Levels for ALT

As tokenization trends impact markets, ALT technical data:

- Price: $0.01 (24h: -1.22%)

- RSI: 32.01 (Oversold)

- Trend: Bearish, Supertrend Bearish, EMA20: $0.0095

- Supports: S1 $0.0069 (⭐ Strong 75/100, -14.92%), S2 $0.0080 (⭐ Strong 66/100, -1.36%)

- Resistances: R1 $0.0083 (⭐ Strong 76/100, +2.34%), R2 $0.0117 (⭐ Strong 62/100, +44.27%)

ALT detailed analysis and ALT futures trading, click here. Don't miss ALT spot opportunities.

Malaysia Stablecoin Sandbox FAQ

What is BNM's sandbox testing?

Ringgit stablecoin payments, RWAs, and tokenized deposits.

Is the RMJDT stablecoin public?

No, it's in the sandbox phase.

How does this contribute to CBDC?

Wholesale tests produce interbank settlement data.