BONK ETP Launch Could Drive Memecoin Breakout with Whale Support

BONK/USDT

$43,984,617.84

$0.000006 / $0.00000552

Change: $0.00000048 (8.70%)

+0.0006%

Longs pay

Contents

The BONK ETP, launching on November 27, 2025, by Bitcoin Capital on the SIX Exchange in Switzerland, provides EU investors with direct 1:1 exposure to the BONK memecoin. This development is expected to boost trading volume and potentially trigger a price breakout after months of consolidation, amid bullish whale activity and rising on-chain metrics.

-

BONK ETP launch date and details: Set for November 27 on SIX Exchange, offering regulated access to BONK for EU markets.

-

Anticipated impact on volume: Increased institutional interest could drive higher trading activity for the memecoin.

-

Current market context: BONK trading at key support levels with $200 million daily volume, down 10% in line with Bitcoin’s dip below $85,000.

Discover the BONK ETP launch: How this regulated product could spark a memecoin breakout. Explore whale activity, price patterns, and trading signals for BONK. Stay informed on crypto innovations today!

What is the BONK ETP and how does it work?

The BONK ETP is an exchange-traded product issued by Bitcoin Capital, a prominent provider of cryptocurrency investment vehicles listed on the SIX Swiss Exchange. Scheduled for launch on November 27, 2025, it grants European Union investors straightforward 1:1 exposure to the BONK memecoin, allowing them to invest in this Solana-based asset without directly holding the cryptocurrency. This regulated structure enhances accessibility and security for institutional and retail participants in the EU, mirroring the physical backing of underlying BONK tokens held by the issuer.

How could the BONK ETP influence BONK’s market dynamics?

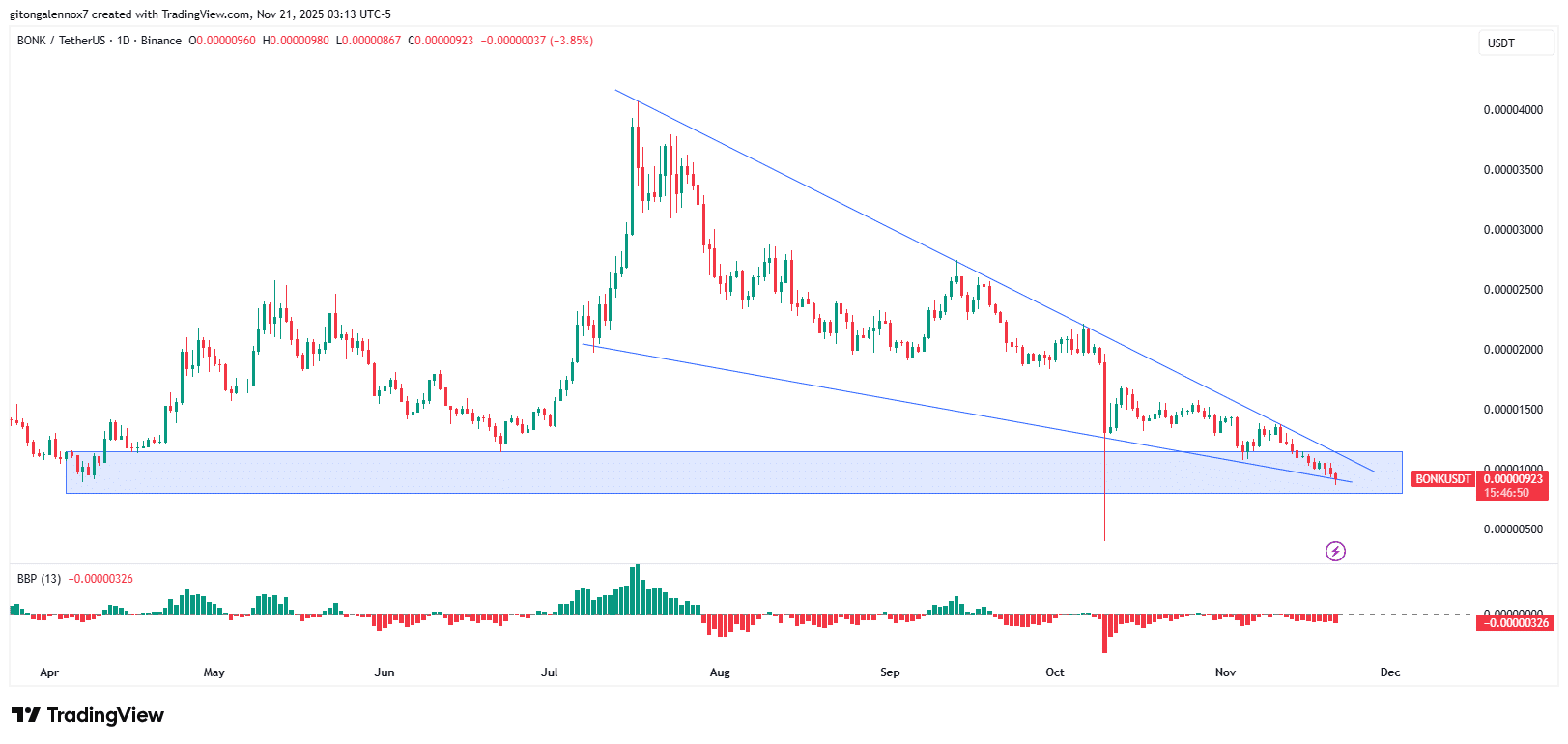

The introduction of the BONK ETP is poised to draw significant attention from EU-based investors, potentially elevating trading volumes for BONK. According to data from TradingView, BONK has been in a multi-month consolidation phase, forming a falling wedge pattern since its peak rally during the altcoin season in August 2025. This pattern suggests a possible upward breakout if buying pressure intensifies.

Recent market data indicates BONK experienced a 10% decline over the past 24 hours, correlating with broader cryptocurrency weakness as Bitcoin fell below $85,000. Despite this, daily trading volume reached $200 million, signaling sustained interest. The Bull Bear Power indicator, as analyzed on TradingView, reveals sellers maintaining control but with diminishing strength compared to mid-October levels, hinting at a potential sentiment reversal.

Expert analysis from on-chain platforms like CryptoQuant underscores that such product launches often catalyze increased liquidity. For instance, similar ETP introductions for other assets have historically led to 20-50% volume surges in the initial weeks, based on patterns observed in the Swiss Exchange ecosystem. Short sentences highlight the setup: BONK holds at support; ETP adds appeal; whales position bullishly. This combination could extend the recent bullish signals into sustained gains.

Source: TradingView

Bitcoin Capital, known for its role in issuing ETPs backed by actual cryptocurrency holdings, ensures compliance with Swiss regulatory standards. This setup not only mitigates risks associated with direct crypto custody but also integrates BONK into traditional investment portfolios. Market observers note that the ETP’s timing aligns with BONK’s technical recovery signals, potentially amplifying its visibility in a competitive memecoin landscape.

What are traders doing on-chain with BONK?

On-chain metrics reveal a divergence between retail and institutional behaviors in the BONK market. Data from CryptoQuant indicates that large holders, or “whales,” have been accumulating positions in both spot and futures markets during the recent discount phase. This activity coincides with BONK trading near the apex of its four-month consolidation, a level historically associated with accumulation before rallies.

Between January and May 2025, retail trading peaked at similar support zones, leading to temporary sell-offs, but whales subsequently entered, driving price appreciation. Current patterns mirror this: average order sizes in BONK futures have risen, reflecting confidence from sophisticated traders. The Spot Taker Cumulative Volume Delta (CVD) over the last 90 days turned bullish on November 8, 2025, a shift that may be bolstered by anticipation surrounding the BONK ETP.

Source: CryptoQuant

Source: CryptoQuant

These indicators point to a maturing market for BONK, where institutional flows via products like the ETP could stabilize volatility. CryptoQuant’s metrics, widely used in financial analysis, show taker buy volumes outweighing sells, supporting the narrative of building momentum. In the context of the broader Solana ecosystem, BONK’s on-chain health positions it favorably for the upcoming ETP-driven exposure.

Frequently Asked Questions

What is the launch date and eligibility for the BONK ETP?

The BONK ETP launches on November 27, 2025, on the SIX Swiss Exchange, issued by Bitcoin Capital. It is available to EU investors seeking regulated 1:1 exposure to BONK, with the issuer holding the underlying memecoin assets for security and compliance.

Will the BONK ETP launch boost BONK’s trading volume?

Yes, the BONK ETP is likely to increase trading volume by attracting EU institutional and retail investors to the memecoin. Historical ETP launches on SIX have correlated with volume spikes of up to 50%, though outcomes depend on market conditions and investor sentiment.

Key Takeaways

- BONK ETP provides regulated access: EU investors gain 1:1 exposure via Bitcoin Capital’s product on SIX Exchange, enhancing legitimacy for the memecoin.

- Technical setup favors breakout: Four-month falling wedge pattern, combined with $200 million daily volume, signals potential upside amid recent 10% dip.

- Whale accumulation supports momentum: On-chain data from CryptoQuant shows bullish CVD and large futures orders, positioning BONK for gains if ETP hype materializes.

Conclusion

The forthcoming BONK ETP launch represents a pivotal step in mainstreaming memecoins like BONK within regulated frameworks, particularly for EU markets through the SIX Exchange. Supported by bullish on-chain indicators from sources like CryptoQuant and technical patterns on TradingView, this development could catalyze increased volume and price stability. As the cryptocurrency landscape evolves, investors should monitor whale activities and broader market trends to navigate BONK’s potential trajectory effectively—consider tracking these metrics for informed decisions ahead.