BTC ETFs Continued Inflows, Goldman Changes

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Momentum Increase in BTC Spot ETF Flows

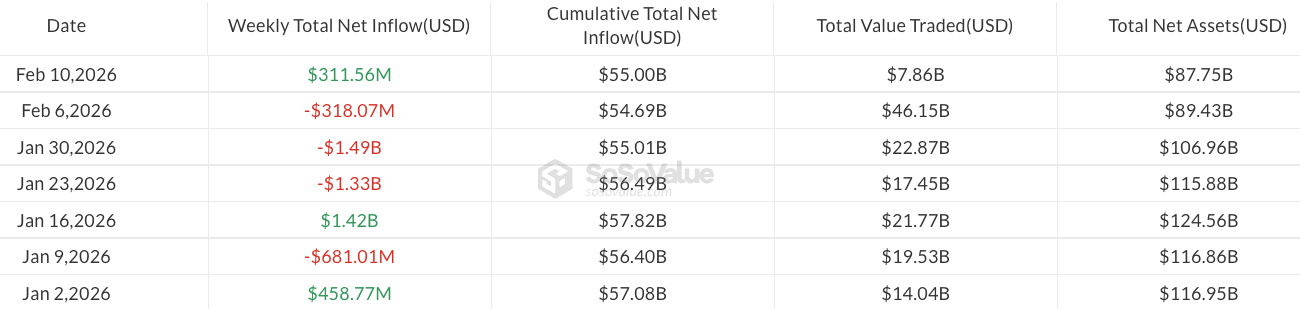

US spot Bitcoin (BTC detailed analysis) ETFs continued their three-session inflow streak. This week's total 311,6 million dollar inflow, recorded with 166,6 million dollars on Tuesday, nearly offset last week's 318 million dollar outflow. According to SoSoValue data, even though the funds experienced more than 3 billion dollars in losses over the last three weeks, momentum increased as the BTC price fell 13 percent over the last seven days to below 68 thousand dollars. Bloomberg analyst Eric Balchunas noted that most investors held their positions, with only 6% of total assets outflowing; BlackRock’s IBIT fund declined from its peak to 60 billion dollars but recorded growth at record speed.

Weekly flows in US spot Bitcoin ETFs in 2026. Source: SoSoValue

Goldman Sachs BTC and Altcoin ETF Positions

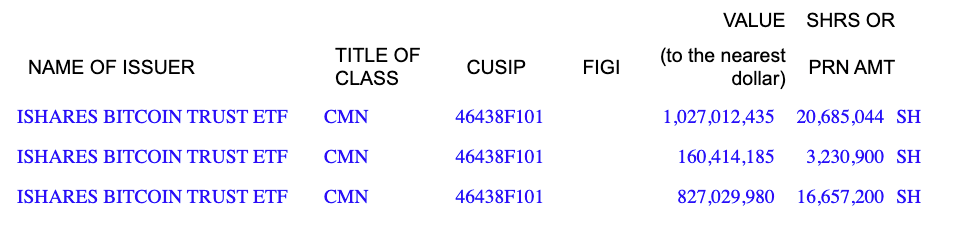

According to its Form 13F filed with the SEC in the fourth quarter of 2025, Goldman Sachs reduced its BlackRock iShares Bitcoin Trust (IBIT) shares by 39% to 40,6 million shares (approximately 2 billion dollars). In total, it holds 1,1 billion dollars in BTC, 1 billion dollars in ETH, 153 million dollars in XRP, and 108 million dollars in SOL. It shortened its positions in Fidelity Wise Origin Bitcoin (FBTC) and Ether (ETH) ETFs. In contrast, the bank took positions for the first time in XRP ETFs with 6,95 million shares (152 million dollars) and Solana (SOL) ETFs with 8,24 million shares (104 million dollars). Yesterday's altcoin ETF inflows added 14 million dollars to ETH funds, 3,3 million dollars to XRP, and 8,4 million dollars to SOL. In the February 9, 2026 flows, BTC ETFs saw 144,9 million dollars, ETH 57 million dollars net inflows.

Goldman Sachs’ holdings of iShares Bitcoin Trust ETF (IBIT) in Q4 2025. Source: SEC

BTC Technical Outlook and Support Levels

Current BTC price 66.705 USD (-3,45%). RSI at 29,98 in the oversold region. Downtrend dominant, EMA20: 76.317 USD. Strong supports: 65.415 USD (⭐ STRONG, -2,23%) and 60.000 USD (⭐ STRONG, -10,33%). Resistances: 70.243 USD (⭐ STRONG, +4,98%) and 73.706 USD. Oversold signals for BTC futures may indicate buying opportunities.