BTC ETFs Set 53 Billion Dollar Net Inflow Record

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

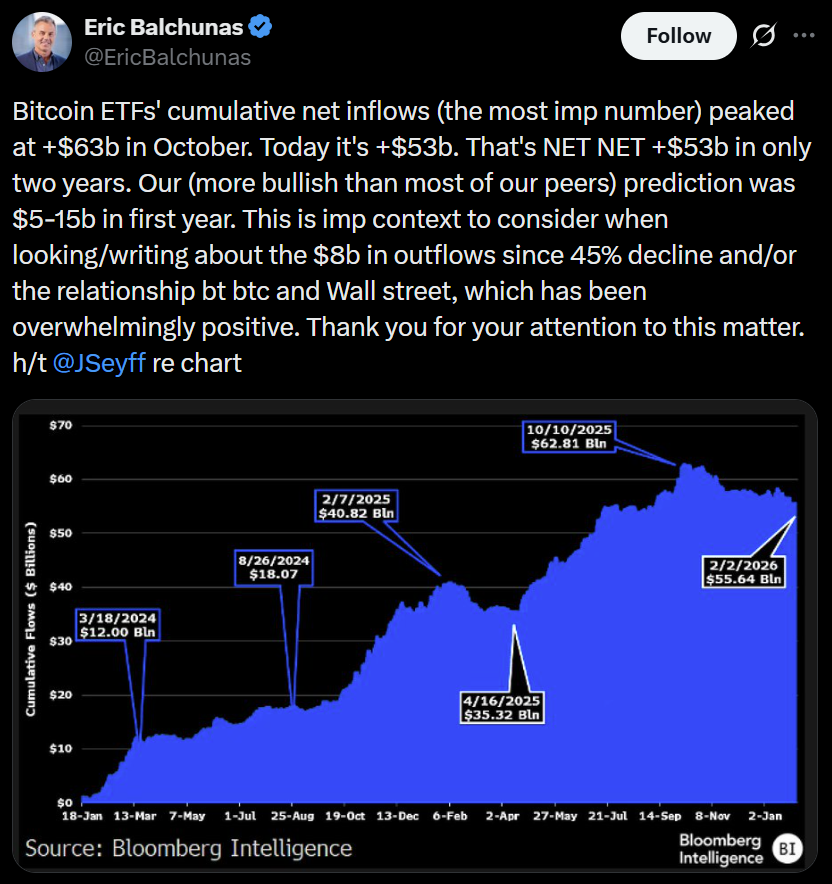

US spot BTC detailed analysis ETFs have experienced intense outflows recently, but the overall picture tells a different story. According to Bloomberg ETF analyst Eric Balchunas, cumulative net inflows into BTC ETFs reached 63 billion dollars in October and are currently at around 53 billion dollars. This figure greatly exceeds Bloomberg's early estimates (5-15 billion dollars). Balchunas shared data compiled by James Seyffart on the X platform, emphasizing that this is a net 53 billion dollar success in two years.

Source: Eric Balchunas

Record-Breaking Facts in BTC ETF Flows

Spot BTC ETFs approved at the beginning of 2024 have become the dominant force in the market. BlackRock's iShares Bitcoin Trust reached 70 billion dollars in assets in one year, breaking the record for the fastest-growing ETF. BTC reached new highs before the April 2024 halving, ETF accumulation accelerated in 2025, and it exceeded 126 thousand dollars in October. According to current news, even though Google searches for "Will Bitcoin go to zero?" are increasing, institutional buyers (like Morgan Stanley) continue to accumulate BTC.

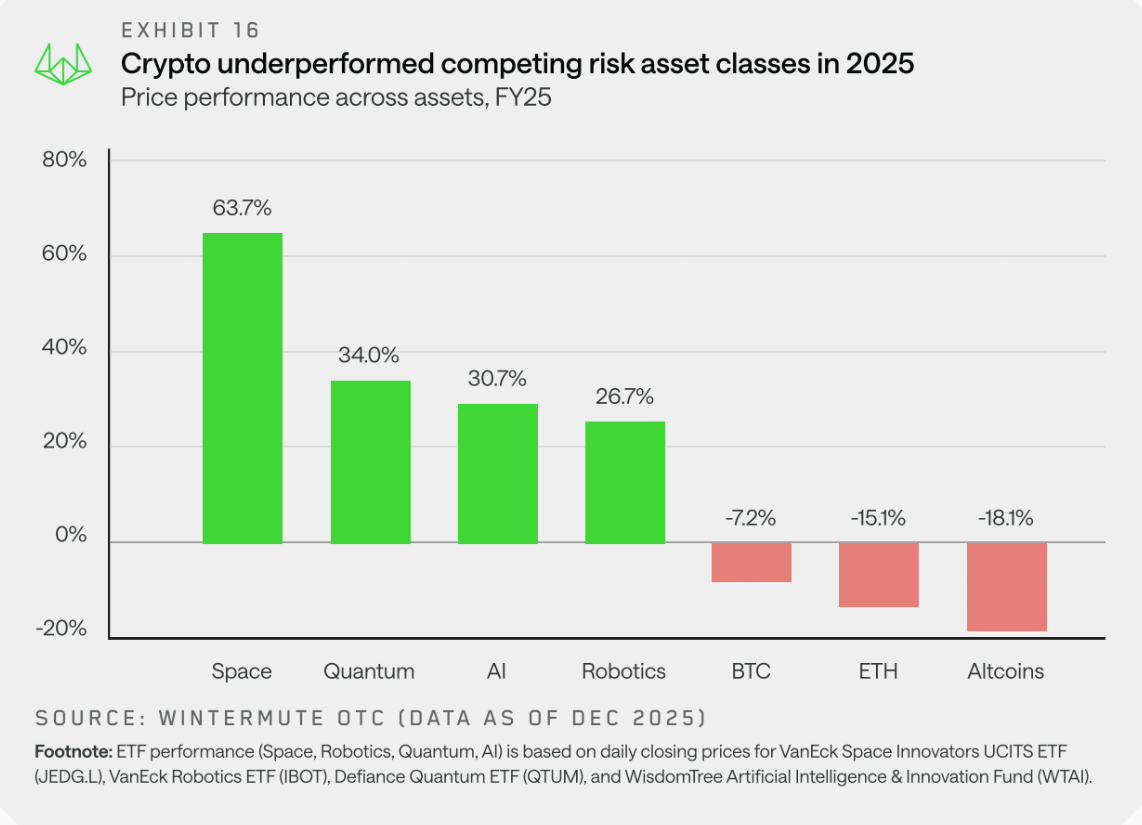

Bitcoin and crypto more generally underperformed other risk assets in 2025. Source: Wintermute

Critical Support and Resistance Levels for BTC

- Price: $66,987.22 (+1.22% 24h)

- RSI: 34.43 (Oversold)

- Trend: Bearish (Supertrend: Bearish, EMA20: $71,660)

- Supports: S1 $65,083 (Strong, -2.87%), S2 $62,910 (Strong, -6.11%)

- Resistances: R1 $68,408 (Strong, +2.10%), R2 $70,606 (Strong, +5.38%)

With the January-February 2026 sell-off, BTC fell back to 60 thousand dollars. The four-year cycle is extending; Bitwise analysts say it has changed due to the influence of institutional capital (Merrill Lynch). In 2025, BTC underperformed risk assets, and retail interest decreased.

BTC Market Cycle and Institutional Impact

Bitcoin mining company Hive increased its hash rate despite a 91 million dollar loss. Quantum security updates like BIP-360 will take 7 years. BTC futures remain dominant.

Frequently Asked Questions About BTC ETF Inflows

- How much net inflow have BTC ETFs received? 53 billion dollars cumulative.

- What do the recent outflows mean? Short-term, long-term accumulation is strong.

- Has the BTC cycle ended? Extended with institutional interest.