BTC Expectations Decreased: Positive Market Signal

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

According to Santiment data, the expectation among crypto market participants that Bitcoin will reach new record levels has decreased, and this is being evaluated as a positive market signal. Calls for Bitcoin to reach the 150,000-200,000$ or 50,000-100,000$ range are drying up, while FOMO and ‘Lambo’ memes have declined; this shows that retail optimism is fading.

Why Has BTC Market Sentiment Risen to Neutral Levels?

BTC market sentiment, measured by the bull/bear ratio in social media comments, has risen from extreme bearish to neutral levels. The price reached 126,100$ in October but fell and closed the year low; it dropped to 60,000$ at the beginning of February. It is currently trading around 67,920$ (+0.08% 24h). Click for detailed BTC analysis.

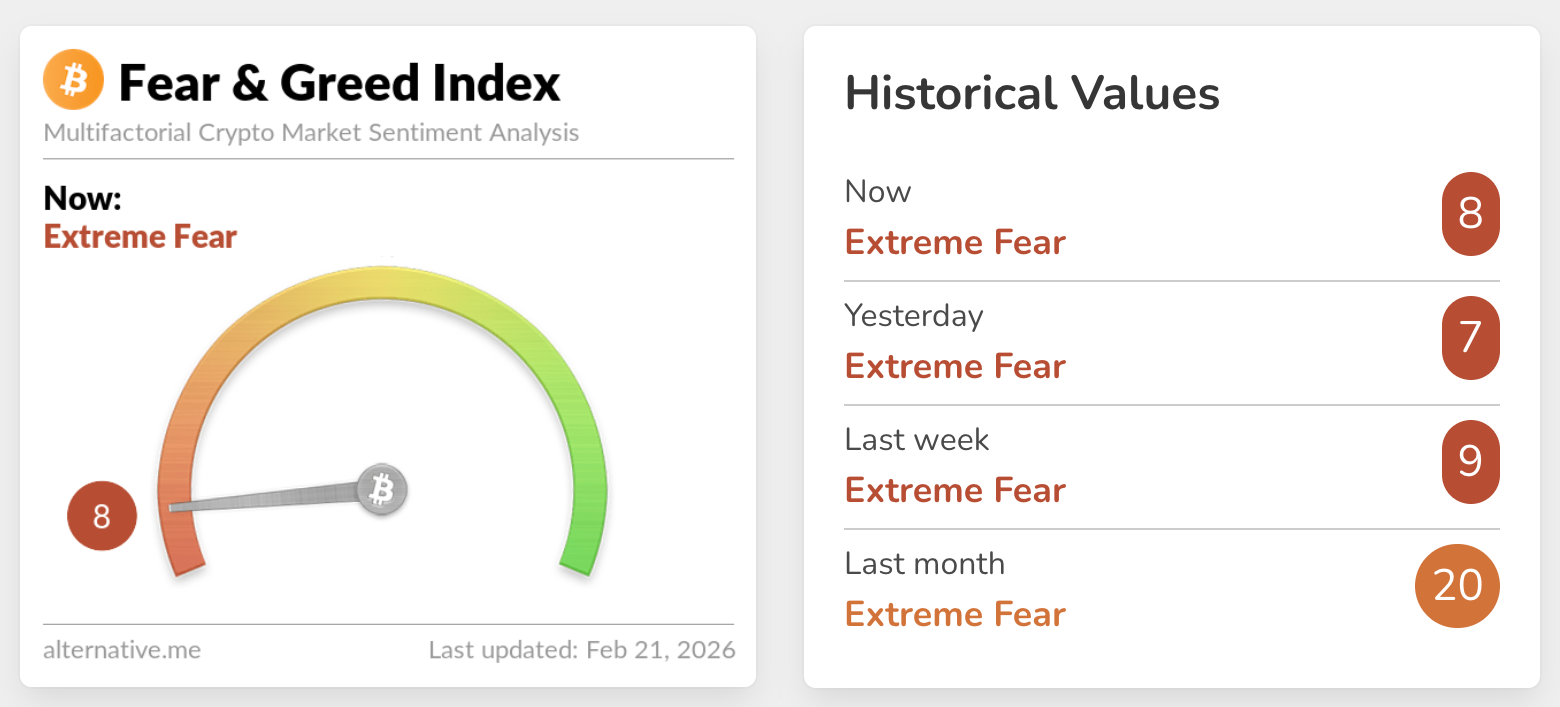

Crypto Fear & Greed Index in Extreme Fear: What Does It Mean?

The Crypto Fear & Greed Index is at 8 points in the Extreme Fear zone. This level usually signals bottoms and creates buying opportunities for contrarian investors. RSI at 37.08 is approaching the oversold zone, with the downtrend continuing.

Bitcoin Network Activity and Technical Indicators in Decline

Bitcoin network activity is declining: transaction volume, active addresses, and network growth have decreased. Supertrend is bearish, EMA 20: 70.986$. See table below:

| Level | Price | Score | Distance |

|---|---|---|---|

| S1 Support | 64.579$ | 70/100 ⭐ | -4.86% |

| S2 Support | 67.575$ | 59/100 | -0.45% |

| R1 Resistance | 68.390$ | 87/100 ⭐ | +0.75% |

| R2 Resistance | 75.264$ | 60/100 ⭐ | +10.88% |

BTC futures data also shows a bearish trend.

Institutional BTC Accumulation and ‘Will Go to Zero’ Searches

According to recent news, Google searches for ‘Bitcoin will go to zero’ are increasing, yet institutional buyers are accumulating BTC. Macro factors (interest rate cuts?) are supportive. This contrasts retail panic with institutional calm.

Bitcoin’s Quantum Resistance: Could Take 7 Years

BIP-360 co-author Ethan Heilman states that Bitcoin’s transition to post-quantum security will take 7 years. A critical development for long-term holders, it could also affect altcoins like AMP and ALT. Follow AMP price analysis.

Recommendations for BTC Investors

- If S1 support at 64.579$ breaks, short positions may increase.

- If R1 at 68.390$ is broken, it signals recovery.

- Accumulation opportunity while the Fear index is at bottom.