BTC Has Turned into Risky Assets: Grayscale Report

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

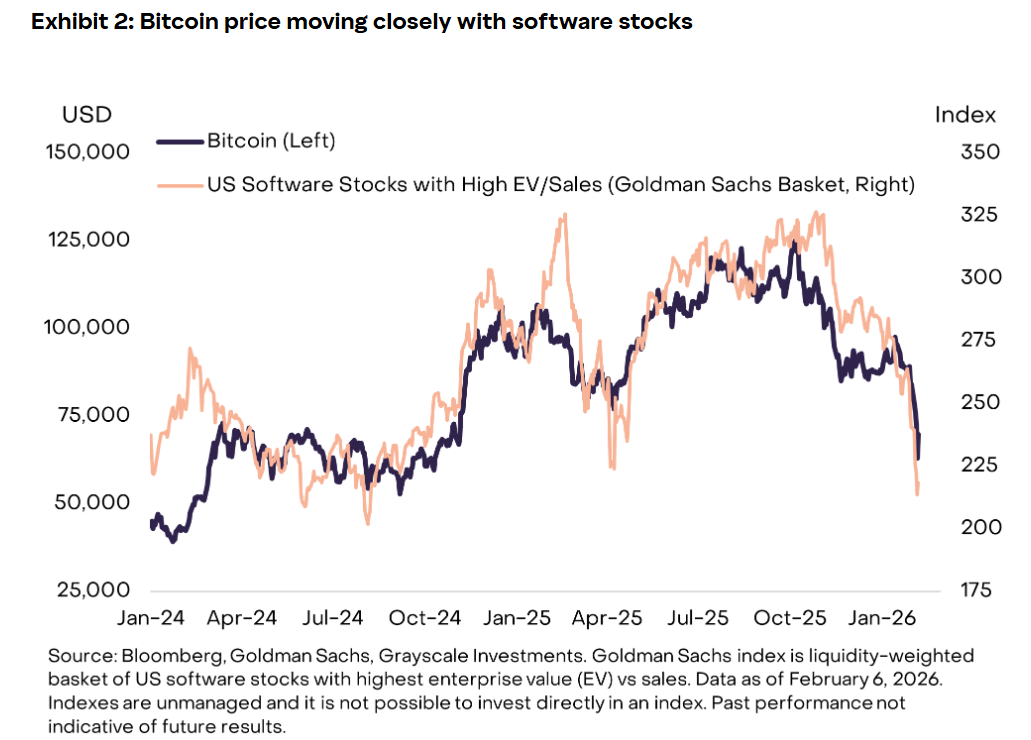

Bitcoin's Correlation with Growth Stocks

Bitcoin (BTC) has started trading like risky assets, moving away from its digital gold promise. Grayscale's new research reveals that BTC has shown strong correlation with growth stocks, especially those in the software sector, over the past two years. Uncertainties stemming from artificial intelligence in software stocks have also affected BTC's price. While seen as a store of value in the long term due to its fixed supply, its short-term movements resemble growth assets.

Bitcoin’s recent price performance tracks closely with software stocks. Source: Grayscale

BTC Technical Outlook and Support Levels

Currently trading at $68,712, BTC has risen %5.02 in the last 24 hours but RSI at 35.44 is in the oversold region and the overall trend is bearish (Supertrend: Bearish). There is pressure above EMA 20 ($74,760). Strong supports: S1 $62,997 (83/100 score, -%8.58 distance), S2 $66,683 (-%3.23). Resistances: R1 $70,235 (+%1.92), R2 $76,011 (+%10.30). Click for detailed BTC analysis.

Latest BTC News and Institutional Moves

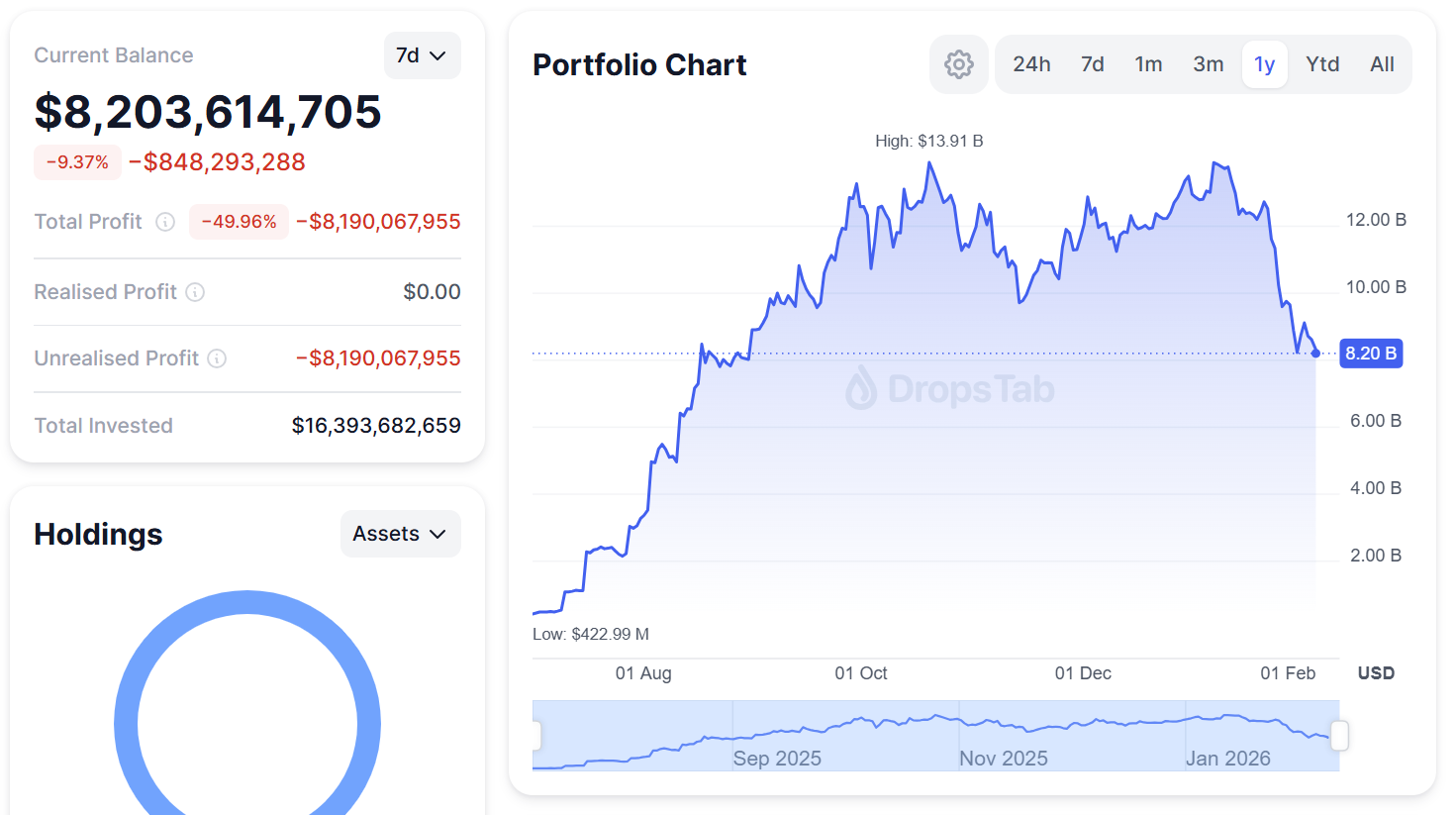

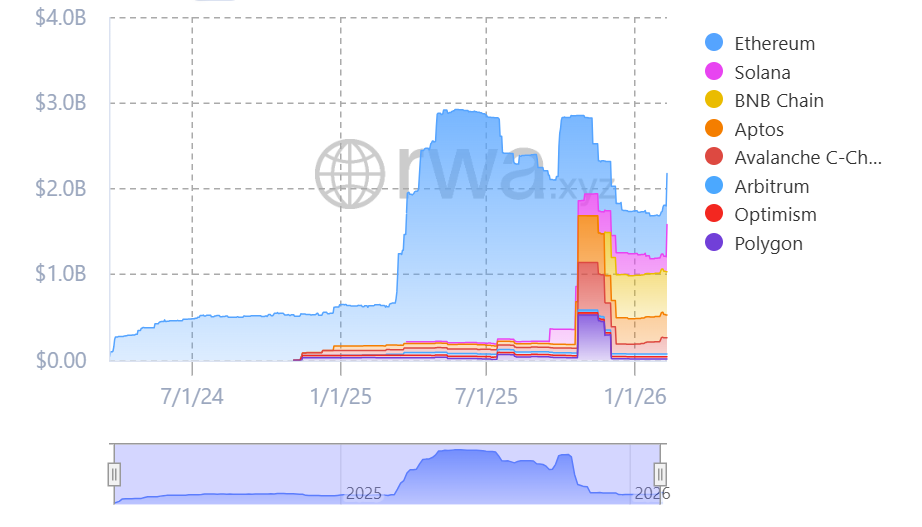

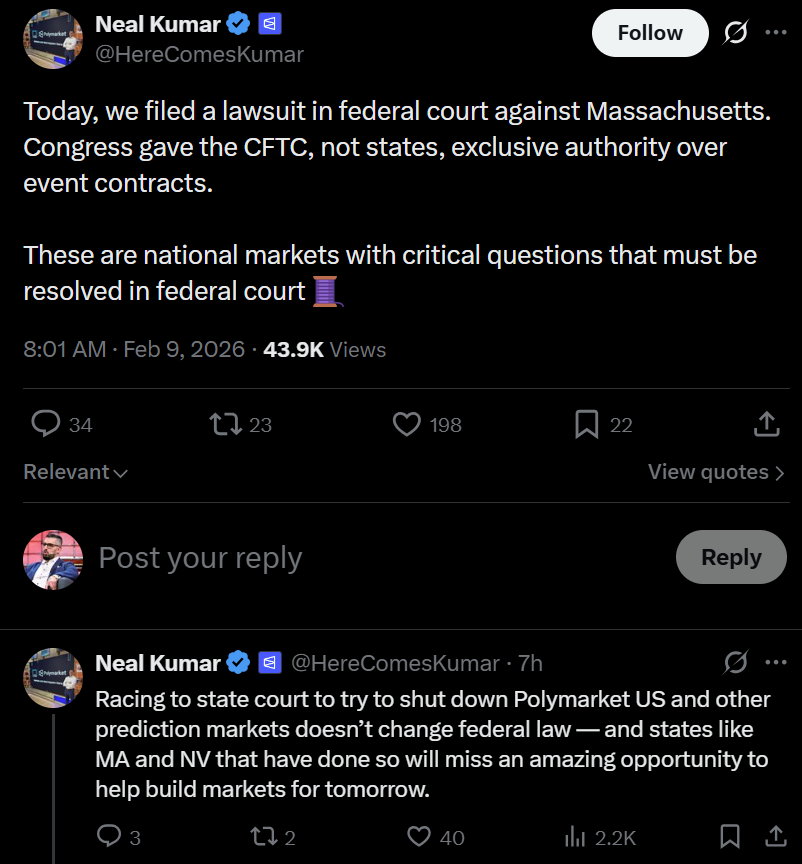

BitMine Immersion Technologies added 40.613 ETH during the market downturn, bringing the total to 4.326 million ETH ($8.8 billion), with $8.1 billion in unrealized losses. BlackRock integrated its BUIDL tokenized fund (with $2.1 billion in assets on Ethereum, Solana, and Avalanche) with Uniswap and bought UNI. Polymarket filed a lawsuit against Massachusetts restrictions. According to Arkham data, Binance's SAFU fund bought 4.545 BTC worth $304.58 million. NYSE American applied for options listing for multi-crypto ETFs. Details on BTC futures here.

BitMine’s paper losses now exceed $8.1 billion. Source: DropStab

BlackRock’s BUIDL has more than $2.1 billion in assets. Source: RWA.xyz

Source: Neal Kumar

Comments

Other Articles

BNB Chain’s RWA Momentum Draws Institutional Interest Amid Market Caution

November 20, 2025 at 06:05 AM UTC

Sberbank Explores Blockchain-AI Fusion, Cautiously Advances Bitcoin-Based Assets in Russia

November 18, 2025 at 03:28 PM UTC

NFT Market Valuation Halves in 30 Days, Bitcoin NFTs Show Resilience

November 5, 2025 at 10:38 AM UTC