BTC Miners Planning 30 GW Capacity for AI

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

BTC Miners' AI Transformation

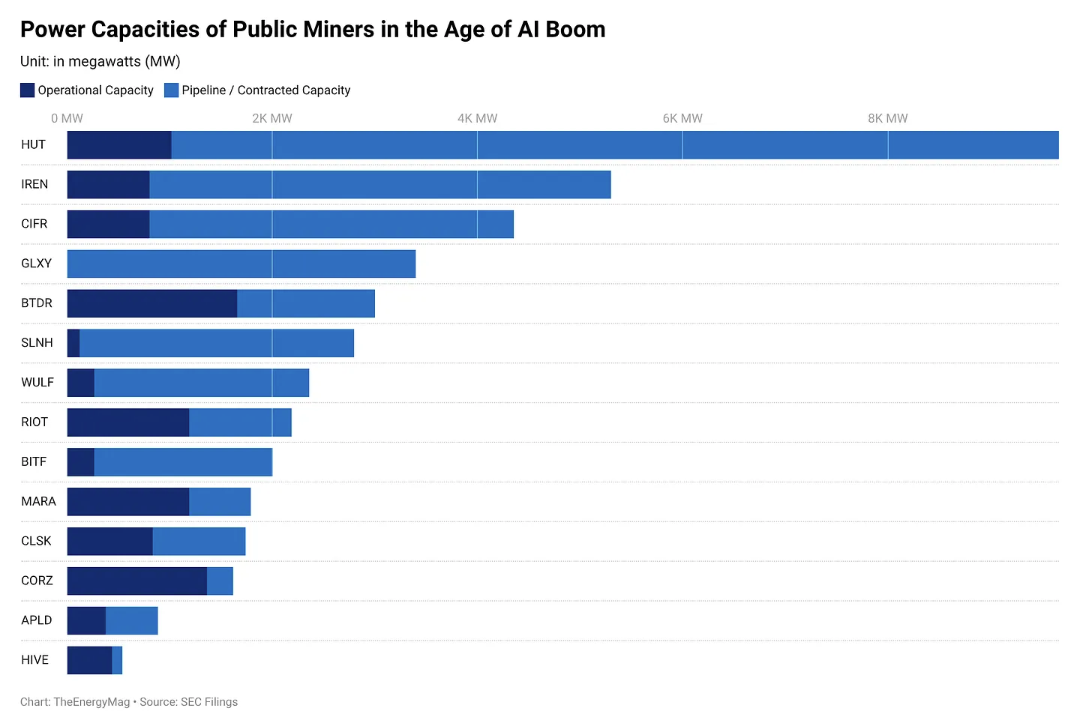

Public Bitcoin (BTC) miners are planning approximately 30 gigawatts of new power capacity for artificial intelligence (AI) workloads; this is nearly three times the current 11 GW in operation. According to a compilation by TheEnergyMag examining 14 public miners, the sector is rapidly moving away from traditional hashpower due to weak hashprice conditions and positioning for the next growth cycle. The planned capacity, as defined by TheEnergyMag as infrastructure "equivalent to the power of a small country," is mostly in development pipelines, connection queues, or early-stage plans.

Current and proposed power capacities of public Bitcoin miners. Source: TheEnergyMag

Transition to AI infrastructure has provided early revenue growth in some miners; for example, HIVE Digital reported record revenue of 93.1 million dollars in the fourth quarter, with contributions from AI and high-performance computing (HPC) workloads, showing a 219% annual increase. However, according to recent news, HIVE announced a net loss of 91 million dollars due to accelerated depreciation. Starboard Value suggested to Riot Platforms accelerating HPC and AI data centers. After the 2024 BTC halving, block rewards decreased and BTC price fell from 126 thousand dollars to 60 thousand dollars, narrowing profit margins. At the beginning of the year, US miners recovered production after the winter storm.

Source: Julien Moreno

BTC Technical Outlook and Supports

BTC is currently at 66.633$, in a downtrend with a -0.81% drop in 24 hours. RSI 32.93 (Oversold), EMA 20: 71.610$. In futures bearish supertrend prevails.

- Supports: S1 65.143$ (Strong, -2%), S2 62.924$ (Strong, -5.3%)

- Resistances: R1 70.639$ (Strong, +6.3%), R2 68.107$ (Strong, +2.5%)