Bubblemaps Data Indicates US May Lead in Bundled Memecoin Origins

Contents

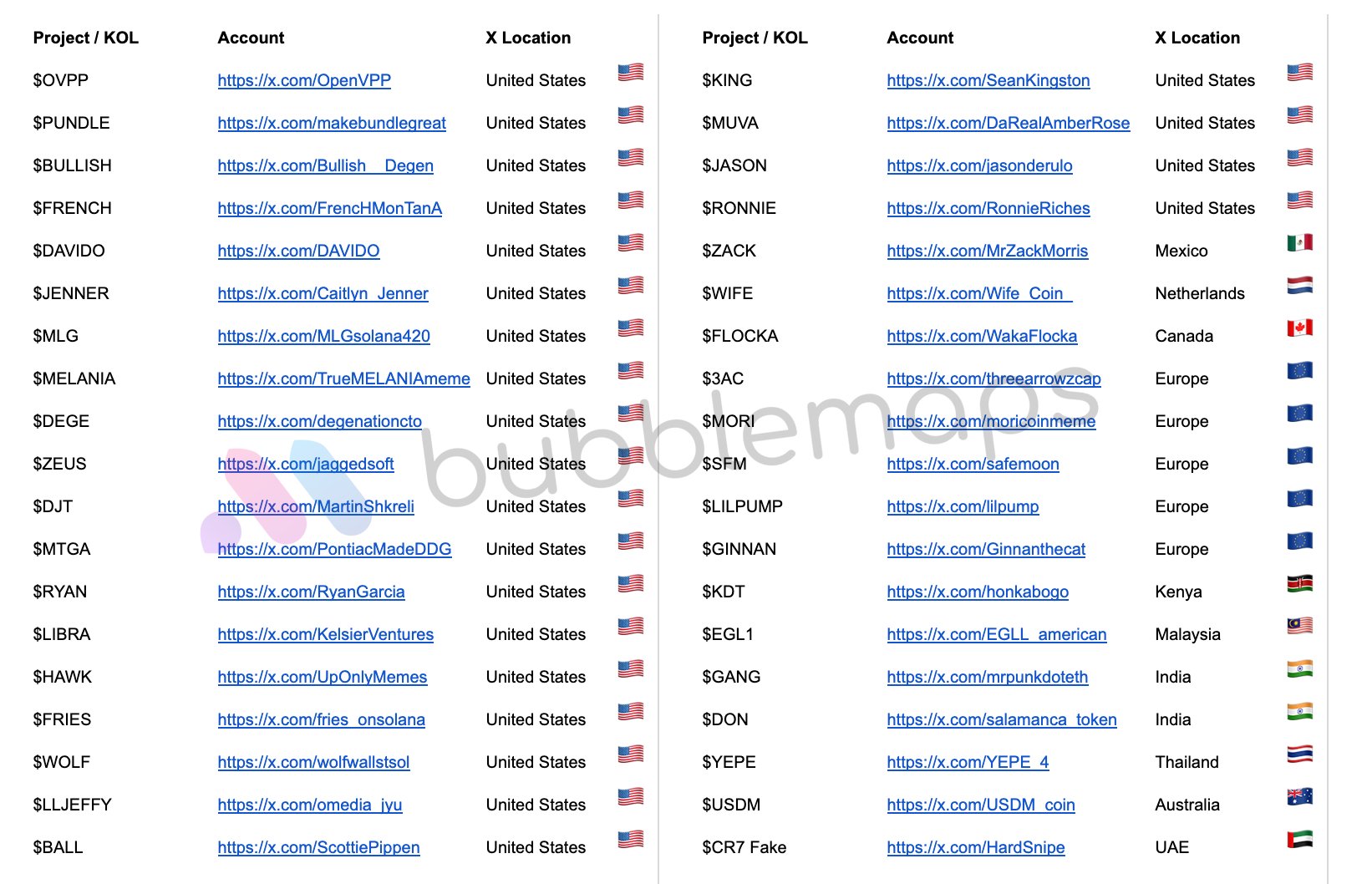

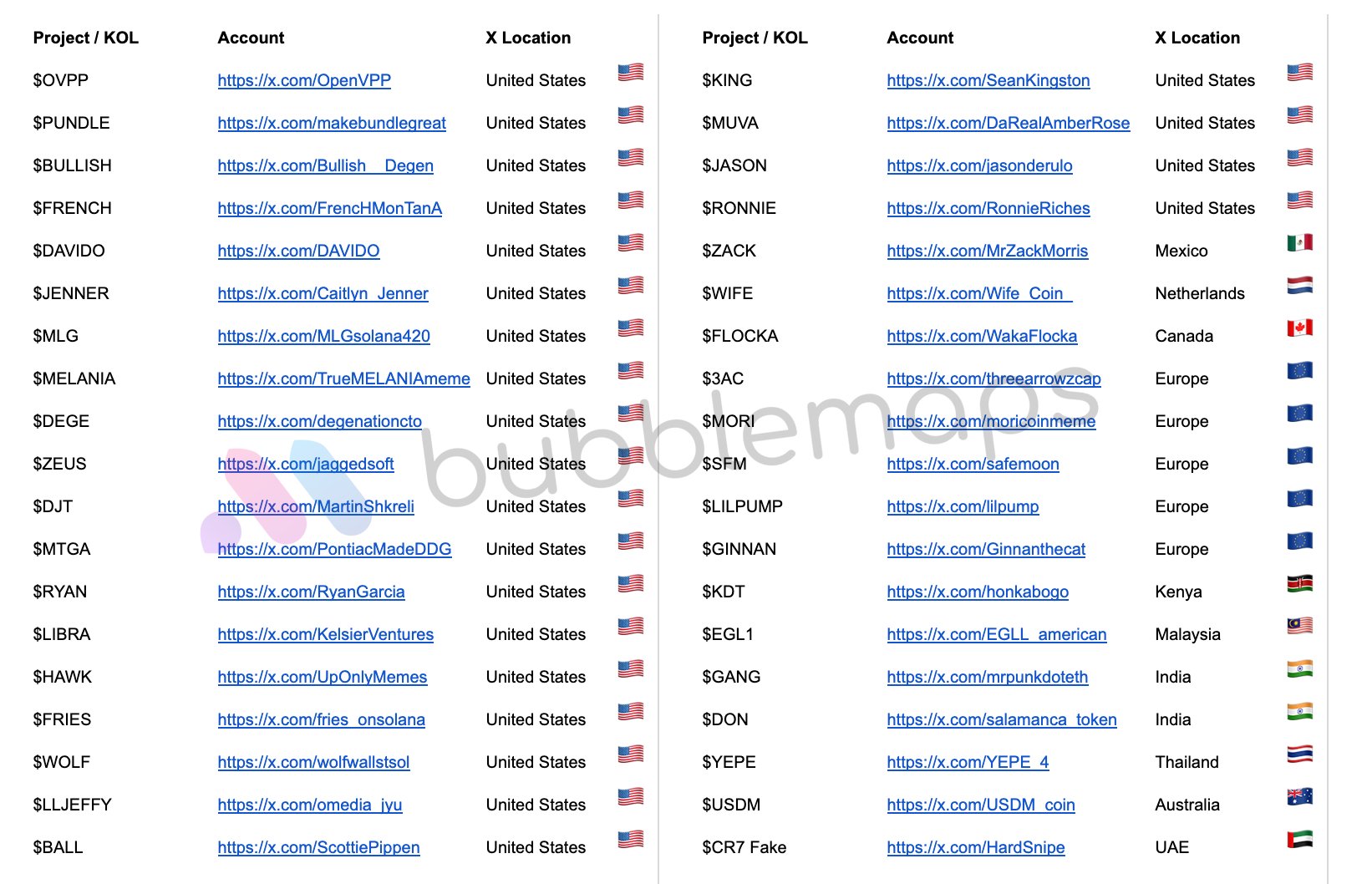

The United States has emerged as the leading hub for bundled tokens in the cryptocurrency space, with over 50% of investigations tracing back to U.S.-based X accounts, according to on-chain analytics from Bubblemaps. These memecoins and celebrity-linked assets often show concentrated insider ownership and coordinated wallet behaviors, raising concerns about transparency in the market.

-

U.S. dominance: Over 50% of bundled token probes link to American influencers and celebrities on X.

-

Examples include tokens like $JENNER and $DJT, tied to high-profile figures with overlapping wallet clusters.

-

Data visualization reveals tight insider control, with U.S. projects outpacing global regions combined in 2025 memecoin activity.

Discover why the US leads in bundled tokens crypto, exposing risks in celebrity memecoins. Explore Bubblemaps insights on wallet clusters and regulatory implications for safer investing today.

What Are Bundled Tokens in the US Crypto Market?

Bundled tokens in the US crypto market refer to memecoins and influencer-linked assets that exhibit signs of centralized control despite appearing decentralized. According to Bubblemaps’ on-chain analysis, these tokens often feature interconnected wallets, synchronized trading patterns, and concentrated holdings by insiders. This U.S.-centric trend, dominating over 50% of cases, highlights how American celebrities and online personalities drive much of the memecoin ecosystem in 2025.

Source: Bubblemaps X

How Do Bundled Tokens Show US Dominance in Memecoin Launches?

Bubblemaps’ dataset reveals that more than half of all bundled token investigations originate from U.S.-located X accounts, underscoring the country’s role as a memecoin powerhouse. This includes tokens promoted by American celebrities and key opinion leaders, with wallet mapping showing clusters of overlapping holdings that suggest coordinated insider activity. For instance, projects from Europe and Asia appear in the data, but U.S. examples dominate, comprising over 50% of cases analyzed in 2025. Experts note that this concentration could stem from the U.S.’s vast pool of social media influencers, who leverage platforms like X for rapid token hype. Bubblemaps’ visualizations, using bubble clusters to depict wallet interconnections, provide clear evidence of these patterns without implying illegality—merely calling for greater scrutiny. Regulatory bodies, including the SEC, have increasingly monitored such assets, citing risks of manipulation in celebrity-endorsed launches. Data from the platform indicates that bundled tokens often follow a predictable cycle: quick pumps driven by social buzz followed by sharp declines, affecting retail investors disproportionately.

Frequently Asked Questions

What Makes a Token ‘Bundled’ According to On-Chain Analytics?

A bundled token is identified through on-chain analytics like those from Bubblemaps, where wallet clusters reveal concentrated ownership by a small group of interconnected addresses. This often involves coordinated behaviors, such as synchronized liquidity additions or shared holdings across multiple projects. In 2025, over 50% of such tokens link to U.S. promoters, emphasizing the need for investors to check wallet transparency before engaging.

Why Are Celebrity Memecoins Concentrated in the United States?

Celebrity memecoins cluster in the United States due to the high number of influencers and entertainers with massive online followings on platforms like X. Bubblemaps data shows U.S.-based accounts driving over half of bundled token activity, fueled by easy access to crypto tools and a vibrant social media ecosystem. This trend aids quick monetization but raises flags for potential insider control, as seen in tokens like $JENNER and $RYAN.

Key Takeaways

- U.S. Leadership in Bundled Tokens: The United States accounts for more than 50% of bundled token origins, per Bubblemaps, with celebrity-driven projects like $DJT exemplifying insider wallet overlaps.

- Risks of Coordinated Activity: These tokens often display synchronized trading and concentrated holdings, visualized through bubble maps that highlight real control behind the hype.

- Investor Caution Advised: Use on-chain tools to verify transparency in memecoins, especially U.S.-linked ones, to avoid boom-and-bust pitfalls in the 2025 market cycle.

Conclusion

The rise of bundled tokens in the US crypto landscape, as detailed by Bubblemaps’ on-chain dataset, spotlights a market segment where celebrity influence meets potential insider risks. With over 50% of investigations pointing to American origins, this trend underscores the need for robust transparency measures amid growing regulatory focus. As memecoin activity surges in 2025, investors should prioritize verified data sources and wallet analysis to navigate these opportunities wisely, fostering a more secure ecosystem for all participants.