Canton Network Trial Explores Real-Time Collateral Reuse with USDC and Tokenized US Treasurys

CC/USDT

$52,538,995.81

$0.17184 / $0.16061

Change: $0.01123 (6.99%)

-0.0184%

Shorts pay

Contents

The Canton Network’s latest trial demonstrated real-time collateral reuse of tokenized US Treasurys using multiple stablecoins, enabling instant transactions across counterparties on shared blockchain infrastructure. This advancement expands onchain liquidity and streamlines institutional financing without traditional delays.

-

Five transactions executed with tokenized US Treasurys and various stablecoins for faster financing.

-

Builds on July pilot combining US Treasurys and USDC for blockchain-based settlement.

-

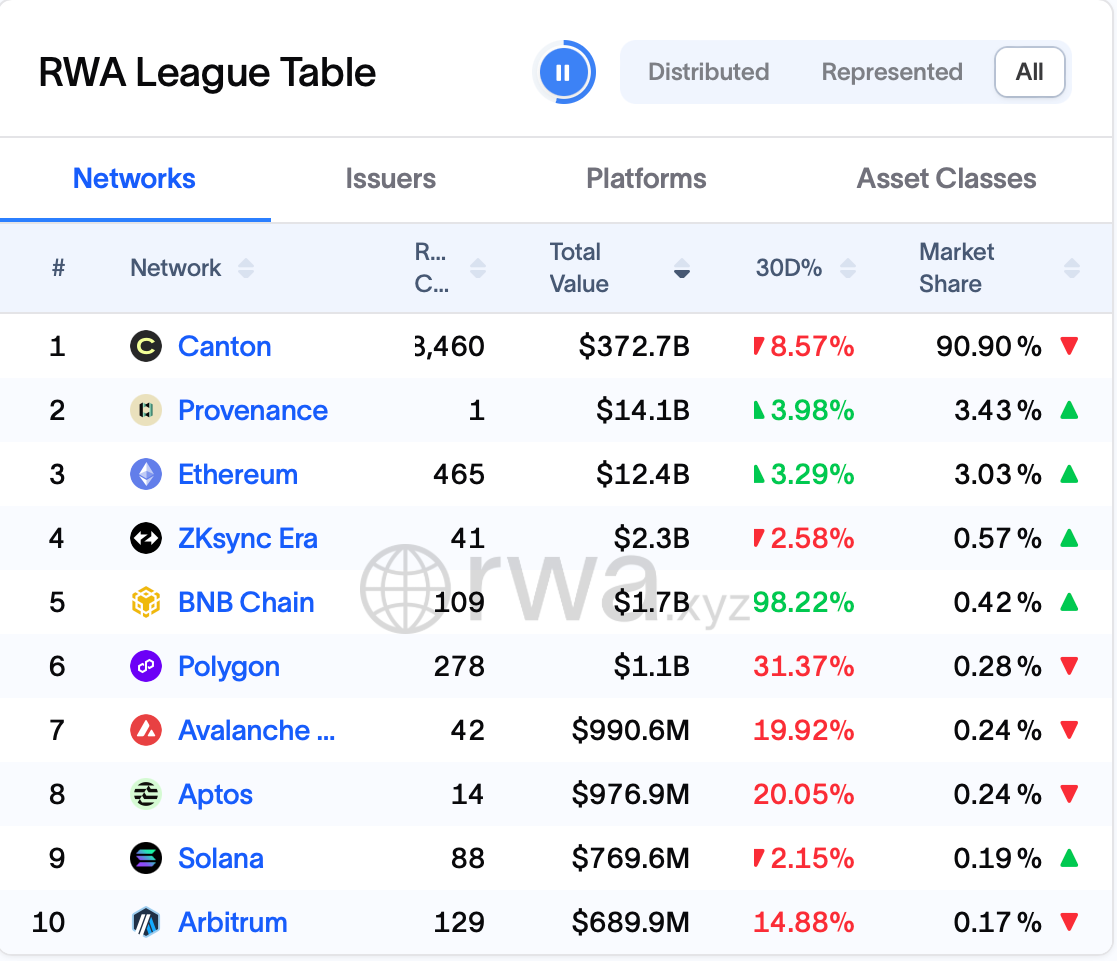

Tokenized assets reused in real-time, reducing operational hurdles in traditional rehypothecation; network now represents over $370 billion in tokenized real-world assets.

Discover how the Canton Network’s onchain US Treasury trial revolutionizes institutional finance with multiple stablecoins and real-time collateral reuse. Explore tokenized assets’ potential today.

What is the Canton Network’s Latest Onchain US Treasury Financing Trial?

The Canton Network’s onchain US Treasury financing trial represents a significant step in blockchain adoption for institutional finance, where tokenized US Treasurys serve as collateral in real-time transactions. In this second phase, participants executed five transactions using multiple stablecoins to finance positions, demonstrating seamless collateral reuse across counterparties. This builds on an initial July pilot that integrated US Treasurys with USDC for efficient settlement.

How Does Real-Time Collateral Reuse Work in Tokenized US Treasurys?

Real-time collateral reuse in tokenized US Treasurys allows assets to be transferred and repurposed instantly between parties on the Canton Network, eliminating the delays common in traditional finance’s rehypothecation processes. According to data from industry analyses, this capability widens the pool of onchain liquidity, making financing more accessible. For instance, the trial involved institutions passing tokenized Treasurys as collateral without manual interventions, potentially cutting settlement times from days to seconds. Experts note that such efficiency could transform how banks and trading firms manage liquidity, with the network’s shared infrastructure ensuring privacy and compliance. Kelly Mathieson, chief business development officer at Digital Asset, the developer of the Canton Network, stated that this test forms part of a “thoughtful progression toward a new market model.” This structured approach highlights the network’s focus on scalability and interoperability in tokenized real-world assets.

Frequently Asked Questions

What Stablecoins Were Used in the Canton Network’s US Treasury Trial?

In the Canton Network’s latest US Treasury trial, multiple stablecoins were employed to finance positions against tokenized US Treasurys, expanding liquidity options beyond the single USDC used in the July pilot. This inclusion of various stablecoins, such as those from Circle and others, facilitates broader participation and enhances the efficiency of onchain transactions for institutional players.

How Is the Canton Network Advancing Tokenized Real-World Assets?

The Canton Network is leading advancements in tokenized real-world assets by providing a secure, privacy-focused blockchain for institutions, now representing over $370 billion in onchain value according to RWA.xyz data. Its migration of platforms like Franklin Templeton’s Benji Investments and recent funding from major players like BNY and Nasdaq underscore its growing role. This setup supports seamless tokenization of assets like US Treasurys, making institutional finance more efficient and interconnected.

Key Takeaways

- Expanded Stablecoin Integration: The trial’s use of multiple stablecoins broadens liquidity for financing tokenized US Treasurys, building on prior USDC-only pilots.

- Real-Time Efficiency: Instant collateral reuse eliminates traditional delays, enabling faster transactions across counterparties on the Canton Network.

- Market Leadership in RWAs: With over $370 billion in tokenized assets, the network outpaces competitors, signaling strong institutional adoption.

Conclusion

The Canton Network’s onchain US Treasury financing trial with multiple stablecoins and real-time collateral reuse of tokenized US Treasurys marks a pivotal evolution in institutional blockchain applications. By involving key players like Bank of America, Citadel Securities, and Tradeweb through the Canton Network’s Industry Working Group, this initiative demonstrates practical scalability and efficiency. As tokenized real-world assets continue to grow, with the network holding a dominant position per RWA.xyz metrics, future developments promise even greater integration of traditional finance with blockchain technology. Institutions looking to optimize liquidity should monitor these advancements closely for emerging opportunities.

Digital Asset and a group of financial institutions have completed a second round of onchain US Treasury financing on the Canton Network, introducing real-time collateral reuse and expanding the number of stablecoins involved. Five transactions were executed in the newest phase, building on the July pilot, which first demonstrated that US Treasurys and the USDC stablecoin could be combined to finance and settle transactions on the blockchain.

In the latest trial, the companies used multiple stablecoins to finance positions against tokenized US Treasurys, widening the pool of onchain liquidity available for financing transactions. The trial showed that tokenized US Treasurys could be passed between counterparties and reused as collateral in real-time, sidestepping the operational delays that typically accompany rehypothecation in traditional finance.

The effort brought together Bank of America, Citadel Securities, Cumberland DRW, Virtu Financial, Société Générale, Tradeweb, Circle, Brale and M1X Global, which are all a part of the Canton Network’s Industry Working Group. Kelly Mathieson, chief business development officer at Digital Asset — the company behind the Canton Network — said in a statement that the test was “part of a thoughtful progression toward a new market model.”

Justin Peterson, chief technology officer of Tradeweb, added that “demonstrating real-time collateral reuse and expanded stablecoin liquidity isn’t just a technical achievement — it’s a blueprint for what the future of institutional finance can look like.”

Canton Network Expands Footprint in Tokenized RWAs

The Canton Network, a layer-1 blockchain built for institutional finance, has been expanding its presence across the tokenization sector this year. On Dec. 4, its developer Digital Asset secured roughly $50 million in strategic backing from BNY, iCapital, Nasdaq and S&P Global. The new funding followed a $135 million raise earlier this year and is intended to support the network’s scaling efforts.

In October, asset manager Franklin Templeton said it would migrate its Benji Investments platform — which tokenizes shares of the firm’s flagship US money market fund — to the Canton Network. Data from RWA.xyz also shows the Canton Network now leads the market for tokenized real-world assets by a wide margin, with more than $370 billion represented onchain, far outpacing popular networks such as Ethereum, Polygon, Solana and other public chains.

Top blockchains for RWA. Source: RWA.xyz

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026