Cardano Faces Key Resistance at $1.20: Analyzing Potential Price Movements and Risks

ADA/USDT

$453,414,109.00

$0.2798 / $0.2686

Change: $0.0112 (4.17%)

-0.0031%

Shorts pay

Contents

-

Cardano (ADA) has seen a spectacular 264% surge in the last month, yet it now confronts significant resistance at the $1.20 mark, suggesting market saturation.

-

The high Market Value to Realized Value (MVRV) ratio indicates an increased likelihood of profit-taking, which further heightens the risk of a price pullback.

-

ADA’s trajectory hinges on overcoming the $1.20 barrier; a potential ascent to $1.50 is in sight, but failure to maintain this level could plunge prices back to $1.01 or lower.

This article explores Cardano’s recent price movements, the implications of its high MVRV ratio, and the crucial resistance levels that could shape its future.

Cardano Faces Critical Resistance at $1.20

Cardano (ADA) has made waves with a remarkable 264% increase in the past month, signaling a bullish momentum that has captured the attention of investors. However, at the intersection of this growth lies the critical resistance level of $1.20. Overcoming this price point is essential for Cardano to extend its rally and build a sustainable upward trend.

MVRV Ratio Highlights Risk of Pullback

The MVRV ratio for Cardano has surged to levels indicative of potential risk. Currently, this metric suggests that many investors are in profit and considering locking in gains. Historically, spikes in the MVRV ratio above a certain threshold—typically between 18% and 33%—have resulted in price corrections for ADA. With the current MVRV hovering above these levels, a consolidation period may be on the horizon.

According to data from Santiment, this trend speaks volumes about the potential short-term volatility that ADA holders might face as more investors may choose to take profits. The market will closely monitor how ADA manages this psychological threshold as it seeks to sustain its upward momentum amid these pressures.

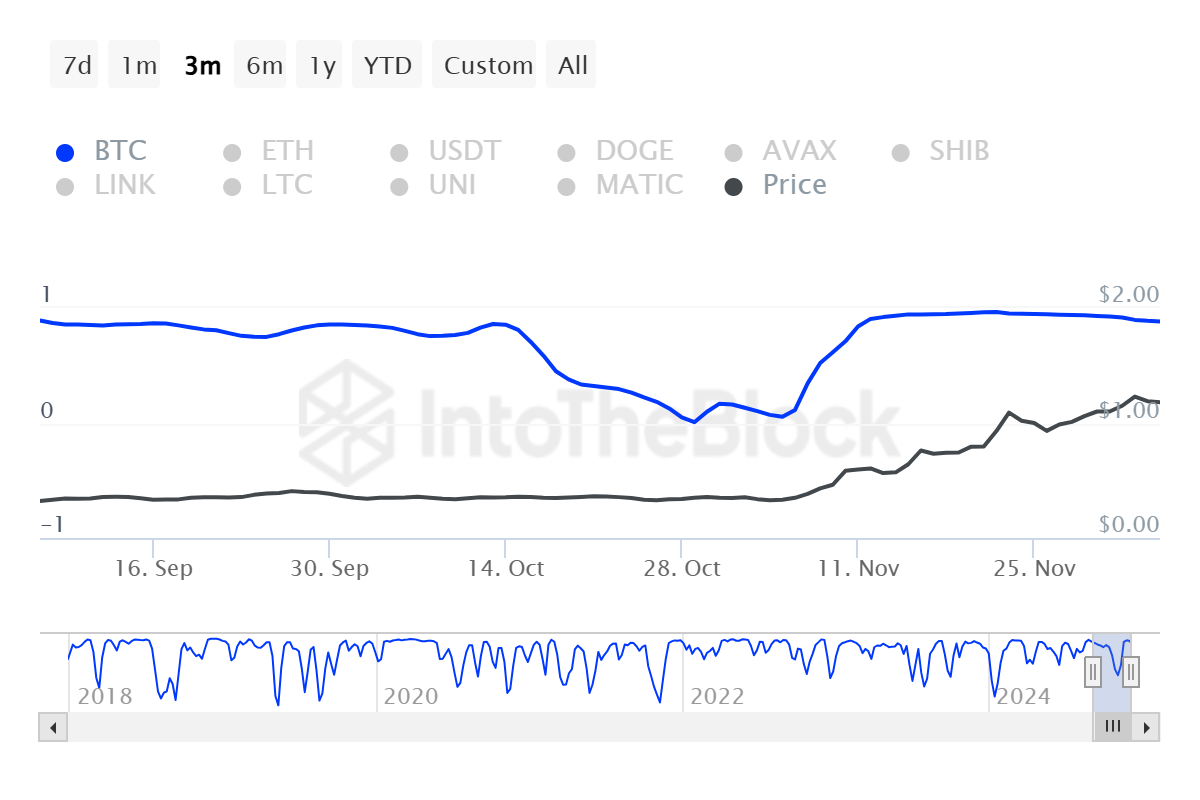

Correlation with Bitcoin: A Double-Edged Sword

The performance of ADA is not solely dependent on its internal dynamics; it is heavily influenced by the movements of the broader cryptocurrency market, especially Bitcoin (BTC). Currently, Cardano maintains a remarkable correlation coefficient of 0.88 with Bitcoin, indicating that ADA likely mirrors BTC’s price movements. This relationship could either bolster Cardano’s upward potential or exacerbate losses should Bitcoin experience a downturn.

As Bitcoin recently surpassed the crucial $100,000 landmark, this broader push could further elevate Cardano’s prospects. If Bitcoin maintains its bullish trajectory, Cardano may benefit significantly, enabling a successful breach of the $1.20 resistance.

ADA Price Forecast: Critical Levels to Watch

Looking ahead, the immediate future for Cardano hinges on its performance around the $1.20 level. A successful breakout above this resistance may pave the way for ADA to target the $1.50 milestone. Should the cryptocurrency hold $1.20 and reinforce this level as support, it would signal robust buying activity and further investor confidence.

Conversely, should ADA fail to maintain this critical support, it could descend towards the $1.01 support level, potentially ushering in a phase of consolidation that might hinder any immediate bullish developments.

Conclusion

In summary, Cardano’s breathtaking surge and currently contested price level serve as a focal point for both traders and investors. With its MVRV ratio indicating potential risks of profit-taking and a critical dependence on Bitcoin’s market dynamics, the next few days could be pivotal for ADA. Observers must closely monitor the $1.20 resistance as its future price action continues to unfold amidst these compelling dynamics.

Comments

Other Articles

Bitnomial XTZ Futures Trading: APT Technical Analysis

February 4, 2026 at 07:32 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

Bitcoin Bear Market Persists as 2–3 Month Consolidation Looms; Bull Run May Not Arrive Until After Christmas 2026 Amid AI-Driven Volatility

December 30, 2025 at 03:57 PM UTC