Cardano Struggles at $0.70: Can Long-Term Holders Prevent Further Declines?

ADA/USDT

$281,277,440.92

$0.2741 / $0.2571

Change: $0.0170 (6.61%)

+0.0071%

Longs pay

Contents

-

Cardano’s 27% drop this month signals a struggle for recovery amid declining investor engagement and low active addresses.

-

Despite the current downturn, intriguing signals like rising Mean Coin Age indicate that long-term holders are accumulating rather than liquidating.

-

Market analysts suggest that maintaining support at $0.70 is vital for preventing a deeper decline to $0.62, with $0.77 serving as a potential turnaround point.

Cardano’s recent decline reveals critical trends in investor behavior and network activity, highlighting key support levels for future price action.

Declining Engagement and Its Implications for Cardano (ADA)

Cardano has struggled significantly in the market, recording a 27% decline this month and marking the lowest price range it has seen in months. This downturn reflects a considerable weakening in investor confidence, leading to reduced participation in network activities.

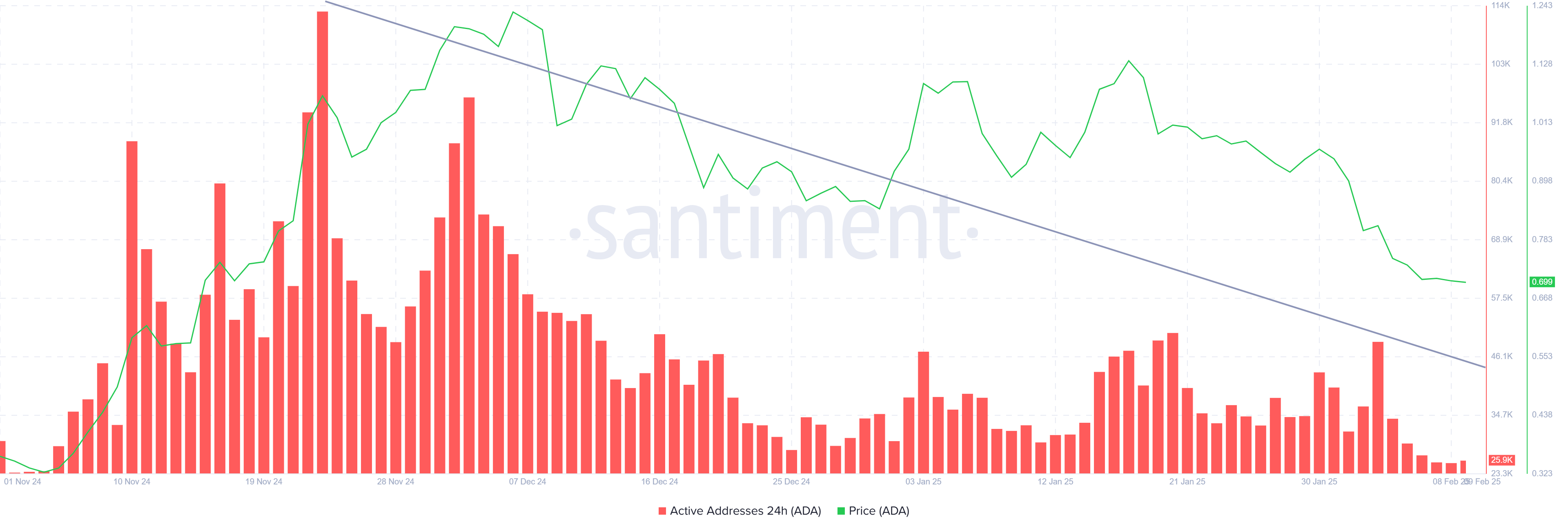

The ongoing decreased engagement is illustrated by the drop in the active address count, which has now reached a three-month low of 25,600. This metric not only indicates a lack of investor interest but also correlates with a notable reduction in transaction volumes across the blockchain ecosystem, further stifling ADA’s potential for a rebound.

If this trend continues without a significant increase in engagement, ADA may find itself pressured towards lower price zones in the immediate future.

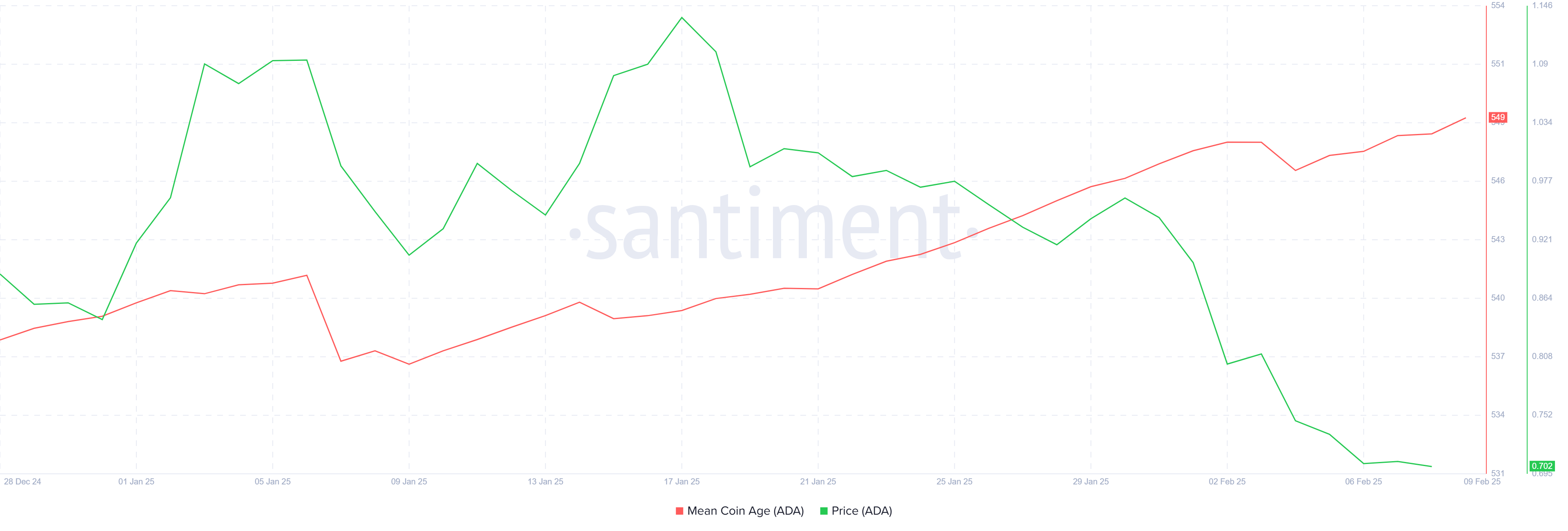

Amidst the price decline, the Mean Coin Age, an important metric that indicates the duration coins remain unspent in wallets, is on the rise. This suggests that while market sentiment is bearish, long-term holders are choosing to accumulate and hold their positions. Accumulating during periods of price decline is generally a strong indicator of confidence in the asset’s long-term potential.

This behavior from long-term holders could play a crucial role in stabilizing the price of ADA, preventing further selling pressure, and potentially facilitating a future recovery.

Bouncing Back: Potential Price Recovery for ADA

The current price of Cardano is teetering around the crucial support level of $0.70. This mark is significant as it is not only the previous support but also a pivotal point in the ongoing price action. An inability to maintain this level could trigger further declines towards $0.62, which would threaten the bullish scenario identified in the falling wedge pattern.

Conversely, if ADA can secure the $0.70 support and rally back towards $0.77, it could signify a positive shift in market sentiment. Successfully reclaiming this resistance level could instill renewed confidence among investors, paving the way for a potential reversal in the current downtrend.

Conclusion

In summary, while Cardano faces significant challenges due to the recent downturn and declining engagement metrics, there are also signs of resilience among long-term holders. As ADA navigates these turbulent waters, maintaining support at $0.70 will be critical for curtailing further declines. Investor interest and network activity are key to fostering recovery; hence, staying attentive to these metrics will be essential as the market landscape evolves.