Cardano’s Long-Cycle Consolidation Signals Potential Pre-2020 Breakout Echo

ADA/USDT

$402,465,613.06

$0.2796 / $0.2594

Change: $0.0202 (7.79%)

-0.0024%

Shorts pay

Contents

Cardano’s price action is mirroring the long-cycle consolidation seen before its 2020 breakout, characterized by structural compression, persistent positioning optimism, and historical cycle symmetry. This setup suggests potential upside targets of $4.88 to $5.50 if consolidation holds, driven by renewed demand rather than short-term catalysts.

-

Cardano exhibits seven-year cycle symmetry in its current compression phase.

-

Market positioning shows sustained long bias despite price declines to around $0.40.

-

Projected targets align with historical expansion math, including conservative zones at $4.88-$5.50 and primary at $10.40, based on prior cycle behavior.

Discover how Cardano’s price action echoes 2020 pre-breakout conditions with long-cycle consolidation and optimistic positioning. Explore targets up to $10.40—stay ahead in crypto with expert insights today! (148 characters)

What is Cardano’s Current Price Structure Indicating?

Cardano’s price action is currently framed by long-cycle consolidation, reflecting a multi-year corrective phase after the 2021 peak rather than outright trend reversal. This structure features lower highs within broad range containment, respecting key long-term trendlines that signal re-accumulation. Historical patterns indicate that such compression often precedes significant expansions, as seen before the 2020 breakout, with time symmetry aligning current conditions to similar preparatory stages.

Analysts observe that Cardano’s weekly chart reveals a repeating sequence of impulse advances followed by extended corrections. This behavior underscores volatility contraction as a precursor to future growth, separating structural health from temporary price weakness. With ADA trading near $0.4086, the focus remains on internal demand rebuilding amid declining volume engagement, which avoids climactic selling and supports cycle-based projections.

How Does Market Positioning Diverge from Cardano’s Price Trend?

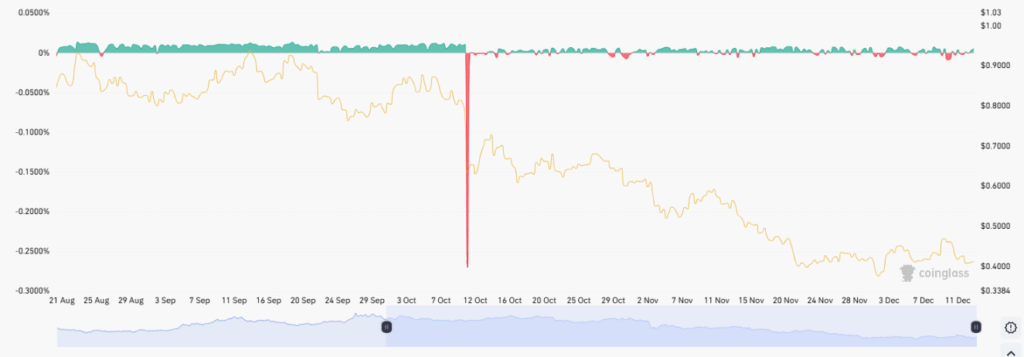

Cardano’s market positioning tells a story of resilience amid decline, with sustained long bias persisting even as prices fell from above $0.90 to around $0.40. Data from Coinglass indicates funding rates stayed neutral to slightly positive, showing limited trader capitulation and quick rebuilding of exposure post-selloffs. This misalignment highlights optimistic expectations that contrast with the methodical price correction, suggesting unresolved structural selling pressure rather than a complete sentiment reset.

During mid-October, a sharp funding shock pointed to forced deleveraging, but subsequent price stabilization efforts fell short, reinforcing ongoing distribution dynamics. Expert analysis, such as from Quantum Ascend, emphasizes this divergence as a key signal, mirroring pre-expansion setups where positioning optimism preceded structural breakouts. Short sentences highlight the data: Funding neutrality avoids panic; quick recovery builds confidence; yet price lag demands caution. These elements collectively demonstrate Cardano’s positioning as a bullish undercurrent beneath surface-level weakness.

Cardano price action reflects long-cycle consolidation as correlation, structure, and positioning echo conditions seen before the 2020 breakout.

- Cardano maintains long-term structural compression, reflecting seven-year cycle symmetry rather than short-term directional weakness.

- Persistent positioning optimism contrasts with declining price, signaling misaligned expectations and unresolved structural selling pressure.

- Projected upside zones align with historical expansion math, contingent on sustained consolidation and renewed internal demand strength.

Cardano continues trading through a prolonged corrective phase as market structure points toward long-cycle compression. Price behavior reflects separation between positioning and structure, reshaping expectations around timing rather than trend invalidation.

Long-Cycle Structure Frames Current Price Action

Cardano’s weekly chart outlines a repeating sequence of impulse advances followed by extended corrective consolidation phases. Historical price behavior shows expansion emerging after volatility contraction rather than momentum-driven continuation.

Following the 2021 peak, Cardano entered a multi-year correction marked by lower highs and broad range containment. This structure respected long-term trendlines, signaling re-accumulation rather than uncontrolled structural breakdown.

The seven-year cycle count places Cardano near a comparable temporal window to its prior expansion phase. Time symmetry remains central, suggesting consolidation serves structural preparation rather than directional failure.

Source: coinglass

Funding rates remained largely neutral to slightly positive, indicating limited capitulation throughout the decline. Even during selloffs, traders rebuilt exposure quickly, preventing durable sentiment resets.

A sharp funding shock in mid-October signaled forced deleveraging rather than discretionary selling pressure. Price stabilization afterward failed, reinforcing unresolved distribution rather than completed downside resolution.

What Are the Projected Targets for Cardano’s Upside?

Projections for Cardano’s price action draw from structural mathematics, not fleeting catalysts, with conservative targets at $4.88 to $5.50 based on measured moves from historical bases. Quantum Ascend’s analysis highlights the similarity to the 2020 pre-expansion phase, focusing on compression depth across time and trend dimensions. These levels serve as value retests within established cycles, avoiding speculative overreach.

$ADA | @Cardano_CF 📽️

Cardano Mirroring 2020 Blastoff Moment ⛽️

Altseason Targets 🎯

➤ Conservative: $4.88-$5.50

➤ Primary: $10.40 ✅

Here’s the 7-Year Count👇 pic.twitter.com/lBUiJuWwk1

— Quantum Ascend (@quantum_ascend) December 13, 2025

The primary target of $10.40 aligns with full-cycle expansion multiples from past advances, contingent on sustained consolidation and demand strength. Current trading at $0.4086 underscores ongoing compression, with volume trends showing reduced engagement that favors preparation over panic. This framework, rooted in seven-year cycle symmetry, positions Cardano for potential structural upside if historical patterns hold, as evidenced by prior breakouts following similar setups.

Broader market context reinforces this view: Cardano’s correlation with overall crypto cycles suggests that external factors, like Bitcoin’s performance, could catalyze resolution. However, internal metrics—such as on-chain activity and developer progress—remain vital. Reports from blockchain analytics firms indicate steady network growth, with transaction volumes stabilizing despite price pressure. Experts like those at Quantum Ascend stress that patience is key, as misalignment between positioning and price often resolves in favor of the former during cycle turns.

Funding data further supports this: Neutral rates imply balanced leverage, reducing downside risk from overextended shorts. Historical precedents show that such conditions preceded 2020’s surge by months, allowing for internal rebuilding. Cardano’s roadmap advancements, including smart contract enhancements, add fundamental weight, potentially amplifying technical projections. In essence, the trajectory hinges on cycle alignment, with structure dictating outcomes over noise.

Frequently Asked Questions

What makes Cardano’s current consolidation similar to 2020?

Cardano’s price action mirrors 2020 through long-cycle compression and time symmetry on the seven-year chart, with lower highs in a broad range signaling re-accumulation. Positioning optimism persists despite declines, echoing pre-breakout resilience, as noted in analyses from Quantum Ascend. This setup prepares for expansion rather than breakdown. (48 words)

Could Cardano reach $10.40 in the next cycle?

Yes, a primary target of $10.40 for Cardano aligns with historical expansion multiples from prior advances, assuming sustained consolidation and demand growth. This projection, based on structural math, sounds straightforward: If cycle symmetry holds like in 2020, renewed internal strength could drive prices there naturally during altseason. (52 words)

Key Takeaways

- Structural Compression Signals Preparation: Cardano’s multi-year correction respects trendlines, indicating re-accumulation akin to pre-2020 conditions.

- Positioning Optimism Persists: Neutral funding rates and quick exposure rebuilding show trader confidence despite price drops to $0.40.

- Cycle-Based Targets Guide Expectations: Aim for $4.88-$5.50 conservatively, with $10.40 as primary, contingent on historical math and demand renewal.

Conclusion

Cardano’s price action embodies long-cycle consolidation mirroring 2020’s breakout prelude, with market positioning divergence underscoring potential for structural upside. As seven-year symmetry aligns and targets like $4.88-$10.40 come into focus, investors should monitor internal demand for confirmation. Looking ahead, cycle progression promises renewed momentum—position yourself wisely in this evolving landscape.

Comments

Other Articles

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

Altcoins Stabilize Near Lows as Bitcoin Holds Highs Amid Volume Slump

December 30, 2025 at 09:04 AM UTC

Mike Novogratz Questions XRP and Cardano’s Survival in Evolving Crypto Market

December 29, 2025 at 11:01 AM UTC