CFTC Pilot Program Explores Bitcoin as Margin Collateral in Derivatives Markets

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The CFTC has launched a pilot program allowing futures commission merchants to use Bitcoin, Ether, and USDC as margin collateral in derivatives markets, with strict reporting requirements to ensure customer protection and regulatory oversight. This initiative integrates cryptocurrencies into traditional finance while maintaining robust safeguards.

-

CFTC’s pilot enables BTC, ETH, and USDC acceptance by FCMs for collateral, promoting crypto’s role in derivatives.

-

The program includes weekly reporting on holdings and issues to enhance monitoring and risk management.

-

Updated guidance covers tokenized assets like US Treasurys, with a withdrawn outdated advisory to foster innovation.

CFTC crypto collateral pilot program integrates Bitcoin, Ether, and USDC into derivatives markets. Learn how it protects assets, reduces risks, and boosts efficiency—explore the details now. (142 characters)

What is the CFTC Crypto Collateral Pilot Program?

The CFTC crypto collateral pilot program is an innovative initiative by the US Commodity Futures Trading Commission to test the integration of digital assets as margin collateral in regulated derivatives trading. Announced by acting chairman Caroline Pham, it permits futures commission merchants—firms that handle client futures trades—to accept Bitcoin (BTC), Ether (ETH), and USD Coin (USDC) for securing positions. This step addresses longstanding barriers to crypto adoption in traditional finance by establishing clear protocols for usage while prioritizing customer safety and oversight.

Collateral in derivatives markets functions as a security deposit, ensuring traders can offset potential losses from volatile positions. The pilot’s design reflects the CFTC’s commitment to balancing technological advancement with financial stability, allowing participants to experiment under supervised conditions. By focusing on major cryptocurrencies and a stablecoin, the program aims to streamline settlements and minimize frictions in high-volume trading environments.

The pilot program allows futures commission merchants to accept Bitcoin, Ether and USDC for margin collateral, provided strict reporting criteria are followed.

The US Commodity Futures Trading Commission has issued updated guidance for tokenized collateral in derivatives markets, paving the way for a pilot program to test how cryptocurrencies can be used as collateral in derivatives markets.

Collateral in derivatives markets serves as a security deposit, acting as a guarantee to ensure that a trader can cover any potential losses.

The digital asset pilot, announced by CFTC acting chairman Caroline Pham on Monday, will allow futures commission merchants (FCM) — a company that facilitates futures trades for clients — to accept Bitcoin (BTC), Ether (ETH) and Circle’s stablecoin USDC (USDC) for margin collateral.

The CFTC pilot is another step toward integrating crypto into regulated markets, and Circle CEO Heath Tarbert said it will also protect customers, reduce settlement frictions and assist with risk reduction.

Pham said in a statement that the pilot program also “establishes clear guardrails to protect customer assets and provides enhanced CFTC monitoring and reporting.”

As part of the pilot, participating FCMs will be subject to strict reporting criteria, which require weekly reports on total customer holdings and any significant issues that may affect the use of crypto as collateral.

Source: Caroline Pham

How Does the Updated CFTC Guidance Support Tokenized Assets?

The CFTC’s Market Participants Division, Division of Market Oversight, and Division of Clearing and Risk have released comprehensive updated guidance on employing tokenized assets as collateral for futures and swaps trading. This framework addresses key areas such as eligible tokenized real-world assets, including US Treasury money market funds, legal enforceability of these assets, and arrangements for segregation and control to prevent misuse.

According to data from regulatory filings, tokenized assets could represent up to 10% of global collateral markets by 2030, as estimated by industry analysts from Boston Consulting Group. The guidance provides much-needed clarity, enabling exchanges and brokers to incorporate digital assets beyond traditional securities like US Treasurys and money market funds. Pham emphasized in a public statement that this development “opens the door for more digital assets to be added as collateral,” fostering a more inclusive financial ecosystem.

Additionally, the Market Participants Division issued a no-action position regarding the application of specific requirements for using payment stablecoins as customer margin collateral and holding proprietary stablecoins in segregated accounts. This relieves certain compliance burdens, allowing firms to innovate without immediate regulatory penalties. A notable change is the withdrawal of Staff Advisory 20-34, previously limiting FCMs’ use of crypto collateral; it was deemed “outdated and no longer relevant” in light of legislative progress like the GENIUS Act, which promotes digital asset frameworks.

The pilot and guidance together create a structured pathway for crypto integration, with expert observers noting potential reductions in settlement times from days to near-instantaneous via blockchain technology. For instance, Circle’s stablecoin USDC, backed by reserves exceeding $30 billion as reported in Circle’s transparency audits, exemplifies the stability suitable for collateral purposes.

Updated CFTC Guidance for Tokenized Assets

The CFTC’s Market Participants Division, Division of Market Oversight, and Division of Clearing and Risk also issued updated guidance on the use of tokenized assets as collateral in the trading of futures and swaps.

The guidance covers tokenized real-world assets, including US Treasury’s money market funds, and topics such as eligible tokenized assets, legal enforceability, segregation and control arrangements.

Pham said in an X post on Monday that the “guidance provides regulatory clarity and opens the door for more digital assets to be added as collateral by exchanges and brokers, in addition to US Treasurys and money market funds.”

The Market Participants Division also issued a “no-action position” on specific requirements regarding the use of payment stablecoins as customer margin collateral and the holding of certain proprietary payment stablecoins in segregated customer accounts.

A CFTC Staff Advisory that restricted FCMs’ ability to accept crypto as customer collateral, Staff Advisory 20-34, was also withdrawn because it is “outdated and no longer relevant,” in part due to the GENIUS Act.

Crypto Execs Back CFTC Move

Several crypto executives applauded the move by the CFTC.

Katherine Kirkpatrick Bos, the general counsel at blockchain company StarkWare, said the use of “tokenized collateral in the derivatives markets is MASSIVE.”

Related: US regulators dismiss SEC-CFTC merger rumors, move to dispel crypto ‘FUD’

“Atomic settlement, transparency, automation, capital efficiency, savings. Feels abrupt but who recalls the tokenization summit in 2/24, a glimmer of hope in the darkness,” she said.

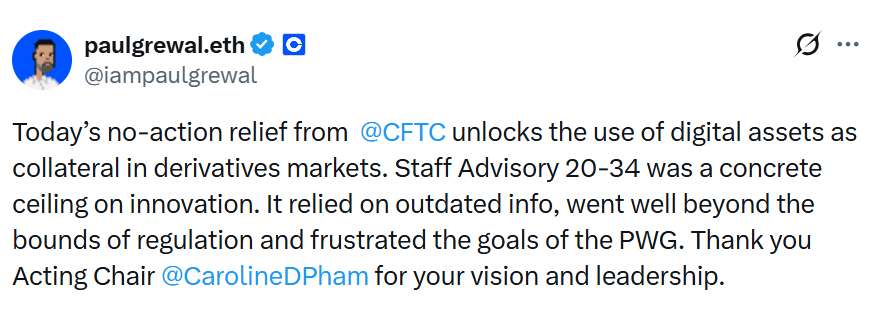

Coinbase chief legal officer Paul Grewal also supported the action, calling Staff Advisory 20-34 a “concrete ceiling on innovation.”

“It relied on outdated info, went well beyond the bounds of regulation and frustrated the goals of the PWG.”

Source: Paul Grewal

Salman Banaei, the general counsel at layer-1 blockchain the Plume Network, said it was a “major move” by the CFTC, and another push toward wider adoption.

“This is a step toward the use of onchain infra to automate settlement for the biggest asset class in the world: OTC derivatives, swaps,” he added.

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest, Nov. 30 – Dec. 6

Industry leaders view this pilot as a pivotal advancement, with projections from Deloitte indicating that tokenized collateral could unlock over $1 trillion in efficiency gains across derivatives markets. Quotes from executives like Tarbert highlight the dual benefits of protection and innovation, underscoring the CFTC’s role in bridging crypto and conventional finance.

Frequently Asked Questions

Can futures commission merchants use Bitcoin for margin in the CFTC pilot?

Yes, under the CFTC crypto collateral pilot program, futures commission merchants can accept Bitcoin as margin collateral, alongside Ether and USDC, as long as they adhere to weekly reporting on holdings and comply with segregation rules to safeguard customer funds.

What tokenized assets are eligible under the new CFTC guidance?

The updated CFTC guidance permits tokenized real-world assets like US Treasury money market funds and stablecoins for futures and swaps collateral, ensuring legal enforceability and proper control measures for seamless integration into trading activities.

Key Takeaways

- CFTC Pilot Enables Crypto Collateral: Allows BTC, ETH, and USDC use by FCMs, with rigorous reporting to monitor risks and protect assets.

- Guidance Boosts Tokenization: Covers enforceable tokenized assets, withdrawing outdated restrictions to promote innovation in derivatives markets.

- Industry Support Signals Growth: Executives praise the move for efficiency and adoption; consider exploring compliant platforms for derivatives trading.

Conclusion

The CFTC crypto collateral pilot program and updated guidance on tokenized assets mark a significant evolution in regulatory approaches to digital finance, enabling secure integration of cryptocurrencies like Bitcoin and Ether into derivatives collateral practices. By withdrawing restrictive advisories and introducing clear frameworks, the CFTC is fostering an environment where innovation can thrive alongside stability. As this pilot progresses, market participants should stay informed on reporting obligations and potential expansions, positioning themselves for opportunities in the tokenized future of global trading.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

ETH Remains the Largest Long Position Despite ~$39.4M Unrealized Losses, Led by BTC OG Insider Whale on Hyperliquid

December 31, 2025 at 02:36 AM UTC