Chainlink ETF Launch May Counter Declining On-Chain Activity and Price

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

+0.0007%

Longs pay

Contents

The Chainlink ETF, set to launch this week by Grayscale, represents a major step in bridging traditional finance with decentralized ecosystems. This spot ETF for LINK tokens could boost institutional demand and liquidity, potentially countering recent declines in on-chain activity and price, which have dropped amid broader market pressures.

-

Grayscale’s LINK Trust conversion to ETF gains SEC approval, enabling traditional investors to access Chainlink’s oracle services directly.

-

On-chain metrics reveal a 22% drop in Total Value Secured over three months, signaling reduced network utilization.

-

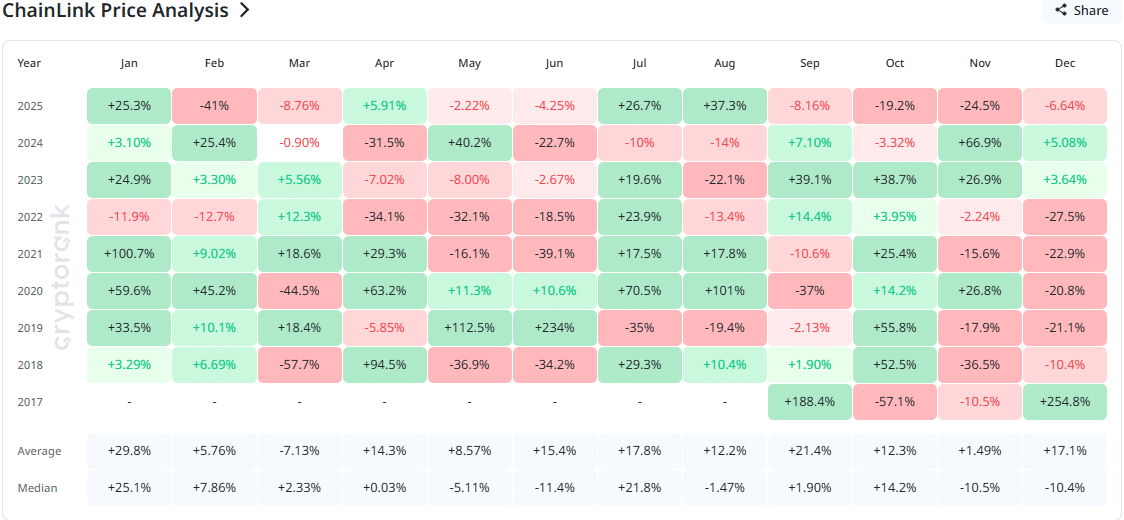

Historical data indicates LINK closes red in December over 60% of the time since 2017, though ETF hype may alter this trend.

Discover how the Chainlink ETF launch could revive LINK’s declining price and activity. Explore impacts, data, and forecasts in this in-depth analysis. Stay informed on crypto innovations today.

What is the Chainlink ETF and How Will It Impact LINK?

The Chainlink ETF is an exchange-traded fund designed to provide investors with exposure to Chainlink’s native LINK token without the need for direct cryptocurrency management. Grayscale’s planned launch this week, following an updated S-1 filing and SEC approval, converts its existing LINK Trust into a spot ETF. This development is poised to attract significant institutional capital, enhancing liquidity for the leading oracle network that connects traditional finance to blockchain applications.

Source: Nate Geraci

Why Is Chainlink’s On-Chain Activity Declining Despite ETF News?

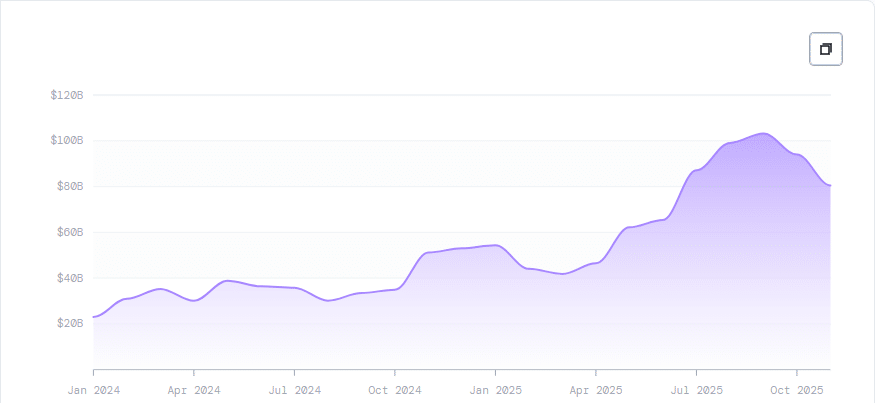

Chainlink’s on-chain activity has shown signs of weakness, with Total Value Secured (TVS) decreasing from $103.21 billion to $80.5 billion over the past three months, according to Chainlink Metrics. This metric, which encompasses values locked in smart contracts and oracles across the network, reflects reduced utilization amid broader market corrections. Nate Geraci, President of The ETF Store, highlighted in a recent post on X that the ETF could reverse this trend by drawing in new capital. However, current data from CoinRank indicates persistent challenges, as network deposits tied to oracle functions have not rebounded. Experts like those at Chainlink emphasize that while integration with traditional finance grows, short-term volatility persists due to macroeconomic factors. This decline aligns with a 10% price drop in recent sessions, breaking key support levels on hourly charts, as observed by TradingView analysts.

Source: Chainlink Metrics

Historical patterns further underscore potential risks for December. Since LINK’s debut in 2017, it has closed the month in negative territory more than 60% of the time, with only three green Decembers recorded. When November ends red—a scenario matching the current cycle—December has followed suit in all but Chainlink’s inaugural year. This seasonal weakness compounds the ongoing downward trajectory that began in September, where LINK has lost over 15% cumulatively.

Source: CoinRank

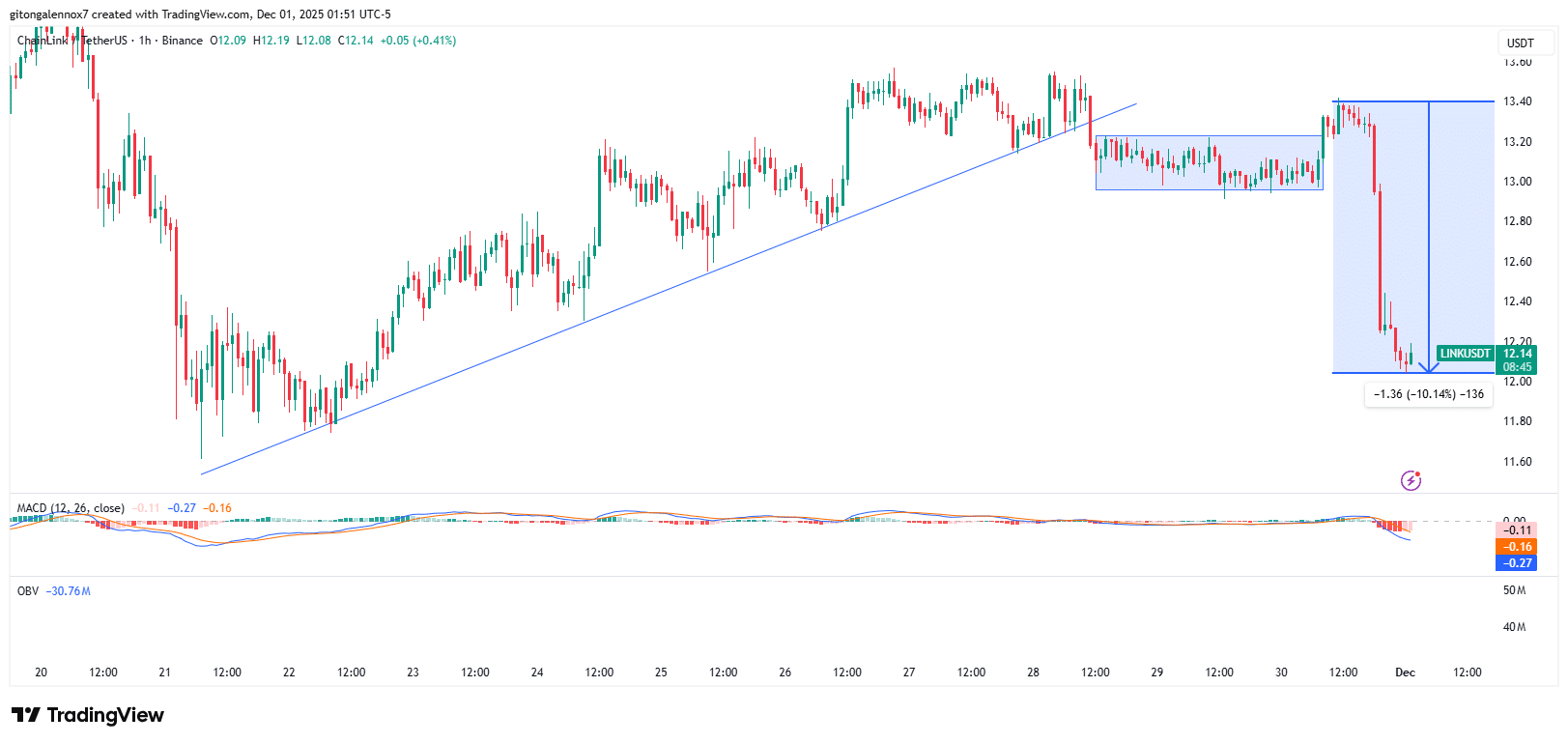

Technical indicators paint a bearish picture in the near term. On the 12-hour timeframe, LINK has breached an ascending trendline established since July 2024, following a 10% crash triggered by widespread liquidations in the crypto market. Analyst Ali from Ali Charts suggests a potential retest of the channel breakdown, forecasting a possible dip to $8 if momentum fails to reverse. Despite this, the impending ETF launch introduces a counterbalance. Grayscale’s move to debut the product this week could spark social media buzz and institutional inflows, mitigating the 6% monthly decline observed on the first trading day.

Source: TradingView

Chainlink’s role as the premier oracle platform remains unchallenged, powering secure data feeds for DeFi protocols and real-world asset tokenization. The ETF’s arrival aligns with growing adoption in traditional finance, where institutions seek regulated avenues to participate in blockchain innovation. While short-term pressures loom, long-term fundamentals—bolstered by partnerships and technological advancements—position LINK for resilience.

Frequently Asked Questions

What Does the Launch of the Chainlink ETF Mean for Investors?

The Chainlink ETF allows traditional investors to gain exposure to LINK through a familiar stock exchange product, approved by the SEC. This spot ETF tracks the token’s price directly, potentially increasing demand and liquidity. With Grayscale leading the conversion of its LINK Trust, experts anticipate inflows that could stabilize or elevate the asset amid current market volatility, based on historical ETF precedents like Bitcoin funds.

Will the Chainlink ETF Reverse LINK’s Recent Price Decline?

Hey there, if you’re wondering about the Chainlink ETF and its effect on LINK’s price, it’s looking promising for a turnaround. The launch this week from Grayscale could bring fresh institutional money into the mix, countering the recent 10% drop and seasonal December risks. Keep an eye on liquidity boosts, as they often lift prices in oracle networks like Chainlink.

Key Takeaways

- ETF Milestone: Grayscale’s Chainlink ETF debut this week marks a pivotal integration of traditional and decentralized finance, enhancing accessibility for institutional players.

- On-Chain Challenges: TVS has fallen 22% to $80.5 billion, highlighting reduced activity that the ETF may help revitalize through increased demand.

- Price Outlook: Despite historical red Decembers and technical breakdowns, ETF-driven buzz offers a pathway to mitigate further declines and support recovery.

Conclusion

As the Chainlink ETF prepares for its Wall Street debut, it stands to bridge gaps between traditional finance and the oracle network’s robust ecosystem. Amid declining on-chain activity and price pressures, this development could inject vital liquidity and optimism into LINK. Investors should monitor institutional adoption closely, as it may pave the way for sustained growth in decentralized applications throughout 2025 and beyond. Stay tuned for updates on how this ETF shapes the future of crypto oracles.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC