Chainlink Exchange Reserves Drop to Yearly Low Despite Ongoing Price Weakness

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

+0.0007%

Longs pay

Contents

Chainlink accumulation has intensified among whales, institutions, and retail investors, with exchange reserves dropping to a yearly low as over 44.98 million LINK tokens were withdrawn. Despite this bullish on-chain signal, the LINK price has declined to around $13.60 amid broader market pressures, highlighting a temporary disconnect between supply dynamics and market sentiment.

-

Exchange reserves for Chainlink reached their lowest point in a year, signaling strong accumulation and reduced selling pressure.

-

Institutional inflows into U.S. spot Chainlink ETFs have provided steady capital, yet failed to counteract the ongoing price downturn.

-

Trading volume for LINK plummeted by over 48% to $295.6 million in 24 hours, reflecting trader caution in a weak market environment.

Explore Chainlink accumulation trends: Exchange reserves hit yearly lows amid whale buying, but LINK price lags at $13.60. Discover on-chain insights and ETF flows driving future potential. Stay informed on crypto dynamics today.

What is Chainlink Accumulation and Why Does It Matter?

Chainlink accumulation refers to the increased holdings of LINK tokens by large investors, known as whales, alongside institutional and retail participants, which reduces available supply on exchanges and often precedes price recoveries. This process is evident from on-chain metrics showing substantial token withdrawals to self-custody wallets over the past year. Despite these positive developments, Chainlink’s price has not yet reflected the underlying strength, trading near $13.65 as of recent data, due to overriding market headwinds.

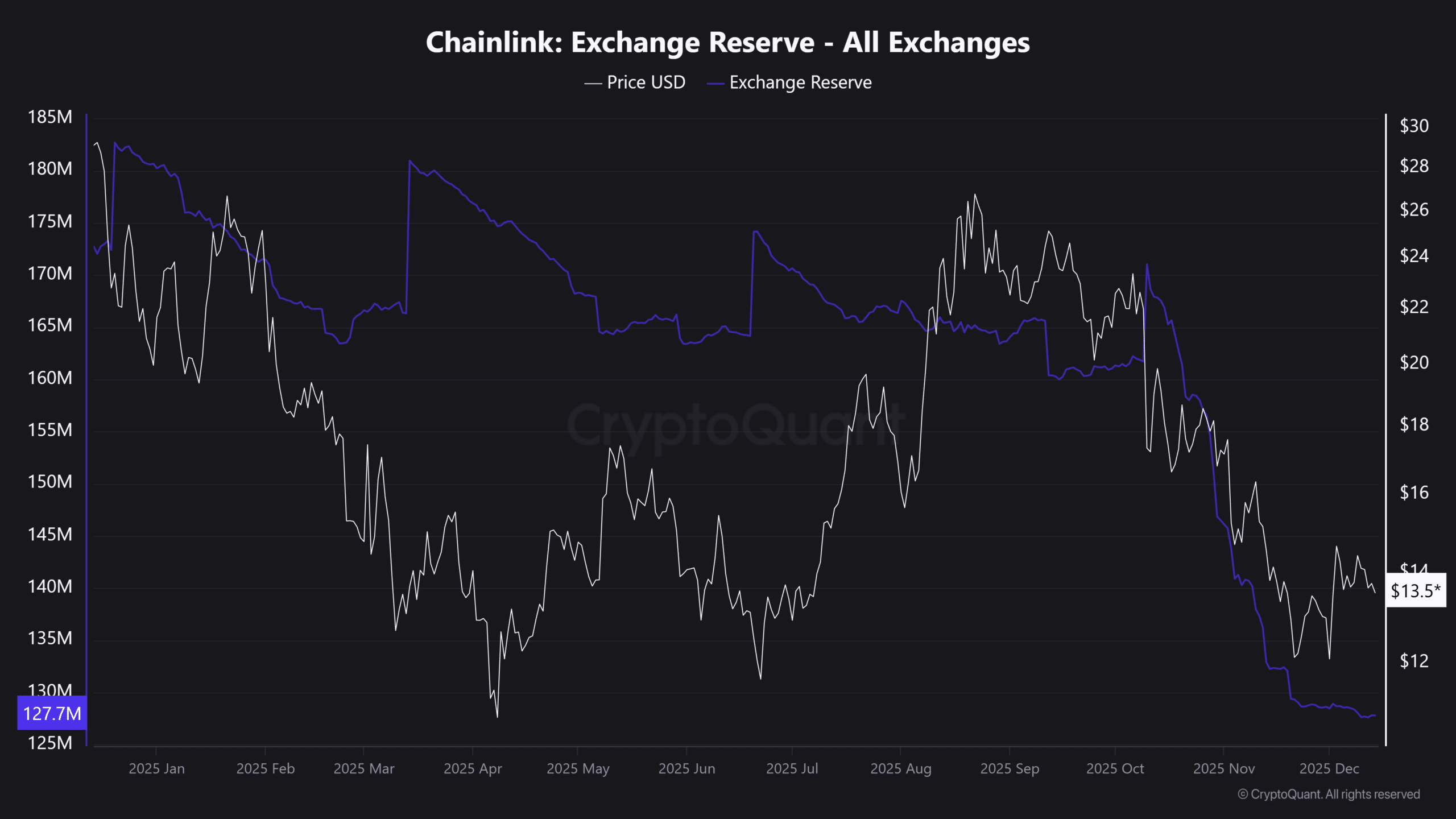

Chainlink, a decentralized oracle network essential for smart contracts, continues to attract attention in the cryptocurrency space. Its native token, LINK, facilitates secure data feeds across blockchain ecosystems. Recent on-chain data from CryptoQuant indicates a notable decline in exchange reserves, dropping by over 44.98 million LINK tokens in the last 12 months. This movement suggests investors are securing their assets outside centralized platforms, a classic sign of long-term confidence.

In the cryptocurrency market, such accumulation patterns typically alleviate sell-side pressure, as fewer tokens remain available for immediate trading. However, the broader market’s persistent weakness has overshadowed this bullish indicator. LINK’s price has slid from nearly $29 to approximately $13.60 during the same timeframe, prompting analysts to scrutinize the factors at play.

Source: CryptoQuant

This divergence raises questions about the effectiveness of accumulation in isolation. Market participants often view declining reserves as a precursor to upward momentum, but external factors like overall crypto sentiment and macroeconomic influences can delay price responses. Experts from platforms like CryptoQuant emphasize that sustained accumulation builds a foundation for resilience, even if short-term volatility persists.

How Are Chainlink Exchange Reserves Impacting Price Trends?

Chainlink exchange reserves have reached their lowest levels in a year, underscoring a shift toward long-term holding strategies. Data from CryptoQuant reveals that this reduction correlates with heightened whale activity, where large holders transfer tokens off exchanges to private wallets. Such behavior minimizes liquidation risks and signals conviction in Chainlink’s utility within DeFi and oracle services.

Supporting this, the total reserves now stand at a multi-month low, with withdrawals totaling over 44.98 million LINK. This statistic aligns with historical patterns observed in other major cryptocurrencies, where reserve drops of 20-30% have preceded rallies of up to 50% in subsequent quarters, according to on-chain analytics firms. Chainlink’s role in bridging real-world data to blockchains adds to its appeal, as adoption in sectors like insurance and supply chain grows.

Yet, the price has not mirrored this optimism. From a peak near $29, LINK has depreciated to $13.60, a decline of over 53%. This lag is attributed to synchronized market downturns, including reduced liquidity since mid-October. Short sentences highlight the key tension: accumulation builds supply scarcity, but demand falters in bearish conditions. Expert commentary from blockchain analysts notes that patience is required, as on-chain metrics often lead price action by weeks or months.

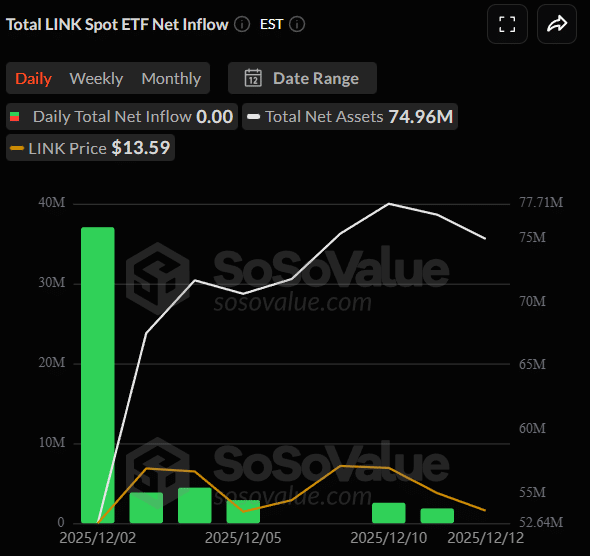

Institutional involvement further bolsters the case. U.S. spot Chainlink exchange-traded funds (ETFs), launched on December 2, have seen consistent inflows as reported by SoSoValue. These products allow traditional investors to gain exposure without direct wallet management, injecting fresh capital into the ecosystem. Inflows since inception total several million dollars, providing a counterbalance to retail selling pressure.

Source: SoSoValue

Despite these inflows, LINK’s trajectory remains downward, trading at $13.65 with a 2.25% drop in the last 24 hours. This persistence in weakness mirrors the crypto market’s stagnation post-October 10, where Bitcoin and Ethereum also faced resistance. Volume metrics paint a clearer picture of subdued interest.

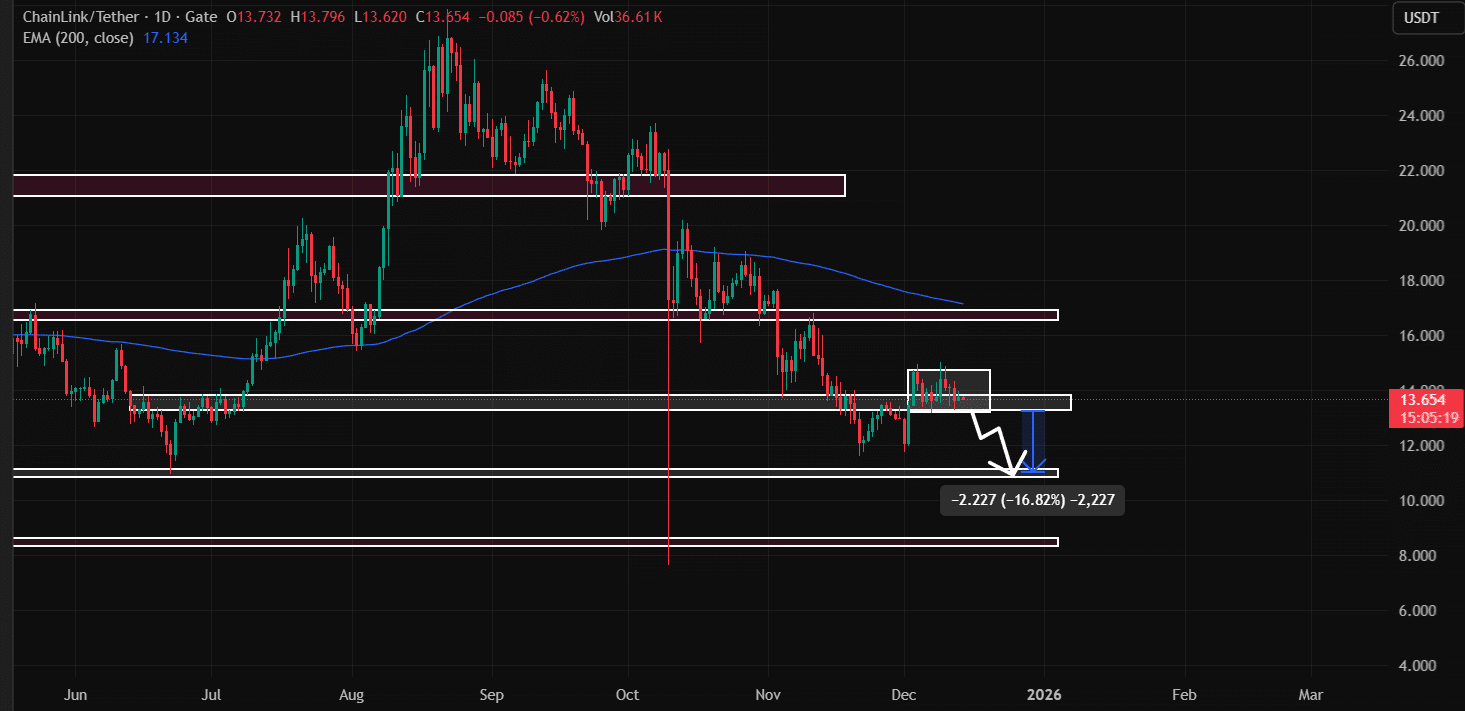

Spot trading volume for LINK has contracted by more than 48%, settling at $295.6 million over the recent day. This sharp decline indicates waning participation, as traders adopt a wait-and-see approach amid uncertainty. Lower volumes exacerbate price swings, making it harder for accumulation signals to translate into gains. On the daily chart, LINK oscillates within a $13.19 to $14.70 range established since early December, currently testing the lower end near $13.20.

Source: TradingView

The $13.20 level serves as critical support. Breaching it could lead to a 16% further drop, based on prior chart structures, with scant support below until lower historical lows. Technical indicators reinforce caution: the Average Directional Index (ADX) registers 20.91, below the 25 threshold that denotes a strong trend, suggesting sideways or mild bearish momentum.

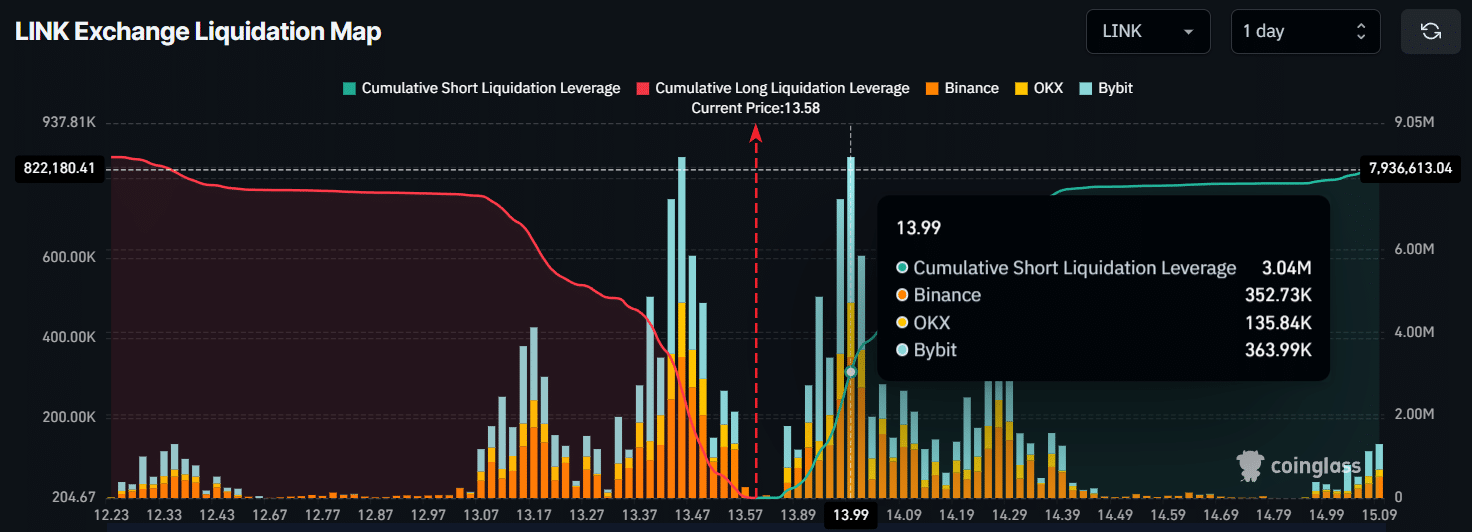

Trader positioning adds another layer. Data from CoinGlass shows elevated leverage at key levels: $2.01 million in long positions at $13.45 and $3.04 million in shorts at $13.99. This imbalance tilts toward bearish bets, aligning with market caution.

Source: CoinGlass

Overall, while short-term sentiment favors bears, the combination of reserve depletion and ETF support points to underlying accumulation. This mixed landscape requires monitoring broader crypto recovery signals for clearer direction.

Frequently Asked Questions

What Causes Chainlink Accumulation During Market Downturns?

Chainlink accumulation during downturns stems from investors recognizing its core utility in oracle networks for DeFi applications. Whales and institutions view dips as buying opportunities, withdrawing over 44.98 million LINK from exchanges in the past year per CryptoQuant data, betting on long-term growth amid temporary weakness.

How Might U.S. Spot Chainlink ETFs Influence LINK Price?

U.S. spot Chainlink ETFs, launched December 2, are drawing institutional capital through steady inflows, as tracked by SoSoValue. This increases demand for underlying LINK tokens, potentially stabilizing prices over time, though current market pressures have delayed immediate impacts for voice searches on investment trends.

Key Takeaways

- Declining Exchange Reserves: Chainlink’s reserves at a yearly low indicate strong accumulation, reducing sell pressure and supporting future upside.

- Institutional Inflows: ETF investments since early December add legitimacy and capital, countering retail caution in a low-volume environment.

- Monitor Support Levels: Watch $13.20 for potential breakdowns; a hold could signal reversal amid weak ADX readings.

Conclusion

In summary, Chainlink accumulation through lowered exchange reserves and ETF inflows demonstrates resilient investor interest despite the LINK price hovering at $13.65 in a challenging market. As on-chain data from sources like CryptoQuant continues to show positive shifts, the network’s foundational role in blockchain interoperability positions it for eventual recovery. Investors should track volume resurgence and support tests closely, preparing for opportunities as broader sentiment evolves toward positivity in the coming months.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC