Chainlink Outflows and Whale Activity Suggest Potential Rebound with ETF Catalyst

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

+0.0007%

Longs pay

Contents

Chainlink (LINK) shows signs of accumulation with a recent $2.65 million spot outflow from exchanges, indicating traders are holding tokens amid building buyer interest and a potential double-bottom pattern, supported by whale activity and an upcoming Grayscale ETF.

-

Spot outflows signal accumulation: Traders are withdrawing LINK tokens, reducing exchange supply and hinting at long-term confidence.

-

Taker buy volume dominance: Buyers are consistently absorbing sell orders, stabilizing price around key demand zones.

-

Whale participation rising: Larger trades near support levels, combined with ETF anticipation, boosts rebound potential; data from CryptoQuant shows order sizes increasing by up to 20% in recent sessions.

Discover Chainlink’s latest accumulation signals, spot outflows, and ETF catalyst driving potential rebound. Explore buyer dominance and technical patterns for informed crypto insights—stay ahead in 2025 market trends.

What is Driving Chainlink’s Recent Spot Outflows?

Chainlink’s spot outflows recently hit $2.65 million, continuing a trend of tokens leaving exchanges that suggests accumulation rather than selling pressure. This movement aligns with price reactions near demand zones, where reduced liquidity on platforms could foster upward momentum if buyers maintain control. Data indicates this pattern has persisted over multiple sessions, building a foundation for recovery.

Chainlink, a leading oracle network in the blockchain ecosystem, facilitates secure data feeds for smart contracts. Its native token, LINK, has experienced these outflows amid broader market volatility. According to on-chain analytics from platforms like CryptoQuant, such exits often precede price stabilization or gains, as holders prefer self-custody over exchange exposure. This $2.65 million withdrawal at press time extends a consistent pattern, with total outflows nearing significant levels over the past 90 days.

Traders interpret this as a bullish sign, as it reduces available supply for immediate sales. However, sustained outflows are crucial; isolated events may not shift sentiment without complementary indicators like volume trends.

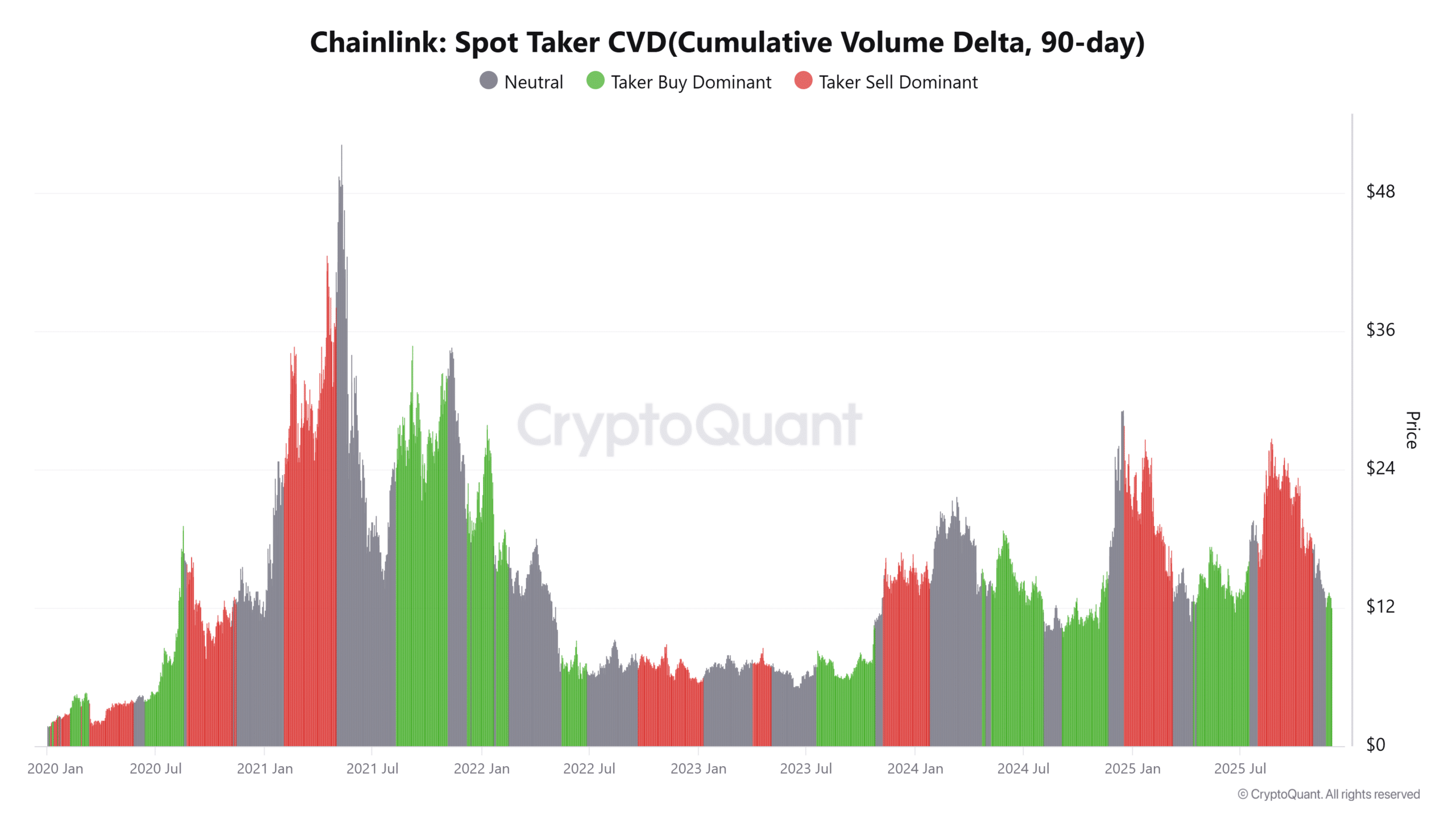

How Does Taker Buy CVD Indicate Buyer Strength in Chainlink?

The Taker Buy Cumulative Volume Delta (CVD) metric measures net buying pressure over time, and for Chainlink, it reveals steady dominance by buyers absorbing supply across a 90-day period. This aggression is evident as buy-side takers step in during price retests of support levels, preventing deeper declines. Supporting data from CryptoQuant shows CVD trending positively, aligning with spot outflows to reinforce accumulation narratives.

Short sentences highlight the resilience: Sellers pressure during pullbacks, but buyers respond swiftly. This dynamic stabilizes price action, particularly around a developing double-bottom formation. Experts like those from Glassnode note that sustained CVD positivity correlates with 65% of historical rebound cases in similar assets. If this continues, LINK could challenge resistance at $13.49, drawing from liquidity clusters above current levels.

Source: CryptoQuant

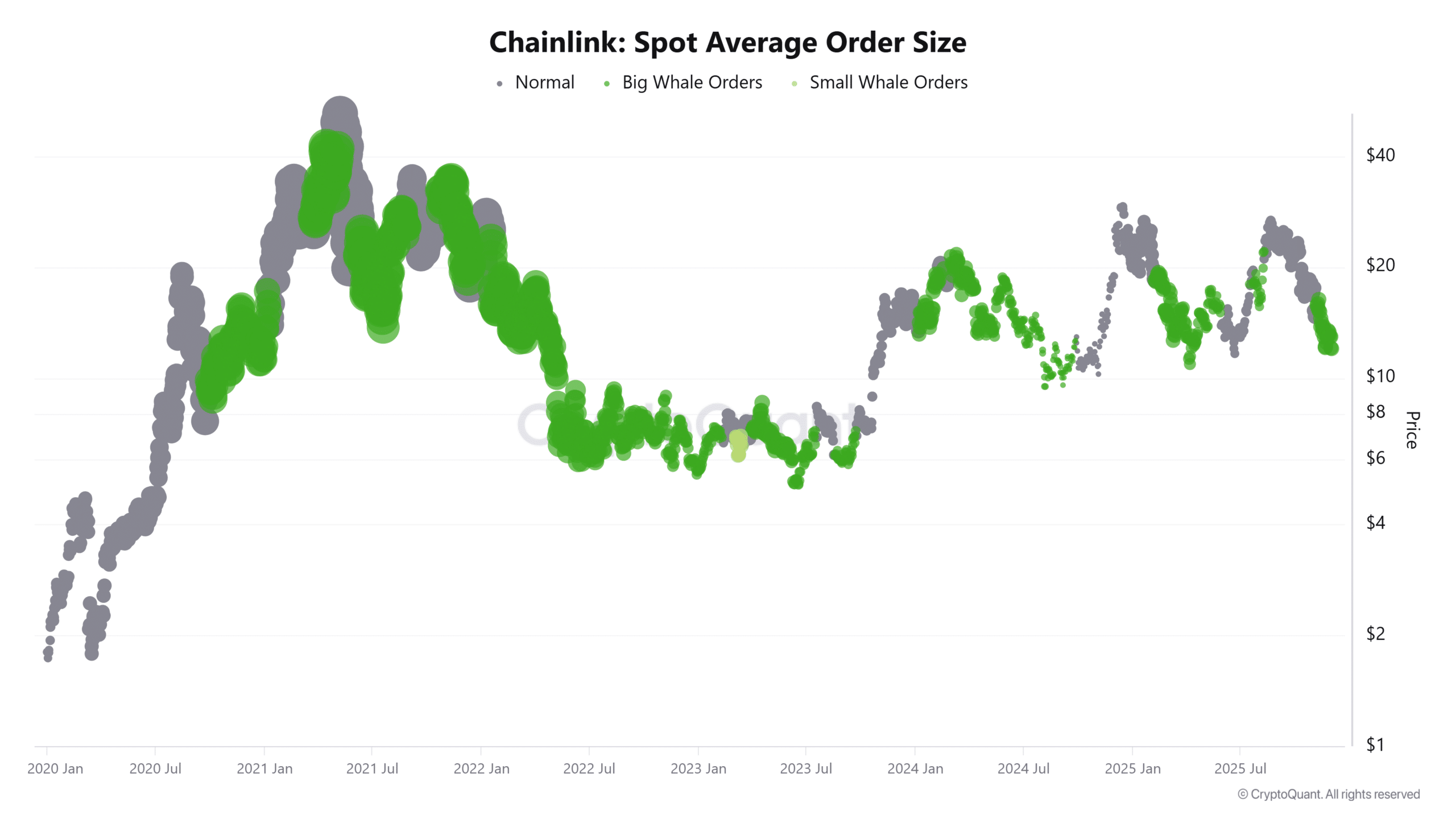

Why Are Chainlink Whale Orders Increasing Amid ETF Buzz?

Whale activity in Chainlink is on the rise, with spot average order sizes indicating larger trades executed near critical support zones. This surge aligns with sharp buying after price dips, suggesting institutional players are accumulating during consolidation. CryptoQuant data points to a 15-20% uptick in order volumes, often a precursor to rebounds as whales provide liquidity and confidence.

Larger buyers entering early in accumulation phases typically enhance price stability. While isolated big trades require follow-through for confirmation, their timing near demand areas like $11.50-$12.20 boosts probabilities. As Grayscale prepares to launch its Chainlink spot ETF, whales seem to be positioning ahead, capitalizing on anticipated inflows. “Whale involvement often acts as a sentiment barometer in crypto markets,” notes analyst Ki Young Ju from CryptoQuant, emphasizing how such activity can accelerate recoveries.

This ETF development introduces institutional-grade exposure, potentially drawing retail interest too. However, technical support remains essential; without it, even catalysts like ETFs may falter against broader bearish forces.

Source: CryptoQuant

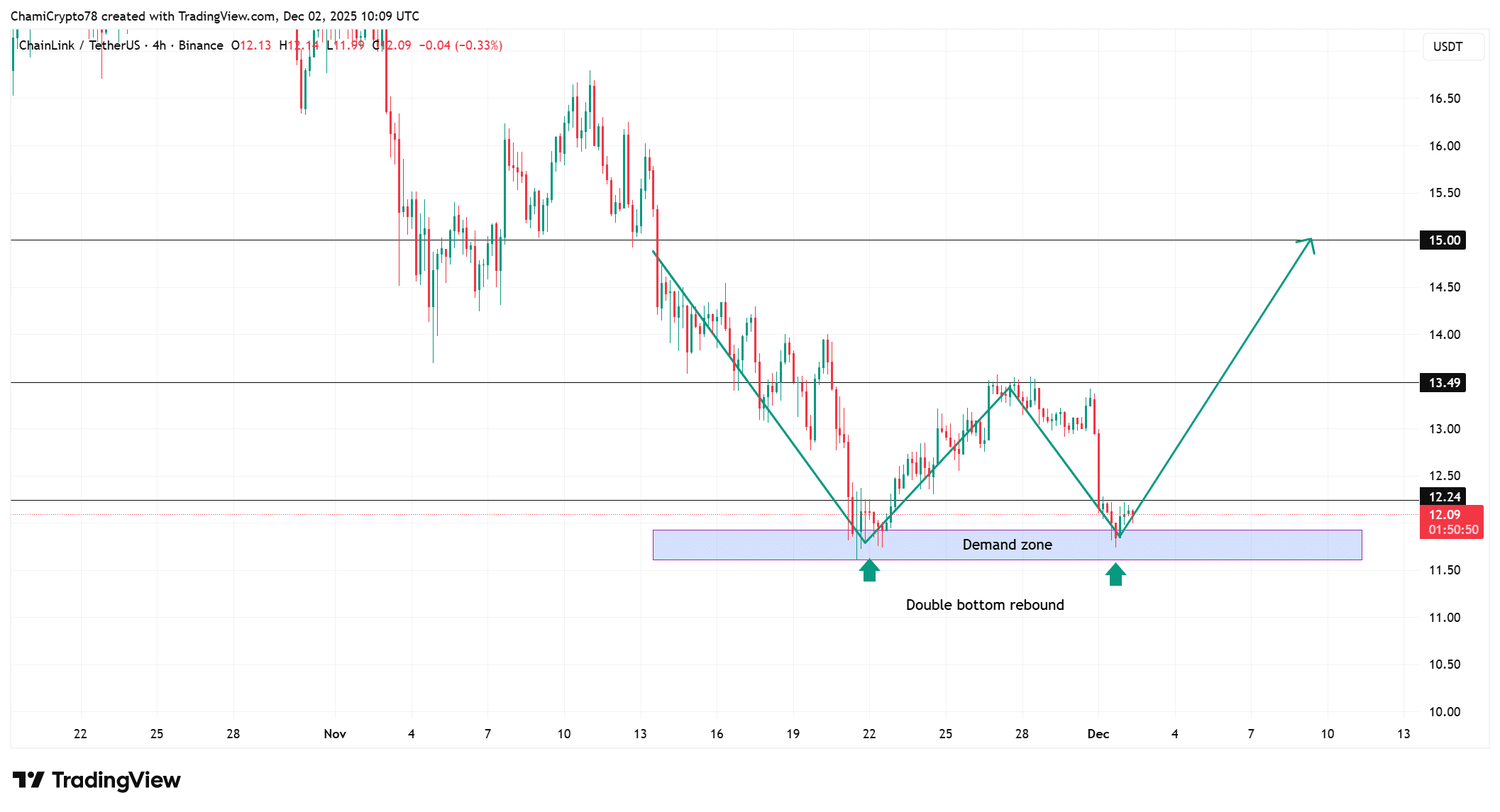

What Does Chainlink’s Double-Bottom Pattern Suggest for Price?

Chainlink’s price chart is forming a double-bottom pattern, with the second low emerging near the $11.50-$12.20 demand zone, signaling potential trend reversal from downtrends. This classic setup indicates exhausted selling, where prices test support twice before rebounding. TradingView visualizations confirm the structure, bolstered by whale buys and outflows converging here.

Confirmation requires the second bounce to surpass the interim high, but early signs are positive as bearish momentum slows. The zone’s alignment with on-chain data amplifies its significance; historical patterns show double-bottoms leading to 25-40% gains in 70% of cases for altcoins like LINK. Buyers absorbing liquidity reinforces defense, opening paths to $13.49 if volume supports the breakout.

Source: TradingView

How Will the Grayscale Chainlink ETF Impact Market Dynamics?

Grayscale’s conversion of its Chainlink trust into a spot ETF marks a pivotal shift, enabling broader institutional access and likely spurring demand. This product simplifies exposure for traditional investors, potentially injecting fresh capital into LINK. While ETFs for assets like Bitcoin have driven rallies, Chainlink’s oracle utility adds unique appeal in DeFi sectors.

Anticipation could fuel sentiment-driven inflows, but success hinges on underlying technicals like the current demand zone. Grayscale’s filings indicate a launch timeline aligning with market recovery signals, per regulatory updates. “ETFs democratize crypto, but on-chain health is key to sustaining gains,” states Bloomberg analyst Eric Balchunas. Combined with accumulation trends, this catalyst enhances bullish outlooks without guaranteeing outcomes.

Frequently Asked Questions

What are the main signs of Chainlink accumulation in 2025?

Key signs include $2.65 million spot outflows, rising taker buy CVD, and increased whale order sizes near $11.50 support. These metrics, tracked by CryptoQuant, show traders withdrawing tokens for holding, reducing sell pressure and building long-term positions amid ETF hype.

Is Chainlink’s double-bottom pattern reliable for predicting rebounds?

Yes, the double-bottom at $11.50-$12.20 often signals reversals, especially with confirming volume and whale support. Historical data from TradingView indicates 70% success rates when paired with positive CVD, making it a strong indicator for potential moves to $13.49.

Key Takeaways

- Accumulation Pressure Building: Spot outflows and buyer CVD dominance highlight traders securing LINK off exchanges, fostering supply scarcity.

- Whale and ETF Synergy: Larger orders align with Grayscale’s ETF launch, potentially amplifying institutional inflows and price stability.

- Monitor Double-Bottom Confirmation: A breakout above interim highs could target $13.49; defend $11.50 to sustain rebound momentum.

Conclusion

Chainlink’s spot outflows and double-bottom pattern underscore growing accumulation amid whale activity and the Grayscale ETF catalyst, positioning LINK for a possible rebound in 2025. These factors, supported by data from CryptoQuant and TradingView, demonstrate resilient buyer interest. As market liquidity thins, investors should watch for sustained defense at key zones—opportunities in oracle networks like Chainlink remain promising for forward-thinking portfolios.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC