Chainlink Price Consolidates Amid Strong Fundamentals and ETF Inflows

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

+0.0007%

Longs pay

Contents

Chainlink price analysis reveals resilience in LINK despite trading at $12.79 on December 16, 2025, supported by strong ETF inflows, high development activity, and limited selling pressure, indicating potential consolidation above key support levels.

-

Chainlink price holds above ascending support amid volatile market conditions, avoiding a decisive breakdown.

-

ETF flows for LINK remain positive with no outflows since launch, showing sustained investor interest.

-

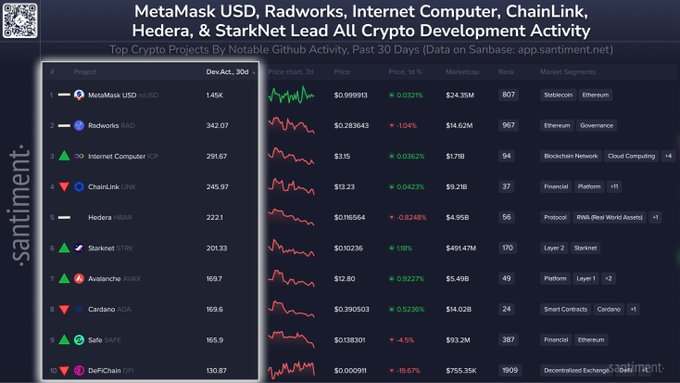

Development activity ranks Chainlink in the top 4 crypto projects over the past 30 days, per Santiment data.

Discover the latest Chainlink price analysis for December 2025, highlighting LINK’s fundamentals amid market choppiness. Explore resilience factors and key indicators—stay informed on crypto trends today.

What is the Current Chainlink Price Analysis Indicating?

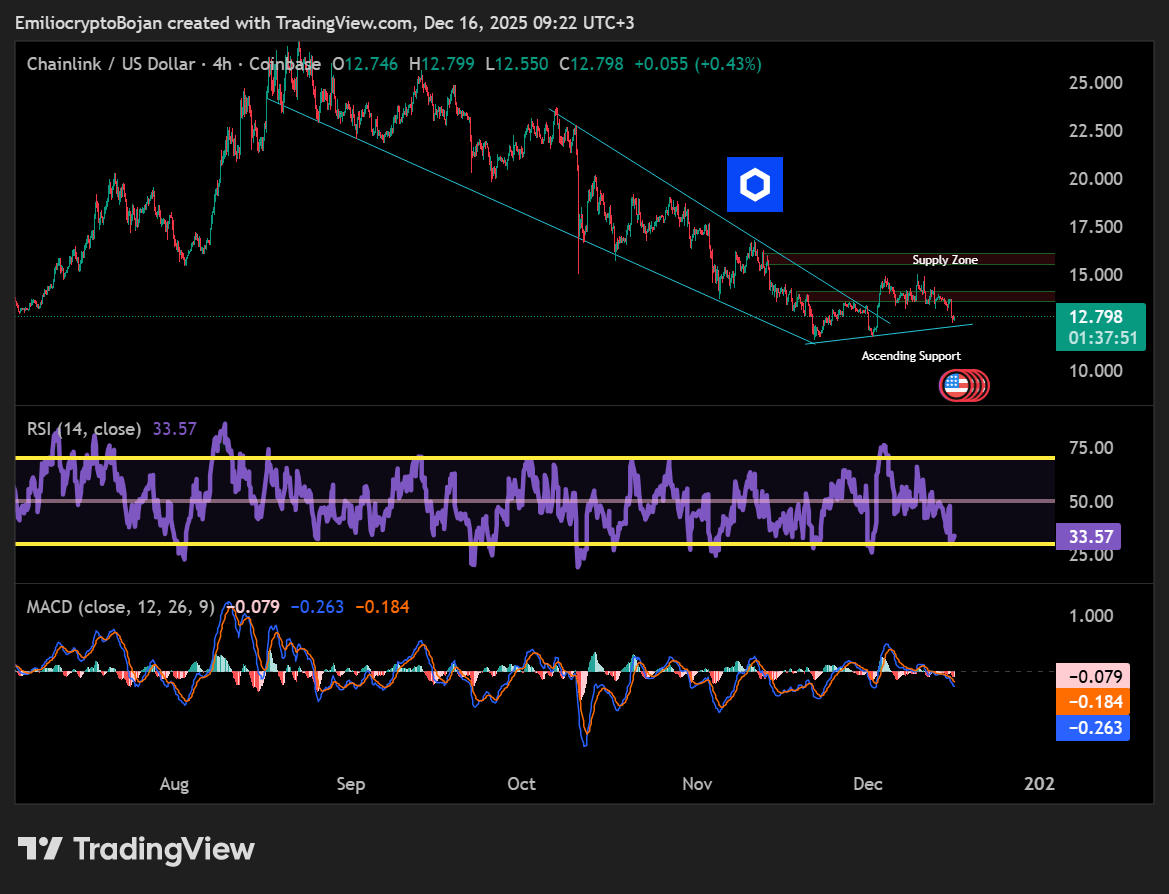

Chainlink price analysis as of December 16, 2025, shows LINK trading near $12.79 after a failed breakout from a falling wedge pattern, yet maintaining position above ascending support for potential consolidation. Momentum indicators like RSI at 33.57 suggest caution but align with historical local bottoms, while MACD indicates subdued directional strength. This setup points to market indecision rather than a sharp decline.

How Do Liquidity Clusters Affect Chainlink’s Short-Term Outlook?

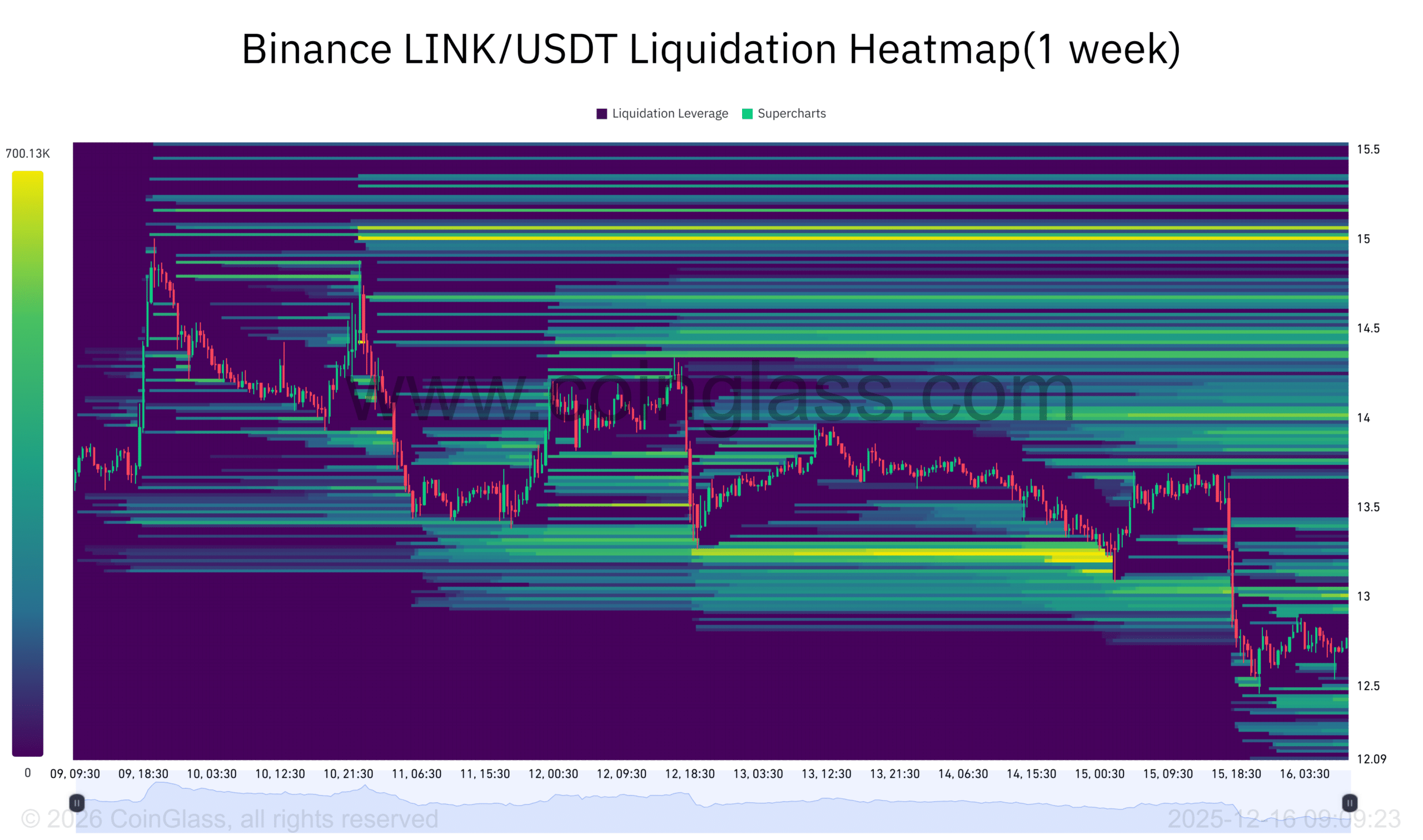

Liquidation heatmaps from CoinGlass reveal dense liquidity clusters above the $15 level for Chainlink, which have historically triggered price reactions during compression phases. Below the current price, liquidity is thinner, implying limited forced selling pressure and reducing the likelihood of immediate downside acceleration. At press time, no breach of ascending support had occurred, supporting a scenario of stabilization. Experts from TradingView note that such imbalances often precede sideways movement rather than continued bearish trends, with data showing previous instances where similar setups led to 10-15% recoveries within weeks. Chainlink’s oracle network continues to underpin DeFi applications, with over 2,000 integrations reported, bolstering its utility despite price volatility.

Source: TradingView

In broader context, Chainlink’s role in providing secure data feeds to smart contracts remains critical, as evidenced by recent partnerships with financial institutions. According to reports from blockchain analytics firms, transaction volume on the network has increased by 25% quarter-over-quarter, reflecting growing adoption in real-world asset tokenization. This fundamental strength contrasts with short-term price weakness, a pattern observed in resilient altcoins during market corrections.

Frequently Asked Questions

What Factors Are Supporting Chainlink Price in December 2025?

Chainlink price in December 2025 benefits from positive ETF inflows, with SoSoValue data indicating no outflows since inception, alongside top-tier development activity per Santiment. These elements highlight sustained capital interest and contributor commitment, helping LINK hold above $12 support amid volatility.

Is Chainlink a Good Investment During Market Volatility?

During market volatility, Chainlink demonstrates resilience through strong fundamentals like high network usage and oracle integrations. Investors should consider its ranking in development metrics and positive liquidity signals, but always assess personal risk tolerance as crypto prices can fluctuate rapidly.

Source: CoinGlass

Source: SosoValue

Key Takeaways

- Price Consolidation: LINK’s position above ascending support signals potential stabilization despite rejection from resistance.

- Positive ETF Inflows: Continuous inflows without outflows underscore investor confidence in Chainlink’s long-term value.

- Strong Development Activity: Ranking in the top 4 projects highlights ongoing innovation and network growth.

Source: Santiment on X

Conclusion

This Chainlink price analysis underscores a divergence between short-term weakness and robust fundamentals, with ETF flows and development metrics providing a solid base. As liquidity clusters above $15 suggest reactions ahead, investors may anticipate consolidation or upside potential. Stay tuned for evolving market dynamics to make informed decisions in the crypto space.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC