Chainlink Price Holds Key Support Amid Whale Outflows and Consolidation Signals

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

+0.0007%

Longs pay

Contents

Chainlink’s LINK price is holding steady at approximately $12.5, reflecting market consolidation amid whale accumulations and a 2.43% rise in Total Value Secured to $46.03 billion, signaling potential for sustained on-chain activity despite short-term bearish indicators.

-

Chainlink broke out of a falling wedge pattern, shifting to consolidation but lacking strong follow-through buying.

-

Whale withdrawals from Binance totaled over 445,000 LINK worth $5.57 million in late December, indicating accumulation.

-

Exchange outflows mirror historical patterns from 2019-2020 and 2022-2023, preceding major rallies, with current TVS at $46.03 billion up 2.43% monthly.

Discover Chainlink price analysis: LINK consolidates at $12.5 with whale activity signaling accumulation. Explore support levels and future outlook for informed crypto decisions today.

What is the Current Chainlink Price Outlook?

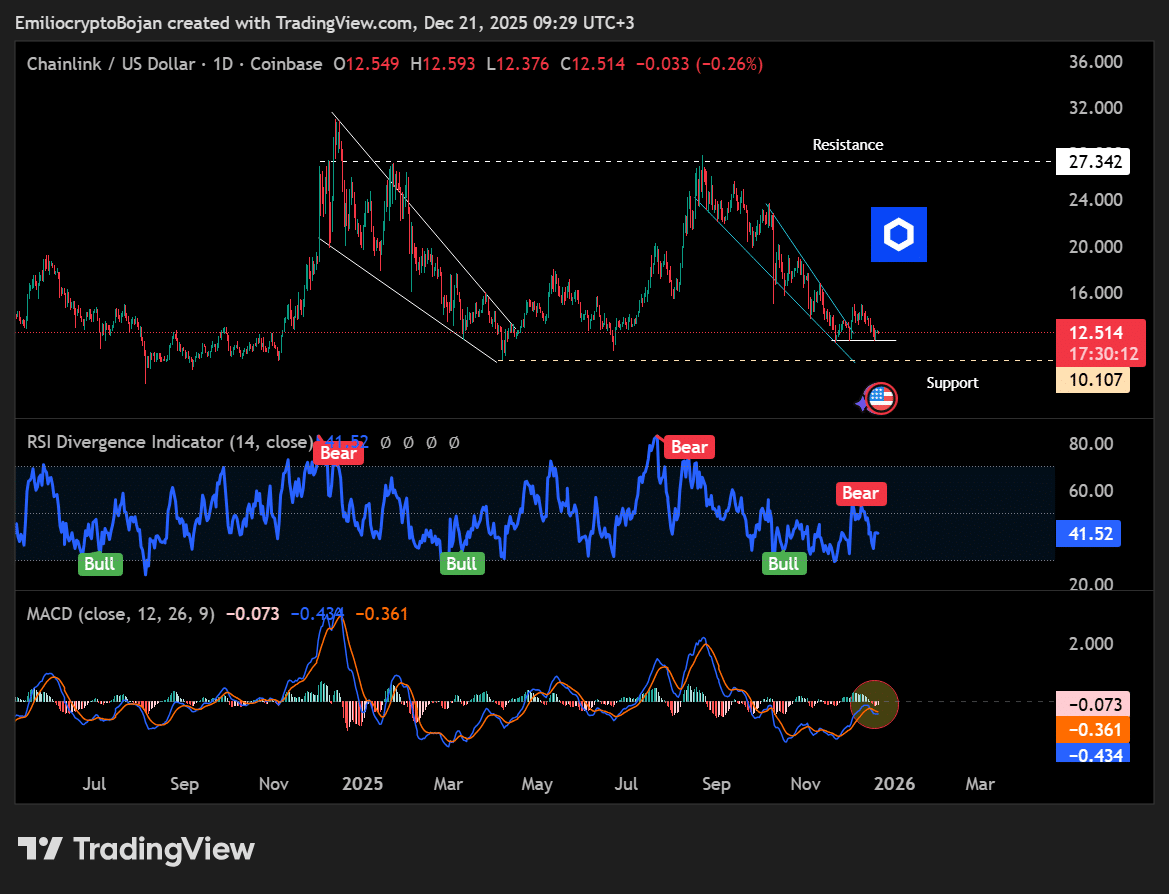

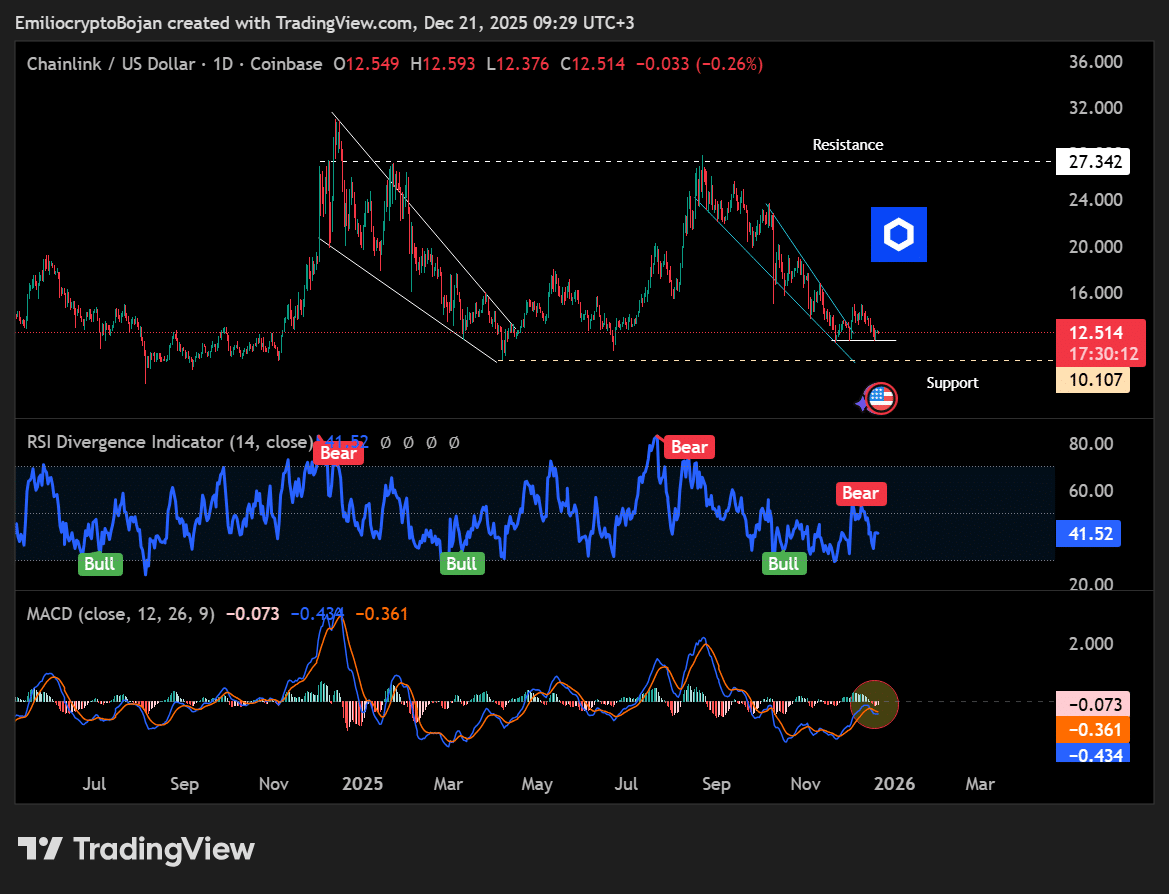

Chainlink price is currently stabilizing around $12.5, defending key support amid broader market caution. This consolidation follows a breakout from a falling wedge pattern on the daily chart, which initially suggested bullish potential but has since seen limited momentum. On-chain metrics like Total Value Secured at $46.03 billion, up 2.43% month-over-month, indicate robust network usage despite muted retail participation.

How Are Whale Movements Influencing Chainlink’s Market Position?

Whale activity has been a focal point for Chainlink observers, with significant withdrawals from major exchanges like Binance underscoring accumulation trends. On December 20, a new wallet pulled out 199,520 LINK valued at $2.49 million, followed by another 246,259 LINK worth $3.08 million the next day, bringing the total holdings to 445,779 LINK. Such moves align with historical data from CryptoQuant, showing declining exchange supplies during accumulation phases rather than distribution.

These outflows echo patterns observed in 2019-2020 ahead of the 2021 bull run and in 2022-2023 before the 2024 recovery. In 2025, this behavior suggests large holders are positioning for potential upside, contrasting with retail hesitation driven by compressed volatility. Experts note that sustained outflows could bolster the $12-$12.5 support zone, preventing deeper corrections toward $9-$10.

The broader crypto market has been trading under fear-driven conditions, with Chainlink reflecting this risk-off sentiment. Retail participation remains subdued as volatility eases across altcoins, leading to LINK’s price action entering a consolidation phase.

Momentum Stalled After Wedge Breakout

Chainlink earlier emerged from a falling wedge on the daily timeframe, altering the market structure from outright decline to neutral consolidation. Yet, subsequent buying pressure has been restrained, keeping price action range-bound near $12.5.

Source: TradingView

Momentum indicators reveal underlying weakness in the short term. The daily MACD has formed a death cross, pointing to bearish divergence, while the RSI shows signs of buyer fatigue through bearish patterns. These technical signals suggest caution, though they do not override the positive on-chain developments.

Whale Activity Concentrated on Binance

Large investor movements continue to shape Chainlink’s trajectory, with whale tracking platforms highlighting key transfers. These actions occurred as LINK traded sideways, defending its support levels without immediate downside pressure.

Exchange data from CryptoQuant further supports this narrative, illustrating a steady decline in LINK supply on centralized platforms. Historically, such reductions have preceded price expansions rather than sell-offs, providing a foundation for optimism amid current stability.

Source: CryptoQuant

Patterns from prior cycles, including the 2019-2020 buildup and 2022-2023 consolidation, show similar outflow dynamics leading into rallies. In 2025, this repetition points to a potential staging period for Chainlink, where institutional interest could drive renewed momentum if support holds firm.

Can LINK Hold Key Support Amid Retail Caution?

The $12-$12.5 range serves as a pivotal structural support for Chainlink price. Maintaining this level is essential for bulls to uphold the current consolidation framework and avoid testing lower demand areas around $9-$10.

Conversely, overcoming the $27 resistance could unlock paths to previous range highs. For now, the market leans toward sideways movement, with on-chain strength providing a buffer against broader crypto volatility. Analysts from platforms like CryptoQuant emphasize that TVS growth reflects real utility in oracle services, underpinning long-term resilience.

Frequently Asked Questions

What Factors Are Driving Chainlink Price Consolidation in 2025?

Chainlink’s price consolidation at $12.5 stems from a falling wedge breakout without strong follow-up, combined with whale accumulations exceeding 445,000 LINK from Binance. TVS rose 2.43% to $46.03 billion, boosting on-chain confidence, though MACD death cross signals short-term caution amid retail pullback.

Is Whale Activity a Bullish Sign for Chainlink Right Now?

Yes, recent whale withdrawals from exchanges like Binance, totaling over $5.57 million in LINK, indicate accumulation similar to pre-rally phases in 2019 and 2022. This contrasts with distribution patterns and supports holding the $12.5 level, potentially setting up for upside if market sentiment improves.

Key Takeaways

- Consolidation Phase: Chainlink’s LINK price at $12.5 reflects stalled momentum post-wedge breakout, but steady TVS growth signals underlying network strength.

- Whale Accumulation: Withdrawals of 445,779 LINK from Binance highlight institutional positioning, mirroring historical bull precursors without immediate selling pressure.

- Support Monitoring: Defending $12-$12.5 is crucial; a hold could lead to expansion, while failure risks $9-$10, urging investors to track exchange flows closely.

Conclusion

In summary, Chainlink price remains in a delicate consolidation at $12.5, bolstered by whale activity and rising Total Value Secured, yet tempered by technical bearish signals. These dynamics echo past accumulation cycles, positioning LINK for potential recovery in 2025 if key supports endure. Investors should monitor on-chain metrics for signs of directional shift, staying informed on oracle network developments to navigate volatility effectively.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC