Chainlink Whale Accumulates 100,000 LINK Tokens as Market Correction Raises Potential Buying Opportunities

LINK/USDT

$277,398,300.61

$9.05 / $8.78

Change: $0.2700 (3.08%)

-0.0049%

Shorts pay

Contents

-

Chainlink (LINK) witnesses significant whale activity as a major holder withdraws over half a million tokens from Binance amid market fluctuations.

-

This recent surge in whale accumulation highlights the growing interest in LINK despite its recent price decline, signaling potential bullish sentiment.

-

According to IntoTheBlock, whale activity surged by 41.5% in the last 24 hours, indicating strong participation by influential market players.

Chainlink’s price correction invites whale accumulation as significant withdrawals signal bullish potential for the altcoin. Is LINK set to rebound?

Chainlink Whale Accumulates 100,000 Tokens Amid Price Fluctuations

According to Lookonchain, a notable Chainlink whale has stepped up its accumulation actions as LINK’s price faces daily declines. This particular whale withdrew 100,000 LINK tokens, equivalent to $2.95 million, from Binance within a mere 24 hours. Over the past three days, this single whale has extracted a total of 529,999 LINK tokens, valued at around $15.5 million.

Source: IntoTheBlock

This accumulation trend is reiterated by the surge in whale activity tracked by IntoTheBlock. With a spike of 41.5% in whale transactions over the last day, it indicates an uptick in interest among larger holders. This behavior suggests that big players are leveraging the current price correction as a strategic opportunity for accumulation.

Source: IntoTheBlock

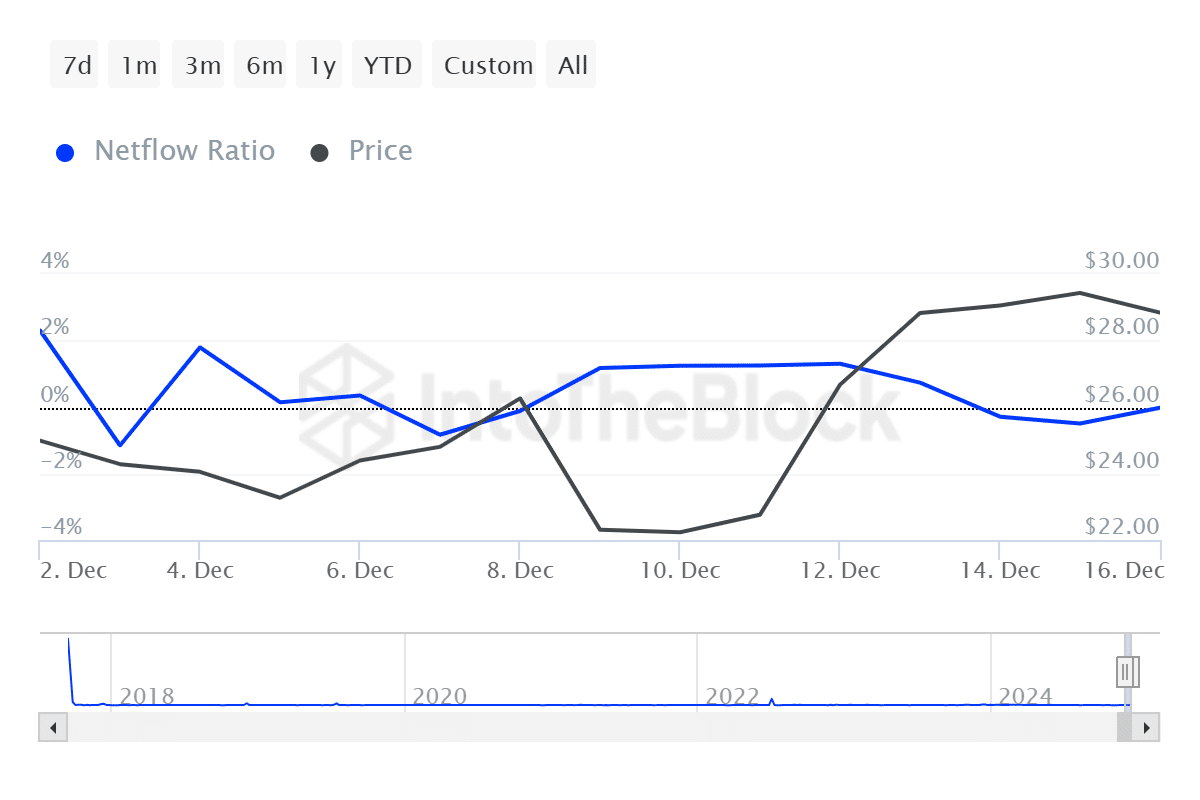

The increase in whale movements coincides with a significant decline in the Large Holders Netflow to Exchange Ratio, which has remained negative for the past three days. This trend typically indicates that more assets are being withdrawn from exchanges than deposited, suggesting a bullish sentiment among large investors. When whales hoard their assets, it tends to alleviate selling pressure, potentially paving the way for future price increases.

Market Sentiment and Price Implications for LINK

Despite the optimistic signs stemming from large holder accumulation, LINK has experienced a decline over the past day. However, it’s essential to consider the broader market context. Presently, the overall sentiment surrounding LINK remains optimistic, bolstered by increased whale activity and a rising stock-to-flow ratio.

Source: Santiment

Notably, Chainlink’s Stock-to-Flow Ratio (SFR) has dramatically increased from 0 to 1618.48, indicating rising scarcity in the market. This increase in scarcity suggests enhanced accumulation behavior among investors, coupled with diminished liquidity—factors that could lead to price uplifts if demand continues to outstrip supply.

As the market adjusts, it appears that both whales and retail traders are observing favorable conditions for Chainlink. A continued bullish trend could see LINK reclaim its previous $30 resistance level and test upwards toward $32.2. Conversely, persistence in downward pressure could see the altcoin retrace to around $26.9.

Conclusion

In summary, the recent activity among Chainlink whales showcases a significant wave of accumulation occurring during the market’s price correction. The interplay between whale movements, market sentiment, and the links between supply and demand will be crucial in determining Chainlink’s price trajectory. As LINK navigates these market dynamics, investors should remain vigilant and assess both macroeconomic trends and on-chain data to inform their trading strategies moving forward.