Chainlink’s Accumulation and Shrinking Reserves Hint at Potential LINK Price Upside

LINK/USDT

$260,016,843.55

$8.76 / $8.21

Change: $0.5500 (6.70%)

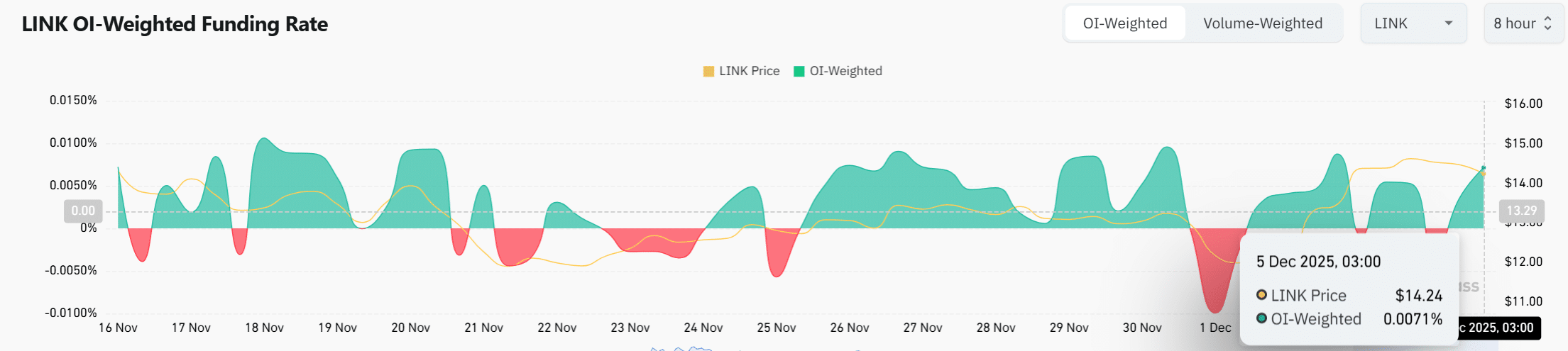

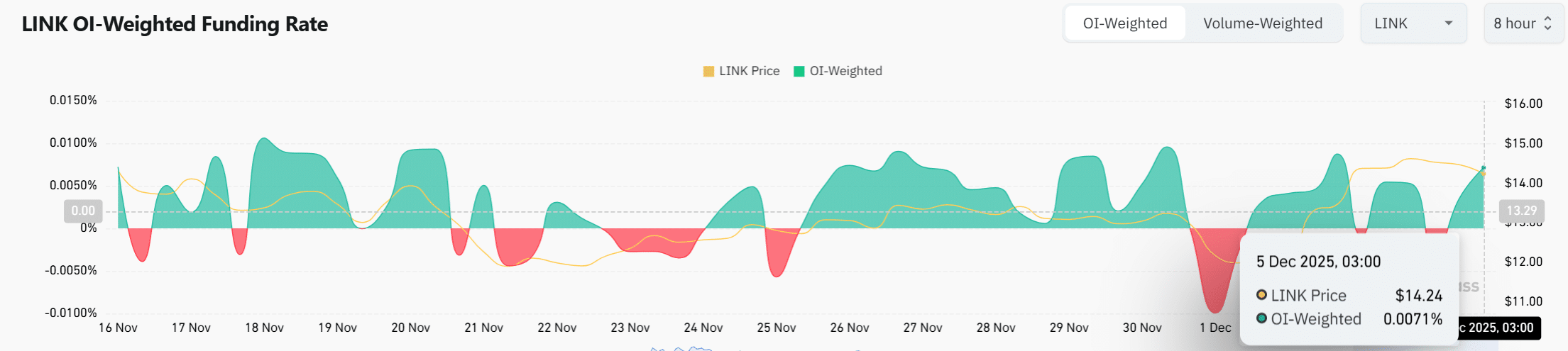

+0.0007%

Longs pay

Contents

Chainlink reserves increased by 81,131 LINK in one day, reaching over 1,054,884 LINK, signaling strong confidence and reducing circulating supply. This accumulation supports LINK price stability and potential upside as demand grows amid shrinking exchange reserves and bullish buyer pressure.

-

Chainlink’s reserve growth removes supply from circulation, fostering long-term bullish sentiment for LINK.

-

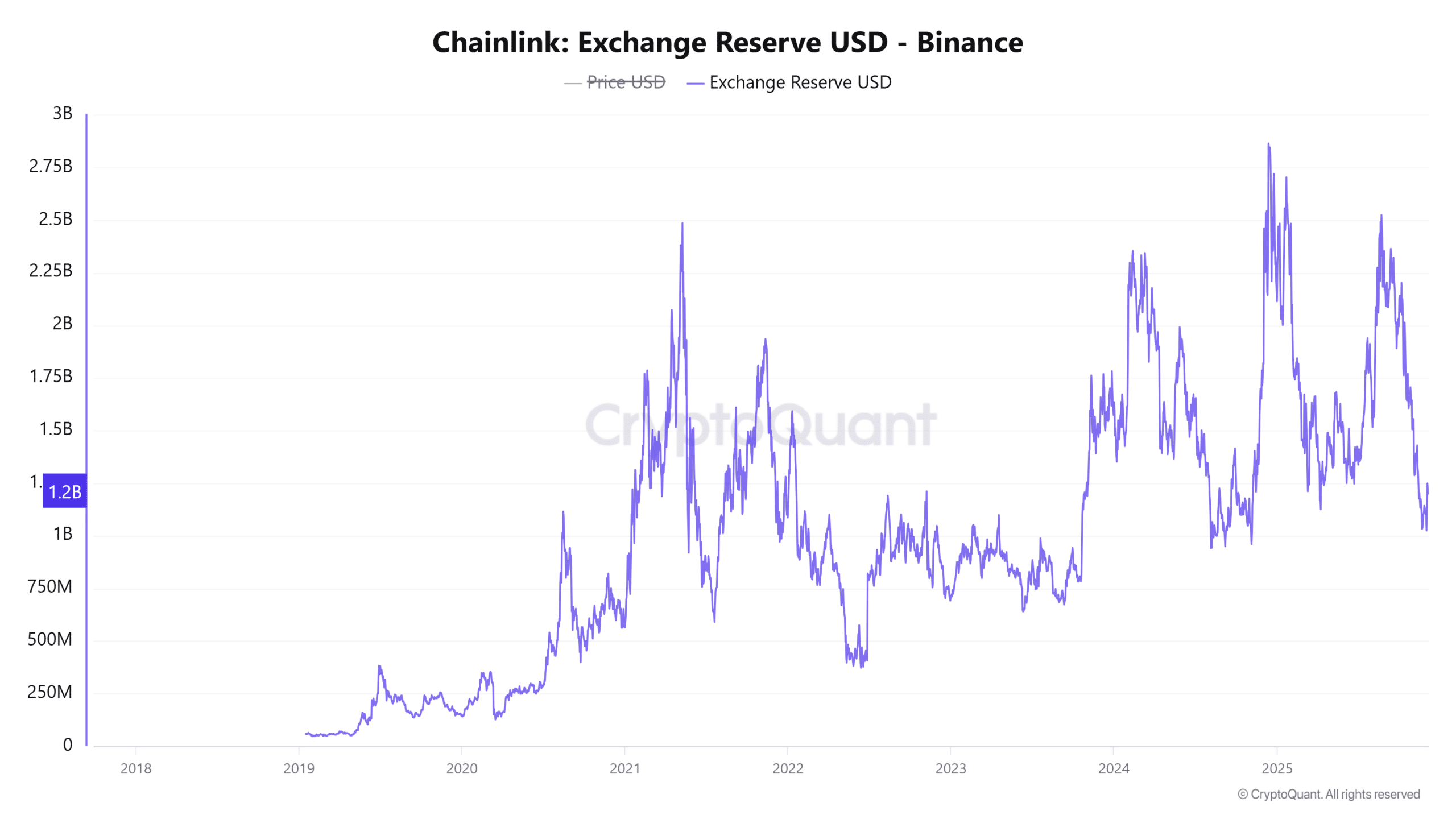

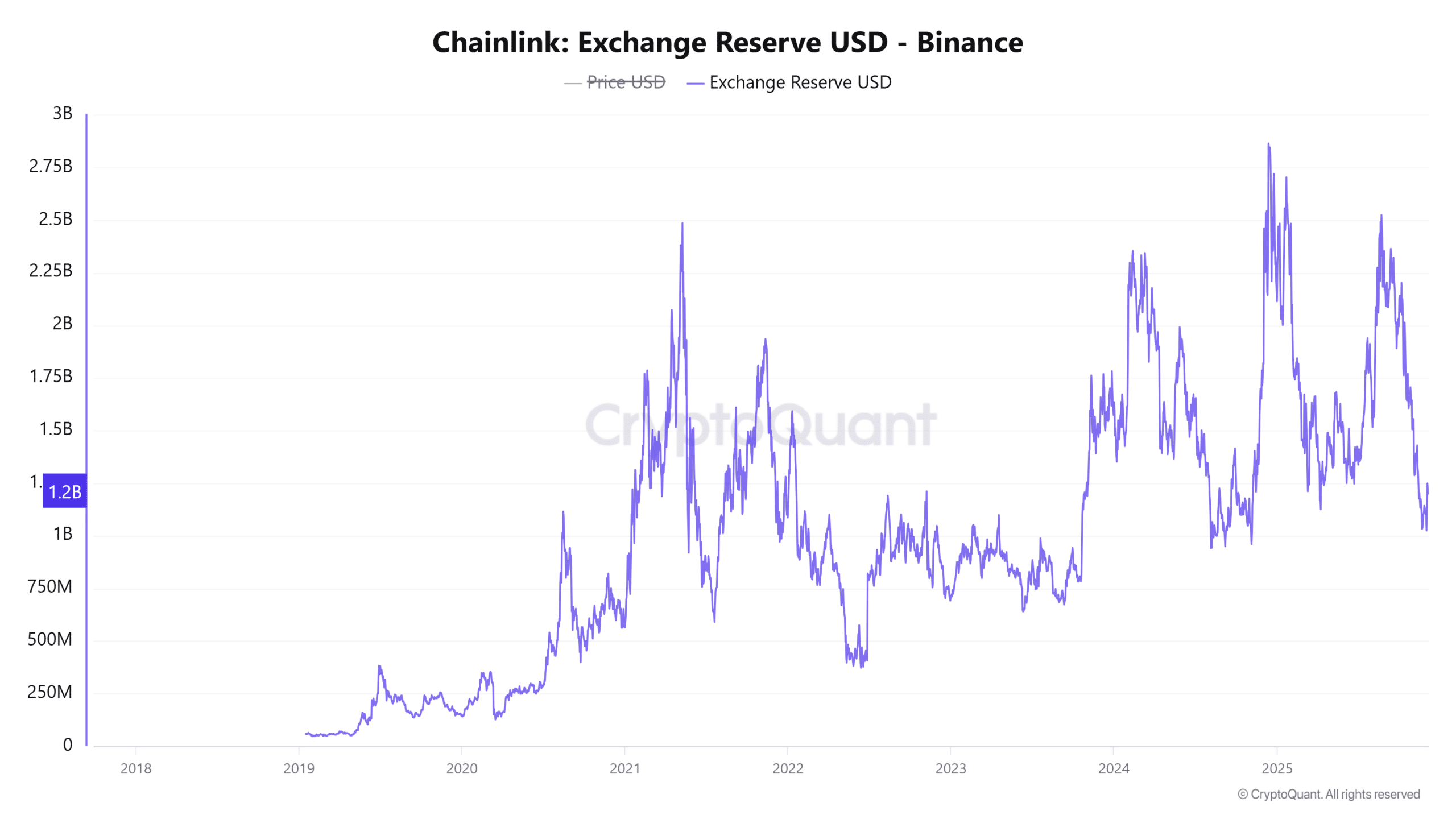

Exchange reserves dropped 3.3% in USD value, tightening sell-side liquidity and aiding price rebounds.

-

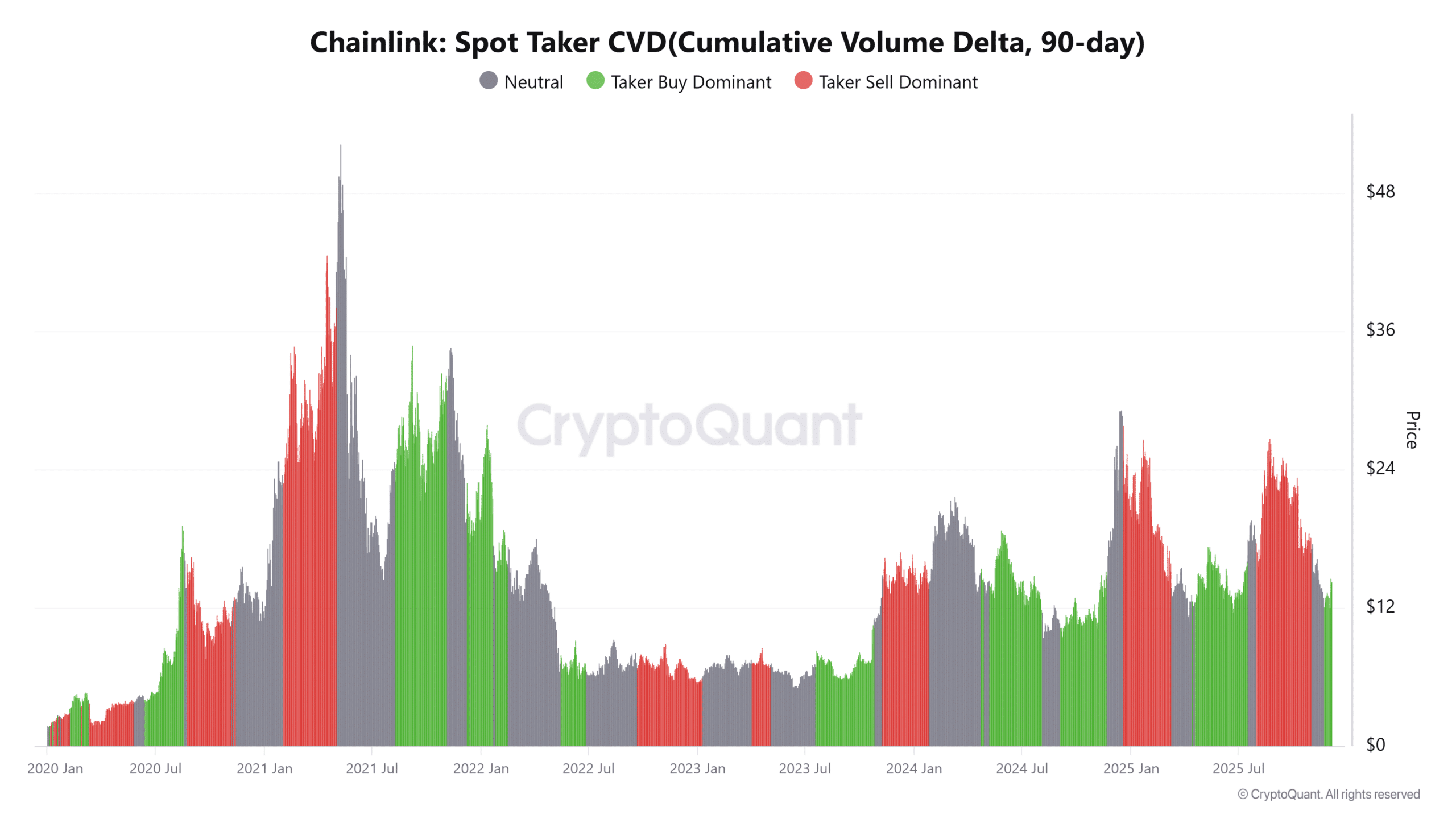

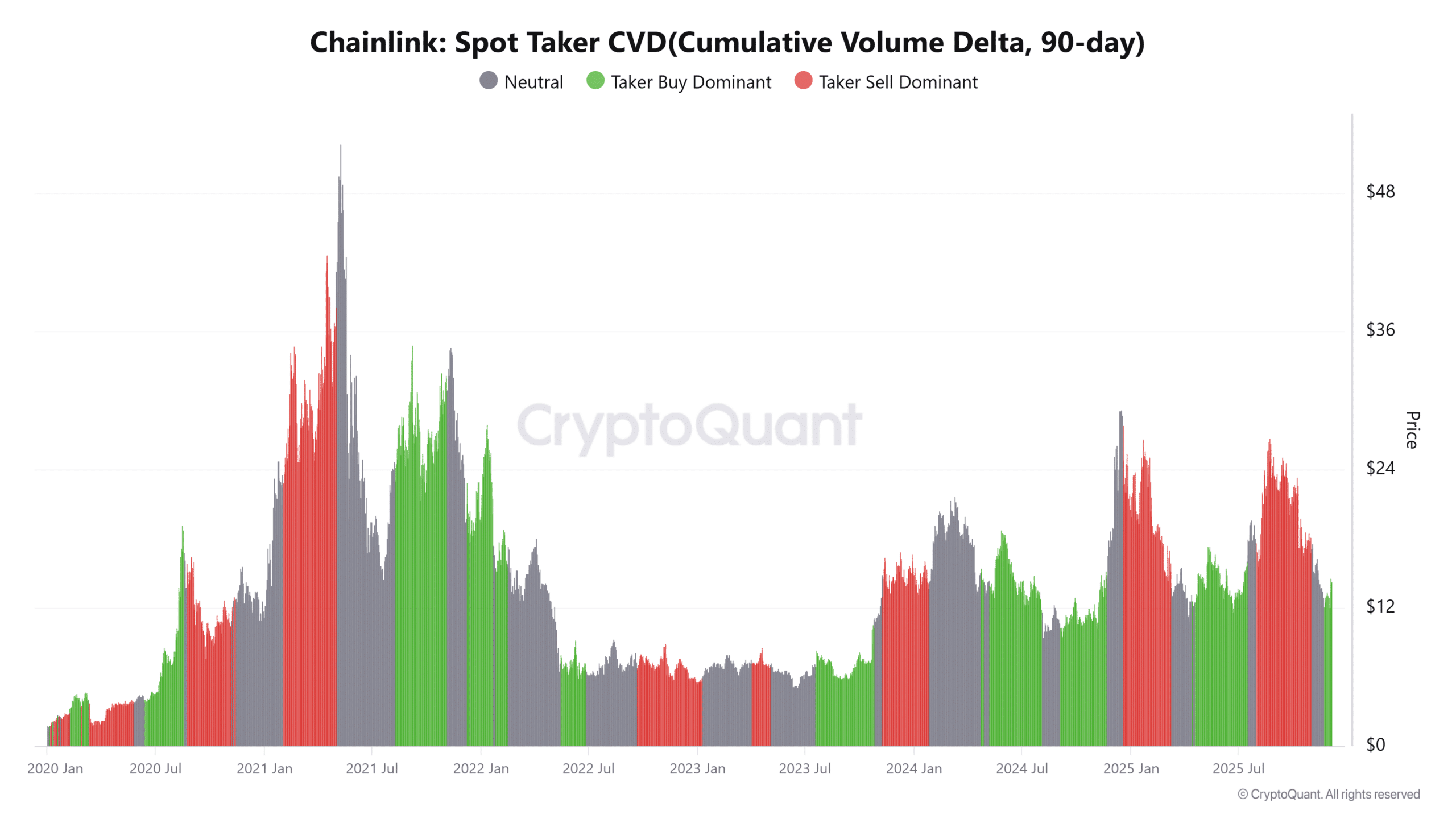

Taker buy cumulative volume delta shows dominant buyer activity over 90 days, with 70% of trades initiated by buyers per CryptoQuant data.

Discover how Chainlink’s surging reserves and shrinking exchange supply are driving LINK price toward a potential breakout above $14.93. Stay informed on crypto trends and investment opportunities.

What Are the Implications of Chainlink’s Recent Reserve Increase?

Chainlink reserves have seen a notable boost with the addition of 81,131 LINK tokens in a single day, elevating total holdings to more than 1,054,884 LINK. This accumulation reflects robust confidence in the network’s future utility and effectively sidelines a significant portion of the token supply from active trading. As a result, it bolsters the ecosystem’s resilience and aligns with ongoing efforts to enhance decentralized oracle services that power smart contracts across blockchains.

How Does Shrinking Exchange Reserves Impact LINK Price?

Exchange reserves for Chainlink experienced a 3.3% decline in USD terms at the time of reporting, reshaping market liquidity by limiting available tokens for immediate sales. According to data from CryptoQuant, this reduction in sell-side inventory heightens the chances of sustained price appreciation, as buyers face fewer obstacles in pushing through resistance levels. Such dynamics have historically preceded stronger rebounds in LINK, with past accumulations leading to 20-30% gains within weeks. Expert analysts note that thinner circulating supply on major platforms like Binance minimizes downside volatility during corrections, allowing structural demand to dominate. This trend not only supports higher lows but also encourages long-term holders to accumulate further, reinforcing the protocol’s foundational role in DeFi and cross-chain interoperability.

Source: CryptoQuant

Frequently Asked Questions

What Causes Chainlink Reserves to Increase and How Does It Affect LINK Price?

Chainlink reserves grow through strategic accumulations by the protocol team or community initiatives to secure network stability, as seen with the recent 81,131 LINK addition. This reduces available supply, potentially driving LINK price higher by limiting selling pressure and signaling long-term commitment, with historical data showing 15-25% uplifts following similar events.

Why Is Taker Buy Pressure Important for Chainlink’s Market Momentum?

Taker buy pressure in Chainlink trading indicates aggressive buying from market participants who initiate trades at current prices, dominating the 90-day cumulative volume delta. This natural surge in spot-market activity, where buyers absorb dips effectively, builds momentum for price recovery and aligns with broader on-chain strength for a smoother upward trajectory.

Source: CryptoQuant

Source: TradingView

Source: CoinGlass

Key Takeaways

- Reserve Accumulation Strengthens Foundation: Chainlink’s addition of over 81,000 LINK tokens highlights ecosystem commitment, reducing supply and supporting price stability amid market recoveries.

- Exchange Supply Reduction Boosts Upside: A 3.3% drop in reserves limits selling pressure, with data from CryptoQuant indicating higher rebound probabilities and lower volatility risks.

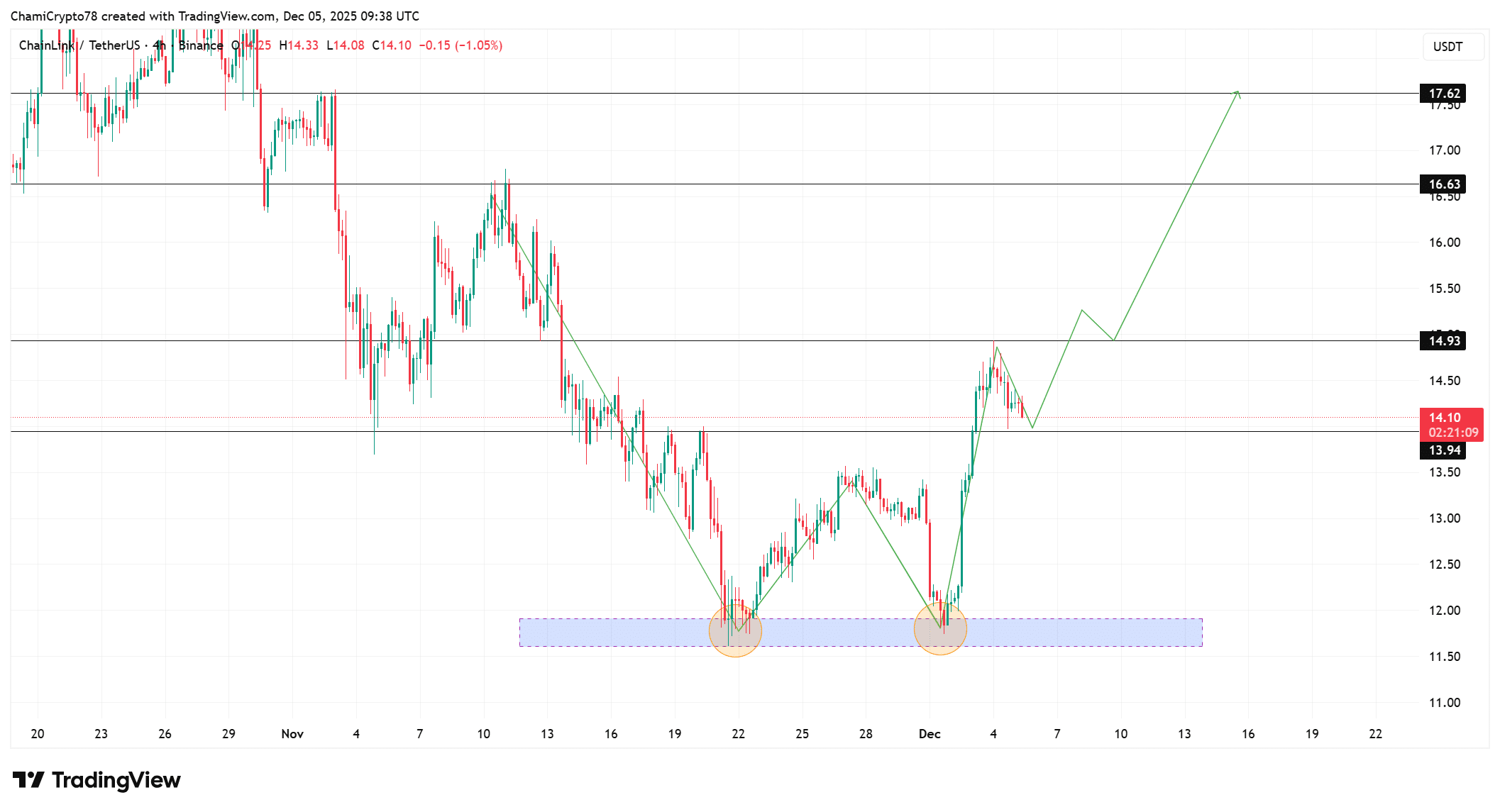

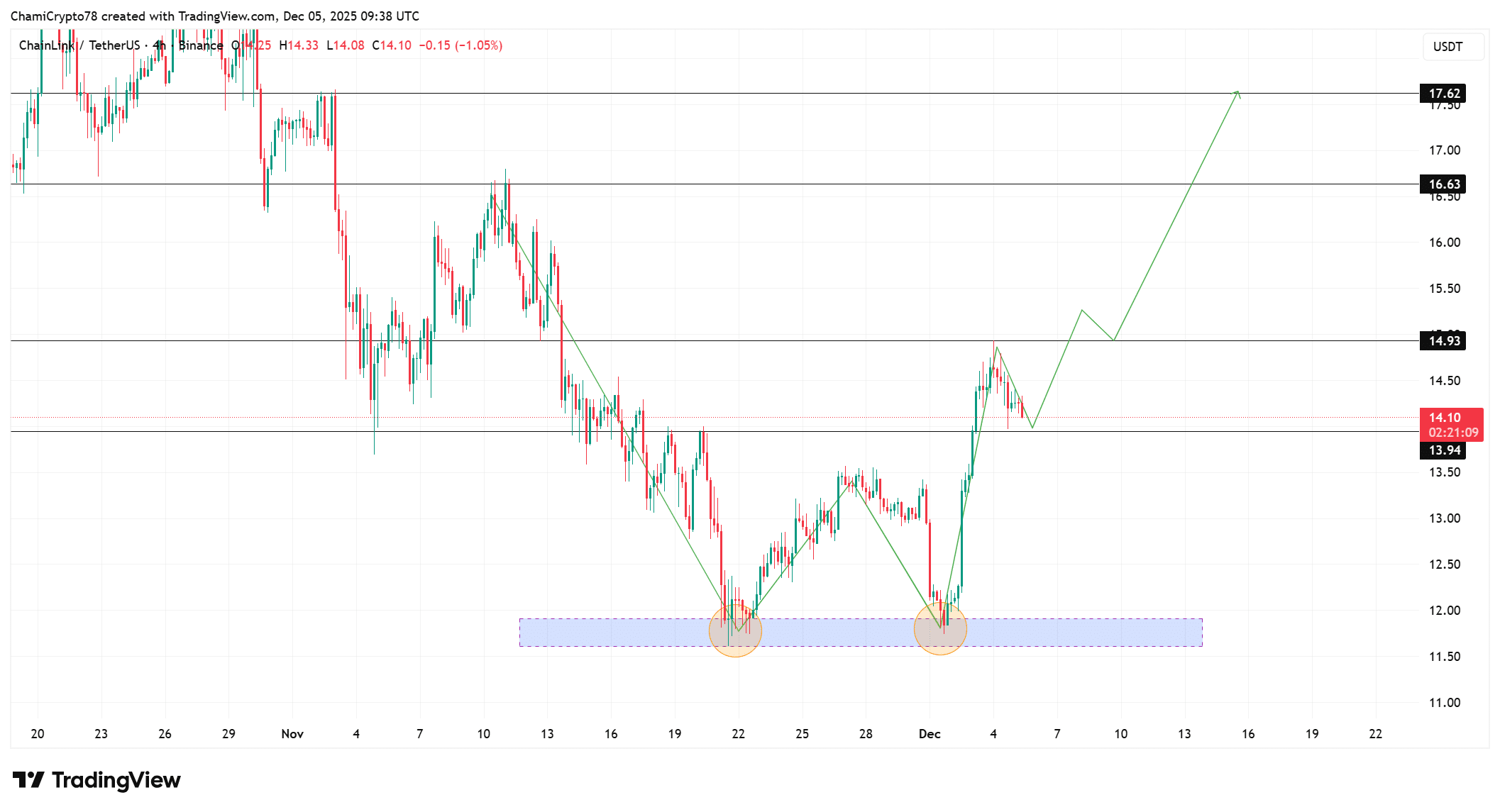

- Bullish Price Structure Emerging: The double-bottom pattern near $12 suggests reversal potential; monitor $13.94 support for targets at $14.93 and beyond to capitalize on momentum.

Conclusion

Chainlink’s recent reserve increases and shrinking exchange supplies underscore a resilient framework for LINK price growth, complemented by strong taker buy pressure and positive funding rates. As the protocol continues to integrate with expanding DeFi applications, these on-chain developments position LINK for potential breakouts toward $16.63 and higher. Investors should track key support levels closely to navigate upcoming opportunities in this dynamic crypto landscape.

Comments

Other Articles

Chainlink Price May Stay Range-Bound Near $12 Amid Fading Whale Demand

January 1, 2026 at 07:14 PM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

UK Lowest in G7 Investments for 2025 Amid Expert Warnings on Frameworks

December 30, 2025 at 04:43 PM UTC