China Bans RMB Stablecoins: e-CNY Promotion

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

China PBOC and Regulators' Joint Stablecoin Ban

The People's Bank of China (PBOC) and seven Chinese regulatory agencies issued a joint announcement prohibiting the issuance of stablecoins pegged to the Renminbi (RMB) and tokenized real-world assets (RWA) without approval. The announcement was also signed by the Ministry of Industry and Information Technology and the China Securities Regulatory Commission. The announcement stated, “Stablecoins pegged to fiat currencies covertly perform some functions of fiat currencies during circulation and use. No unit or individual may issue RMB-linked stablecoins without approval from the relevant departments.” The ban covers both domestic and foreign issuers.

Hidden Risks of RMB-Pegged Stablecoins

According to the announcement, RMB-pegged stablecoins can bypass capital controls by mimicking fiat currencies' reserve, payment, and store-of-value functions. This carries the potential to breach China's strict capital flow controls. Tokenized RWAs create circulation risks in unregulated markets by bringing assets like real estate and bonds onto the blockchain. The ban covers offshore CNH and onshore CNY markets, weaving a complete supervisory network.

Promoting the e-CNY CBDC to the Forefront

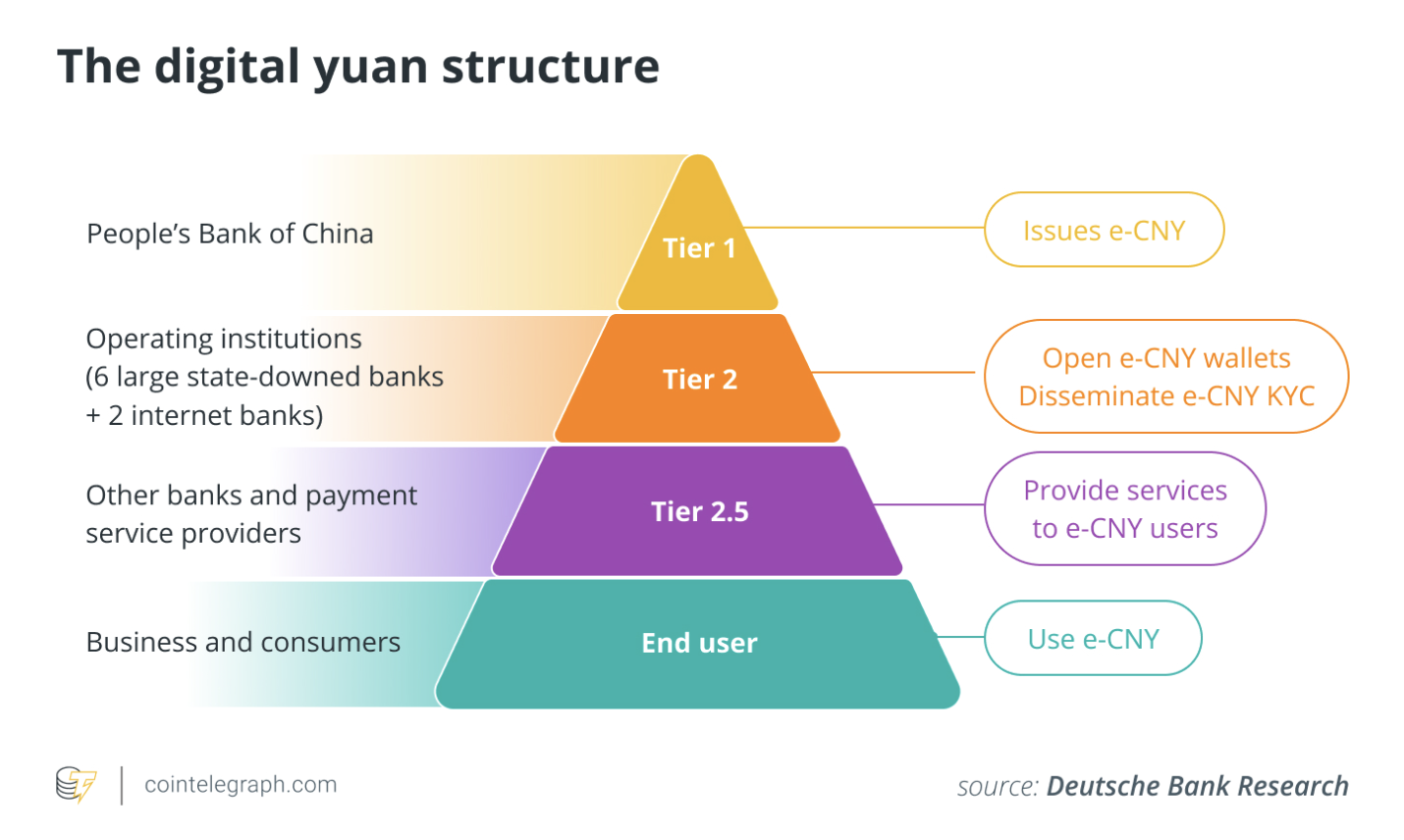

Winston Ma, an assistant professor at New York University School of Law, noted that the ban covers both onshore CNY and offshore CNH RMB markets. This step aims to promote the use of the national CBDC called e-CNY issued by the Chinese central bank while keeping speculative cryptocurrencies away from the traditional financial system. The recent development approving commercial banks to pay interest to customers holding digital yuan makes e-CNY attractive. Investors examining BTC detailed analysis can see how CBDCs shape stablecoin competition.

| Date | Development |

|---|---|

| August 2025 | Idea of permitting Yuan-pegged stablecoins |

| September 2025 | Trials halted |

| January 2026 | Interest mechanism added to CBDC |

| February 2026 | Stablecoin ban announced |

Expert Analysis: Winston Ma and Market Coverage

According to Winston Ma, the ban strengthens China's digital sovereignty by channeling the global use of RMB through e-CNY. Unlike USD stablecoins like USDT or USDC, this protects national monetary policy. In the global crypto ecosystem, China's step could accelerate other countries' CBDC race.

Impacts on Global Crypto Market and BTC

China's ban could affect BTC futures volume by reducing stablecoin liquidity in Asia. For BTC investors, the risk is increased volatility from the collapse of RMB-based DeFi protocols. Historically, Chinese regulations have pressured BTC prices by 10-20%. Follow these dynamics in our BTC detailed analysis reports. e-CNY integration strengthens the bridge between traditional finance and crypto while limiting speculative flows.

Future Regulatory Expectations

As of 2026, China's approach may influence other BRICS countries. Pilot programs for approved RWAs may emerge, but speculative stablecoins will remain banned. Investors should monitor e-CNY wallet integrations.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/25/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/24/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/23/2026

DeFi Protocols and Yield Farming Strategies

2/22/2026